Summary:

Data has already been reported.

Trends reversed in the last two weeks.

US jobs data may disappoint.

It will take a few more weeks to lift some of the uncertainty hanging over the markets.

There are four things investors should know as the New Year begins. First, it has already begun with several PMI reports already reported. Second, in the last two week of the December, the trends that dominated Q4 were retraced to some extent. Third, there are several economic reports due from Europe in the coming days, but the highlight will be the US jobs data at the end of the week. Fourth, uncertainty over the UK Supreme Court ruling regarding Article 50 and what policies the new US administration will pursue will linger for a while longer.

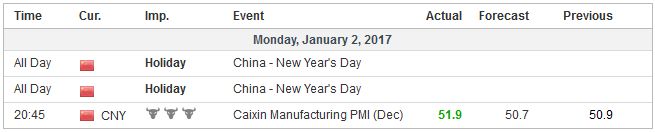

ChinaChina’s official December PMIs were reported. Both the manufacturing and non-manufacturing slipped. The former eased to 51.4 from 51.7 and the latter to 54.5 from 54.7. The details of the non-manufacturing were a bit better than the headline, though the services component fell to 53.2 from 53.7. The construction component rose to 61.9 from 60.4. Also suggesting modest growth, new orders rose to 52.1 from 51.8. |

Economic Events: China, Week January 02 |

EurozoneThe eurozone manufacturing PMI matched the flash estimate of 54.9, which is the highest level in five and a half years. It points to a modest acceleration in the manufacturing sector. The PMI averaged 53.1 in Q4 after 52.0 in Q3. The 12-month average is 52.5. Prices also rose the most since the spring of 2011, as did new orders (to 55.9 from 54.4). Germany’s 55.6 (flash 55.5) reading is a three-year high. France’s 53.5 (same as flash) is a five-year high. Recall that from March through September 2016, France’s manufacturing PMI was below the 50 boom/bust level. SpainSpain saw new vigor. The manufacturing PMI rose to 55.3 from 54.5. It had fallen to 51 in July and August. With December’s gains, it averaged 54.4 in Q4 and 51.4 in Q3. The 12-month average is 53.2. Italy too did well. The manufacturing PMI rose to 53.2 from 52.2. It is also well above its recent averages. Several emerging market economies reported their manufacturing PMIs. Two caught our attention. First is India’s. The PMI tumbled to 49.6, the low for the year, from 52.3 in November and 54.4 in October. Modi’s cash experiment has proven disruptive, and with the end of the year, it has surpassed the 50 days the Prime Minister promised it would take. Political tensions will likely intensify. Second is South Korea. The manufacturing PMI rose to 49.4 from 48.0 in October and November, and 47.6 in September. The new orders component rose to a five-month high. The Korean won fell 8.8% against the US dollar in Q4 16, making it the second worst performing emerging market currency behind the Turkish lira (14.9%) in the last three months of 2016. The Japanese yen experienced a greater depreciation (-13.5%) than the won in the quarter, but for the year as a whole, the yen appreciated 3% against the dollar, and the won fell about 3% against the dollar.

There were several powerful trends in the capital markets in Q4. The US dollar rose. Yields rose, more in the US than other high income countries and curves steepened. Flows left emerging markets, and after a five-month advance, the MSCI Emerging Market equity index fell in November and December. The trends seemed to reverse in the second half of December. Emerging market shares rallied, interest rates eased, and the dollar fell. An important question is why the trends reversed in the last two weeks. There appear to be two answers. The first is buy the rumor, sell fact type of activity following the Fed’s rate hike on December 14. If this is the case, investors should expect a continued unwinding of those trends. On the other hand, if it just a short-term pause in trends as books were closed, then the underlying trend may be expected to reassert itself. Our understanding of the technical condition favors the first scenario, and look for the broader correction to continue. Participation may be slow to return and wait for the US employment data. The holiday break may have also served to psychologically break the strong momentum that had built. Given that the ECB and Fed moved in December, Q4 data may have lost some of its ability to impact investment decisions. Psychology and positioning may be more important drivers than economic data as the New Year begins. In the big picture, we expect the dollar’s uptrend to continue, driven by the divergence of monetary policy broadly understood, and the political risks emanating from Europe. On different valuation calculus, the European equities may look relatively cheaper than the US or Japanese stocks. There may be good macroeconomic reasons for this, but our point is that the interest rate differentials are such that one is paid for hedging the euro and yen (several other foreign exchange exposures) back into dollars. Consider that in Q4 16; the Nikkei rallied 16.2% while the yen fell 13.4%. The eurozone economy is growing near trend, which is often estimated to be around 1.25%-1.50%. The problem, we are told, is prices. Assuming that the services PMI is in line with the flash reading, then the midweek’s CPI report are the most important of the week. Due primarily to the base effect from oil, the headline CPI is expected to rise to 1.0% from 0.6%. It is not that high since September 2013. Recall that from February through May it was in negative territory. The core rate, on the other hand, is expected to be steady at 0.8%, where it has been since August. It bottomed in the first part of 2015 at 0.6%. There has yet to be any traction in the core prices, and this is one of the things that cannot set right with ECB’s Draghi. |

Economic Events: Eurozone, Week January 02 |

GermanyIt is not ideal, but one way that the periphery of Europe can gain competitiveness on Germany is if they can experience lower inflation than Germany. This was a problem when German CPI is near zero, other countries either experienced deflation or lose competitiveness to Germany. However, now German inflation is set to rise quicker than others. Next week’s national reports include Germany, France, Italy and Netherlands. German CPI is expected to jump to 1.3% in December from 0.7%. French inflation may rise to 0.9% from 0.7%. Italy’s CPI is expected to rise to 0.3% from 0.1%. The Dutch may still be experiencing deflation (-0.3% in November). |

Economic Events: Germany, Week January 02 |

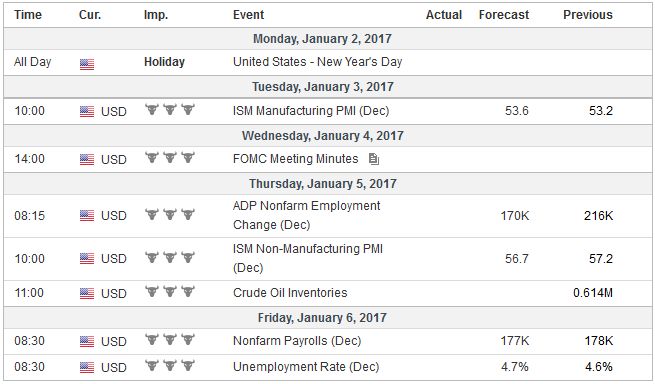

United StatesThe highlight of the week is the US jobs report. The consensus is for about the same as November or 178k. We see scope for disappointment. Over the last ten years, December has seen less job growth than November in seven times and for the last three years in a row. This is not sufficient to refute the null hypothesis, but it may make one cautious. Moreover, the US economy appears to have slowed down considerably after that heady 3.5% pace reported in Q3. The NY Fed has the economy tracking 1.8% in Q4. The Atlanta Fed’s tracker is likely to fall from the 2.5% pace seen on December 22 as subsequent data, including the preliminary merchandise trade figures in November. Many economists anticipate that the unemployment rate will tick up to 4.7% from 4.6%.Recall that the unemployment rate had fallen sharply from 4.9% in October. The underemployment rate fell from 9.5% to 9.3%, its lowest level since the spring of 2008. The work week is important to track because of the output implications, given the size of the workforce. However, barring a major surprise, the most important aspect of the report may be the average hourly earnings. It was a disappointing when it fell by 0.1% in November. The year-over-year pace may recover to the recent high seen in October of 2.8%. In December 2015, it was 2.6%. In December 2014 it was 1.7% and 2.0% in 2013. Separately, the US reports December auto sales. Sales remain elevated, and likely boosted by extra incentives. However, sequentially improvement is proving difficult around 17.8-18.0 mln annualized pace. We note that apparently due to inventory accumulation, GM has temporarily closed production at a few factories. IV: Uncertainty We trace the big portfolio adjustment to the beginning of Q4 but recognize it having been accelerated by the US election results. There is a range of opinions held on trade and economic issues in the incoming administration. It is not immediately clear which voices win and the priorities. Another dimension to the unknown is the administration’s relationship with Congress. The visibility on these issues is unlikely to improve much over the next couple of weeks. The flash point in the days ahead will be the president-elect’s response to the President Obama’s sanctions on Russia hacking. Many in Congress do not think Obama were sufficient, while Trump appears to be pulling in the opposite direction. On a nominal trade-weighted basis, the US dollar appreciated by almost 2% in December for a 4.6% advance in Q4. The last time this Fed measure of the dollar rose for three consecutive months was November 2015-January 2016, when it rose 4.5%. Investors will be sensitive to how Fed officials talk about it in the weeks ahead. |

Economic Events: United States, Week January 02 |

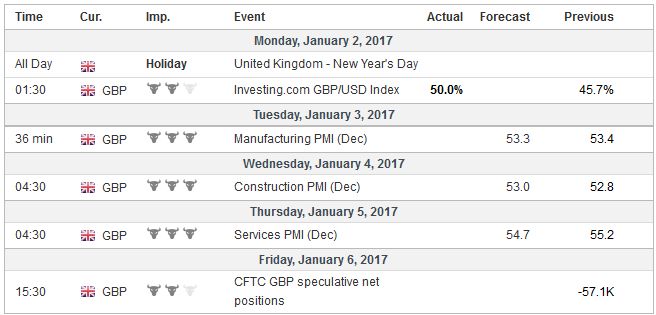

United KingdomInvestors await the UK Supreme Court decision on the appeal from the government about its prerogative to trigger Article 50. The decision is expected toward the middle of January. There are 11 judges. Initially, reports suggested only one would side with the government, but subsequent reports suggest a sizable minority are with the government. Some suggest decision as tight as 7-4. A narrow loss for Prime Minister May is thought to improve her negotiating position within UK politics. |

Economic Events: United Kingdom, Week January 02 |

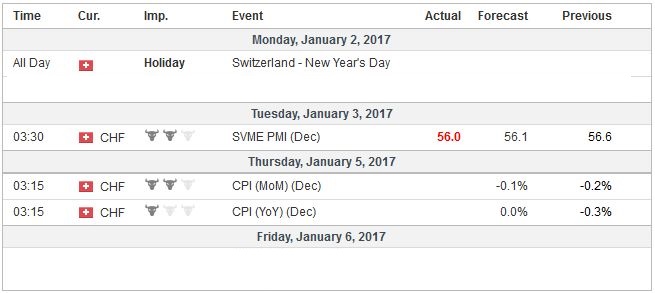

Switzerland |

Economic Events: Switzerland, Week January 02 |

Full story here Are you the author? Previous post See more for Next post

Tags: #GBP,#USD,$EUR,$JPY,newslettersent,SPY