Monthly Archive: December 2016

Fed Hikes, Sees Three More in 2017–A Year Ago it Saw Four in 2016

Biggest change is that Fed sees three instead of two hikes next year. Minor tweaks in the forecasts. Fiscal policy could raise the long-run growth potential, which would be a net good but not needed to reach full employment.

Read More »

Read More »

Swiss fact: Switzerland is one of the world’s top 5 coffee exporters

According to UN trade statistics, the small Alpine nation exported US$ 2.4 billion1 of coffee in 2013. This figure is far higher than its cheese (US$ 615 million2) or chocolate (US$ 822 million3) exports, two far more famous Swiss exports.

Read More »

Read More »

Recovering America’s History of Progressive Populism

The elites' toadies, lackeys, shills, sycophants, water-carriers and apologists are desperately hyping the context-free, historically ignorant narrative that "populism leads to autocracy" to protect the existing autocracy of the elites.

Read More »

Read More »

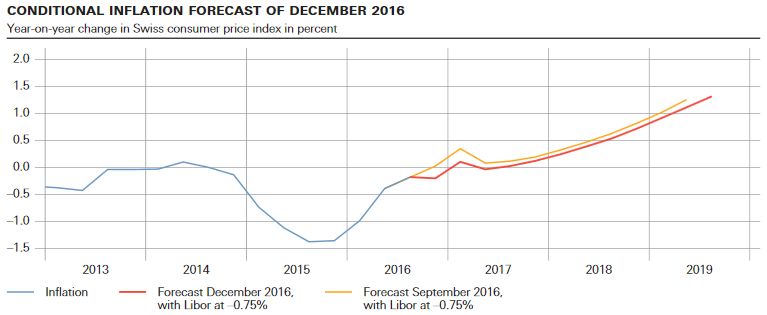

SNB Monetary policy assessment December 2016 and Comments

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy. Interest on sight deposits at the SNB is to remain at–0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. At the same time, the SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

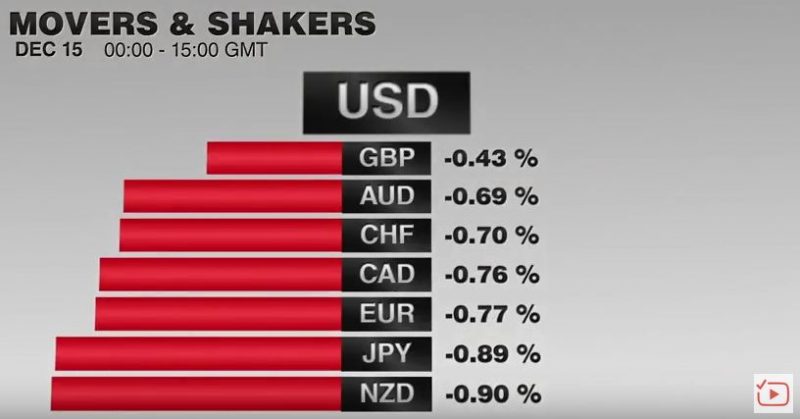

FX Daily, December 15: Greenback Extends Gains on Back of Fed

Sterling has made steady gains against the CHF over the past month and although the spike has levelled this week, the Pound has certainly gained a foothold. Yesterday’s decision by the US Federal Reserve to raise their base rate from 0.25% to 0.5% did little to shift the value of GBP/CHF but with investors still digesting the outcome, we may yet find it still has an effect.

Read More »

Read More »

Cool Video: Big Picture Dollar Outlook

I had the privilege of joining Scarlet Fu and Joe Wisenthal on the set of What'd You Miss on Bloomberg TV yesterday afternoon. It was within a couple of hours of the second Fed rate hike in a decade. The dollar rallied.

Read More »

Read More »

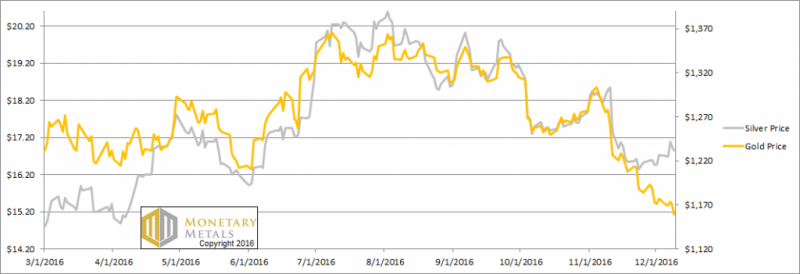

WTI Crude tumbles To $49 Handle, Erases OPEC/NOPEC Deal Gains

But, but, but... growth, and inflation, and supply cuts, and growth again... Well that de-escalated quickly... As Libya restarts exports and The Fed sends the dollar soaring so WTI crude prices just broke back to a $49 handle for the first time since Dec 8th.

Read More »

Read More »

FX Daily, December 14: Markets Quietly Edge into FOMC Meeting

The Pound is entering mid-December in the same fashion it begun the month after having a very strong November as well. After being buoyed by Donald Trump’s victory and the High Courts ruling that parliamentary approval is needed before invoking Article 50, the Pound has been boosted further after economic data has also impressed, with yesterday being a good example of this.

Read More »

Read More »

Swiss banks probed at home over Brazil’s ‘Carwash’ bribe scandal

The Switzerland attorney general’s office is shifting its focus to banks operating in the country as it continues to investigate Brazil’s bribery scandal, after plea deals with individual executives provided fresh insights into how the illicit funds flowed through the financial system.

Read More »

Read More »

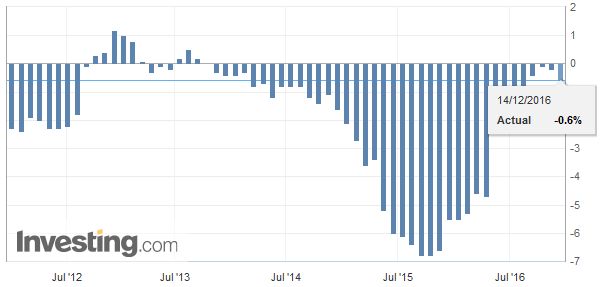

Swiss Producer and Import Price Index, November 2016: +0.1 percent MoM, -0.6 percent YoY

The Producer and Import Price Index rose in November 2016 by 0.1% compared with the previous month, reaching 99.9 points (base December 2015 = 100). The slight rise is due in particular to higher prices for scrap and petroleum products. Compared with November 2015, the price level of the whole range of domestic and imported products fell by 0.6%. These are the findings from the Federal Statistical Office (FSO).

Read More »

Read More »

“Fake News”, Censorship, Darwin and Democracy

Perhaps we can start by separating "news" from "analysis" from "commentary." "News" is "he said this, she did that, this happened." Analysis tries to make sense of trends that are apparent in the news longer-term--for example, why did Trump win? Is the economy actually healthy or not? "Commentary" is opinion that establishes a point of view and defends it while attacking other POVs.

Read More »

Read More »

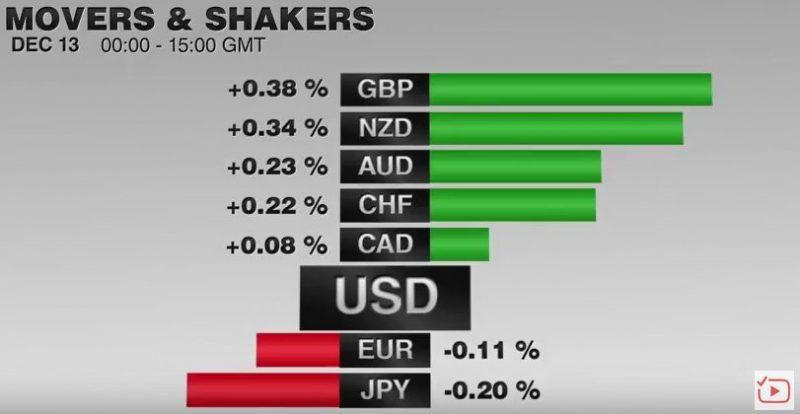

FX Daily, December 13: Narrowly Mixed Dollar Conceals Resilience

The US dollar is little changed against most of the major currencies. The dollar finished yesterday's North American session on a soft note, but follow through selling has been limited. After rallying to near 10-month high above JPY116 yesterday, the greenback finished on session lows near JPY115.00. Initial potential seemed to extend toward JPY114.30, but dollar buyers reemerged near JPY114.75, and it rose back the middle of the two-day range...

Read More »

Read More »

Busy Week for the UK

The UK reports inflation, employment and retail sales this week. The BOE meets but will keep rates steady. The US 2-year premium over the UK is the highest since at least 1992 today.

Read More »

Read More »

Migros Bank could pass on negative interest rates

Because of negative interest, even a savings account earning 0% interest is earning too much reckons the bank’s boss. Soon many banks will be passing on some of the cost of negative interest to their clients, reports 20 Minutes. Migros Bank will need to seriously consider doing the same in 2017.

Read More »

Read More »

The Climate Changes Back – What Comes Next?

Last year’s El Nino phenomenon temporarily provided succor to climate alarmists, who were increasingly bothered by the “Great Pause” – the fact that the tiny amount of warming experienced since the last cooling cycle ended in the late 1970s had apparently stopped. Despite trace amounts of CO2 in the atmosphere continuing to climb, mother nature decided to disobey alarmist models and temperatures went sideways for about 20 years (or even longer,...

Read More »

Read More »

Who Has To Work The Longest To Afford An iPhone?

How many hours must you work to buy a new iPhone? It varies dramatically around the world, reflecting disparities in productivity and purchasing power. According to a recent report by UBS that aims to measure well-being by estimating how many minutes workers in various countries must work to afford either an iphone, a Big Mac, a kilo of bread or a kilo of rice, the average worker in Zurich or New York can buy an iPhone 6 in under three working days.

Read More »

Read More »

FX Daily, December 12: Dollar and Yen Trade Lower to Start the Week

The US dollar and Japanese yen are trading lower. The tone is largely consolidative, and the foreign exchange market is not main focus today. Instead, the OPEC-non-OPEC agreement before the weekend is arguably the key driver today. Oil prices are up 4.5%-4.8%, lifting bond yields and supporting oil producers' currencies, like the Norwegian krone, Canadian dollar, the Russian ruble and Mexican peso.

Read More »

Read More »

Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday's agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its highest close since September...

Read More »

Read More »