Monthly Archive: December 2016

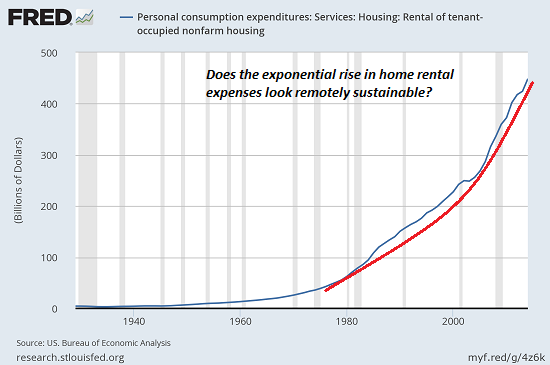

What Have the “Experts” Gotten Right? In the Real Economy, They’re 0 for 5

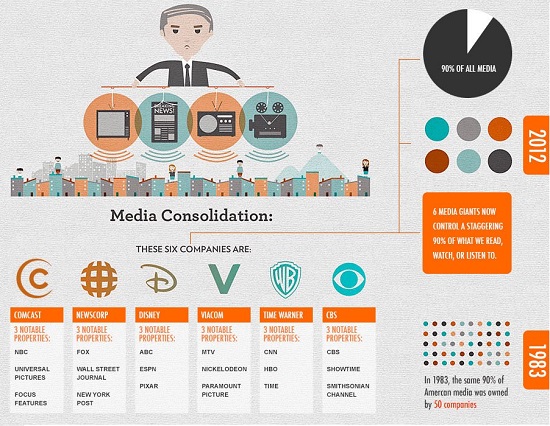

If the "experts" were assessed on results, they'd all be fired. The mainstream media continually hypes the authority of "experts," i.e. people with a stack of credentials from top institutions. But does the mainstream media ever check on whether the "experts" got anything right? Let's compare the "experts" (conventional PhD economists) diagnoses and fixes with the results of their policies.

Read More »

Read More »

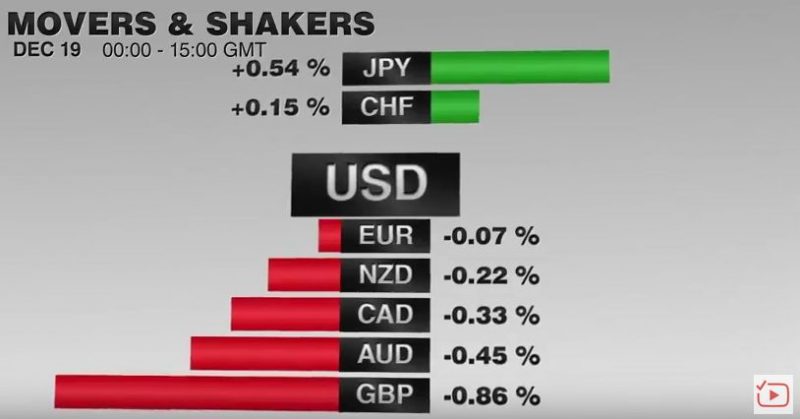

FX Daily, December 19: EUR/CHF Dives under 1.07

Once again a line in sand for the Swiss National Bank is broken. The EUR/CHF falls under 1.07. But trading algorithms are like this: When the EUR/USD is falling, then the EUR/CHF must follow. The SNB decided not to intervene any more at 1.07.

Read More »

Read More »

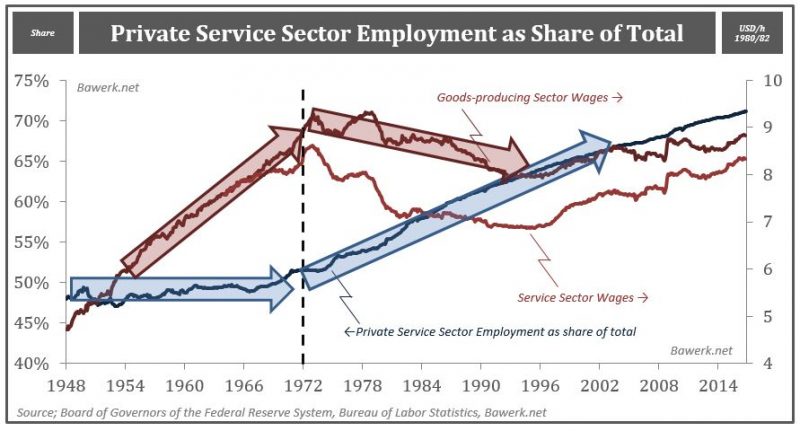

Toward A New World Order, part III

A new world order is coming of age and the transition is painful to accept for a Western middle class with a deep-seated sense of entitlement. We showed how the West feels threatened globally in Toward a New World Order and followed up explaining how this translate into domestic politics in Toward a New World Order Part II. We will now continue this series by showing how gross economic mismanagement have created the new political class that we...

Read More »

Read More »

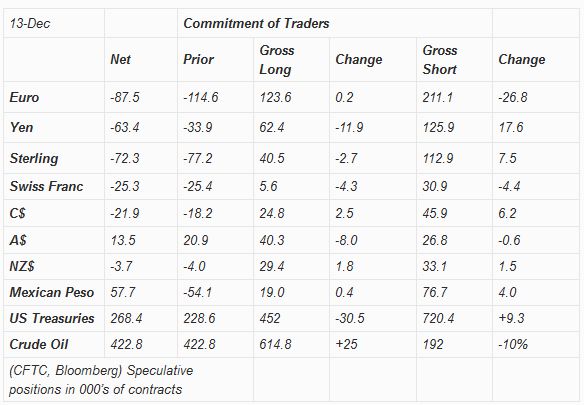

Weekly Speculative Positions: Short CHF Close to Records of 2015

The net short CHF speculative position is close to reaching new records. Shortly before the end of the peg, speculators were net short CHF by 26.4K contracts. Now we are at 25.4K.

Read More »

Read More »

FX Weekly Preview: Twas the Week Before Christmas, Amidst Powerful Trends

The Nikkei, the dollar-yen and 10 yr US yield have risen nine of the past 11 weeks. The Dollar Index and 2 yr US yields have risen while gold has sold off in eight of past 11 weeks. Issue in next two weeks, profit-taking or trend extension? Spoiler alert: I expect some profit-taking.

Read More »

Read More »

Has the Fed Turned “Hawkish?”

Juiced, Stimulus, in a general sense, is something that causes an action or response. A ringing alarm clock may prompt someone to exit their slumber. Or a fist to the gut may force someone to gasp for breath.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM ended the weak on a soft note, as the hawkish Fed decision continued to have reverberations for global markets. Worst performers in EM last week were CLP (-3.3%), ZAR (-2%), and KRW (-1.5%). With little fundamental news expected this week, markets may take a more consolidative tone, especially with the holidays approaching. However, we continue to believe that the global backdrop for EM remains negative.

Read More »

Read More »

BIS: A Paradigm Shift on Bond Yields?

Review of recent BIS report. US election spurred a substantial change in sentiment. Equity and bond market reactions are roughly similar to when Reagan was elected, with the dollar, at least initially, stronger than then.

Read More »

Read More »

FX Weekly Review, December 12 – December 16: Fed Lifts Dollar, but Consolidation may be on Tap

The small adjustment to Fed’s anticipated path for the Fed funds target helped lift the US dollar to its highest level against the euro since 2003, and to ten-month highs against the Japanese yen. The graph shows that the dollar has improved by 25% against the euro, but only by 10% against CHF over the last 3 years.

Read More »

Read More »

Swiss-based Glencore’s Rosneft deal reopens battle for Russian commodities

In the cutthroat world of commodities trading, there’s no bigger prize than Russia. The country of Vladimir Putin has it all: oil, natural gas, aluminum, nickel, wheat, coal and many other riches. The world’s biggest trading houses have jostled over it for decades.

Read More »

Read More »

Is the Deep State at War–With Itself?

The recent pronouncement by the C.I.A. that Russian hackers intervened in the U.S. presidential election doesn't pass the sniff test--on multiple levels. Let's consider the story on the most basic levels.

Read More »

Read More »

“This Is Total Chaos” – Venezuela Shuts Colombia Border To Stop “Mafia” Currency Smuggling

As if things were not already chaotic enough in the socialist utopia of Venezuela, following President Nicolas Maduro's decision to follow Indian PM Modi's playbook and announce that the nation's largest denomination bill (100-Bolivars - worth around 3c) will be pulled from circulation in 72 hours, he has tonight closed the border to Colombia to crackdown on currency smuggling by so-called "mafias".

Read More »

Read More »

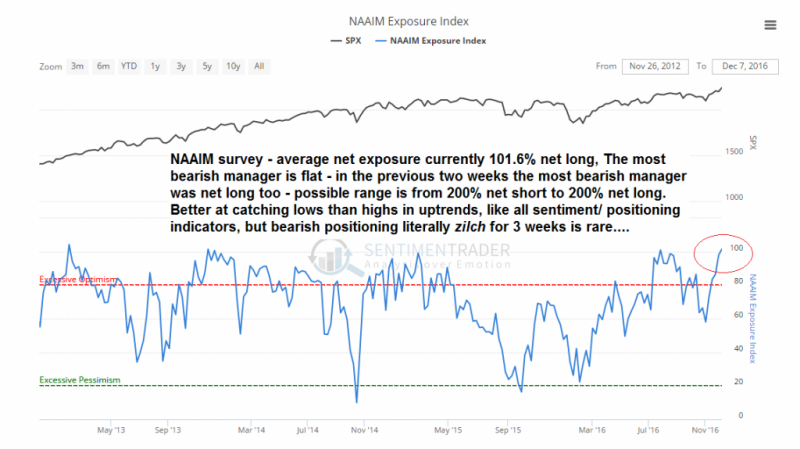

The Exiling of Risk

A Quick Chart Overview Below is an overview of charts we picked to illustrate the current market situation. The selection is a bit random, but not entirely so. The first set of charts concerns positioning and sentiment. As one would expect, these look fairly stretched at the moment, but there are always ways in which they could become even more stretched. First a look at the NAAIM exposure index.

Read More »

Read More »

Swiss pay doesn’t always match company success, Ethos says

Switzerland continues to see a disconnect between executive pay and company performance three years after voters passed some of the world’s strictest limits on compensation, according to a study by corporate governance group Ethos.

Read More »

Read More »

Rising Trade Tensions

Obama Administration has taken a hardline against China's trade practices. Other countries are also resisting China's arguments that it is a market economy. Last week, US imposed anti-dumping duties on imported washing machines from China.

Read More »

Read More »

Why the Democrats Can’t Let Go of Losing

The Democratic Party has become everything it once was against. The Democratic Party has become everything that it once loathed: elitist, globalist, interventionist, self-serving, warmongering and overflowing with hubris.

Read More »

Read More »

Emerging Markets: What has Changed?

China will raise the sales tax on small cars to 7.5% in 2017. New methodology used by Turkstat to measure Turkish GDP has led to significant upward revisions. Turkish authorities are growing more concerned about the weak lira. Fitch moved the outlook on Chile. Chile’s central bank shifted to an expansionary policy bias. Colombia selected Juan Jose Echavarria to be the new central bank governor. Fitch revised the outlook on Mexico’s BBB+ rating from...

Read More »

Read More »

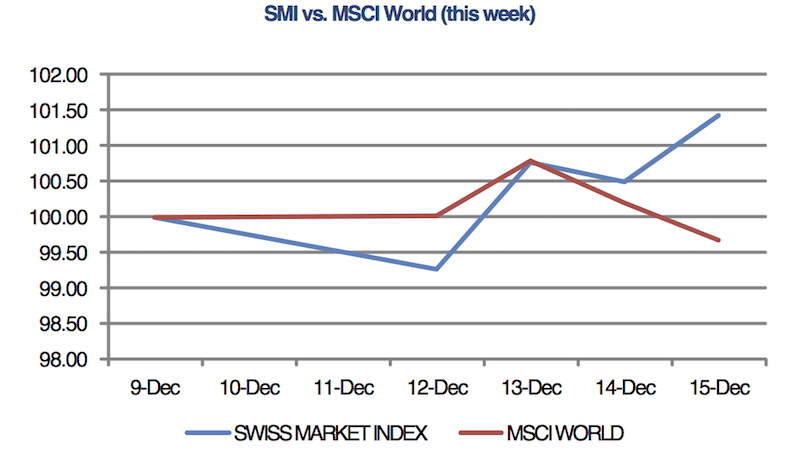

December rally continues this week for SMI

2016’s December rally continued this week as Swiss and European equities outperformed global stocks. The US dollar continued to surge after the Federal Reserve increased interest rates for only the second time in a decade on Wednesday.

Read More »

Read More »

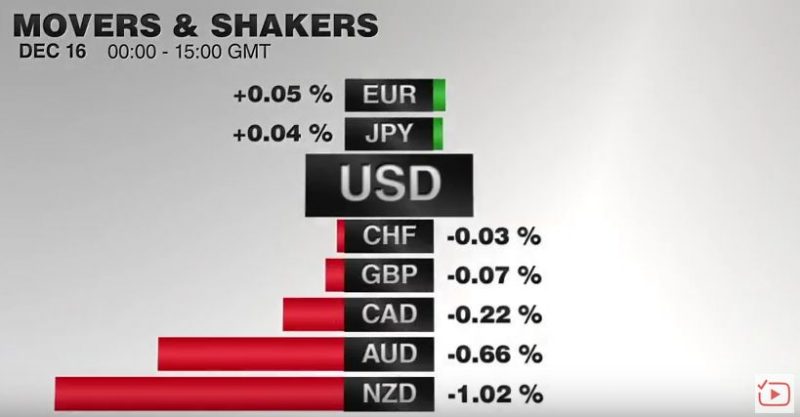

FX Daily, December 16: Markets Turn Quiet Ahead of the Weekend, Dollar Consolidates Gains

Some mild position squaring pressures are evident ahead of the weekend, and for many market participants the year is coming to an end. Outside of the BOJ meeting next week, the calendar turns light and markets are moving into holiday mode. The Dollar Index is seeing this week's gains trimmed, but it is up nearly 1.4% this week. Although the election has seen the dollar's gains accelerate, the current leg up began in early October. The Dollar...

Read More »

Read More »