Monthly Archive: December 2016

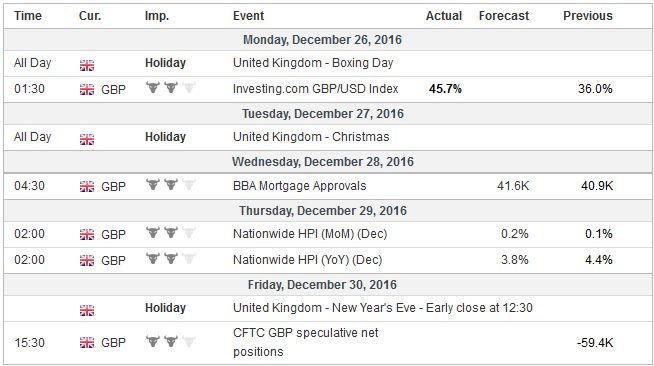

FX Daily, December 27: Markets Becalmed in Wait-and-See Mode

As skeleton teams return to the trading desks in New York, the US dollar is largely where they left it at the end last week. Japanese markets were open yesterday, while UK, Australia, New Zealand, Hong Kong and Canadian markets are still closed today.

Read More »

Read More »

Crisis of Meaning = Crisis of Work

Allow me to connect two apparently unconnected dots. Dot #1: The last sugar plantation in Hawaii is closing down, ending more than a century of plantation life in the 50th state.

Read More »

Read More »

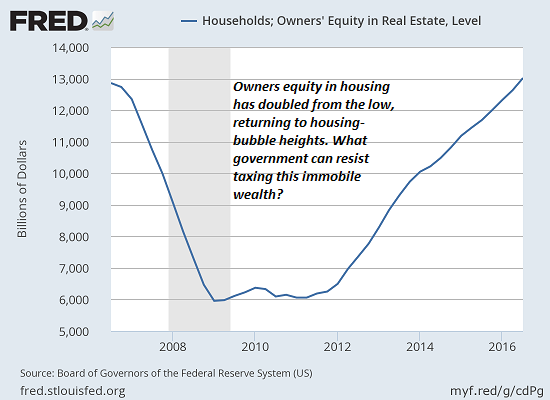

When Assets (Such as Real Estate) Become Liabilities

It will be the middle class that accepted the notion that "real estate is the foundation of family wealth" that will be stripmined by higher taxes on immobile assets such as real estate.

Read More »

Read More »

FX Outlook 2017: Politics to Eclipse Economics

Investors are familiar with a broad set of macroeconomic variables that often drive asset prices. Many are familiar with corporate balance sheets, price-earning ratios, free cash flow, Q-ratio, and the like.

Read More »

Read More »

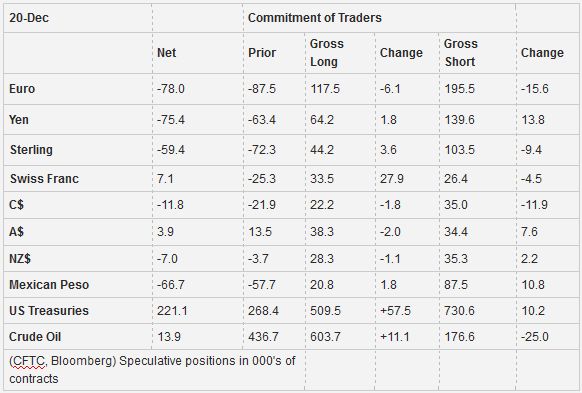

Weekly Speculative Positions: After Fed Rate Hike, Speculators Close their Short CHF and Open Long CHF

The expiry of the December currency futures may spurred more than normal speculative position adjusting. The out-sized 27.9k contract jump in the speculative gross long Swiss franc futures position is a prime example.

Read More »

Read More »

FX Weekly Review, December 19 – December 23: Assessment of the Dollar’s Technical Condition

The small adjustment to Fed’s anticipated path for the Fed funds target helped lift the US dollar to its highest level against the euro since 2003, and to ten-month highs against the Japanese yen. The graph shows that the dollar has improved by 25% against the euro, but only by 10% against CHF over the last 3 years.

Read More »

Read More »

Emerging Market Preview for the Week Ahead

EM gained some limited traction as last week ended. However, renewed concerns about China could limit this bounce as President Xi signaled the possibility that growth could fall below the government’s 6.5% target.

Read More »

Read More »

How to Invest in the New World Order

In our latest Toward a New World Order, Part III we ended by promising to look closer at investment implications from the political and economic shift we currently find ourselves in; and that story must begin with the dollar.

Read More »

Read More »

Moody’s & Reserve Bank of Australia Warn of Increasing Mortgage Arrears and Looming Apartment Defaults

Moody’s & Reserve Bank of Australia Warn of Increasing Mortgage Arrears and Looming Apartment Defaults. Last Wednesday Moody’s reported that mortgage arrears continue to rise across Australia, particularly in the mining states of WA & NT:

Read More »

Read More »

The Washington Post: Useful-Idiot Shills for a Failed, Frantic Status Quo That Has Lost Control of the Narrative

Don't you think it fair and reasonable that anyone accusing me of being a shill for Russian propaganda ought to read my ten books in their entirety and identify the sections that support their slanderous accusation?

Read More »

Read More »

The Burrito Index: Consumer Prices Have Soared 160 percent Since 2001

In our household, we measure inflation with the Burrito Index: How much has the cost of a regular burrito at our favorite taco truck gone up? Since we keep detailed records of expenses (a necessity if you’re a self-employed free-lance writer).

Read More »

Read More »

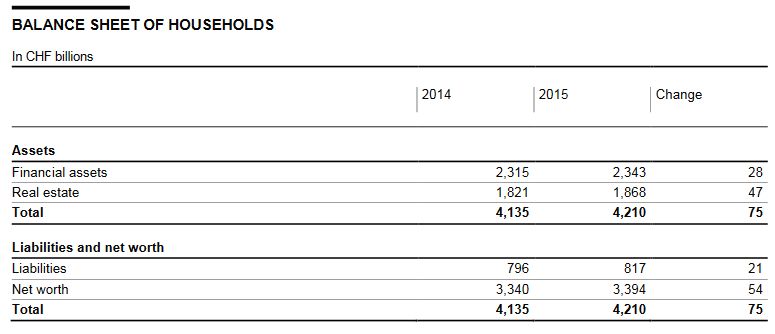

Swiss Financial Accounts, 2015 edition

This year, the Swiss financial accounts, which have been released by the Swiss National Bank since 2005, feature changes affecting both timeliness and presentation.

For the first time, data on the financial accounts are now published within eleven months of the reference date, reducing time to publication by one year. Moreover, the balance sheet of households, previously the subject of the press release on household wealth, is now included in the...

Read More »

Read More »

Emerging Markets: What has Changed

China President Xi raised the possibility of sub-6.5% growth. Fitch moved the outlook on Indonesia’s BBB- rating from stable to positive. The Philippine central bank raised its 2017 inflation forecasts for 2017 and 2018.

Read More »

Read More »

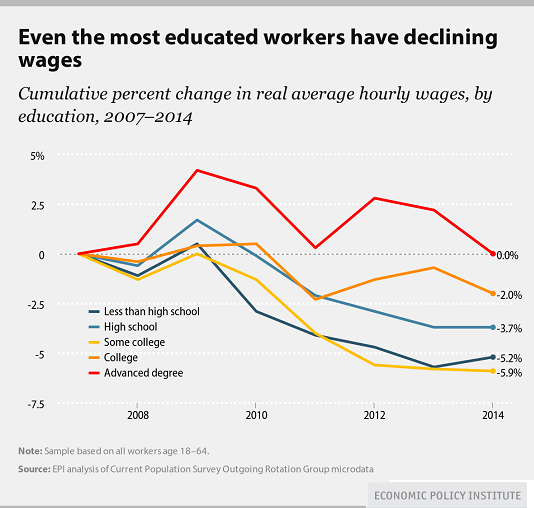

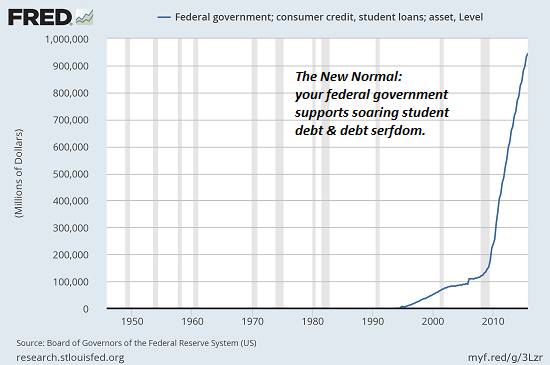

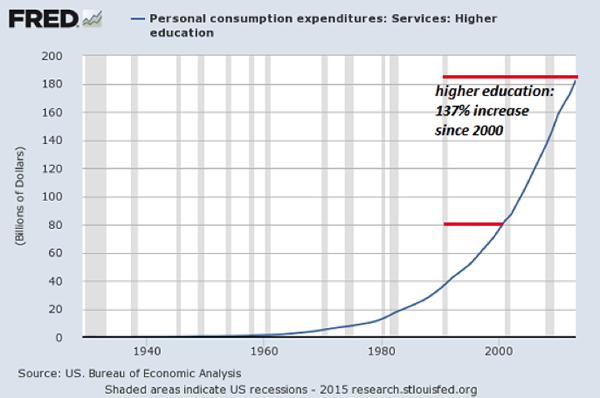

The Disaster of Inflation-For the Bottom 95 percent

Central banks are obsessed with boosting inflation, but the "why inflation is good" arguments make no sense for households being ravaged by inflation. The basic argument is that inflation makes it easier for debtors to service their debts.

Read More »

Read More »

Seven banks fined in Swiss probes of rate-rigging cartels

Switzerland handed out about $100 million in antitrust fines against seven U.S. and European banks for participating in cartels to manipulate widely used financial benchmarks.

Read More »

Read More »

Modi’s Fantastic Promises

This article continues right where Part VI left off (for earlier updates on the demonetization saga see Part-I, Part-II, Part-III, Part-IV, and Part-V). There is still huge support for Modi even among the poor. A big carrot is dangled before them, which makes many stay numb to their current suffering. During his election campaign in 2014, Modi promised to deposit more than Rs 1.5 million (~$22,000) in each poor person’s account once the...

Read More »

Read More »

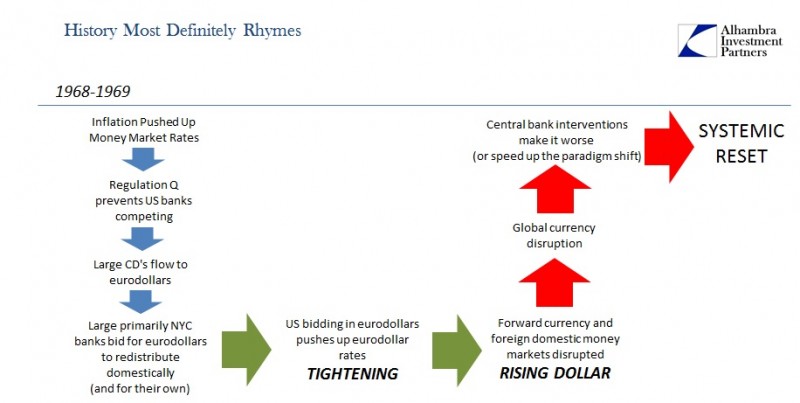

We Know How This Ends – Part 2

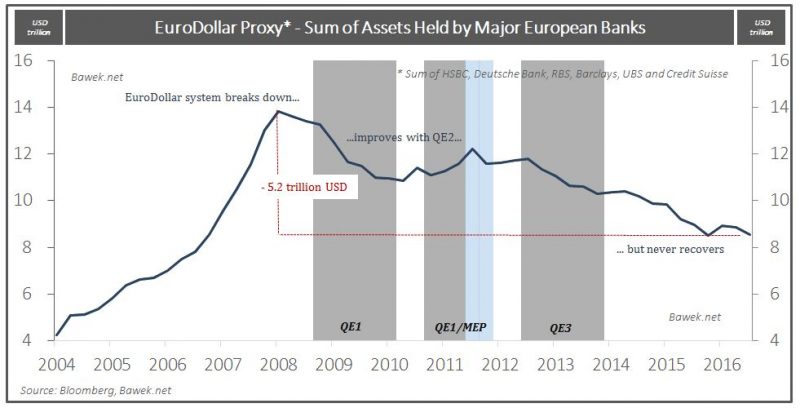

In March 1969, while Buba was busy in the quicksand of its swaps and forward dollar interventions, Netherlands Bank (the Dutch central bank) had instructed commercial banks in Holland to pull back funds from the eurodollar market in order to bring up their liquidity positions which had dwindled dangerously during this increasing currency chaos.

Read More »

Read More »