JuicedStimulus, in a general sense, is something that causes an action or response. A ringing alarm clock may prompt someone to exit their slumber. Or a fist to the gut may force someone to gasp for breath. Stimulus can come in many forms and varieties. It can come in the form of a stick; do this and you won’t get whacked over the head. So, too, it can come in the form of a carrot; do that and you’ll get a reward. |

|

| Other forms of stimulus can produce a short, burst like, reaction. The caffeine in a cup of coffee, for instance, will temporarily reduce drowsiness. Yet once the caffeine wears off, more coffee is needed to sustain the effect.

Former professional baseball player, and all around dirt bag, Jose Canseco knows a thing or two about stimulus. Not from what someone has taught him. But from what he learned through real world experience. He literally wrote the book on it. His 2006 memoir, Juiced: Wild Times, Rampant ‘Roids, Smash Hits, and How Baseball Got Big, tells the story of how he and other athletes experimented with performance enhancing drugs to stimulate their baseball careers. If you recall, baseball players in the later 1990s – their necks and baseball statistics puffed up like balloons. They became caricatures in appearance and performance. |

|

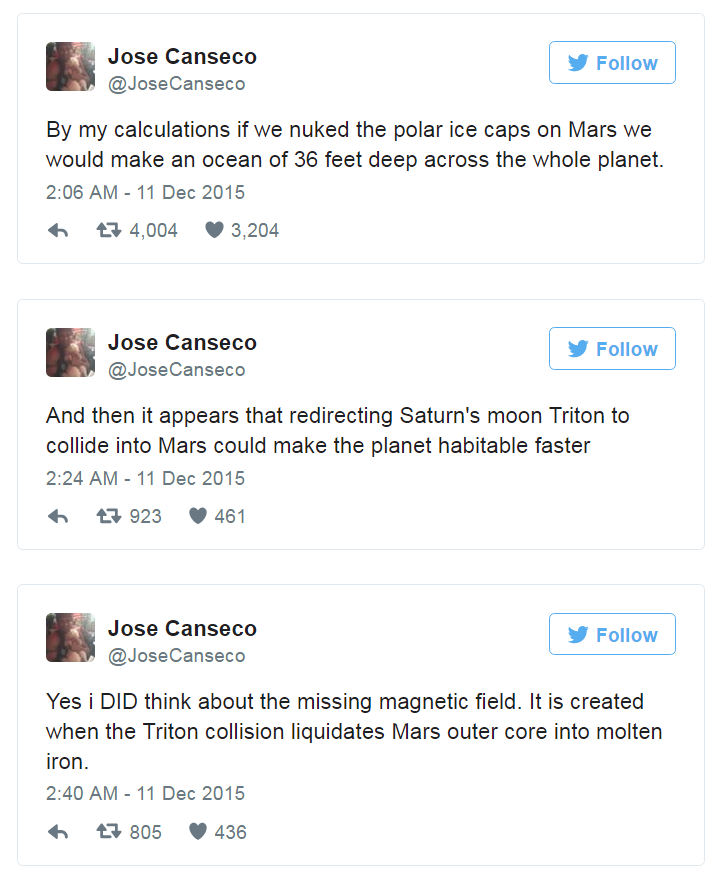

Dow 40,000!Apparently, Canseco’s experimental research makes him an expert on all things related to stimulus. Even monetary stimulus. In fact, Canseco’s lobbying President-elect Donald Trump to make him Chairman of the Federal Reserve. As of market close on Thursday, the Dow was a horse’s hair away from 20,000. Make of it what you will. Every historical metric and inkling we know of informs us that this market is extremely overvalued. A brief intermezzo to illustrate why the man is eminently qualified to do just about anything – he is in possession of nigh superhuman imagination and derring-do potential. Here are a few tweets of his in which he displays his previously hidden talents as a space engineer/ Mars terraformer (incidentally, his obsession with outer space may be a reason why he wants to send the Dow there as well). He has even figured out how to outfit the place with a magnetic field, which it apparently lacks at present. Just drop Triton on Mars, right after you’ve nuked it… presto, problem solved! In fact, the proposed Triton drop seems to be killing two birds with one very big stone, so to speak. Now that’s some “stimulus”! In case you’re wondering, Triton is lounging about practically around the corner, with nothing much to do apart from keeping Saturn company. Quickly grabbing it and dropping it into the 36 foot deep oceans of freshly nuked Mars seems so… what is the word… obvious! And yet; remember the story of the famed egg of Columbus? You may believe it’s obvious dear reader, but it took Jose Canseco to actually think of it! |

|

But according to Canseco, if he were Chairman of the Federal Reserve, the DJIA would hit 40,000 in four years. On Monday Canseco directed the following tweet at Trump:

Quite frankly, only an idiot would think DOW 40,000 in four years would somehow make the economy great again. Monetary stimulus has already puffed up the market to something that has no obvious connection with the economy. Moreover, the economy ain’t great. Wall Street’s gone up. Main Street’s flat lined. Of course, the only way to achieve a DOW 40,000 target in four years is through massive amounts of monetary stimulus. Given the radical monetary policy, and subsequent market distortions and economic flailing that has taken place over the last eight years to reach DOW 20,000, there’s no reason to believe DOW 40,000 would make the economy great again. |

Relative Strength IndexWhat you see above is the IBC General Index in Caracas, Venezuela. If you look closely, you will notice that it almost hit the 40,000 points level not too long ago. So has Venezuela’s economy missed greatness just by a hair? Not at all! In fact, the 40,000 points greatness threshold was crossed a very long time ago already – Venezuela’s authorities perpetrated a 1000 for one reverse split on the IBC General Index when it hit 2 million points, so it has actually reached almost 40 million points recently, adjusting for said split… one would actually have to conclude that Venezuela has crossed over into economic Nirvana not once, but many times. By now it must surely be close to Nirvana squared… no doubt the roasted chickens are flying into the mouths of hungry comrades voluntarily!

|

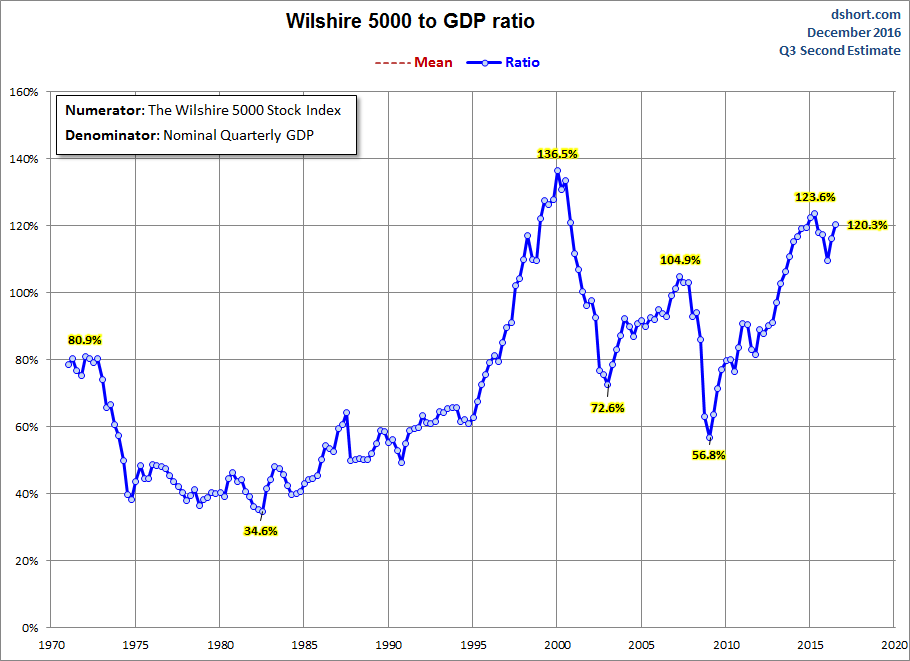

Has the Fed Turned “Hawkish?”Canseco, however, isn’t alone in his fantastical thinking and enthusiasm. Countless intelligent individuals, that have made careers out of economics, have had their minds softened over by theories not too different from Canseco’s. Namely, that a perpetually higher stock market is good for the economy. This philosophy is best illustrated by a popular idea of economists called the “wealth effect.” In a nut shell, the wealth effect is the idea that people spend more as the value of their assets rises. When investment portfolios increase in value, consumers feel more financially secure and they buy stuff… like cheaply made light-up reindeer antlers from China. The increase in spending, in turn, stimulates the economy. Yet the experience over the last 8 years tells a different story. The Dow has gone up 160 percent. GDP has gone up just 30 percent. |

Wilshire 5000 to GDP ratio Wilshire 5000/ nominal GDP ratio – this is actually quite a damning indicator in a great many ways. Both its volatility and its tendency to go to ever more extreme levels in modern times is quite telling. You can inter alia see here that money cannot possibly be “neutral”. Evidently, monetary inflation doesn’t affect prices in a uniform manner. This fact has real economic consequences (we will discuss this indicator in more detail in a future post). - Click to enlarge |

| This week we learned the Fed will finally begin to make gradual increases to the federal funds rate. On Wednesday, Fed Chair Janet Yellen announced the Fed will raise the federal funds rate a quarter percent to somewhere between 0.5 to 0.75 percent.

Following the announcement we came across numerous statements from economists whom are of the opinion that the Fed has somehow turned “hawkish.” What planet are these fellows from? If the Fed’s now hawkish, then a canary’s a big fat juicy turkey. To be clear, despite the slight increase, and the possibility for gradual increases in 2017, a federal funds rate of 0.75 percent is still highly accommodative. Similarly, the Fed is still a dove. So in the world we’re entering, where Donald Trump will be pushing hard for new fiscal stimulus, the Federal Reserve will continue to press the monetary stimulus pedal to the metal. Nonetheless, Jose Canseco’s DOW 40,000 and the Fed’s wealth effect will not come to pass. |

Charts by: BigCharts, AdvisorPerspectives / Doug Short

Mars fixing by Jose Canseco, our man in outer space

Transmigration of Venezuela to economic Nirvana: a H. Chavez/N. Maduro co-production

Chart and image captions by PT

Full story here Are you the author? Previous post See more for Next post

Tags: central-banks,newslettersent