| As global markets bask in the glow of the Trumpflation recovery, the ECB continues to be busy providing the actual levitating power behind what DB recently dubbed global “helicopter money“, by buying copious amounts of bonds on a daily basis (at least until tomorrow when the ECB goes on brief monetization hiatus, and Italy will be on its own for the next two weeks).

According to the latest weekly breakdown of what the six central banks acting on behalf of the Euro system bought in the week ending December 16, the ECB purchased at least 6 corporate bonds under its CSPP program. The latest weekly purchase lifts the number of securities held to 773; this means that the ECB now holds 9.2%, (€50.6bn) of the entire European corporate market (€549.34bn outstanding). |

Weekly Purchases |

| The ECB bought bonds issued by AB InBev, Autostrade Per L’Italia, Knorr-Bremse, Snam and Uniper. 104 (~13.5%) of the 773 securities are negative yielding. Utilities remain the largest industry group with 207 securities.

For the week ending 16th December, the bond purchases stood at €0.7bn across sectors (vs. €1.6bn the week prior). The complete list of ISINs can be found here, courtesy of UBS. Last week, total EUR issuances worth €6.2bn were issued in the primary market, of which €0.23bn were CSPP eligible. For the month ending November, total CSPP holdings stood at €47.2bn, with 86% of the purchased amount coming from the secondary market. |

ECB bought bonds issue |

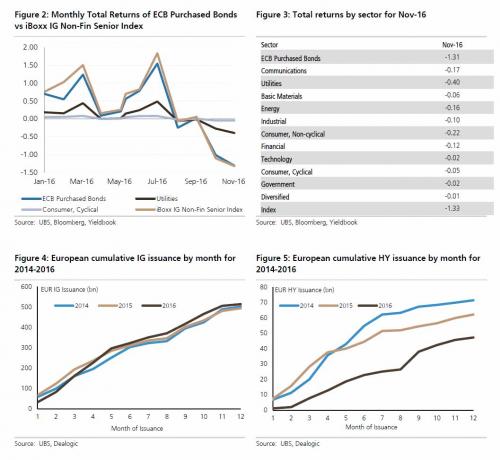

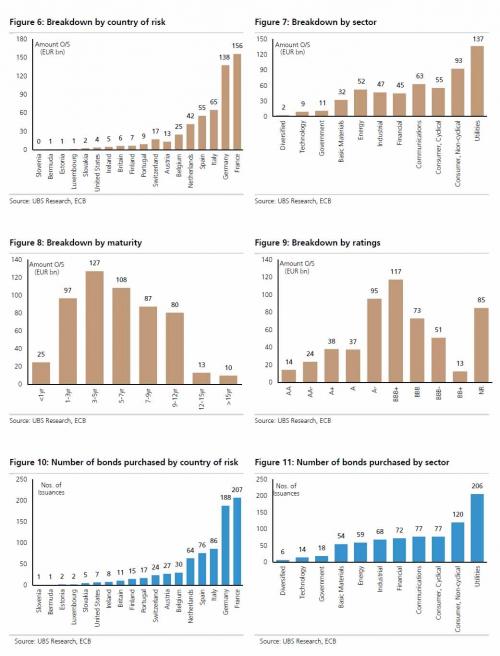

What bonds has ECB bought into?Looking at the break-up country wise, French and German issuers continue to dominate the ISIN count (395 issuances worth €294bn in amount outstanding). Bonds from non-Eurozone corporates were also on the list, with the bulk from Switzerland (24 issuances worth €17bn). When looking at the purchases by sector, Utilities remains the top pick (206 issuances worth €137bn), while non-cyclical consumer is a distant second (120 issuances, €93bn in amount outstanding). In terms of duration, while the ECB has bought across the curve, it has avoided going very long (12+yr). The bulk of the purchases has occurred in 3-7yrs region (337 issuances worth €235bn). By rating, it’s clear that the ECB hasn’t been reluctant from taking credit risk as they have bought into overall 178 BB-rated and non-rated bonds. By yield, the ECB has already bought into 152 negative yielding bonds (€116bn, average yield of -0.13%). By issuer, we find that the ECB has bought into 771 bonds from 227 issuing entities. The bond with the longest maturity that was purchased was the 20 year EDF 1.875% 13/10/36 from the Electricité De France. The ECB has provided a strong bid for Euro credit since its announcement in Mar-16 with EU high grade and high yield credit spreads tightening by 36bps and 158bps, respectively. Corporate purchases began on 08-Jun-16, with the weekly average of ~€1.8bn per week and total corporate bond holdings of €50.6bn (as of 16-Dec-16), or roughly €7.2bn a month. ECB purchased bonds have lost 1.31% in Nov vs 1.02% in Oct. However, the bonds purchased under CSPP have marginally outperformed the broad index that shed 1.33% in November. |

|

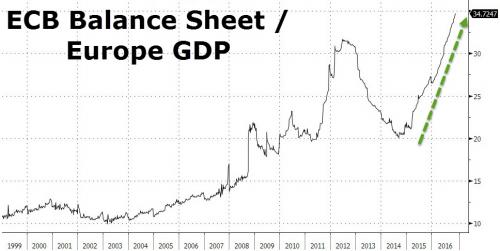

| Finally, looking at the overall ECB balance sheet, as of the latest update, the central bank added a total of €21 billion in assets, bringing the total to €3.631 trillion, an amount equal to almost 35% of the entire Eurozone GDP. |

ECB Balance Sheet/Europe GDP |

Tags: Bond,Business,central banks,Economy of the European Union,Eurozone,France,Italy,monetization,money,newslettersent,Primary Market,recovery,Switzerland