Summary:

Review of recent BIS report.

US election spurred a substantial change in sentiment.

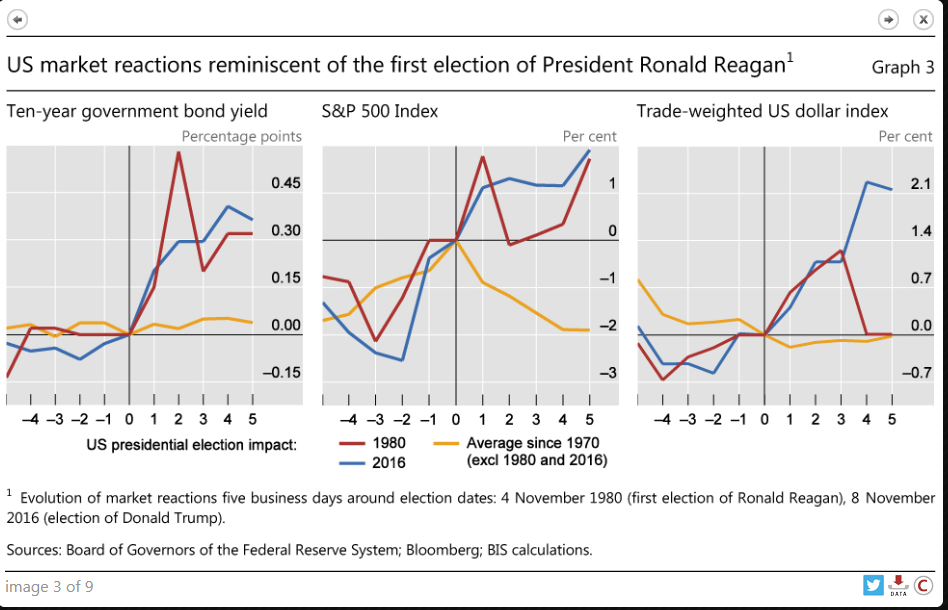

Equity and bond market reactions are roughly similar to when Reagan was elected, with the dollar, at least initially, stronger than then.

| The Bank of International Settlement asks in its quarterly report if there has been “a paradigm shift in the markets?” Although it does not provide an explicit answer, it does argue that there has been a significant change in sentiment. The chart of the US 10-year yield, created on Bloomberg, depicts the 35-year decline in US yields. The recent rise in yields can be seen, but there have been other counter-trend increases in the past.

The BIS notes that after falling to new lows, overall yields jumped dramatically by the end of November. The rise in yields was comparable to the taper tantrum in May-September 2013. The key change, according to the BIS, was the US election. It recognizes that until then assets in the emerging market economies seemed unperturbed by the developments in the advanced economies, even though US bond yields were 50 bp off their lows by the time of the election in early November. The election prompted a marked change in expectations. The BIS notes that investors were now anticipating expansive fiscal policy, lower corporate taxes, easier regulation and a boost to corporate profits. Indeed, as this Great Graphic from the BIS shows, the apt comparison is the election of Reagan in 1980. The rise in yields and S&P 500 since the US election were broadly similar since 1980, while the dollar’s rally has been stronger. Our approach focused on the policy mix. The best policy mixed for a currency is tighter monetary and looser fiscal policy. We thought regardless of the election outcome the policy mix would become more favorable for the dollar. Both candidates promised fiscal stimulus, and Trump’s campaign promises were bigger, not only than Clinton’s pledges, but Sander’s as well. |

US Generic Govt 10 Year Yield |

| Monetary policy had already begun the normalizing, albeit extremely slowly, though the commitment was there. The direction of monetary policy was clear prior to the election, and end of the inventory and capex-led headwinds saw the US economy return to above trend growth. Although fiscal policy may expand as much as it did during Reagan’s first time, monetary policy is most unlikely to match what Volcker did for the simple reason that the starting point for inflation diametrically different.

Perhaps, blunting this in part is the divergence in the interest rate cycle between the US on one hand, and nearly all of the major economies on the other. The US 10-year premium over Germany is the widest since the 1997. The US 10-year premium over Japan is at six year highs. The US 10-year premium over the UK is near 16 year highs. The BIS appears relatively relieved that the sharp rise in core yields was fairly orderly even if sharp. It notes that corporate spreads remained tight in contrast to the taper tantrum experience. In the run-up to the election, corporate spreads narrowed and were near the lowest for the year at the end of November. Corporate spreads widened a little in Europe, though they were around a fifth lower than experienced immediately after the UK referendum. In seeking to explain the limited impact of the higher yields, the BIS suggests that the major holders of US Treasuries no longer bear mark-to-market risks, while there is less ripple effect from hedgers. These are the direct consequences of official action. Specifically, around 40% of the US Treasury market is in the hands of the Federal Reserve and other foreign central banks. In the past, a rise in Treasury yields would spur hedging from the likes of Fannie Mae and Freddie Mac. This contributed to past bond market turbulence. However, as is well appreciated, Fannie and Freddie sold a large share of their portfolios to the Federal Reserve, which does not hedge its securities. |

US Market Reactions: Ten year government bond yields, S&P 500 Index, US Dollar Index |

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,Bank of international Settlements,newslettersent,policy mix,taper tantrum