Summary:

FOMC meeting is the last highlight of the year.

OPEC and non-OPEC producers strike a deal: optics good and that can lift prices further in near term.

Italy will have a new Prime Minister, the fourth unelected PM.

Provided that the Federal Reserve delivers the widely tipped and expected 25 bp hike in the Fed funds target range, the key to investors’ reaction will be a function of the FOMC statement and forecasts. The FOMC meeting is the last big event of the year for investors. The Bank of England, the Swiss National Bank, and Norway’s Norges Bank hold policy meetings, none are likely to alter policy. Several emerging market central banks meet this week, and Mexico is the only one that will likely move. Many expect a 25 bp hike, but there is some risk of a 50 bp move. The Bank of Japan meets the following week, and it too is unlikely to take fresh measures.

A failure of the Federal Reserve to raise interest rates would be a significant shock and spur a dollar sell-off, a Treasury rally, and probably an equity market sell-off. The likelihood of this scenario is so low that it is not worth much time discussing. Similarly, 50 bp move also is highly unlikely. It would go against everything the Fed has been saying about gradual moves. It would be an admission of getting behind the curve, and there is no evidence that this is their assessment.

Since the FOMC last met, the US dollar has strengthened, interest rates have risen sharply, and the unemployment rate has fallen further. Investors will learn what the central bank makes of these developments. Officials that have spoken since the election have generally agreed that it is premature to make any judgments of changes in fiscal policy or economic policy more broadly. And for good reasons. It is far from clear the policies of the new Administration.

There seems to be a broad sense that probably near midyear there will some tax cuts and spending increases, alongside a tougher, perhaps more mercantilist trade policy. The details are vague, and how this sits with fiscal conservative wing of the Republican Party is not clear. While the intentions and signals of the President-elect have spurred a sizable reaction in the capital markets, more concrete details are needed to begin contemplating the impact on monetary policy.

Therefore, and this is where some investors may be disappointed, the FOMC’s economic assessment, and most importantly, their forecasts are unlikely to change very much. Of course, the part of the statement that updates the economic assessment may be upgraded a notch. The headwinds that held the economy below trend appear to be transitory as the Fed had anticipated. The fourth quarter growth looks to be around 2.5%. Consumption may be a little less robust and trade is looking like a drag.

The Fed will have to recognize the rise in market-based measures of inflation expectations. Both the 5-year forward forward and the 10-year break-even rates are up around 30 bp since the end of October to be around 2.0%. There are two mitigating factors. First, the survey-based measures of inflation expectations if anything have softened. The University of Michigan survey found expectations for the next 5-10 years slipped to 2.5% this month from 2.6%. Second, due to technical factors such as liquidity differences, in a rising interest environment, TIPS tend to sell off more than conventional bonds.

All else being equal the appreciation of the dollar and rise in yields would likely have a dampening impact on growth and inflation forecasts. This may be blunted by the further decline in the unemployment and underemployment rates and the wealth effect. And given the uncertainties over the new Administration, most Fed officials are likely to be reluctant to change their forecasts much now, when in three months, visibility will be better.

Specifically, we expect the median dot show expectations for two hikes next year. While this is twice as fast as the pace in 2015 and 2016, it fits any definition of prudent and cautious. A recent Wall Street Journal survey found that among economists three rate hikes are thought likely.

Interpolating from the December 2017 Fed funds futures contract is a trickier. Various possible scenarios calculations and assumptions are needed. Here is a simple one. Assume that the Fed hikes rates in the first half (Q2?), and the Fed funds target range coming into the 13 December 2017 FOMC meeting is 0.75%-1.00%. In the first 13 days December 2017, the Fed funds effective average is 87.5 bp, the midpoint. If the Fed were to raise the target range to 1.00%-1.25%, then the midpoint of the new range is 1.125%.

The last trading day is 29 December 2017. Fed funds may be volatile but it often falls on the last day of the year. For the sake of this exercise, let’s assume that the effective average on 29 December is half the average of 56 bp. Since it is a Friday, that rate applies to the weekend as well. On these assumptions, the average for the month is a fraction more than 1.03%. Before the weekend, the December 2017 Fed funds futures contract closed at 1.04%.

In her press conference, Yellen will likely deflect any discussion of the new Administration’s policies. However, she can be counted to offer a vigorous defense of the Fed’s independence against encroachments. Given two current vacancies, the expiration of several governor terms in 2018, the new Administration will have the opportunity to change the Federal Reserve significantly without going through the politically and economically sensitive course of direct confrontation.

Outside of the new Administration’s possible economic policies, the reversal of Saudi Arabia’s oil strategy may be another factor behind the rise of inflation expectations. Although an agreement within OPEC and between OPEC and non-OPEC producers is also difficult the achieve, the real challenge is the enforcement, as no such mechanism exists. While everyone is well aware of that, our point is that sequence is important and it is too early to worry about violations.

Like many, we seem to have underestimated the Saudi’s resolve. Shortly after securing an agreement from non-OPEC members to cut output, Saudi Arabia indicated it was prepared to cut output more than agreed last week. It suggested it would cut output below the psychologically important 10 mln bpd threshold. Not is OPEC not dead, but Saudi Arabia’s leadership is significant. Although non-OPEC members will cut 558k barrels, less than the 600k asked for, but it is still the most ever. It is also impressive, that despite Kazakhstan new large oil field coming on line, it also participated by a small cut (20k bpd).

The optics are good and this will likely lift oil prices further. Over the coming months, we suspect there is scope for oil to rise 12%-25% ($57-$65 a barrel basis the January futures contract). That said, the closer one examines the details, the less impressive it looks. Consider Russia will account for 300k bpd reduction, more than half of the non-OPEC contribution. Russia had boosted its output in recent months as an agreement was distinct, even if unlikely, possibility. There was a post-Soviet Union record 11.247 mln bpd in October. It says that it will cut 200k barrels by March and another 100k bpd in six months.

Saudi Arabia’s agreement with OPEC would have brought its output back to its average earlier this year. Several other countries, including Mexico are simply formalizing a natural decline. Important non-OPEC producers, including those in the US, Canada, and Brazil will be the beneficiaries, as free-riders. US capacity, especially the shale component, is very flexible and there are reports of that many wells have been drilled, but the wells have been capped. Consider it a free natural underground storage facility.

Also, recall that important technological advances have been made over the past two and half years (yes, Professor Gordon, the innovations are not as significant as the internal combustion engine) that lowers the cost of getting that marginal barrel of shale.Assuming that some US producers are skeptical of the implementation of the oil agreement, there may be incentives to boost output quickly to take maximum advantage of what could be a small window of opportunity.

EurozoneGiven last week’s ECB meeting and the approaching holidays, European economic data, including the PMIs may not be particularly important. Given the disappointing German and French industrial production figures last week, the risk is on the downside for the aggregate report after a 0.8% contraction in September. Just like there is no agreed upon definition of QE, there is no agreed upon definition of tapering. Context is important and intent matters. Draghi said it is not tapering as in the beginning of a gradual slowdown of purchases as an exit strategy rather than an abrupt end. At this point, there are only guesses as to why the ECB reduced its monthly purchases. However, this is a one-off adjustment, unless circumstances change. Moreover, the end date, year from now is soft. The ECB will most likely buy bonds well into 2018. The ECB did not begin an exit strategy, which is what many of those who want to insist on calling what it announced as tapering seem to think. The easing of the deposit floor limit on purchases and widening the range purchases suggests a sustainable course. The adjustments to the securities lending may also help minimize disruptions. The ECB has also not exhausted scope for additional technical adjustments. The decision not to lift the security ownership cap hit Portugal because it is near its cap. Italy remains a source of tension, but its problems remain localized. We do not see the rejection of the referendum has part of the Brexit-US election axis, and the 40% that voted for the referendum is a sufficient block to elect the next Prime Minister. We would suggest the local elections earlier this year, in which the Five-Star Movement won in Rome and Turin is a more revealing sign of its ascendancy. Italy’s foreign minister Gentiloni will replace Renzi as Prime Minister provided he can put together a government that can win a confidence vote. A broad coalition government needs to be in place by the middle of the week, to allow Gentiloni to represent Italy at the EU Summit that begins Thursday. Gentiloni is the fourth unelected Italian Prime Minister. There are three main tasks for the caretaker government: prepare for elections, make the necessary decisions to address the simmering banking crisis, continued reconstruction of the areas devastated by the recent earthquakes. An election before the Dutch election in March seems optimistic, but still the table is set for quite a political spring in Europe (Holland, Italy and France, UK likely triggering Article 50, before German elections in the Fall). The Italian premium over Germany has been trending higher all year. It began below 100 bp and is now at 167 bp, having been a little above 185 bp in late November. Italy’s 10-year bond yield is up 45 bp this year. Spain’s is off 25 bp. However, Italy can still borrow money at negative interest rates going out two years. The current minus nine basis points compares with positive ten basis point in late November. The Italian bank stock index fell 2.25% before the weekend, it still closed higher on the 12.75% on the week and 18% over the past two weeks. Perhaps, if necessary, the interregnum government can take the unpleasant step of seeking ESM support, which could otherwise tarnish Renzi’s comeback. Renzi not Grillo, the head of the 5-Star Movement is likely the odds-on favorite of the next election at this juncture. The Constitutional review of the new electoral law for the lower chamber after the former law were disallowed will take place in late January. If the new electoral law is rejected by the Court on grounds that giving a bonus to the largest party is not consistent with representative government, it would further bolster Renzi insofar as it favors coalition building, and this is a critical weakness for the Five-Star Movement. |

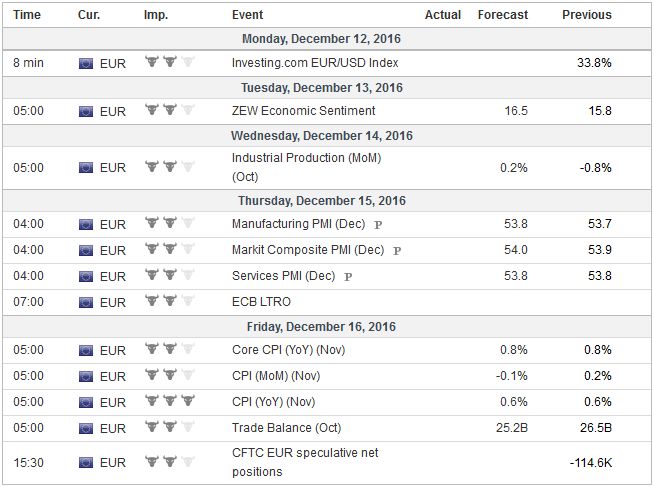

Economic Events: Eurozone, Week December 12 |

United StatesLastly, we note the dollar is running against the yen. It has risen in seven of the past nine weeks. It began with an eight-day advance in late September and early October, well before the US election. After carving out a base in the summer around JPY100, the dollar has rallied strongly. Since the middle of September, the yen has fallen nearly 12% against the dollar. The greenback has retraced a little more than 60% of the decline since peaking in June 2015 near JPY126. In the coming months, we expect the dollar to works its way back toward JPY120. |

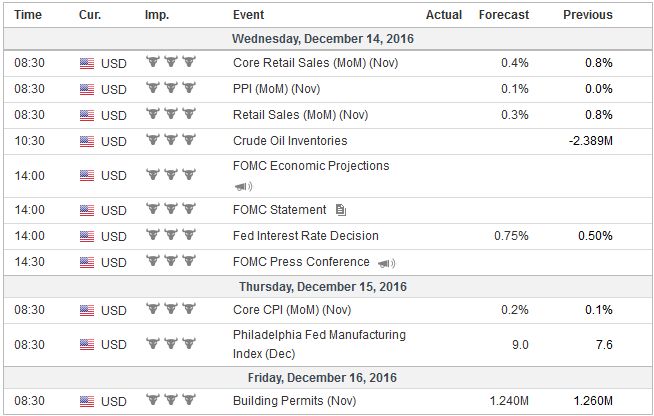

Economic Events: United States, Week December 12 |

JapanSince the middle of September foreign investors have returned to the Japanese stock market.In the last 10 weeks, foreign investors bought an average of JPY258 bln of Japanese equities a week. In these ten weeks, in all bought one saw net foreign buying. The average over the previous 10 weeks was a net sale of JPY249 bln over which time foreigner were net buyers in two of the weeks. The Topix has rallied about 13% over the period. Japan reports the Tankan Survey next week. There is good reason to be optimistic of the Japanese economy in the near-term. Growth in this quarter is off to a better start than the previous quarter. There will be an increase of fiscal stimulus next year. Higher oil prices will aid efforts to arrest lingering deflation pressures. While the US President-election appears to have ruled out TPP, much to Japan’s dismay, his more confrontational approach to China and “American First” plays well for Abe, who continues to expand Japan’s military capacity. |

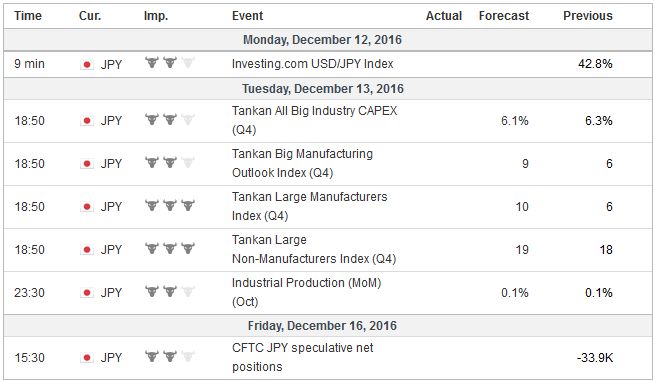

Economic Events: Japan, Week December 12 |

Switzerland |

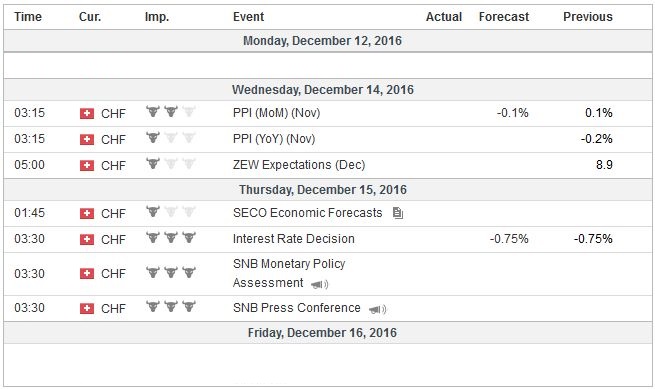

Economic Events: Switzerland, Week December 12 |

Tags: #USD,$EUR,$JPY,Italy,newslettersent