Ticking Time Bomb

“There are more things in heaven and Earth, Horatio, than are dreamt of in your philosophy.”

– William Shakespeare, Hamlet

The American populace counts down to Election Day with impatient intent. Will their party man occupy the White House come January 21, 2017? Or will their party woman occupy a federal prison cell?

These are questions that only the good wisdom of time can answer. Here at the Economic Prism we watch with indifferent curiosity. We don’t think either candidate’s worthy of high office. But we’re eager to know the election outcome, nevertheless.

The real noteworthy thing taking place today, that will have a real impact on your life, has nothing to do with who will be the next President. That’s merely a diversion. Rather, the real noteworthy thing taking place today – at this very moment – has everything to do with the ticking time bomb beneath the U.S. and world economy. |

Don “Groper” Trump and Hillary “Private Position” Lincoln. - Click to enlarge |

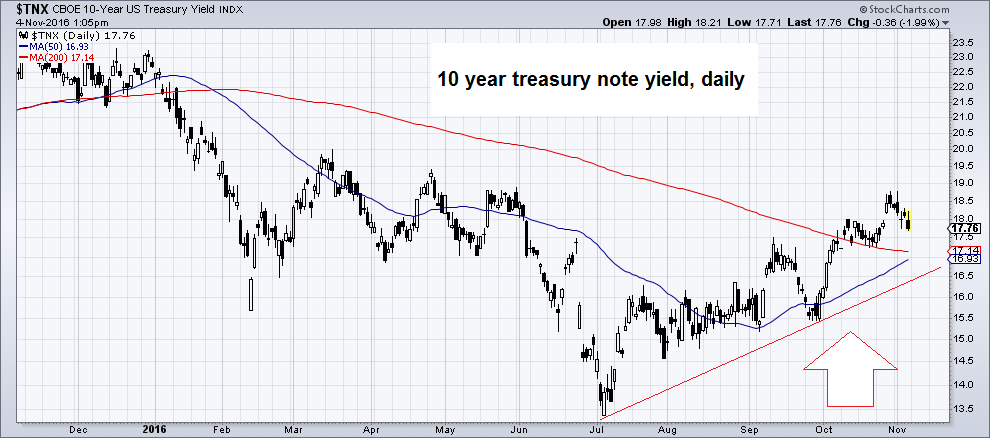

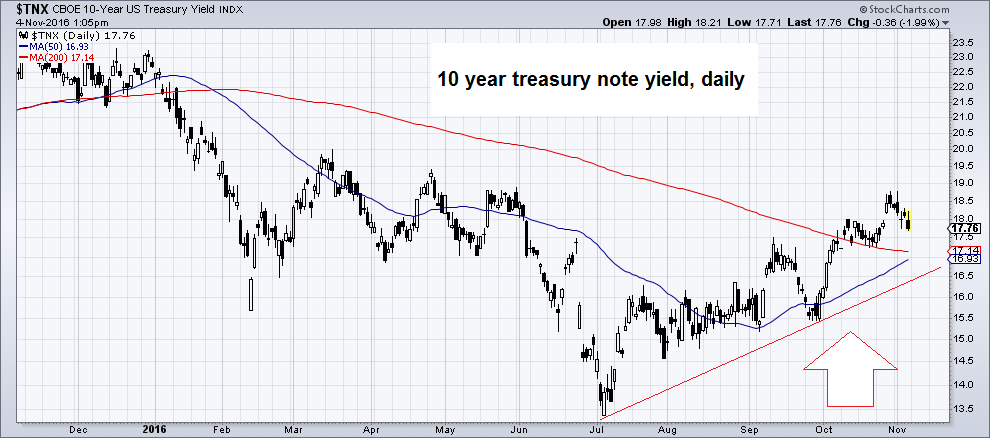

| Indeed, we are talking about interest rates. If you haven’t noticed, they have been going up as of late. In fact, they have been going up quite a bit.

On Tuesday, the yield on the 10-Year Treasury note notched 1.88 percent. No doubt, from a historical perspective, this is extraordinarily low. However, back in early July the 10-Year Treasury note bottomed out at just 1.34 percent. In other words, the yield has increased 40 percent over the last four months. What to make of it? |

10 Year Treasury Note Yield Meet the ticking time bomb – the 10 year treasury note yield. File under “this was not supposed to happen” – after all, central banks will pressure yields to lower levels forever and ever, and bond buyers simply have no alternative, right? - Click to enlarge |

The End of the Great Treasury Bond Bubble?

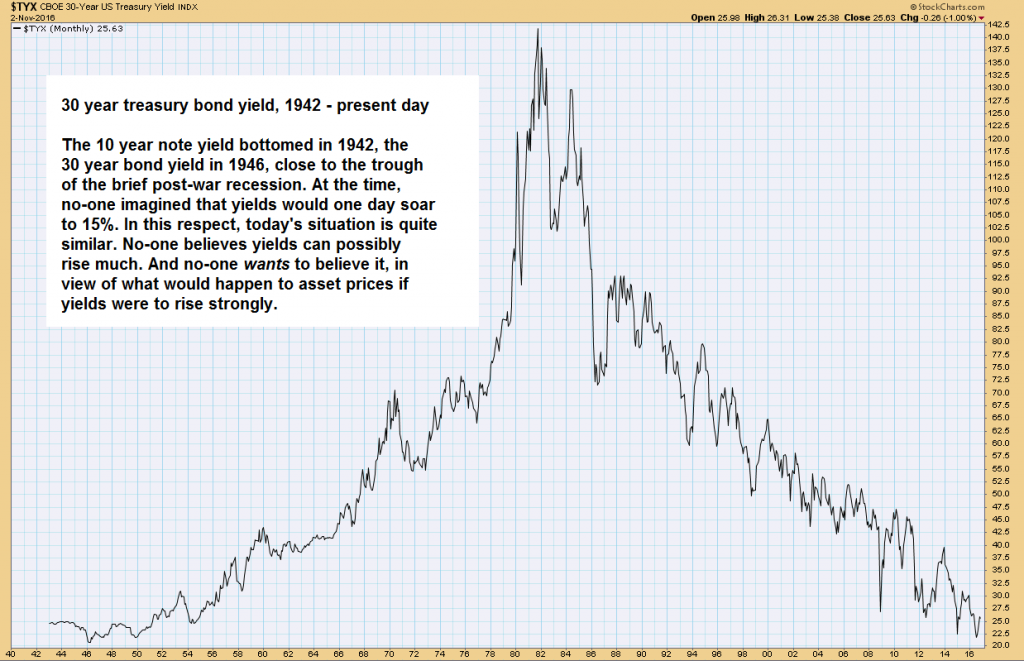

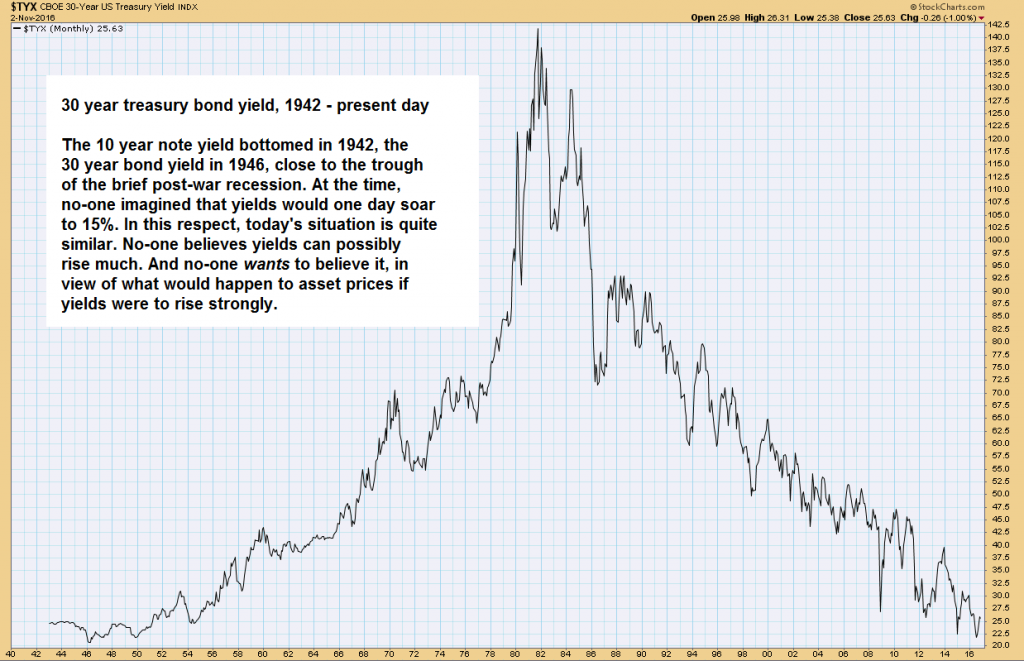

The last time the interest rate cycle bottomed out was during the early 1940s. The low inflection point for the 10-Year Treasury note at that time was a yield somewhere around 2 percent. After that, interest rates generally rose for the next 40 years.

The high inflection point for the rising part of the interest rate cycle was in 1981. At the peak, the 10-Year Treasury note yielded over 15 percent. Bond prices – which move inverse to yields – had been going down for so long that Dr. Franz Pick declared them to be “guaranteed certificates of confiscation.”

Pick, who was in his 80s, was looking backward. Not forward. Perhaps if he’d looked forward – and peered over the yield summit – he’d have seen the forthcoming 35 year soft, slow slide in interest rates before his eyes. Of course, these broad trend reversals are only recognizable in hindsight.

So what about right now? Could it be that credit markets are now reversing, and returning to a long term rising interest rate trend?

Quite frankly, we don’t know. We’ve been anticipating the conclusion of the great Treasury bond bubble for at least 8 years. But over this time, we have been consistently fooled by a variety of head fakes. Instead of going up over the last 8 years like we thought they would, yields have gone down… and then they’ve gone down some more.

The only rationale we can surmise is that the fiat based paper money system and extreme central bank intervention, have served to push rates down well beyond what was honestly conceivable. Nonetheless, we are confident that markets will eventually overcome the constraints imposed by monetary policy. |

Long Term Cycle in Bond Yields The long term cycle in bond yields - Click to enlarge |

| The One Thing that Will Change Everything

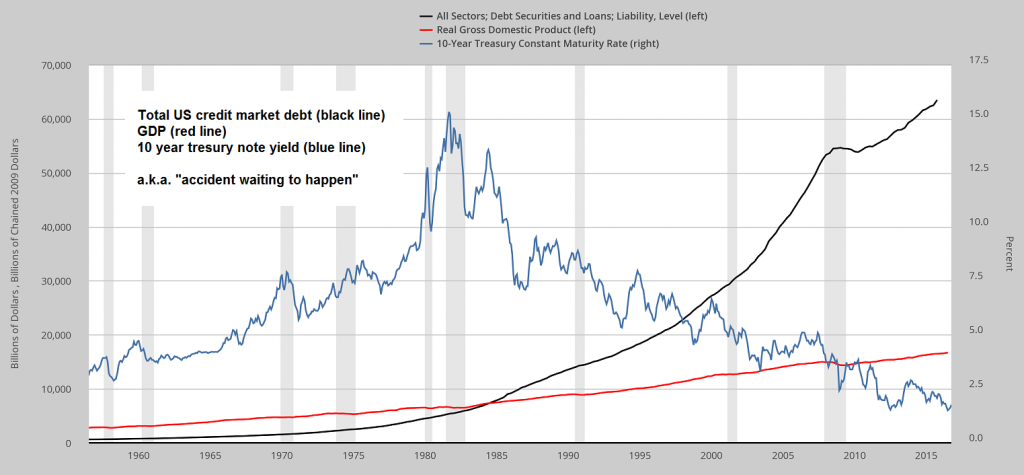

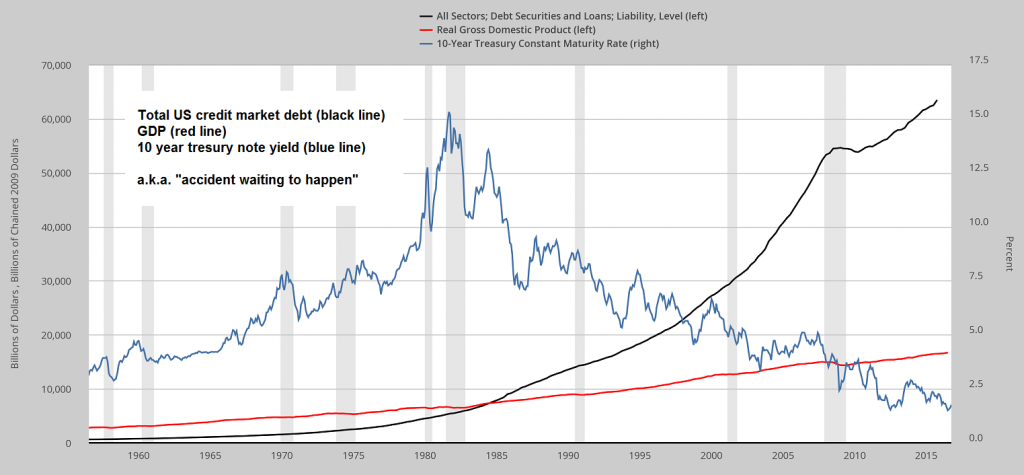

So once again, the long term credit market trend that commenced over 35 years ago appears to be reversing. If this happens to be more than just another head fake, it would mean the price of credit will become more and more expensive over the next several decades. Specifically, interest rates will rise over the next generation or more. This one thing will change everything.

Obviously, there are many implications associated with this. One that comes to mind is that things that are commonly bought on credit – like houses and cars – must become less expensive to balance out higher rates of interest. Stocks could also become less expensive as the monetary gas is sucked out of corporate earnings and, by extension, share prices. |

US Credit Market Debt Total US credit market debt outstanding (black line, lhs), GDP (red line, lhs), and the 10 year treasury note yield (blue line, rhs). This debtberg is not going to be sustainable at much higher interest rates. Although the growth momentum of debt has slowed since the 2008 crisis, it remains far stronger than the growth momentum of GDP. So even if interest rates were to remain stable, the economy’s ability to service this debt will continue to decline. There simply is no way to avoid the final catastrophic denouement - Click to enlarge |

These examples may seem obvious, although you can never be sure. There will most definitely be some strange twists and turns along the way.

Some less obvious examples have to do with reconciling the imbalances that have accumulated in an economy that’s relied on cheaper and cheaper credit to stay solvent. Refinancing expensive assets at lower and lower rates every several years will no longer be an option. Debt burdens will no longer be thinned out and softened up over time.

And what about businesses that require a high volume and low margin operation to turn a profit – like cheaply produced consumer goods? How does their cash flow pencil out when credit becomes more and more expensive? Can they still make it work at higher rates? Will the associated costs emerge in consumer price inflation?

What about the $19.8 trillion national debt? What happens when the tax receipts needed to service it double… and then double again? We imagine this will make the populace noticeably livid.

The point is, for everything under the sun there’s a symbiotic counter balance in place to keep it from drifting out of orbit. For example, every village has an idiot. So, too, every idiot has a village.

In a rising interest rate environment things are generally going to shift in the opposite direction from where they have been going in a declining interest rate environment. Things are going to get real different real quick. Namely, the world as we have known it for the last 35 years – including its ability to remain solvent – will be stood on its head.

Now is the time to adjust your thinking accordingly.

Charts by: StockCharts, St. Louis Federal Reserve Research

Chart and image captions by PT

Full story here

Are you the author?

Making sense of the latest economic policy touted by the Federal Reserve or the U.S. Treasury is an exercise in befuddlement. No doubt about it, the economics trade is overcome with an abundance of nonsense these days. This is no coincidence. M.G. Gordon of Economic Prism looks to bring clarity to the muddy waters of economic policy.

Previous post

See more for 6b.) Acting Man

Next post

Tags:

newslettersent,

On Politics