Swiss Franc |

EUR/CHF - Euro Swiss Franc, November 10(see more posts on EUR/CHF, ) |

|

GBP/CHF rates spiked by almost two cents during Wednesday’s trading, providing those clients holding Sterling with some of the best rates they’ve seen in the past few weeks. This move came following confirmation that Donald Trump had won the race for the White House, news which sent shockwaves through the market. How the outcome will affect the global markets is difficult to analyse at this point but could yesterday’s positive spike indicate better times ahead for the Pound? Whilst there is no direct correlation between the US Presidential election and GBP/CHF rates, it is sure to have a knock-on effect for the global markets and due to the fact investors viewed a Trump victory in such a negative light, increased market volatility is likely over the coming days. One of the catalysts for Sterling’s improvement could be attributed to previous comments made by Trump, who went against President Obama’s view that the UK would indeed be at the front of any que when it came to trade negotiations. This could have alleviated some of the current concerns investors have about future growth in the UK economy and the Pound benefitted as a result. I still don’t feel a sustainable increase for Sterling is likely under current market conditions, whilst so much uncertainty remains about how we will facilitate our Brexit and therefore I would be looking to take advantage of the current rates rather than gamble on an increasingly unpredictable market. If you have an upcoming GBP or CHF currency exchange to make and you are concerned by the increased market volatility of late, it may be wise to look at protecting the gains you’ve made, or limiting your losses with one of our forward contracts, rather than gamble on what has become an increasingly volatile and unpredictable market. |

GBP/CHF - British Pound Swiss Franc, November 10(see more posts on GBP/CHF, ) |

FX RatesAfter an initial wobble, the markets have stabilized as two themes emerge: reflation and the spread of populism. The shift away from monetary policy towards fiscal policy had already begun, and both US presidential candidates had promised fiscal stimulus. Trump offered greater stimulus (spending and tax cuts), and other policies on trade and immigration that seen as pro-growth. Canada has already shifted some burden of stimulus to fiscal policy, and the UK government is expected to unveil a small step in that direction with the Autumn statement in a fortnight, the US move may be bigger. The obvious comparison is Reagan in 1980. Since the financial crisis, low real growth and low inflation has bedeviled policymakers across Europe, North America and Japan. |

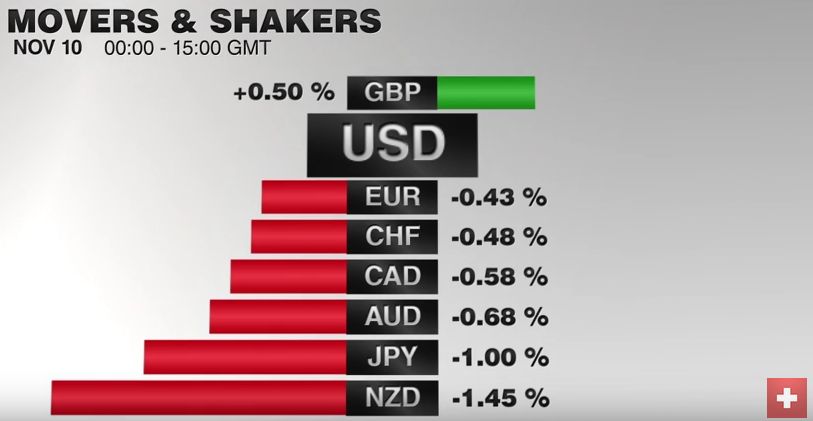

FX Performance, November 10 2016 Movers and Shakers . Source: Dukascopy - Click to enlarge |

| Comparisons between the Brexit and the US election were being drawn by some observers, and now with two points on the line, the third is expected from Europe. The Italian referendum in early December coincides with the Austrian presidential election. The Italian referendum is over the size and powers of the Senate, the reformist center-left Prime Minister Renzi had threatened to resign if defeated. He has since backtracked, but some political damage is likely, and some are still suggesting it could topple the government. This is important as the leading opposition party, the Five-Star Movement, favors a referendum to leave the monetary union.

Some bookmakers shifting odds that Le Pen wins the French presidency next year. She promises a referendum on EU membership is she wins. The Netherlands and Germany also hold elections next year. The populist parties do not appear as powerful; there as elsewhere, but seem to enjoy some momentum. |

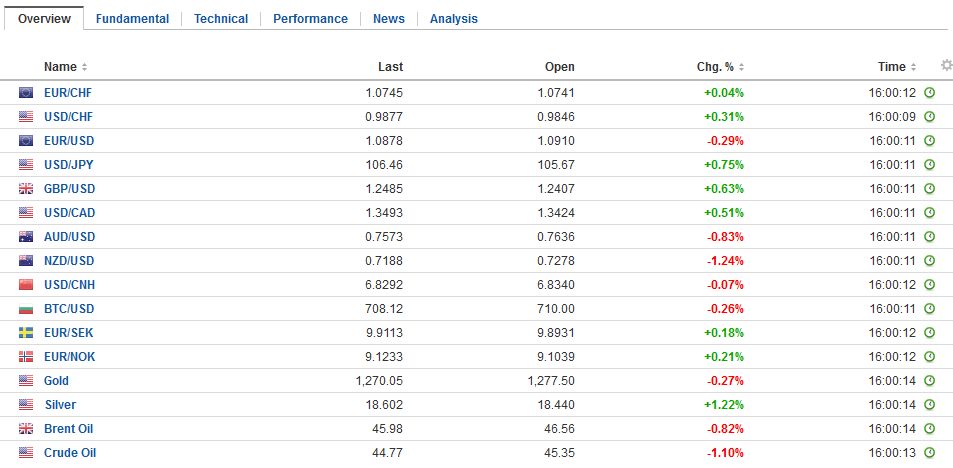

FX Daily Rates, November 10 (GMT 16:00) |

| Asian markets played catch-up today. The MSCI Asia-Pacific Index rose 2.8% after yesterday’s 3.2% slide. The Nikkei rallied 6.7%, more than offsetting yesterday’s 5.4% drop. Bond yields rose, with Australian and New Zealand 10-year yields rising 21 and 28 bp respectively.

The US dollar is mostly higher as the larger interest rate premium gives the greenback traction. Investors remain confident of a Fed hike next month. The Australian dollar is pushing the $0.7700 again, while the Scandi currencies are recovering from yesterday’s slide. Outside of these three, the other major currencies are heavier against the dollar. The yen is off nearly 1.0% is leading the drop. The dollar is also advancing against most emerging market currencies, which may struggle in the higher interest rate environment despite the firmer commodity prices. Gains in the industrial metals is particular noteworthy. Iron ore, aluminum, nickel, copper and tin are all posting strong gains. |

FX Performance, November 10 |

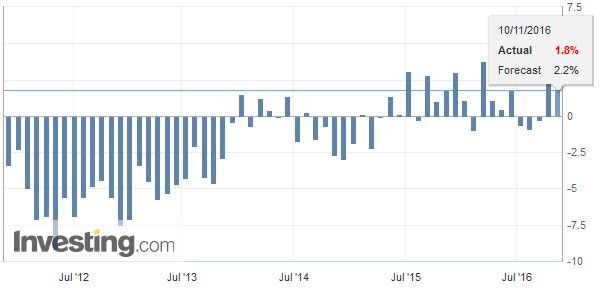

ItalyFrance and Italy reported weaker than expected September industrial output figures, but investors paid little notice. The data is seen as old and have been preempted by other issues. |

Italy Industrial Production YoY, October 2016(see more posts on Italy Industrial Production, ) . Source: Investing.com - Click to enlarge |

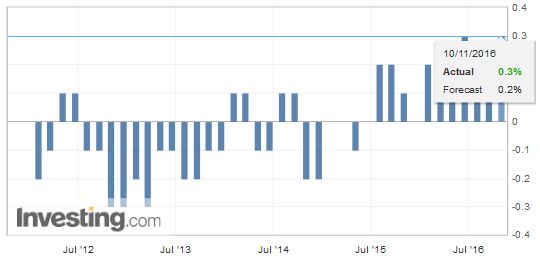

FranceThe French chart is particularly interesting in that today’s gap launched the CAC into the gap created in the sharply lower opening to start the year. For its part, the DAX is holding just below the 10800 level that has capped the index despite repeated tried since mid-August. |

French Non-Farm Payrolls QoQ October 2016 Source: Investing.com - Click to enlarge |

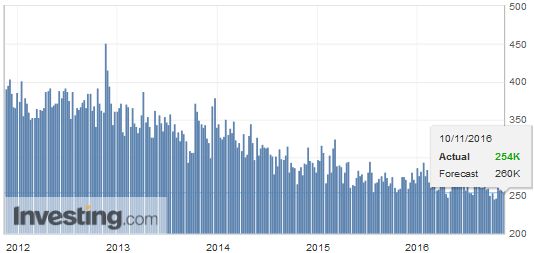

United StatesUS data is also of little consequence today with weekly jobless claims the main feature. The stabilized of the markets has seen expectations for a Fed hike next month increase. Bloomberg estimates the odds at 82% while the CME calculation is near 71% chance. |

U.S. Initial Jobless Claims, October 2016(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

Eurozone

European bonds are extending yesterday’s sell-off, while stocks continue to move higher. Financials are leading European shares higher. The Dow Jones Stoxx 600 is up 1.1% near midday in London, and the financials are up 3.3%. Interest rate sensitive utility sector is off nearly 2%. Given the continued rally in US after European markets closed yesterday, spurred a gap higher opening in Europe today, including in the German DAX and the French CAC.

Bearish curve steepening is the theme in the debt markets. Two year benchmark yields are 1-3 bp higher in Europe. The RBNZ did cut the cash rates 25 bp as expected at the start of today’s session, but it shifted its stance to neutral, hinting that it is the last cut. Yesterday’s surge in 10-year US yields is dragging global yields. Typically when yields rise in Europe, the peripheral premium grows but that is not the case today. Core bond yields up around 7 bp while peripheral yields are up a few basis points less. Italian bonds are underperforming a little while its equities are outperforming the other large European bourses. Italian bank share are up for the fourth consecutive session for a cumulative gain of 9.2%. Last week it is off nearly 9%. However, bank shares were up in the four weeks of October for an 11% recovery.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Bonds,Donald Trump,equities,EUR/CHF,FX Daily,gbp-chf,Italy Industrial Production,newslettersent,U.S. Initial Jobless Claims