Swiss FrancThe EUR/CHF has finally retreated from the highs. The dollar remains strong despite a rather dovish Fed. |

EUR CHF - Euro Swiss Franc, October 11 2016(see more posts on EUR/CHF, ) |

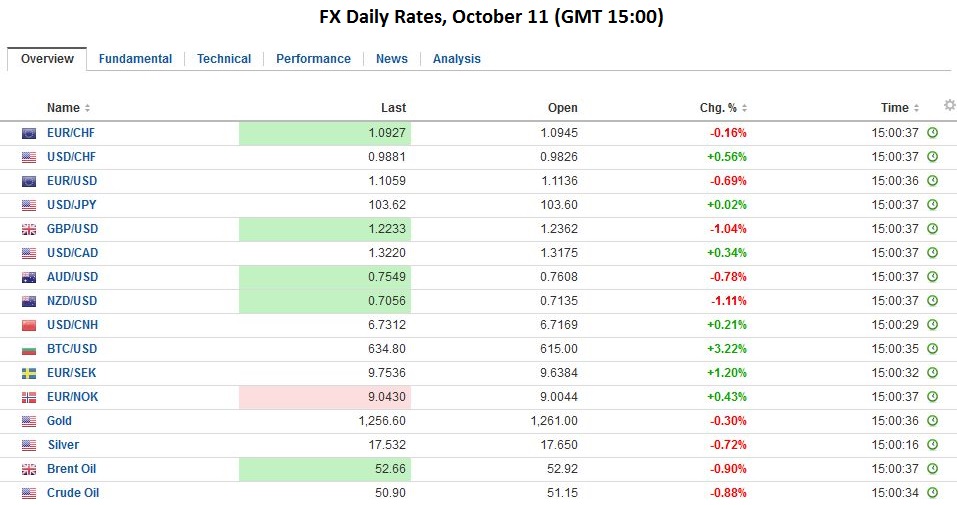

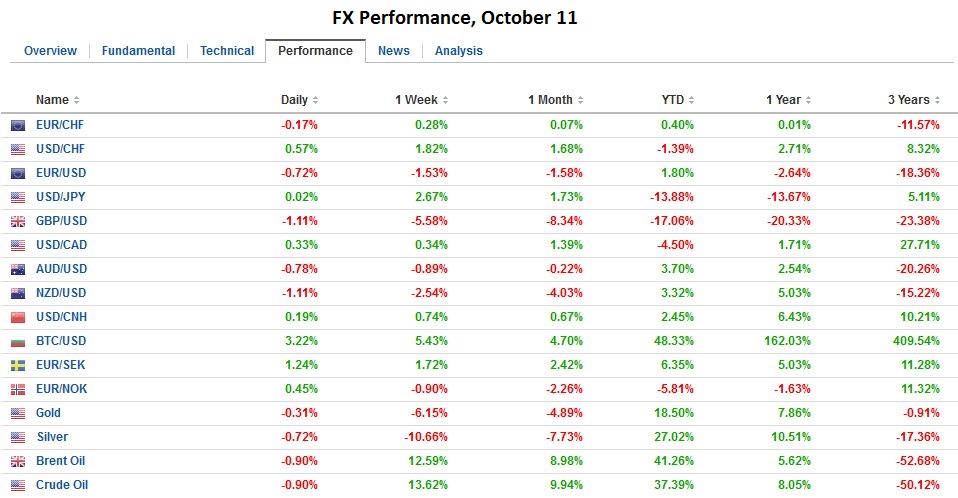

FX RatesThe US dollar is bid against all the major and most emerging market curerncies. An important driver is the backing up of US rates. The two-year yield, which is particularly sensitive to Fed policy is at it highest levbel since early June (~86 bp). The US 10-year yield is five basis points hihger today at 1.77%, which is the highest in four months. |

Source: Dukascopy - Click to enlarge |

| Sterling’s cannot find any traction. It is extending its losses against the dollar for the fourth consecutive session. It hass fallen in eight of the past 10 sessions. The euro has risen against sterling for four conesecutive sessions also and in nine of the past 10 sessions. The general direction has been set in motion, not by UK economic data, which continues to surprise on the upside, but by fears that the UK will cut its nose to spite its face. The newest wrinkle is a potential consitutitional challenge as Parliament is insisting that it play a larger role in the Brexit decision than Prime Minister May is prepared to concede. | |

| A hard exit is thought to be more negative for sterling for a number of reasons, including a greater burden on prices (weaker sterling, higher domestic inflation to adjust the external deficit rather than volume (trade and capital flows). That sad, the selling pressure appears to have abated as the London morning got under way. Upticks from $1.2280 may extend toward $1.2330-$1.2350. Note that low since the flash-crash low was near $1.2230.

The Federal Reserve’s new Labor Market ConditionsIndex is the main economic report today. The highlight of the week is the retail sales report on Friday. After taking August off, consumers went shopping again in September. The FOMC minutes from the Septmeber meeting will be reported tomorrow. Canada reports housing starts today and existing home sales at the end of the week. |

|

EurozoneIn comparison Europe’s two-year yields are mostly lower today. Germany’s two-year yield is minus 68 bp and Japan’s stands at minus 27 bp. The UK two-year yield is below 20 bp. |

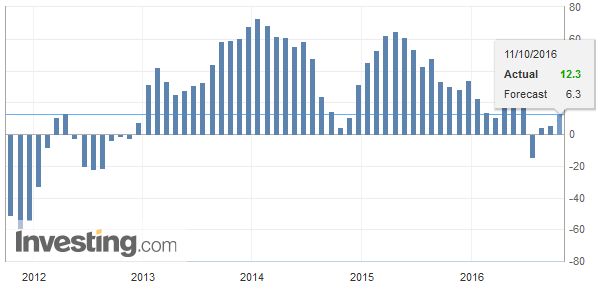

Eurozone ZEW Economic Sentiment, September 2016(see more posts on Eurozone ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

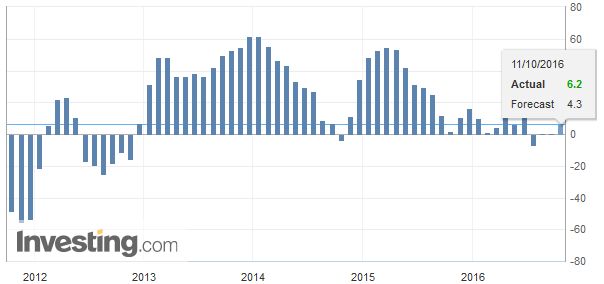

GermanyGermany’s ZEW survey handily beat expectations, but this has not deterred the euro from being sold back to the pre-US jobs low near $1.1100. The assessment of the current situation rose to 59.5 from 55.1 in September. It is the highest since January. The expecxtations component rose to 6.2 from 0.5. The median foercsat was for a 4.0. It is the best reading since June. A break of the $1.1100 area would target the early-August low near $1.1045. |

Germany ZEW Economic Sentiment, September 2016(see more posts on Germany ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

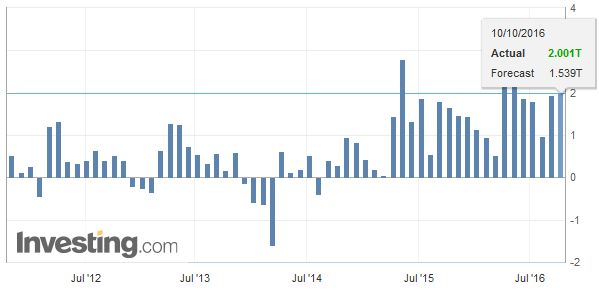

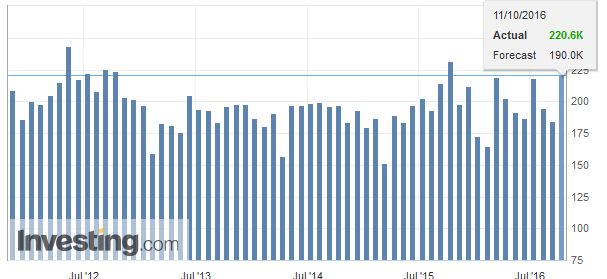

JapanJapan reported a larger than expected August trade and current account figures. The dollar’s rally that began on September 22 has seen only two losing sessions: September 26 and October 7. The dollar recovered its post-job data losses yesterday and returned briefly poked through JPY104 earlier today. Last week’s high was recorded near JPY104.15 and last month’s high was closer to JPY104.35. Japan’s August current account surplus was JPY2 trillion. The median guesstimate was JPY1.5 trillion after JPY1.94 trillion in September. This represents anearly 25% increase from a year ago. The trade surplus was reduced as it typically is in Aguust from July. However, it was more than twice as big as expected at JPY243 bln. |

Japan Current Account n.s.a., Septeber 2016(see more posts on Japan Current Account n.s.a., ) Source: Investing.com - Click to enlarge |

United StatesUS political developments and news that Russia may cooperate with OPEC producers to stabilize the market sent the Canadian dollar sharply higher yesterday. Canadian markets were closed yesterday, and it was a partial holiday in the US. The US dollar fell nearly 1% against the Canadian dollar; its biggest drop since late-July. Oil prices are consolidating yesterday’sadvance, while the US dollar has climbed form CAD1.3140 yesterday as Europe was closed to almost CAD1.3235 today. Initial support is seen near CAD1.3180. |

United States Housing Starts, September 2016(see more posts on U.S. Housing Starts, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next post

Tags: #GBP,#USD,$CAD,$EUR,$JPY,EUR/CHF,Eurozone ZEW Economic Sentiment,FX Daily,Germany ZEW Economic Sentiment,Japan Current Account,Japan Current Account n.s.a.,newslettersent,U.S. Housing Starts