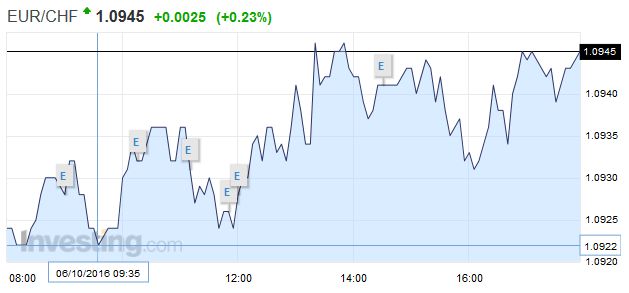

Swiss FrancThe euro depreciated against the dollar, but it went up against CHF. This is a pretty unusual pattern. We would have expected that it fell against both. |

EUR/CHF - Euro Swiss Franc, October 06 2016 |

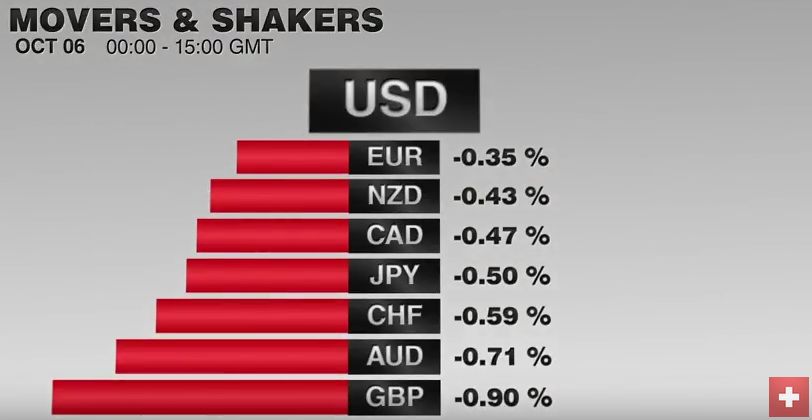

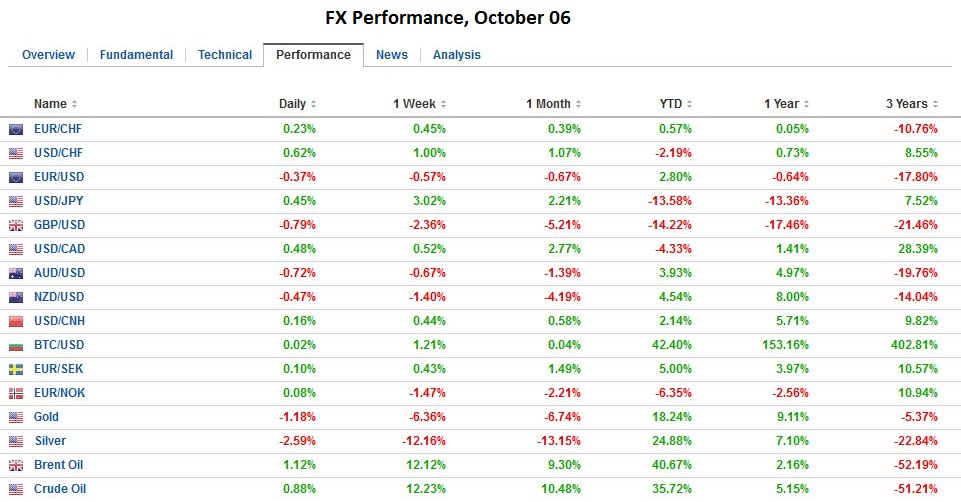

FX RatesThe US dollar is advancing against the major and most emerging market currencies. Activity is subdued and ranges are narrow. We share four observations about the price action. First, the euro has been unable to sustain upticks even after Germany reported a jump in industrial orders three-times more than the median estimate (1.0% vs. 0.3%). More generally the dollar’s rise has coincided with the firmer equities and higher oil prices. After today’s report, there may be some upside risk to tomorrow’s industrial output report, where a 1% gain is expected to offset a chunk of the 1.5% drop in July. |

|

| Second, the dollar is extending its gains against the yen for the eighth consecutive session. Yesterday, the dollar finished the North American session near JPY103.50.

Third, we think it is notable that the dollar’s firmer tone is happening alongside a rise in interest rates. Yields on the two and 10-year Treasury has risen four consecutive sessions coming into today. Fourth, at the same time, we recognize that it is not just a dollar story playing out. Sterling’s heavy tone, for example, is a function of perceptions that Prime Minister May is steering the UK toward a harder exit from the EU. In a speech yesterday, Merkel forcefully argued against any exception to the single market rules. Ideas that German businesses could be a fifth column pressing for compromises were disappointed when the head of the BDI (business association) took a similar stance as the Chancellor. |

|

| Equities are rising today The MSCI Asia-Pacific Index rose 0.4%. Only India and Indonesian markets bucked the trend. Rising oil prices helped lift Japan’s Topix (0.45%), with a 2.2% advance in the energy sector. In Europe, the Dow Jones Stoxx 600 is fractionally, but strength is being seen in financials, industrials, and energy. Yesterday’s nearly 0.6% loss snapped a six-day advance.

Bonds are recouping some of their recent losses today, with benchmark European 10-year bonds mostly 3-5 bp lower. Asia-Pacific yields had earlier followed US yields higher. The Australian dollar is the heaviest of the majors today; giving up almost 0.5% to the greenback. Its losses, the euro’s, comes despite favorable economic news. In Australia’s case, the favorable news took the form of a smaller trade deficit. The August shortfall was A$2.01 bln. The median expectation was for an A$2.3 bln deficit. The July series was revised almost A$300 mln better to an A$2.12 bln deficit. The $0.7700 area has proved a formidable cap, and once again the Aussie has been turned back from it. It has been sold through the $0.7590 low seen at the end of September. Today’s low, a little ahead of $0.7575 coincides with the 50% retracement of the rally since the mid-September low near $0.7450. The next retracement is found near $0.7550. |

|

EurozoneIn an otherwise quiet news stream, we note the deputy speaker of Italy’s Chamber of Deputies and one of the leaders of the opposition 5-Star Movement stirred the pot. Di Maio broke ranks with officials in Europe to say that the UK should be given market access and migration controls. He would naturally say this as he and the 5-Star Movement want to have a referendum on EMU membership. The better the deal the UK gets, the more compelling of a narrative he can offer. And this is precisely why a hardline is being sought. In terms of domestic politics, De Maio argued that if the referendum loses, Renzi must resign. This strikes us as simple partisan politics. Di Maio is quoted on Bloomberg: “I am sure that Italians will ask him to maintain his promise despite the fact he has changed his mind.” What we noted earlier, still strikes us important. The referendum does not change party representation in parliament. It would be difficult for Di Maio and the opposition parties to force Renzi out. Meanwhile, the 5-Star Movement won the mayoral contests in Rome and Turin. The former is a bit of a poison chalice in the sense that it is thought to be an exceedingly difficult task, and it is proving itself so now. Italian assets are mostly outperforming Spain today. |

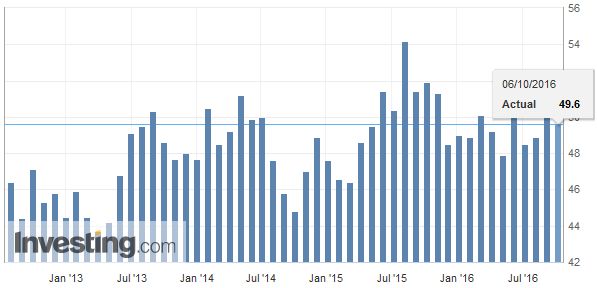

Eurozone Retail PMI , September 2016(see more posts on Eurozone Retail PMI, ) Source Investing.com - Click to enlarge |

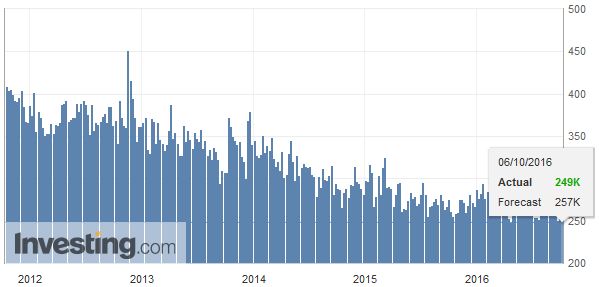

United StatesThe US calendar is light with Challenger job cuts the weekly jobless claims the main events. Yesterday’s jump in the service ISM, including employment, new orders, and new export orders offset the disappoint ADP estimate (165k) that reached a five-month low. The improvement in the US stands in stark contrast with the eurozone and Japan. In the coming month, investors will learn whether the diverging sentiment is reflecting diverging economic performances. |

U.S. Initial Jobless Claims, October 06 2016(see more posts on U.S. Initial Jobless Claims, ) Source Investing.com - Click to enlarge |

Switzerland |

Switzerland Consumer Price Index, September 2016(see more posts on Switzerland Consumer Price Index, ) Source Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$EUR,Eurozone Retail PMI,FX Daily,newslettersent,Switzerland Consumer Price Index,U.S. Initial Jobless Claims