(Dublin business trip is ending, London next week, sporadic posts to continue)

Swiss Franc |

|

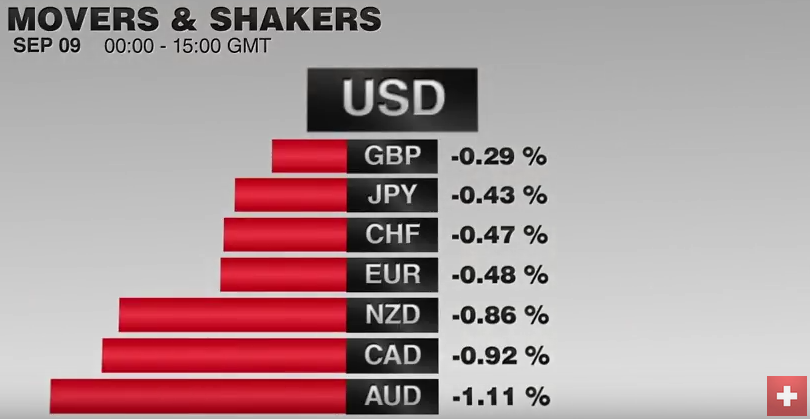

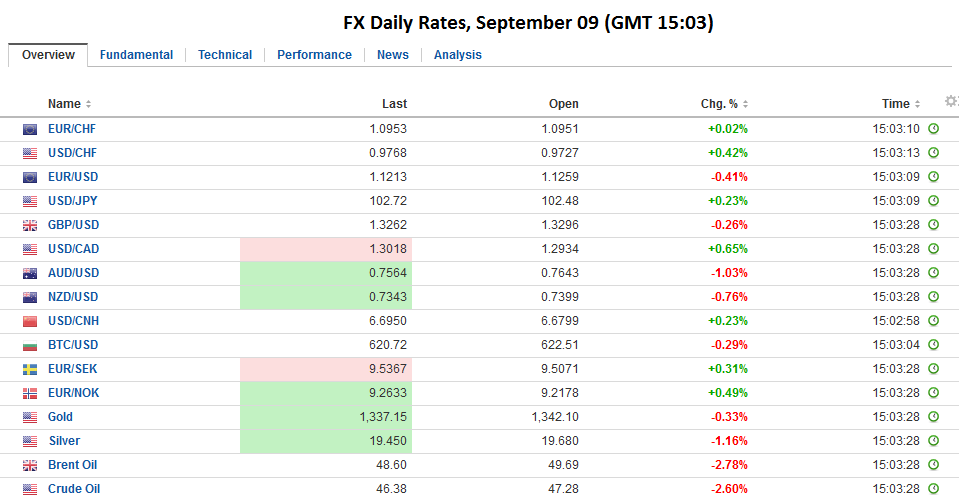

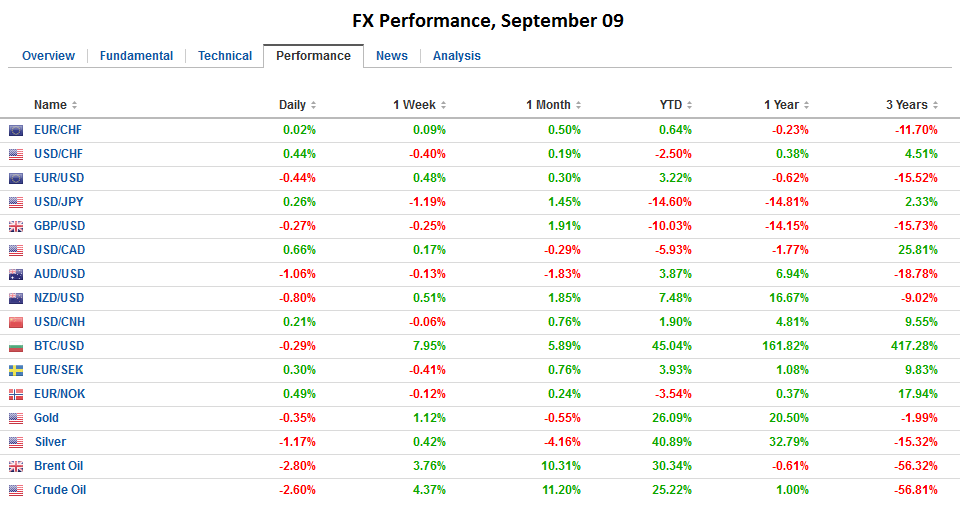

FX RatesThe US dollar is lower against all the major currencies this week as North American participants close it out. On the day, the dollar is consolidating swings yesterday and is narrowly mixed. Bond yields are higher and equities are mostly lower. The euro has finished lower the last three Fridays. The streak may end today. The euro has found support nearly $1.1260, and the intraday technicals favor a move higher in the US morning. |

|

| The important takeaway from the trade report is that the deficit has deteriorated, and the combination of the decline in sterling and slower UK growth suggests that with a lag, improvement should be expected. The merchandise and service trade deficit has averaged GBP3.62 bln. The July shortfall was GBP4.5 bln, and the three-month average is GBP4.69 bln. Note that the BOE meets next week but is expected to leave policy steady.Although the German trade surplus is a source of tension within the EU, EMU, and G20, its tightfisted fiscal stance is just a troubling. While there had been talk that Merkel was moving to embrace a tax cut, we had played down its likelihood and significance. However, this week, it has become clearer than some tax relief will be offered. | |

| There are a couple of mitigating factors to consider. First, the tax cut of around 15 bln euros will be forthcoming after the 2017 national election which takes place in about 12 months. Second, the tax cut is miserly as Germany may still record a budget surplus.Third, details of the tax cut is not yet available, but it may prove too small to be a game changer.

Consider that this is the fourth year Germany surpluses. The surplus in the first half of 9.7 bln euros (on revenue of 693 bln euros) suggests the country is on pace to top last year’s record. German Finance Minister Schaeuble has complained about the low interest rate policy of the ECB. He even argued that it has fostered the rise of the AfD. A review of the AfD’s campaign suggests Merkel’s immigration policy and the shift in AfD’s leadership (from an anti-EU thrust to an anti-immigration emphasis) may have been more critical than low interest rates. What Schaeuble does not yet appear to recognize is that the low interest rates are the key to the German fiscal position, not the widely touted fiscal discipline. Consider that Germany’s debt servicing costs since the Great Financial Crisis (2008-2015) has been reduced by a little more than 120 bln euros. This is more than the sum of the budget surpluses over the past three years. |

|

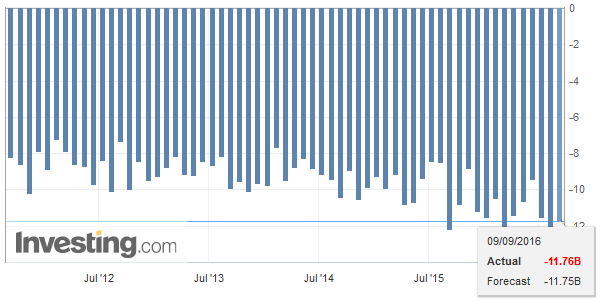

United KingdomGermany and the UK data were featured. The UK reported another trade deficit (July) larger than expected, while July construction output was not as poor as expected or as the PMI had led investors to believe. The flat report compares with expectations for a 0.5% decline and a 1% drop in June. |

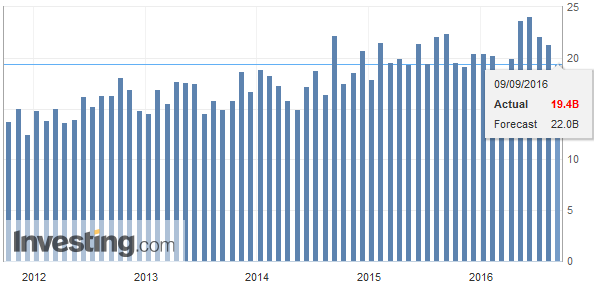

U.K. Trade Balance(see more posts on U.K. Trade Balance, ) Click to enlarge. Source Investing.com |

GermanyIt is has been a tough week for German economic data. A weak service PMI as followed by an unexpectedly large drop in industrial output. These were followed today may a smaller than expected trade surplus. The 19.5 bln euro surplus in July compares with a 24.7 bln surplus in June and expectations for a 23.7 bln euro surplus. Export and imports were weaker than expected. Exports fell 2.6% in July, the largest since August 2015. Exports have fallen in four of the past seven months. The average over the past 12-months is a 0.4% decline. Imports fell 0.7%. It is the largest decline in March. The 12-month average is 0.3%. It appears that the German trade surplus may have peaked in the March-April a little below 26 bln euros. |

Germany Trade Balance(see more posts on Germany Trade Balance, ) Click to enlarge. Source Investing.com |

United States

Another development that will likely get more air time over the next couple of weeks is the modest pick-up in market-based inflation expectations in the US. The 10-year breakeven and the five-year forward-forward breakeven are at elevated levels. The 10-year breakeven is near 154 bp. It has not been more than a basis point above it since mid-June. The five-year forward forward reached a 178 bp yesterday, the highest since mid-May.

We have argued that core inflation is the US is likely to rise due to rents, medical services, and some wage developments. The JOLTS data earlier this week showed a record number of job opening, and there have been anecdotal reports of shortages of unskilled or low skilled employees. We have also cited that expectation the health insurance premiums at the exchanges are expected to be increased in the next several weeks.

The biggest drop in US oil inventories in 17 years, a further decline in US output, and a sharp drop in gasoline inventories to the lowest level of this year boosted oil prices, and may have helped lift inflation expectations. However, inflation expectations have been gradually trending higher, and the drop inventories appears to be a function of Hurricane Hermine than fundamental new development.

In addition to next week’s US retail sales, the other highlight is Fed Governor Brainard speech on the economic outlook. This is important because among the Governor’s Brainard is understood to 1) emphasize international considerations, 2) seemingly more cautious than the Yellen, Fischer, and Dudley Troika (though they have agreed to one hike thus far, which also meets a definition of cautious), and 3) some suggest she may be considered as a candidate for US Treasury Secretary in a Clinton Administration.

China

Also, there has been some suggestion that the depreciation of the Chinese yuan is exporting deflation. Yesterday, it appears the PBOC intervened in the offshore (CNH) market, and this was seen by many observers as signaling a desire not to see the dollar rise above CNY6.7. Talk that officials did not want a much weaker yuan first emerged in July. The idea may have been reinforced by the US-China pledge at the G20 meeting not to seek competitive devaluation.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next post

Tags: #GBP,#USD,$CNY,$EUR,Bond yield,ECB,FX Daily,Germany Trade Balance,newslettersent,U.K. Trade Balance