Speculative position adjustments in the currency futures continued at a low pace in the Commitment of Traders report for the week ending August 9. There were though two distinct patterns:

- Speculators reduced their exposure in EUR, CHF and peso.

- Speculator increased their exposure in JPY, GBP, CAD and NZD.

Euro, Swiss Franc, Peso: Lower Exposures

The first pattern is found in the euro, Swiss franc, and Mexican peso. In these currency futures, speculators reduced exposure. Longs were liquidated and shorts were covered. The adjustments were small with only the 9.8 contract

reduction of the gross short euro position more than 5k contracts.

The Swiss Franc net position increase from minus 1.7K contracts to +0.1K.

reduction of the gross short euro position more than 5k contracts.

The Swiss Franc net position increase from minus 1.7K contracts to +0.1K.

Yen, Sterling, Loonie, Kiwi: Higher Exposures

The second pattern was with the yen, sterling, and the Canadian and New Zealand dollars. Here speculators were taking on new risk. Gross long and short positions were extended. Most of the position adjustments were also less than 5k

contracts. There were two exceptions. Gross long yen positions jumped 10.1k contracts, the biggest increase in two months, to stand at 35.5k contracts. The other exception were sterling bears who added 9.7k contracts to their gross short position to lift it to a record 125.6k contracts. It is the sixth consecutive increase.

contracts. There were two exceptions. Gross long yen positions jumped 10.1k contracts, the biggest increase in two months, to stand at 35.5k contracts. The other exception were sterling bears who added 9.7k contracts to their gross short position to lift it to a record 125.6k contracts. It is the sixth consecutive increase.

Over this period the gross short sterling speculative position has increased by 32k contracts, which given the price action seems quite modest. This speak to how we use this speculative positioning data. It is most useful, we think, as a proxy for a segment of market participants who are trend followers and momentum traders.

Australian Dollar

Admittedly, this is a generalization. We find that looking at the gross positioning helps identify market vulnerabilities more than net, which is the conventional focus.

The only currency that does not fit into either pattern is the Australian dollar. The bulls added 1.3k contracts to raise the gross long position to 59.6k contracts. The bears covered 2.2k short contracts, leaving a gross short position of 24.7k contracts.

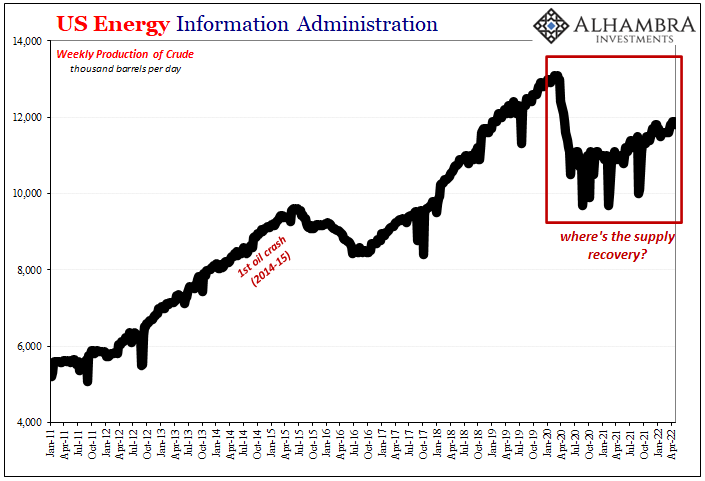

Oil Futures

Oil prices traded heavily over the reporting period. The bears were emboldened and added 8.4k contracts to the gross short position. It now stands at 303.8k contracts. However, the bulls sat tight and trimmed only about five hundred contracts from the gross long position. They still have 562k contracts.

Treasury Notes

Speculators in the 10-year note futures were active. The bulls added 40.7k contracts to the gross long position, lifting it to 616.2kcontracts. The bears continued looking for a top, added 43.7 contracts to the net short position, boosting it to 498k contracts. The net long position fell 3k contracts to 118.2k.

| 9-Aug | Commitment of Traders | |||||

| Net | Prior | Gross Long | Change: of Gr. Long |

Gross Short | Change of Gr. Short | |

| Euro | -98.4 | -104.1 | 100.4 | -4.1 | 198.8 | -9.8 |

| Yen | 48.8 | 41.7 | 86.7 | 10.1 | 37.9 | 3.0 |

| Sterling | -90.1 | -82.5 | 35.5 | 2.1 | 125.8 | 9.7 |

| Swiss Franc | 0.1 | -1.7 | 20.4 | -0.8 | 20.3 | -2.6 |

| C$ | 15.4 | 17.8 | 43.6 | 1.9 | 28.3 | 4.3 |

| A$ | 34.9 | 31.4 | 59.6 | 1.3 | 24.7 | -2.2 |

| NZ$ | -0.6 | 0.2 | 28.3 | 1.2 | 28.9 | 2.1 |

| Mexican Peso | -54.4 | -52.1 | 20.0 | -4.0 | 74.3 | -1.7 |

| Oil Futures | 258.2 | 562.0 | -0.5 | 303.8 | +8.4 | |

| Treasury Notes | 118.2 | 121.2 | 616.2 | +40.7 | 498 | +43.7 |

CFTC Speculative Positions

Tags: British Pound,Commitments of Traders,EUR/USD,Japanese yen,newslettersent,OIL,Speculative Positions