See the introduction and the video for the terms gold basis, co-basis, backwardation and contango

One Cannot Trade Based on the EndgameThe prices of the metals were down again this week, -$15 in gold and more substantially -$0.57 in silver. Stories continued to circulate this week, hitting even the mainstream media. Apparently gold is going to be priced at $10,000. Jump on the bandwagon now, while it’s still cheap and a bargain at a mere $1,322! Our view is, well, not so fast. Of course, at the end of the day the irredeemable paper currencies will fail. But we have two thoughts to add to this. By the time the US dollar is failing, it will become obvious to everyone that $10,000 is no riches. It will be clear even to the Monetarists that this does not mean gold is going up, but that the dollar has gone down over 7X from where it is now (from 23.5 milligrams of gold to 3.1mg). Of course, our old refrain is that a lot of price action can occur between now and then. If you’re playing the gold market for dollars, you can’t trade based on the endgame. |

|

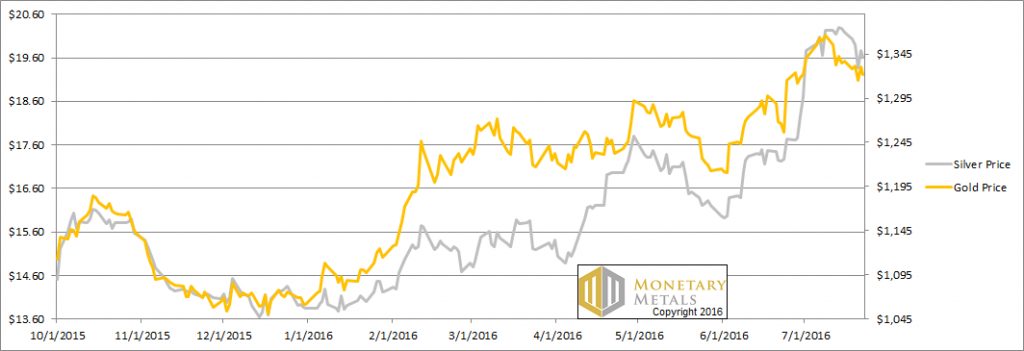

Fundamental DevelopmentsSo let’s look at the only the only true picture of the supply and demand fundamentals for gold and silver. But first, here’s the graph of the metals’ prices. |

|

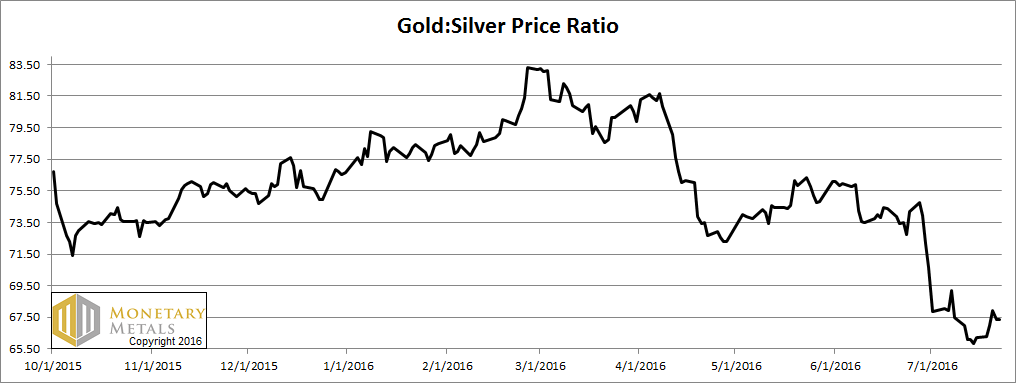

| Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio rose this week. | |

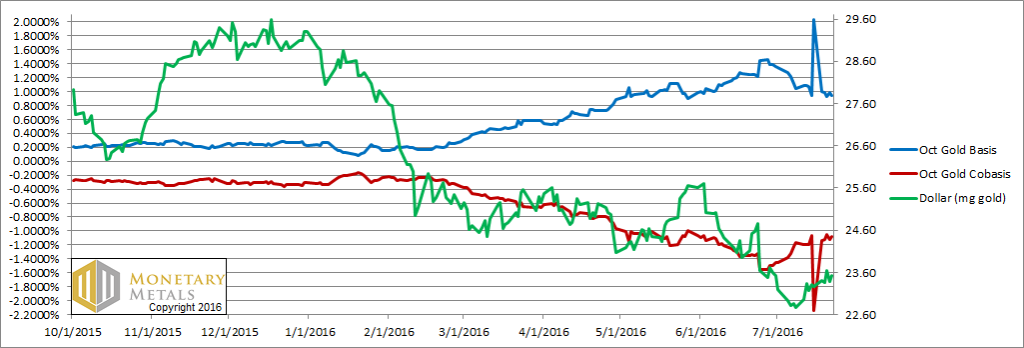

Here is the gold graph. |

|

Last week, we said:

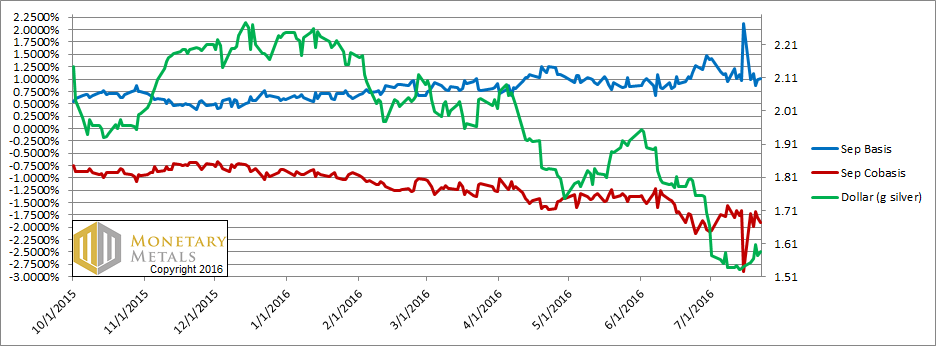

As is clear on the graph, we were right to distrust these spikes. The real move is clear (going forward, we will erase the one day with the bad data so the graph will be easier to read). The price of the dollar, in gold terms (i.e. inverse of the price of gold, measured in dollars) is rising. With it, gold is becoming less abundant (blue line, i.e. the basis). The fundamental price is not buying the $10,000 gold story. Not one bit. It is down around $1,140. Now let’s turn to silver. In silver, it’s even worse as we see a falling scarcity (i.e. red line, the cobasis) as the price of silver falls (inverse to the graph, which shows the price of the dollar, measured in silver). Not counting the anomaly, the silver cobasis fell from -1.66% on Thursday, July 14 to it’s current -1.9%. While the price of the metal fell from $20.28 to $19.62. The fundamental price is way down, to about $16. |

Charts by: Monetary Metals

Full story here Are you the author? Previous post See more for Next post

Tags: dollar price,Gold Backwardation,gold basis,Gold co-basis,Gold Contango,gold ratio,gold silver ratio,Gold-Cobasis,Precious Metals,silver basis,Silver co-basis,silver price,silver ratio