It never ceases to amaze how vastly different the investment styles of gold paper vs physical traders are: while we have documented previously how the latter tend to buy progressively more the lower the price (as traditional “buy low, buy more lower” investing would suggest), “investors” in gold paper-derivatives such as ETFs and ETPs are quite the opposite: in fact, they rarely buy until someone else is buying and generating momentum. At that moment a reflexive buying spree is unleashed and paper buying begets even more paper buying.

Nowhere is this more evident than in today’s daily report of ETF Securities, where “inflows into gold ETPs of US$263mn on Friday 1st July were at their highest since inception.”

More:

| Demand for safe haven ETPs rise as uncertainty continues. Last week saw long gold, silver and long CHF recording strong inflows of US$433.5mn in total. Inflows into gold ETPs of US$263mn on Friday 1st July were at their highest since inception. Gold and the Swiss Franc have historically been sought after for their safe haven traits allowing investors to hedge portfolios from downside risks. We expect demand for haven assets to remain elevated as uncertainty surrounding the UK’s leadership contest and its formal exit from the EU block remain high. While the Bank of England is preparing for more monetary policy easing, Deutsche Bank and Santander failed the US Federal Reserve stress test again, keeping investors nervous. |

It never ceases to amaze how vastly different the investment styles of gold paper vs physical traders are: while we have documented previously how the latter tend to buy progressively more the lower the price (as traditional "buy low, buy more lower" investing would suggest), "investors" in gold paper-derivatives such as ETFs and ETPs are quite the opposite: in fact, they rarely buy until someone else is buying and generating momentum. - Click to enlarge |

Spot GoldWhile dramatic in the aftermath of Brexit, the sudden influx of funds into paper-ETFs tracking gold is hardly new: in March we noted that “The Last Time Gold ETF Flows Were This Strong, The Fed Was Starting QE.” |

It never ceases to amaze how vastly different the investment styles of gold paper vs physical traders are: while we have documented previously how the latter tend to buy progressively more the lower the price (as traditional "buy low, buy more lower" investing would suggest), "investors" in gold paper-derivatives such as ETFs and ETPs are quite the opposite: in fact, they rarely buy until someone else is buying and generating momentum. - Click to enlarge |

IAU (Gold) ETP, GLD (Gold) ETFUpdating the gold fund inflow ETF chart shows the following: |

It never ceases to amaze how vastly different the investment styles of gold paper vs physical traders are: while we have documented previously how the latter tend to buy progressively more the lower the price (as traditional "buy low, buy more lower" investing would suggest), "investors" in gold paper-derivatives such as ETFs and ETPs are quite the opposite: in fact, they rarely buy until someone else is buying and generating momentum. - Click to enlarge |

It has gotten to the point where even Bloomberg, the majority of whose financial TV anchors and “pundits” abhor gold, was forced to report about the surge in ETF allocations.

Global gold holdings have expanded by more than 500 metric tons since bottoming in January in a signal of investors’ rising concern about slowing growth, a Federal Reserve that’s probably on hold and the ructions caused by Britain’s vote to quit the European Union. Assets in bullion-backed exchange-traded funds rose 6.6 tons to 1,959.1 tons on Friday, up from 1,458.1 tons on Jan. 6, according to data compiled by Bloomberg. Holdings increased 37 tons last week as investors reacted to the U.K.’s vote, and swelled in five months out of six in the first half.

Bullion prices climbed to the highest level in more than two years in June as investors absorbed the implications of the U.K. result, adding to a rally that’s been driven by the Fed’s hesitation in raising borrowing costs and the spread of negative rates in Europe and Japan. Banks including Goldman Sachs Group Inc. raised their outlooks for gold after the vote, while yields on 10- and 30-year U.S. Treasuries have touched record lows.

Actually the simple reason why everyone, including momentum-chasing algos, is once again rushing into gold is because not only are central banks about to unleash the latest and greatest round of currency devaluation, one which will require trillions more in FX “warfare” tools, but because with over 30% of all global debt trading in negative yields, gold’s 0% nominal yield is increasingly looking attractive to those who would rather not pay insolvent government for the privilege of lending them money. And if last night’s Chinese short squeeze-driven 7% explosion in silver is any indication, the scramble for precious metals is only just starting.

Finally, those wondering where gold may be headed next, here is a blog post from the abovementioned ETF Securities, which calculates the “fair value” based on net spec exposure and ongoing trends in FX:

Gold’s fair value at US$1440 as uncertainty reigns

Net speculative futures market positioning in gold had already risen to all-time high before the “Brexit” vote and we suspect positioning has moved considerably higher in recent days (data only available weekly with delay). Net speculative positioning hit a record high of 316,525 long contracts last Tuesday, far above the 289,250 net longs hit during the worst of Greek sovereign crisis and considerably above the 83,000 contract average since beginning of the series.

The US Dollar basket (DXY) has risen by close to 4% since the announcement of Brexit. We believe that it could rise further as investors look for haven assets. We also assume the US Federal Reserve will at some point in the coming year raise interest rates (on the assumption that Brexit contagion to the real economy of the US is limited).

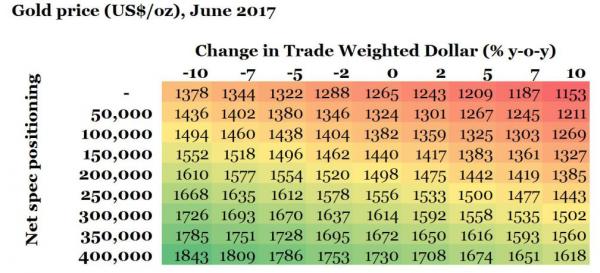

Given the heightened uncertainty about how events will unfold, we present some scenarios for gold prices. We use our proprietary gold model that we presented in “Policy mistakes provide upside potential for gold” and vary the assumptions on US Dollar movements and level of speculative positioning (presented above). We assume that US inflation will hover around 1.1% (around current levels), based on 1yr-1yr break-evens and nominal 10 year Treasury rates will also remain around current levels even if policy rates rise (we assume a bond curve flattening rather than a shift).

In a scenario where the US Dollar appreciates 5% and speculative positioning remains elevated, but moderates to 200,000 contracts, gold is likely to trade around US$1440/oz by June 2017. In the absence of any US Dollar appreciation, gold could trade closer to US$1500/oz.

One thing is sure: the BIS’ gold price appreciation desk will be very busy in the weeks ahead.

Full story here Are you the author? Previous post See more for Next postTags: 10 year treasury yield,Bank of England,Bond yield,Central Bank Gold Holdings,central banks,Deutsche Bank,European Union,Federal Reserve,Futures market,gold price,Goldman Sachs,Japan,Monetary Policy,newslettersent,Precious Metals,U.S. Treasuries