Summary:

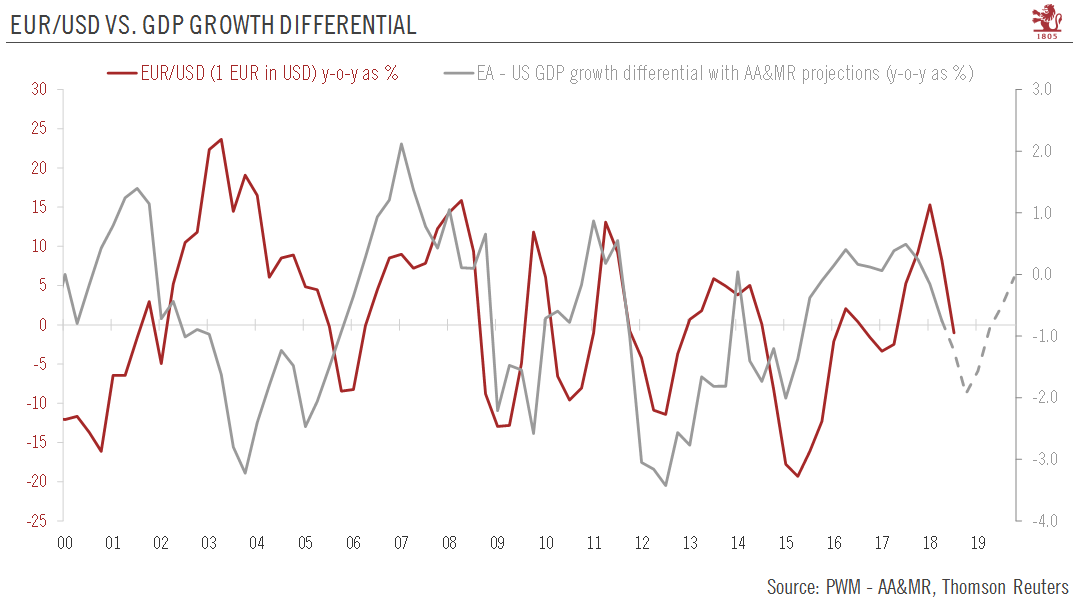

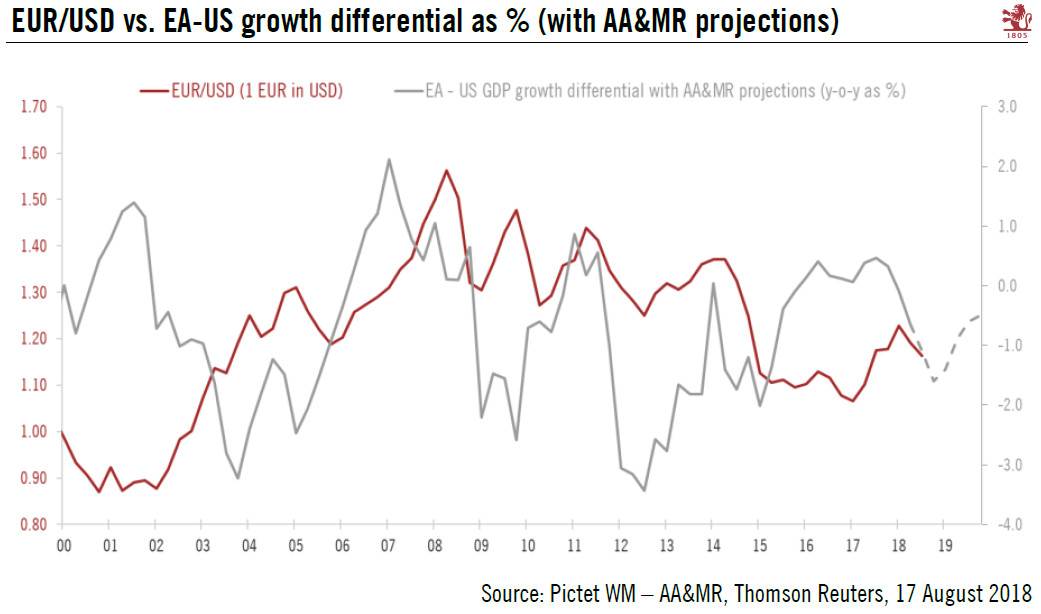

European banks are worrisome.

EBA’s stress test results will be out at the end of the week.

Nonperforming loans are a separate issue, but also need to be addressed.

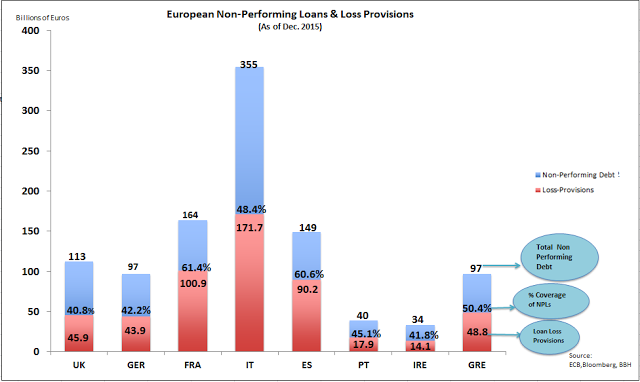

European Non-Performing Loans and Loss ProvisionsBetween Germany, France, Italy and Spain, the four largest economies EMU, the banks had about 765 bln euros of bad loans on their books as of the end of last year. Banks in these countries have made loan-loss provisions of almost 407 bln euro, covering about 53% of the bad loan value.

Part of the problem, of course, is that the banking union in the EMU is incomplete. Therefore the distribution of the bad loans and provisions is important. Drawing from ECB and Bloomberg data, my colleague, Dimitrios Skambas, created this Great Graphic that shows the nonperforming loans and coverage for a select group of European countries. |

Tags: Banca Monte dei Paschi,EUR/USD,Italian Bank,newslettersent