On Edge

First, the Fed waited until last December to pry open a single quarter-point rate increase. That took the federal funds rate – the base lending rate of the entire economy – to all of 0.25 – 0.5%.

When that set the world’s nerves on edge, the Fed did as we warned it would: It put away the crowbar… procrastinated… hesitated… mumbled… and dragged its feet.

Every month brought a new meeting of the Fed’s monetary policy committee… and each meeting brought forth an effluent rich in waffle and hocus-pocus.

The Fed’s chief witch doctor, Janet Yellen, says the committee will make its decision based on the incoming data. The next move toward normalization of interest rates will be “data dependent,” she insists.

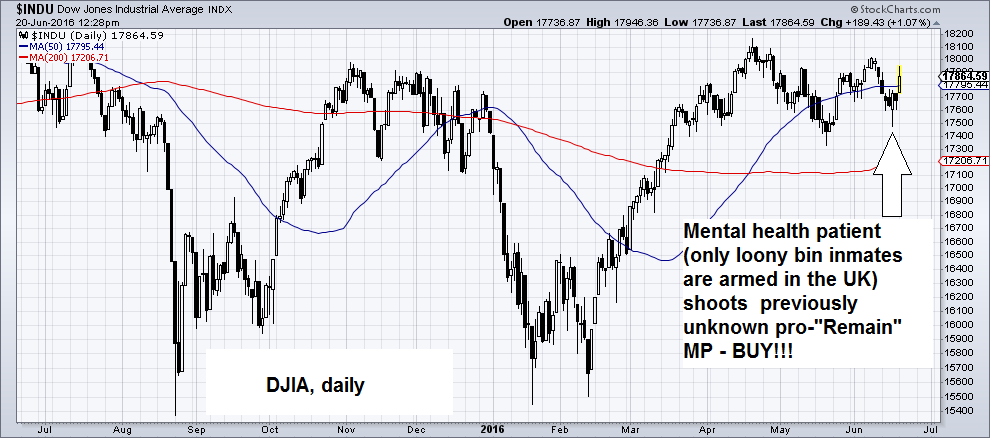

That idea is preposterous, too. These are markets we’re talking about; they go up and down. After so many years of a bull market on Wall Street, Mr. Market must be planning for a change. Stocks gotta go down sometime. Can the Fed raise rates in the face of falling stock prices? We don’t think so.

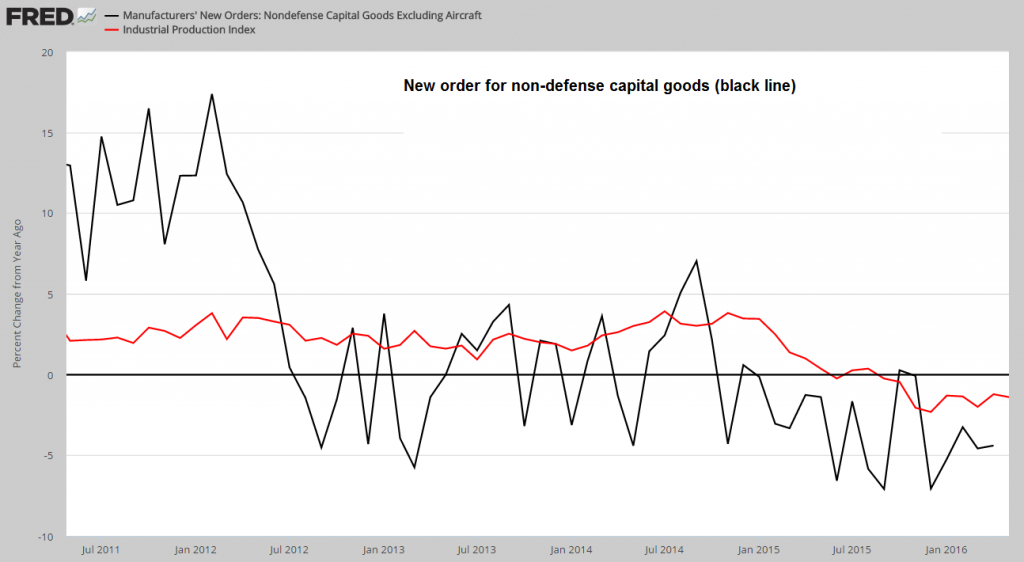

And with the annual rate U.S. GDP growth falling below 1% in the first three months of the year, a prudent investor should prepare for a little backsliding in the economy, too. Will the Fed cling to its “normalizing” program when a recession sets in? Nah.

Bear markets and recessions are facts of life. Because mistakes are facts of life. That’s why markets go up and down. People pay too much for stocks; they need to take a breather until their companies are worth what they paid for them.

Businesses invest too much… hire too many people… produce more than they can sell. Occasionally, they, too, need to slow down, work down their inventories, lay off workers and prepare for the next growth spurt. |