Summary:

Debt is just the flip side of credit. As debt goes bad, credit disappears. And then the system that created so much credit-money will go into reverse, destroying the nation’s money supply.

The money supply (actually, the supply of ready credit) will shrink – suddenly and dramatically. And what should have been a minor, routine pullback in the economy will become a catastrophic panic.

BezzleBALTIMORE – Barron’s, in a lather, says the market is facing the “Two Horsemen of the Apocalypse.” Huh?

Supposedly, the so-called Brexit – the vote in Britain this Thursday on whether to leave or remain in the European Union (EU) – and uncertainty over where the Fed will take U.S. interest rates are cutting down stocks faster than a Z-turn mower. But Brexit is a side show. As our contacts in London explained in last week’s issue of Bonner & Partners Inner Circle, Britain will do just fine outside of the EU. It will even thrive. As for the Fed’s fumbling, it is a consequence, not a cause, of falling stock prices. The real threat to this market is more basic, more dangerous… and completely unavoidable. It is a “doomsday device” – hidden in plain view – in the feds’ fiat money system. It took us a long time to understand how this works. For many years, we referred to the Fed’s EZ money policies as “printing money.” Finally, we realized that this metaphoric description of the Fed’s role probably hides more than it reveals. The Fed is not printing money. If it were printing money, we’d have more money around and higher consumer prices. Instead, when the feds went to a “paper” money system in 1971, they did it very cleverly. Yes, their new system is totally fraudulent and absolutely ruinous – just like an old fashioned money-printing scheme. But the fraud takes much longer to uncover, and the ruin is only obvious at the end. It is a “bezzle”… where you only become aware that you’ve been had when it blows up. |

Debt is just the flip side of credit. As debt goes bad, credit disappears. And then the system that created so much credit-money will go into reverse, destroying the nation’s money supply. The money supply (actually, the supply of ready credit) will shrink – suddenly and dramatically. And what should have been a minor, routine pullback in the economy will become a catastrophic panic. - Click to enlarge |

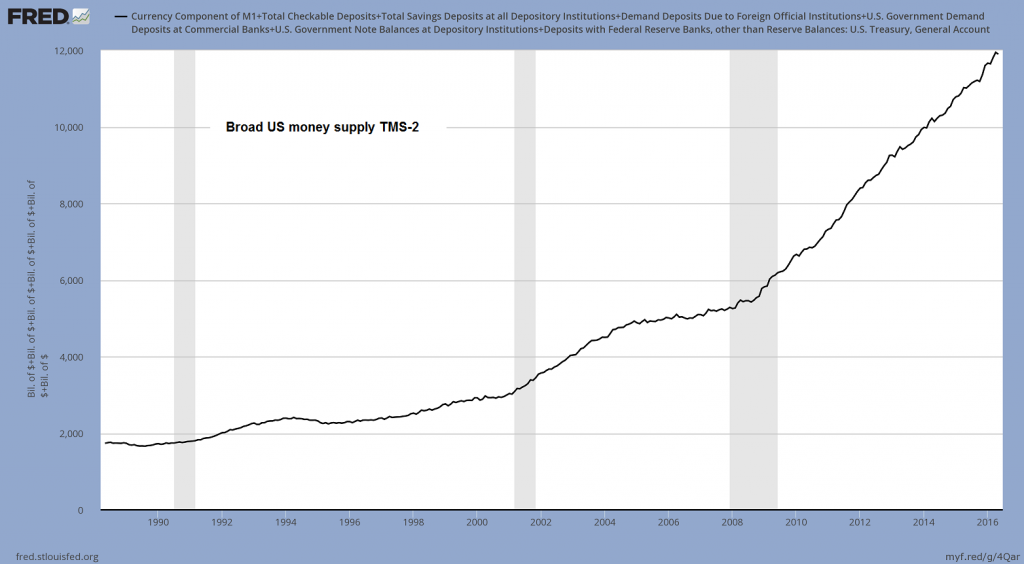

Unlimited CreditHere’s the deal…Instead of printing money itself, the Fed allows banks to create an almost unlimited amount of credit (providing they meet certain capital requirements). Contrary to popular belief, banks don’t act as “warehouses” – taking in deposits and then lending them out again. Instead, banks create new deposits (aka money) when they make a loan. US true money supply TMS-2 – we actually have to disagree with Bill on one point: while normally, the bulk of credit and money supply expansion is indeed left to commercial banks, the Fed can and does “print money” directly if it deems it necessary. In fact, this happened during the three iterations of QE – every time the Fed purchases a security from a non-bank (and the primary dealers are legally non-banks), new deposit money is created to the extent of the purchase. You can catch up on the details here: “Can the Fed Print Money?”. All it takes is a few strokes on a keyboard, and account balances – along with the money supply – go up.0 At first, this new credit-money acts much like printing-press money: It gives people money to spend that nobody ever earned. Everybody is happy. But if you keep on creating more and more paper money, the fraud is soon obvious. Prices rise. People realize that they have no more purchasing power than they had before. In the meantime, businesses and consumers have all made bad decisions, based on the apparent increase in “demand.” After a while, all those mistakes have to be flushed out… in a recession or a depression. |

Debt is just the flip side of credit. As debt goes bad, credit disappears. And then the system that created so much credit-money will go into reverse, destroying the nation’s money supply. The money supply (actually, the supply of ready credit) will shrink – suddenly and dramatically. And what should have been a minor, routine pullback in the economy will become a catastrophic panic. - Click to enlarge |

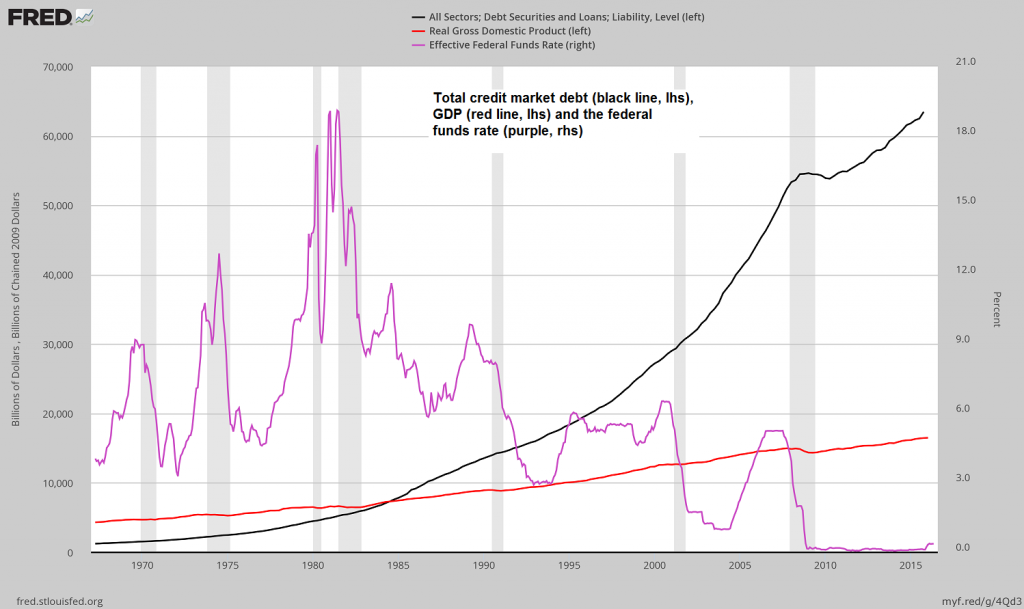

Problem PostponedBy setting up this credit-money system, on the other hand, the feds avoided that problem, or at least, postponed it. Between 1980 and 2016, for example, Americans spent $32 trillion in net, excess credit. That’s credit (and debt) above and beyond the historic relationship between GDP and debt. That, too, would have increased consumer prices dramatically, but the Japanese, and then the Chinese were busily making things much more cheaply. This offset consumer price increases. And more important, much of the increase in credit-money went directly into Wall Street, instead of the Main Street, economy. In a credit-money system, the sectors of the economy that are most creditworthy get most of the new money. Who’s most creditworthy? The rich. Big business. Government. Prices soared, all right. But they were the kinds of prices people wanted to go up. Houses… businesses… commercial real estate… collectibles – talk about inflation; these things went through the roof. Everything that can be financialized – priced and traded – became incredibly expensive. But the price of labor went nowhere. |

Debt is just the flip side of credit. As debt goes bad, credit disappears. And then the system that created so much credit-money will go into reverse, destroying the nation’s money supply. The money supply (actually, the supply of ready credit) will shrink – suddenly and dramatically. And what should have been a minor, routine pullback in the economy will become a catastrophic panic. - Click to enlarge |

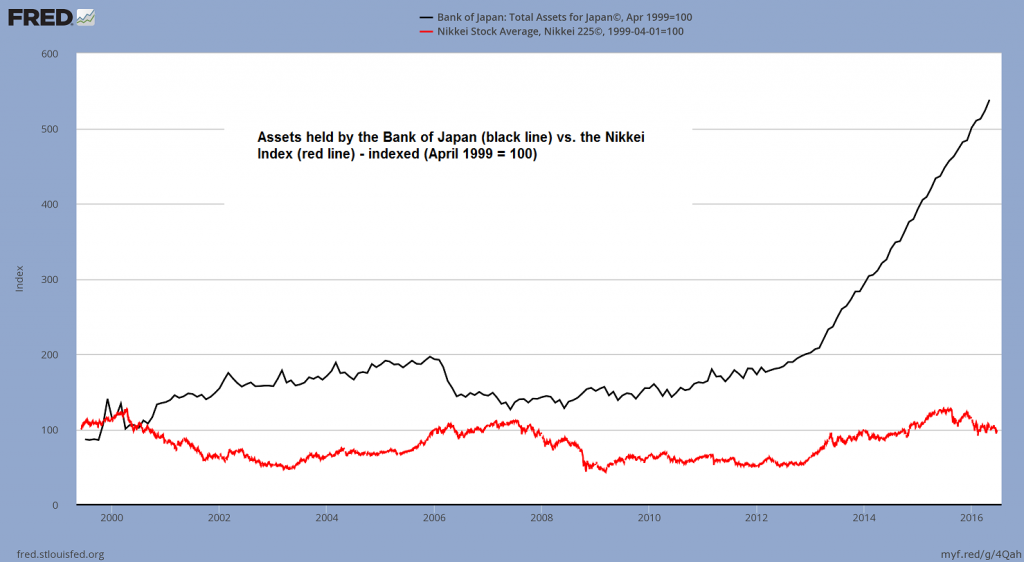

The Rich Get RicherAlmost unbelievably, according to the Pew Research Center, today’s average hourly wage has roughly the same buying power as it did in 1973 – more than 40 years ago. The system hasn’t done much for the common man, but it has helped the rich get richer. And now we know that the Deep State controls the U.S. government (and indirectly, the Fed and the financial system). So nobody really cares about the voters anyway. What a system! The banks are allowed to create money. They lend it to consumers until the household sector can’t take anymore. (This is what happened in 2008). Then they lend to corporations and the government. One by one, each sector takes on too much debt and ceases to be creditworthy. Finally, only government can borrow – because it is the only sector that can print money! We’re approaching that already in Japan, where the central bank buys about 100% of new Japanese government debt issuance. |

Debt is just the flip side of credit. As debt goes bad, credit disappears. And then the system that created so much credit-money will go into reverse, destroying the nation’s money supply. The money supply (actually, the supply of ready credit) will shrink – suddenly and dramatically. And what should have been a minor, routine pullback in the economy will become a catastrophic panic. - Click to enlarge |

Recession WarningIf the feds had handed out paper money, prices would have gone up. But even in a recession, or a debt deflation, the cash would still be there. Printing-press money raises prices, permanently. But a credit-money system is very different. Every new dollar that comes into the system is also another dollar of debt. Now, American consumers, businesses, and government all drag behind them about $60 trillion in debt. It slows them down. It depresses economic growth. And most important, it is subject to the credit cycle… and to the “doomsday device” built into system. A recession is coming in the U.S. If it hasn’t already begun, it will probably set in within six months. When that happens, stock prices will fall. This will have a similar effect as the 2008 crisis when houses plunged. Ultimately, a company’s earnings potential and stock market equity provide the collateral for its debt. When the stock market falls, lenders disappear. Then, the debt market tightens and the doomsday device explodes. Debt is just the flip side of credit. As debt goes bad, credit disappears. And then the system that created so much credit-money will go into reverse, destroying the nation’s money supply. The money supply (actually, the supply of ready credit) will shrink – suddenly and dramatically. And what should have been a minor, routine pullback in the economy will become a catastrophic panic. |

Debt is just the flip side of credit. As debt goes bad, credit disappears. And then the system that created so much credit-money will go into reverse, destroying the nation’s money supply. The money supply (actually, the supply of ready credit) will shrink – suddenly and dramatically. And what should have been a minor, routine pullback in the economy will become a catastrophic panic. - Click to enlarge |

Charts by St. Louis Federal Reserve Research

Chart and image captions by PT

The above article originally appeared at the Diary of a Rogue Economist, written for Bonner & Partners.

Tags: central-banks,Credit Markets,Deep State,GDP,newslettersent