The assassination of US President Kennedy in 1963 turned the conservative Democrat into a martyr, which was a critical inspiration for the 1964 Civil Rights Act. Similarly, it is too early to say with any degree of confidence that Cox’s assassination has the potential and investors responding by reducing some of their risk off trades ahead of the weekend.

Perhaps the most striking move has been sterling. It neared $1.40, a key psychological level we have noted and rebounded to $1.4250 as investors grappled with the impact of the Cox’s death. Asia picked up with North American markets let off to take sterling a little through $1.4300. The intraday technicals suggest it may be difficult for the North American session to significantly extend sterling’s gains further.

After sterling, the Australian and Canadian dollars are leading the major currencies higher. The less risk averse tone and firmer commodity prices are helping. Oil is snapping a six-day slide. Other industrial metals, including copper, is firmer. The roughly 0.5% gain in gold is consistent with the broader commodity move even if not with general risk-on.

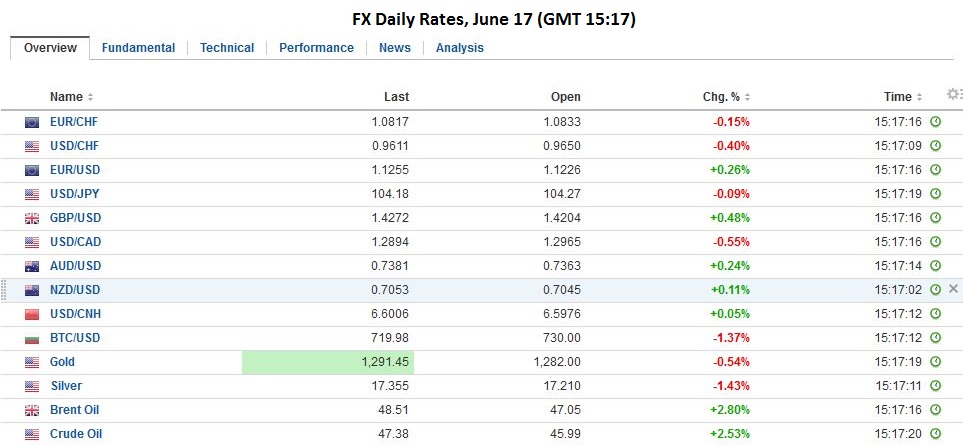

FX RatesThe dollar extended its recovery against the yen after reaching JPY103.50 yesterday in Asia. It finished the North American session near JPY104.25 and edged to almost JPY104.85 in Asia earlier today. Despite the firmer tone in equity markets and higher core bond yields, the dollar has not sustained its earlier momentum. It is consolidating above JPY104.00. The sharp move in the yen in recent days has seen Japanese officials renew their expressions of concern. |

|

Japanese YenThe yen has gained 2.6% against the dollar this week and the same against the euro, which is flat against the dollar. Given the dovish tilt of the Fed, the stand pat BOJ, and slide in equities, the yen’s gains do not seem unusual or a sign of a disorderly market. |

The quiet economic news stream and somber mood have seen equity markets recoup part of yesterday’s losses. MSCI Asia Pacific was up 0.6% after falling 1.1% on Thursday. It is nearly 3% this week. The MSCI Emerging Market equity index is up 0.7% ahead of Latam’s open but is still off 2.2% on the week. European shares are seeing a stronger response. The Dow Jones Stoxx 600 is up a little more than 1.6% near midday in London. Financials and energy sectors are leading the way, but the breadth is good with all sectors higher. The index is off less than 2% for the week.

Graphs and additional information on Swiss Franc by the snbchf team.

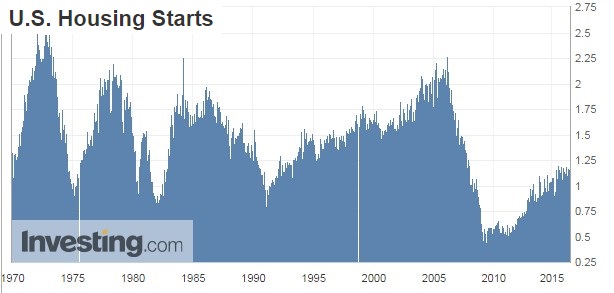

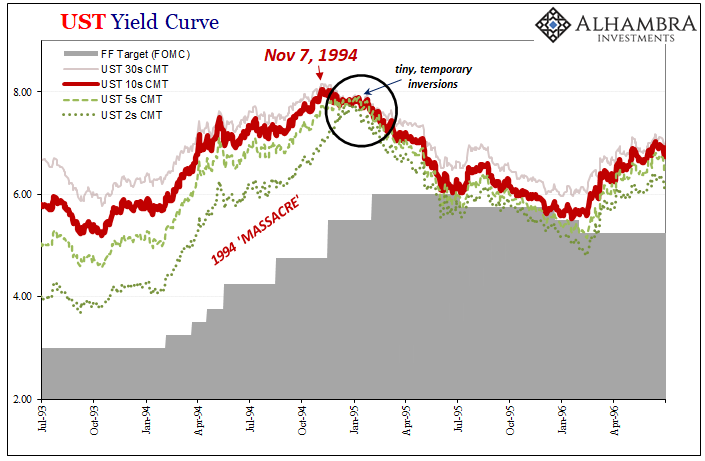

Full story here Are you the author? Previous post See more for Next postTags: Brexit,FX Daily,Japanese yen,Jo Cox,newslettersent,U.S. Housing Starts,U.S. Treasuries