Trump Is Right

PARIS – On Wednesday, brick-and-mortar retailers – such as Macy’s – led U.S. stocks lower. The Dow lost about as much as it had gained the day before. Nothing much to talk about there…

Macy’s Inc. NYSE + BATSMacy’s on the way to Zool. |

When we left off yesterday, we posed two questions: Shouldn’t your editor (under torture, of course) confess his sins, renounce his apostasy, and register to vote before it is too late? And… isn’t democracy – for all its faults – still the best game in town?

We pause to note that when Donald Trump suggested that he might, as president, default on America’s debt, it brought screams of doubt and pain from all over the financial world.

U.S. debt, said the pundits, was the “glue”… the “foundation”… the sine qua non… of the entire system. Any trace of “renegotiating” or “discounting” it would lead to a huge crisis.

Mr. Trump is right: There is too much debt; one way or another, it will have to be discounted. He was merely proposing to do it honestly. Out in the open. But his critics are right, too: It will surely bring about a crisis when Treasury bond investors – including millions of U.S. retirees – realize that they are in for a haircut.

Cockamamie System

You may have noticed that for months we’ve been coaxing out an insight. It helps explain many of the strange and startling features of the world’s financial system.

Such as how China’s economy grew so fast…what caused the crisis of 2008… how come $9 trillion of debt is now trading at negative yields… and why growth has now stalled, despite more money spent to stimulate the world economy than ever before.

The short explanation is this: The U.S. financial system – in place since 1971 – runs on debt, not wealth. A dollar no longer represents accumulated earnings or savings. It comes into being, courtesy of a few keystrokes, when the government spends or someone takes out a bank loan.

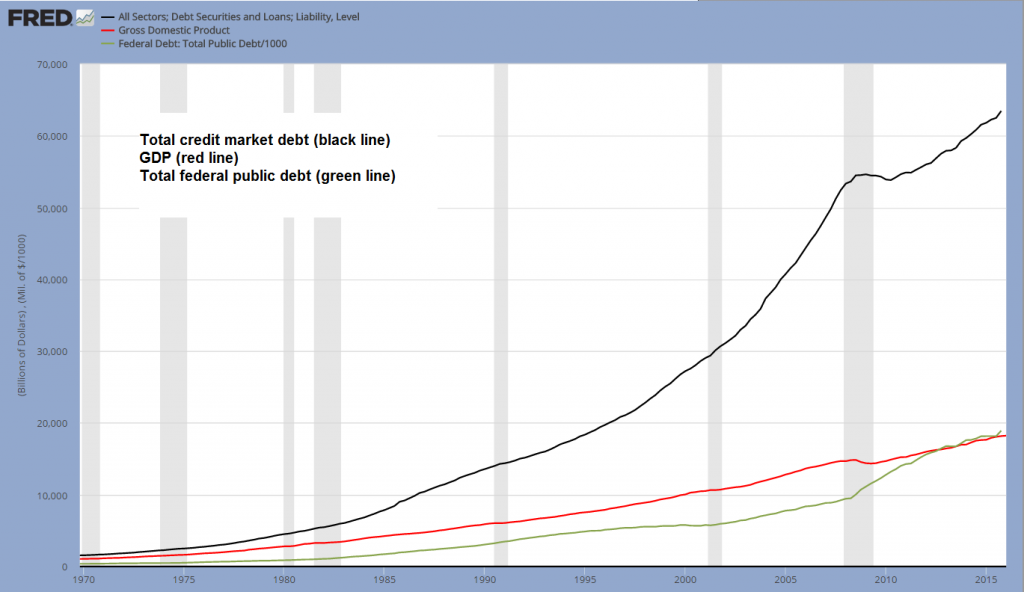

Total credit market debt, GDP, Total federal public debtTotal credit market debt, federal government debt and GDP – an economy running on debt, and now running on empty. |

It represents the expectation of future wealth, not the recognition of wealth that has already been made. And that dollar will never have real value unless and until the economy grows enough to make it worth something.

The system worked passably well for three decades. But like everything in nature – including a cockamamie money system – there are limits… feedback loops… and unwelcome consequences.

A debt-based system hits the wall when growth slows and debtors can no longer pay. That happened in the U.S. mortgage sector in 2008. It is happening today with student debt, auto debt, and junk corporate debt.

Government debt will be the last to fall. You know that the feds are always good for the money; after all, they print the stuff. The trouble is, the feds’ money is not always good for you. Stay tuned…

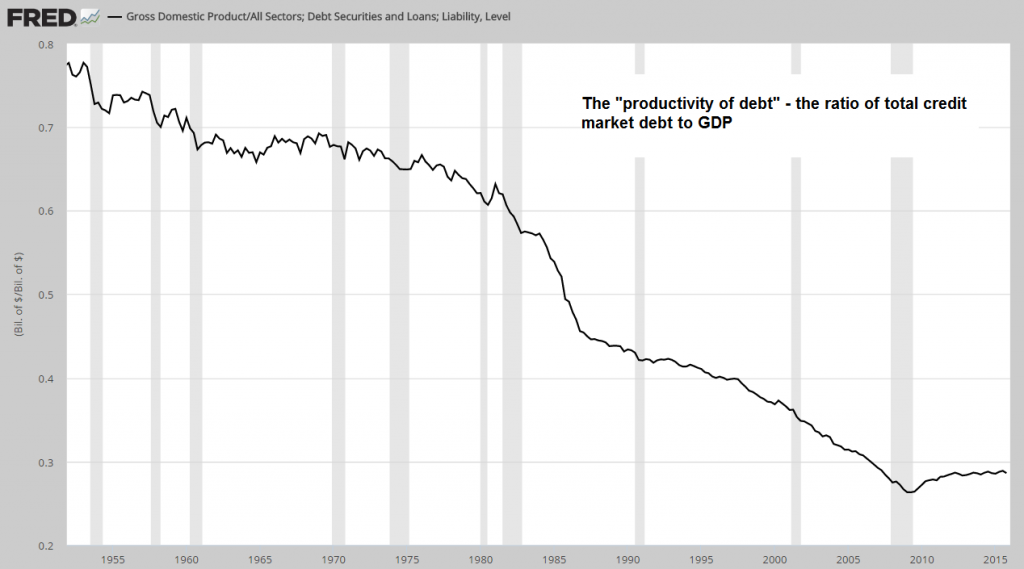

Gross Domestic Product/All Sectors; Debt Securities and Loans; Liability, LevelA proxy for “debt productivity” – the ratio of total credit market debt to GDP |

Big Boy Pants

Back to politics…in response to our questions about democracy above, the preponderance of reader opinion is this: It may not be a perfect system… and God knows we may not have perfect candidates… but we should still “put on our big boy pants,” get in line, and do our duty.

Bonner compares Total credit market debt, federal government debt and GDP – an economy running on debt, and now running on empty. - Click to enlarge

Besides, most readers are 100% certain that “The Donald” would make a better president than “The Hillary” – and it will be your editors’ fault (and the fault of other abstainers) if he doesn’t get elected.

Perhaps it was all those years we spent in Washington, trying to get politicians to spend less of our money. (Before setting up our publishing company, we worked at the National Taxpayers Union.) Or perhaps it was all those years we’ve spent in finance, trying to figure out where the markets were going.

Those experiences have made us cynical. You tell us that “gold is headed to $10,000.” You say “oil can’t drop below $50.” You say Donald Trump will “make America great again.”

“Un-huh,” we answer.

When Democracy Works

“The problem with democracy,” we explained to a friend yesterday, as she looked at her watch and hoped her phone would ring, “is a matter of scale.”

“We see the New England town meeting as a model,” we explained. “It’s a democracy that seems to work plausibly well. Everybody knows everybody else. They are all families, friends, coworkers.

“So, everybody knows the important details – for example, that the mayor is a scalawag and that you have to stay off the streets when Ms. Jones gets behind the wheel.

“In a small town, you can know real things… and vote on things that concern you all. You can do central planning, too… You almost have to. Where to put the town dump. When to schedule the next town fair. How much to charge for parking in the town’s lot.

Bonner compares Total credit market debt, federal government debt and GDP – an economy running on debt, and now running on empty. - Click to enlarge

“Everybody has to do central planning. When you get up in the morning, you have to plan your day. When you have a business or a family, you have to make decisions… you have to decide what you’re going to do and how you’re going to do it.

“On a small scale, central planning is necessary and effective. And democracy is not bad, either. It helps build the consensus you need to set goals and get everyone behind them.

“But even then, you still get a lot of bullying and bumbling. There are always some jackasses who want to tell everyone else what to do. But in a small community, most people learn to get along with one another.

“In a big community, on the other hand, central planning and democracy are completely different things. People elect leaders they’ve never met… based on slogans and brand advertising. Nobody really knows what they will do, or why.

“And then, the leaders get away – literally – with murder. But people think it’s okay because they think it is just a big version of the town meeting. It’s not. Large-scale democracy is something entirely different. On a large scale, central planning and democracy don’t work.”

We’ll tell you why in the next installment.

Charts by: StockCharts, St. Louis Federal Reserve Research

Chart and image captions by PT

The above article originally appeared as “Will “The Donald’s” Debt Plan Torpedo Your Retirement?” at the Diary of a Rogue Economist, written for Bonner & Partners. Bill Bonner founded Agora, Inc in 1978. It has since grown into one of the largest independent newsletter publishing companies in the world. He has also written three New York Times bestselling books, Financial Reckoning Day, Empire of Debt and Mobs, Messiahs and Markets.

Full story here Are you the author? Previous post See more for Next post

Tags: Donald Trump,GDP,government debt,Loans,newslettersent,On Economy,On Politics,Switzerland Gross Domestic Product