Buy Low, Sell High?

It is an old truism and everybody has surely heard it more than once. If you want to make money in the stock market, you’re supposed to buy low and sell high. Simple, right?

As Bill Bonner once related, this is how a stock market advisor in Germany explained the process to him:

Thirty years ago, at an investment conference, there was a scalawag analyst from Germany. He showed a chart where a stock had gone up steadily for 10 years. He pointed to the bottom, left side, and in a thick accent explained his system:

“Ja, you see, down heer? Vee buy.”

Then, pointing the upper right hand corner opposite…

“Und up heer, vee sell. Zat vay vee never lose money.”

A hand went up. A listener had a question:

“But what happens if the stock doesn’t go up?”

“Ah, zen,” he replied without a moment’s hesitation, “vee don’t buy it.”

He was right. The winning formula is “Buy low. Sell high.”

A recent article at Bloomberg points out that investors have apparently not taken this lesson to heart in the gold sector (more on this further below). Gold stocks have rallied by approximately 110% between mid January and mid April – something that obviously doesn’t happen very often. The rally has started after the conclusion of one of the most grueling bear markets the sector has ever endured. As we pointed out at the time, the turnaround was marked by a “false breakdown”.

Gold stocks rise 110% from mid January to mid April.A number of individual stocks have surged a lot more. For instance, HMY, which we discussed in early December and again in early January, because we felt a great trading opportunity was shaping up in it (see “Marginal Gold Producer Takes Off” and “The Canary in the Gold Mine” for details), rose by nearly 800% from its late November low to its early April peak (it has since then begun to correct, in line with the Rand gold price). |

Of course, no-one could know that such a big rally was in the offing – its size and speed surprised us as much as anyone – but there were numerous signs that the sector was getting ready to deliver at least a tradable move. As we noted in late November in “Gold and Gold Stocks, it Gets Even More Interesting”:

“When a market is down 83% like the HUI gold mining index is, we are generally more interested in trying to find out when it might turn around, since it is a good bet that it is “oversold”. Of course, if it makes it to 90% down, it will still be a harrowing experience in the short term. We like these catastrophes because they usually mean “the stuff is cheap and there is probably something people don’t see”. That is definitely the case here, since one of the things that has been routinely ignored is the improvement in costs and cash flows that is slowly but surely progressing at many gold producers.”

[…]

“While we are waiting for the turning point, we are always interested in the potential for tradable rallies until it happens, because they tend to be so big in this sector. Just look at the last move from 104 to 140 in the HUI – that’s as if the DJIA went from its current level of 17,792 points to 24,000 points in just two and a half weeks. Will it do that? We doubt it. The HUI can – and not only that: it can rally that much and still be a few light years below its 200 day moving average. In short, these “small bounces” are really gigantic, because prices are so compressed and the sector is so small and illiquid.”

Ultimately, what we were saying above amounted to: “It is time to think about the “buy low” part”. Apparently many investors were no longer prepared to do so though, after the battering the sector had taken over the previous three years.

Missing Out as the Pet Rock Strikes Back

This is where the above mentioned Bloomberg article comes in. It is entitled “Gold Miner ETFs Are Having the Rally of a Lifetime and Burned Investors Are Missing It”. In a way it is quite ironic to read this at Bloomberg of all places, because at the end of last year, it published one obituary on gold after another.

Considering that gold is just an unimportant “barbaric relic”, resp. a “pet rock” as one of the countless self-anointed gold “experts” that have popped up in recent years wrote in the WSJ, a huge amount of ink has been spilled in the mainstream financial press on disparaging its prospects and mocking those who disagreed.

As we have frequently pointed out, gold is an investment the mainstream loves to hate, mainly because it is the free market antagonist of the centrally planned fiat money system in place today. This system has predictably failed to deliver on its promises and as ever crazier experiments are resorted to by the planners, the propaganda has seemingly intensified.

But this is just an aside. What makes the story interesting is actually something else: it represents an important lesson in a general sense. As Bloomberg informs us:

“Investors in exchange-traded funds tracking gold mining companies just can’t seem to get it right. After years of trying–and failing–to call a bottom for the miners, investors are scared to buy into what is turning into the rally of a lifetime for ETFs tracking these once left-for-dead stocks.

Despite returns of more than 65 percent in a year when the S&P 500 is up 4 percent, gold miner ETFs have seen half a billion in outflows. That is practically unheard of as inflows and performance are usually highly correlated when it comes to ETFs. Gold miner ETFs, it seems, are the rare exception.

(emphasis added)

We would note to this that bulls should be very happy to hear that the rally is still disbelieved. It is of course quite natural that an initial rally after a steep bear market meets with a great deal of skepticism – but once an index has risen by more than 100%, most of the skepticism has usually been dispelled.

Not so in gold stocks it seems. It gets even better – after noting that gold miner ETFs have “burned” through a lot of investors cash (which is no surprise given a bear market decline of 83% from peak to trough), Bloomberg writes further:

Throw in a few of the smaller gold miner ETFs as well, add it all up, and such funds have effectively burned through about $8 billion in investor cash. That’s more than any other industry, sector, or category.

This explains why such an intense rally can coincide with outflows, as many burned investors are getting out and trimming losses before they get burned again. One gold miner ETF is seeing some significant inflows, however. The only problem? It’s the Direxion Daily Gold Miners Bear 3X Shares (DUST), which is down 88 percent. Meanwhile, the Direxion Daily Junior Gold Miners Index Bull 3x Shares (JNUG) has put in a jaw-dropping return of 294 percent (along with outrageous volatility that is 10 times that of the S&P 500).

JNUG is returning four times the returns of its underlying index due to the compounding effect of resetting leverage daily into a upward-moving market. No ETF has ever returned more than 300 percent in a year. Yet JNUG has still seen $83 million in outflows.

(emphasis added)

JNUG vs. SPX performance since the low in junior gold stocks on January 19.In other words, so far they couldn’t have been more wrong. We distinctly remember that there were large inflows into gold mining ETFs while they were going down. This turned out to be a major contrary indicator. We expect the same will turn out to be true for the recent outflows (the potential for a near term correction notwithstanding). |

A Historic Rally in Gold Stocks – and Most Investors Missed It

The Lesson

Many investors also missed the rebound in base metal mining stocks and the oil sector. As we have stressed many times in these pages, commodity prices always bottom when their fundamentals still look absolutely horrendous. One simply cannot hope to successfully trade these sectors based on supply-demand fundamentals everybody is already talking about ten times a day.

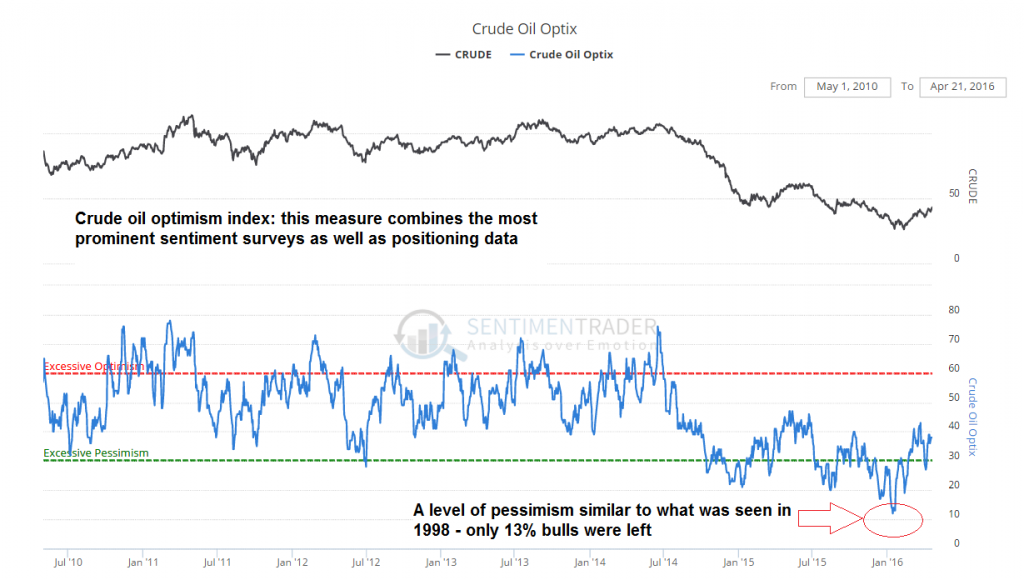

Crude oil bullish consensus: at the low it reached a level comparable to 1998 (there was a brief spike to a similar level in 2002 as well, but in terms of pervasiveness and duration only 1998-1999 sentiment comes close)In crude oil the most important information investors overlooked was the fact that the bullish consensus had fallen back close to the previous record low recorded in late 1998. As we have mentioned on a previous occasion (even though we were a bit early), at the time oil fundamentals looked just as bad. |

The mainstream press was full of articles about “hundreds of millions of barrels floating on tankers because there is no more storage space” (does that sound familiar?). Within just a few weeks of the Economist publishing a cover story entitled “Drowning in Oil”, the oil price embarked on a rally in the course of which it would ultimately gain nearly 1,400%.

There are two reasons for this: 1. markets at some point always discount the worst – and they routinely do so before the worst actually happens. 2. commodity prices (this goes for prices in general) do not only depend on the supply-demand fundamentals of the commodity concerned, but also on the supply of and demand for money.

In other words, prices are not independent of the money relation. No-one would expect the prices of 50 years ago to be seen again – this is never questioned, people just naturally assume that it won’t happen. While there is no quantifiable or direct correlation between money supply growth and specific prices, it should be obvious that prices cannot be independent of the money supply over the long term.

In the domestic US economy alone, there is over 300% more money today than there was in the year 2000. One must not lose sight of this fact when pondering how low certain prices may go.

Conclusion

The skepticism that has accompanied the rally in gold stocks is certainly a strong counterpoint to the extended net long position held by speculators in COMEX gold futures which many people have worried about lately. It is also an encouraging sign for bulls – they should actually consider selling when these outflows become inflows, as that will be a sign of “capitulation”.

Moreover, there are several lessons here, which evidently need to be retaught over and over again:

Never trust the conventional wisdom. In gold, the conventional wisdom was that it would surely fall further once the Fed hiked rates – as we expected, the exact opposite has happened (we mentioned that it was inter alia the threat of a rate hike that weighed on gold prices – the actual hike was likely to create a “sell the rumor, buy the news” situation).

Prices bottom before fundamentals turn around. This is particularly true in the case of industrial commodities. Once everybody knows about a bad fundamental situation and the press is chock-full of ever more extreme bearish predictions (or bullish ones in the case of rising prices), it is time to pay attention, as an opportunity will be close. The best money making opportunities always involve defying the consensus.

Lastly, one has to be prepared to see a “faith-testing” correction at some point. This is something that also tends to happen with unwavering regularity, and has yet to happen in the mining sector.

Charts by: StockCharts, SentimenTrader

Full story here Are you the author? Previous post See more for Next post

Tags: 200-day moving average,Chart Update,newslettersent,Precious Metals,The Stock Market