from the official release

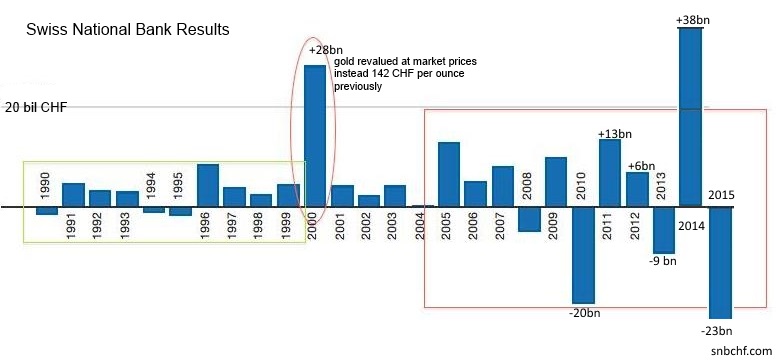

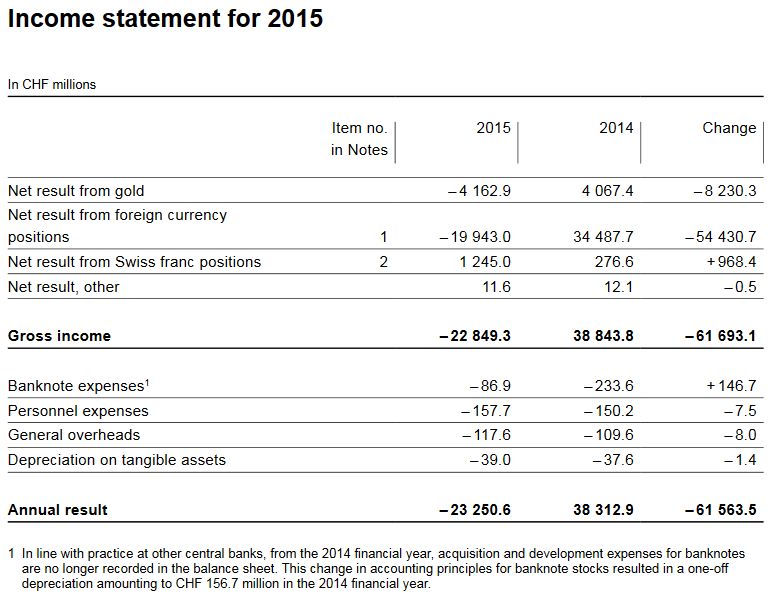

The Swiss National Bank (SNB) is reporting a loss of CHF 23.3 billion for the year 2015 (2014: profit of CHF 38.3 billion).

The loss on foreign currency positions amounted to CHF 19.9 billion. A valuation loss of CHF 4.2 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.2 billion.

For the financial year just ended, the SNB has set the allocation to the provisions for currency reserves at CHF 1.4 billion. Taken together, the annual loss and allocation to provisions totalling CHF 24.6 billion are less than the distribution reserve, which amounts to CHF 27.5 billion. Thus, despite the annual loss, the resulting net profit will allow a dividend payment to shareholders of CHF 1.5 million as well as the ordinary profit distribution of CHF 1 billion to the Confederation and the cantons. The distribution reserve after appropriation of profit will amount to CHF 1.9 billion.

The increasing volatility of SNB ResultsAnnual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or the opposite. |

SNB Results Longterm 2015 |

Loss on foreign currency positions

|

SNB loss in 23.3 bn. CHF in 2015, after a profit of 38.3 bn. in 2014 Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||

Valuation loss on gold holdings

Percentage of gold to balance sheetEven if the gold price is rising, its parts of the balance sheets is falling.

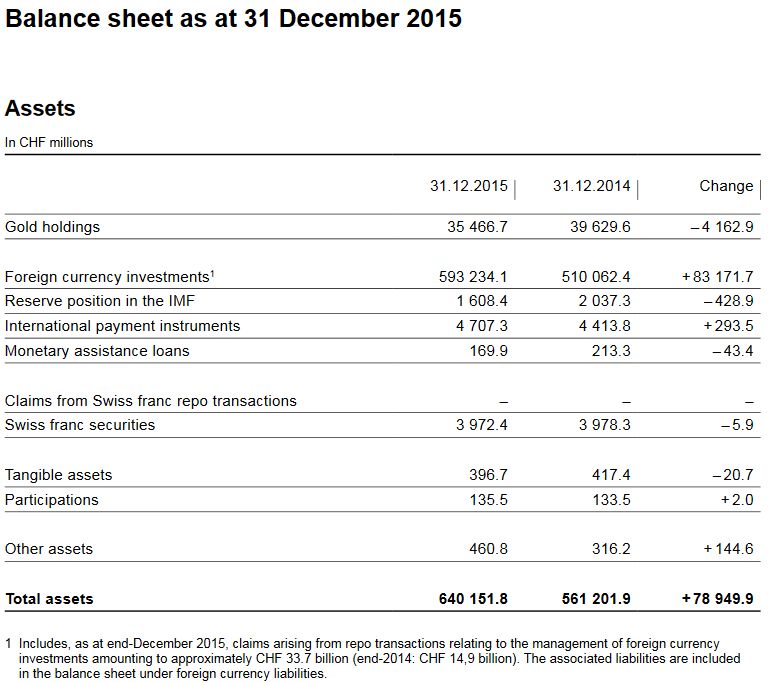

Balance SheetThe balance sheet has expanded by over 79 bn francs by 14.08%

|

|

||||||||||||||||||||||||||||||||||||

While the SNB supports foreign stock markets and foreign companies, it does not invest in Swiss stocks.

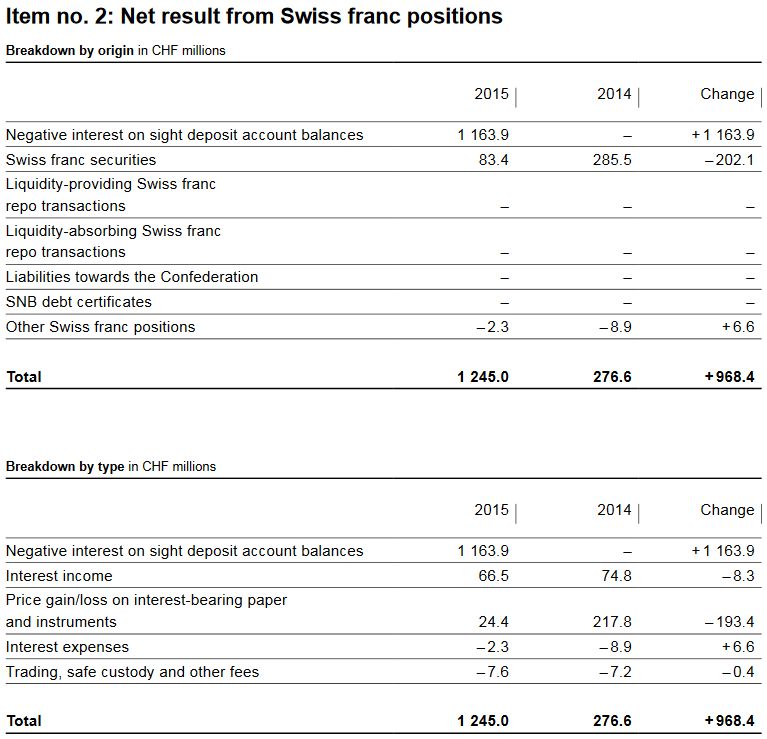

Profit on Swiss franc positions

Negative Interest ratesFurthermore the SNB harms the Swiss economy, when it reduces the profits of Swiss banks by negative interest rates. With this measure it maintains its own profitability.

|

One essential part of SNB profits are negative interest rates Source: snb.ch - Click to enlarge |

||||||||||||||||||||||||||||||||||||

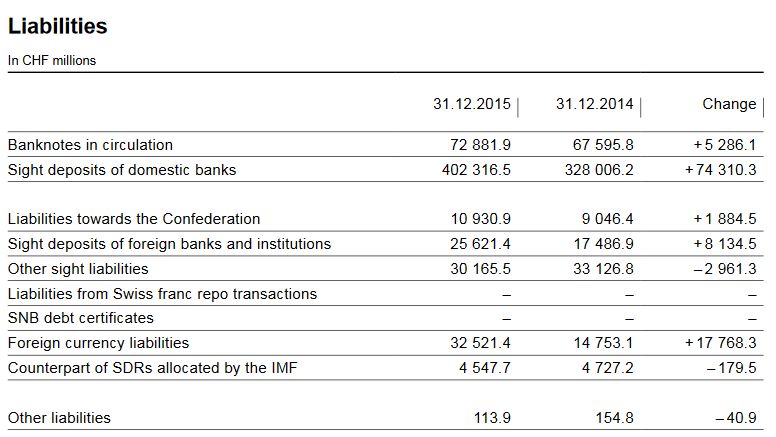

SNB LiabilitiesSight deposits is the biggest part of SNB interventions

Banknotes in circulation: +5.28 bn francs. |

Liabilities track the SNB interventions Source: snb.ch - Click to enlarge |

Provisions for currency reserves

The allocation to provisions for currency reserves amounted to CHF 1.4 billion. The figure is lower than in the previous year (CHF 2.0 billion) because the average period for the calculation of the allocation upon which the 2015 financial year is based includes several years with low nominal GDP growth rates. At 1.2%, average nominal GDP growth was therefore lower than in the relevant previous period (1.8%). For the 2015 financial year, as in the preceding years, the basis for calculating the allocation was twice the average nominal GDP growth rate for the previous five years.

Full story here Are you the author? See more for Next postTags: newslettersent,SNB balance sheet,SNB equity holdings,SNB Gold Holdings,SNB profit,SNB results,SNB sight deposits,Swiss National Bank