"We're gonna need a bigger Bullard"

- overheard on a trading desk this morning.

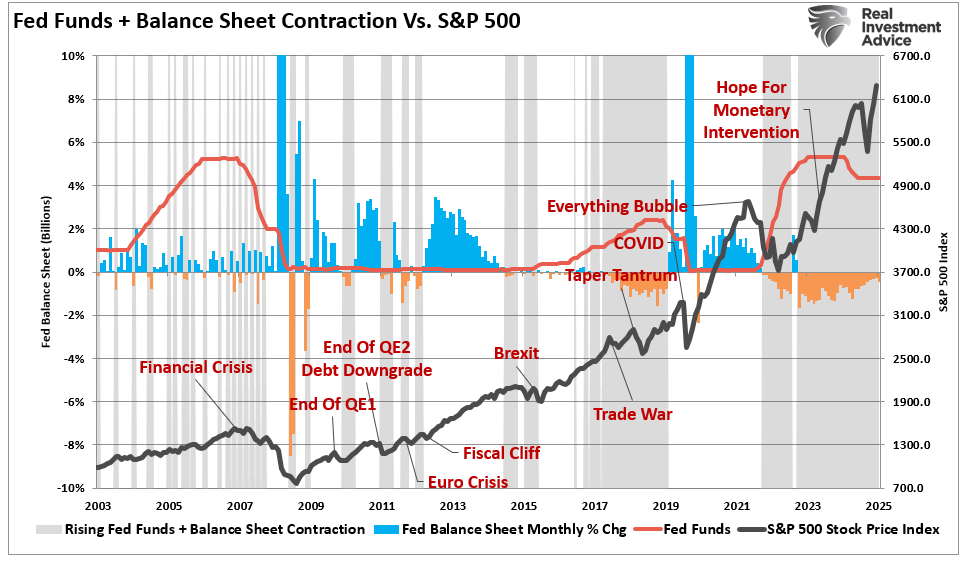

Yesterday, when looking at the market's "Bullard 2.0" moment, which was a carbon copy of the market's kneejerk surge higher response to Bullard's "QE4" comments from October 17, 2014 (at least until just a few minutes prior to yesterday's market close when suddenly selling pressure appeared), we said that either the S&P would soar - as it did in 2014 - hitting all time highs just a few months later, or the "Fed is now shooting VWAP blanks." Judging by what has happened since, in what may come as a very unpleasant surprise to the "the market is very oversold" bulls, it appears to have been the latter.

It all started with China overnight, where shortly after the disappointing news that new bank loan creation in December rose by 597.8 billion yuan, well below the 700 billion expected (however offset by a surge in aggregate financing of 1.82 trillion yuan; far above the estimated 1.15t yuan driven entirely by new corporate bond issuance right into the world's biggest bond bubble), the Shanghai Composite started sliding and did not stop until it dropped to just about 2,900, down 3.55% on the session, and officially entering its second bear market of the past year. The Chinese stock gauge is the world's worst-performing global equity benchmark to start 2016, and the Composite has now fallen to levels last seen in 2014, wiping out all gains from China's unprecedented state-rescue campaign.

In addition to the new loan disappointment, adding negative pressure to stocks was a report that some banks in Shanghai have stopped accepting shares of smaller listed companies as collateral for loans.

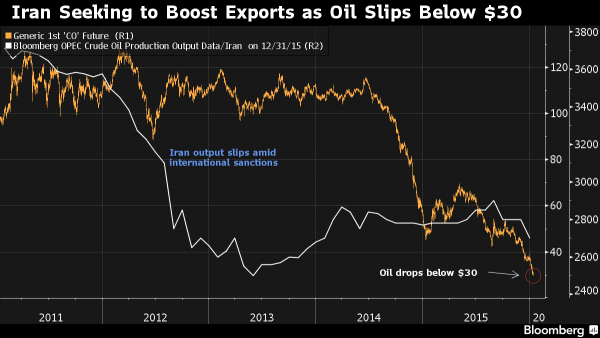

Then there was oil, which after flirting with $30 for the past two days, finally broke the psychological support barrier with gusto, and both WTI and Brent have tumbled by about 5% and 4% respectively at last check, and substantially below $30, driven first by rising fears of the imminent landfall of millions of barrels of Iran oil the moment the sanctions are officially lifted as soon as Monday...

... and then about 3 hours ago a new report by Goldman reiterated supply fears, when it once again hinted at $20 oil, although adding that was not its baseline forecast yet, and that it was keeping its $40 oil price target:

While the surplus in oil continues to pressure oil timespreads wider and reversed the WTI-Brent spread as European surpluses are moved to the US Gulf Coast where spare storage exists, we still aren’t adopting the $20/bbl scenario as our baseline forecast since balances have not deteriorated further following our mid-December update. Barring a supply or demand/weather shock that shifts the balance by more than 340,000 b/d we don’t see the oil market hitting storage capacity constraints, which is why we are maintain our $40/bbl WTI price forecast for 1H16.

The market read between the lines and is already trading as if $20 oil is here. As a result,

Norway sees a crisis in its industry, energy firms are laying off workers and currency markets from commodity-producing countries are in turmoil. The slump is also denting the outlook for inflation around the world, causing traders to curb bets on how far the Federal Reserve will raise interest rates this year.

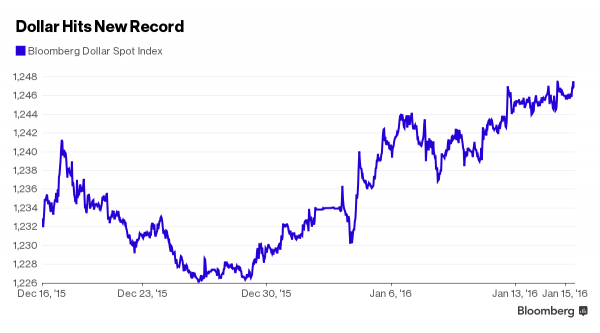

Also not helping oil was another bout of strength in the US dollar, even as doubts grow about the Federal Reserve's ability to raise interest rates four times in 2016. According to Bloomberg, the gauge tracking the performance of the dollar against 10 of its leading global peers is heading for a third weekly gain, the longest stretch since July. As a result the Bloomberg Dollar Spot index just hit a new record high...

... and while the dollar surges, the all important Yen carry trade is getting unwound pushing the USDJPY down 100 pips overnight, and slamming US equity futures which were down over 30 points at last check, or down 1.6% to 1884. Elsewhere, stocks fell around the world and bonds gained as the outlook for inflation soured while a measure of credit risk for investment-grade companies in Europe climbed for an eighth day.

Among other commodities, the latest plunge in copper is notable, which as of this morning has dropped nearly 2% to a fresh 6 year low...

... which in turn has sent the stock of our old friend Glencore relling, down 8.5%. It's not better elsewhere: as Bloomberg notes, industrial metals headed for the first back-to-back weekly decline since November on signs of further slowing demand in the Chinese economy and after oil prices dropped. Mining shares also sank. All base metals fell on Friday and the LME Index of six metals has lost 1 percent this week.

The Stoxx Europe 600 Index retreated 1.4%, heading for a weekly drop of 1.5 percent. Europe’s benchmark has tumbled 19 percent since an April high, inching closer to the common definition of a bear market. Shares are trading at 14.2 times estimated earnings, the lowest in about a year. The Euro Stoxx 50 Index entered a bear market this week.

A measure of commodity producers posted the biggest drop of the 19 industry groups on the Stoxx 600. BHP Billiton Ltd. fell 5.9 percent after saying it expects a $4.9 billion impairment charge on onshore U.S. assets. Energy companies slid, with Total SA and Royal Dutch Shell Plc leading declines.

Looking at markets around the globe, Asian stocks shrugged off the firm gains from the "Bullard Bounce" with sentiment dampened by the resumption of crude weakness as oil prices retreated back below the USD 31/bbl level. Consequently, the ASX 200 (-0.3%) and Nikkei 225 (-0.5%) slid into negative territory as the drop in oil weighed on sentiment.

Chinese bourses traded lower with the Shanghai Comp. (-3.6%) below the psychologically key 3,000 level alongside continued China woes and the longest stretch of margin debt declines in 4 months. 10yr JGBs traded higher amid weakness in Asian equities with the paper also supported by the better than prior enhanced liquidity auction.

In Europe, once again the energy complex dictated price action across asset classes so far this morning, with Brent and WTI both slipping below the key USD 30/bbl level, following on from further dampened mood amid disappointing data and the Shanghai Composite entering bear market territory. While also of note, The Times noted that the UN could lift sanctions next week which could see Iran further flood the market with oil. The oil move guided equities lower (Euro Stoxx: -1.0%), with the risk off sentiment filtering through to upside in Bunds, gold and JPY.

In FX, amid the fresh downturn in risk sentiment, there is one standout move to highlight this morning; the USD/CAD ramp through 1.4400 and 1.4500. In what took a matter of minutes, the 130 tick rally took out exotic limits at both levels, with the larger 1.4500's seen to be the underlying reason for such a sharp move, which had little news/data behind it.

Russia’s ruble and South Africa’s rand fell at least 1 percent, leading a gauge of emerging-market currencies down 0.2 percent, capping its third weekly decline. Over the five day period, the ruble slid 3.1 percent and the rand lost 1.8 percent.

The Hong Kong dollar fell 0.14 percent to HK$7.7926 per dollar, taking its two-day drop to 0.4 percent, the most since October 1992. The global foreign-exchange situation is complicated and it’s possible the currency will decline to the weaker side of the peg, the city’s Financial Secretary John Tsang told reporters. The existing exchange-rate system limits declines to HK$7.85 and caps gains at HK$7.75.

Australia’s dollar led declines in the currencies of raw-material producing nations, dropping as much as 1.5 percent to the weakest level since April 2009. The Canadian dollar fell for an 11th straight day in its longest run of losses on record. New Zealand’s kiwi slumped 1.1 percent.

The yen appreciated against all its 16 major peers as turmoil in markets boosted demand for havens. The euro also gained, while the Bloomberg Dollar Spot Index, which tracks the U.S. currency versus 10 major counterparts, rose for a sixth day.

Finally in commodities, WTI and Brent are below USD 30/bbl, with analysts noting that the UN are expected to approve the removal of Iranian trade sanctions as soon as Monday, which could see millions of extra barrels of oil exported from Iran as soon as next week. Goldman Sachs noted that while USD 20/bbl is a possibility although it is not yet their base scenario after many have quoted this forecast in the current commodity climate. As we head into the North American crossover, WTI futures continue to tick lower breaking below the USD 29.50 level.

Gold rebounded overnight alongside a pull-back in USD and weakness in riskier assets and continues to trade in positive territory this morning after the Shanghai comp closed down 3.6% and European stock indices once again reside in a seas of red. However, precious metal still remains on course for its largest weekly loss since November, with prices continuing to retrace off the recent low of 1071.10.

Elsewhere, copper prices remain under pressure this morning and a note from Codelco overnight saying they will maintain production at 1.8mln tonnes a year, will do nothing to support prices in today's trade.

The most important data release today will be the US retail sales print for December where current expectations are for a -0.1% monthly decline at the headline reflecting the decline in auto sales while ex auto is expected to come in at +0.2%. As always the retail control component will be closely followed too. Also out will be PPI, empire manufacturing, industrial and manufacturing production, business inventories and finally the preliminary University of Michigan consumer sentiment print. It’ll be interesting to see if the big selloff in equity markets so far this year impacts the latter data. There’s more important Fedspeak for us to keep a watch for too with Dudley (due at 9.00am EDT) and Williams (due at 11.10am) both scheduled. Earnings season continues with Citigroup and Wells Fargo the notable reporters in the bank space.

Bulletin Headline Summary From Bloomberg and RanSquawk

- Amid the fresh downturn in risk sentiment, there is one standout move to highlight this morning; the USD/CAD ramp through 1.4400 and 1.4500

- WTI and Brent are below USD 30/bbl, with analysts noting that the UN are expected to approve the removal of Iranian trade sanctions as soon as Monday

- Highlights today include US retail sales, PPI final demand, empire manufacturing, industrial production, business inventories and University of Michigan sentiment as well as Fed's Dudley, Williams and Kaplan

- Treasuries gain as global stocks plunge led by China, crude at 12-year low; 10Y has gained every day this year but one, yield falling to 2.05% from 2.269% on New Year’s Eve.

- Chinese shares fell into a bear market for the second time in seven months, wiping out gains from an unprecedented state rescue amid waning confidence in the government’s ability to manage the country’s markets and economy

- China’s broadest measure of new credit surged the most since June as companies increase borrowing on the corporate bond market, underscoring a shift away from reliance on state- backed banks for funding.

- With oil dropping below $30 a barrel, producers in western Europe’s biggest crude exporting nation are now considerably worse off than they were in the darkest hours of 2008

- Norway’s oil “industry is in a crisis now, we can’t deny that,” Bente Nyland, director general of the Norwegian Petroleum Directorate, told Bloomberg

- Analyst earnings estimate cuts outnumbered upward revisions by the most since 2009 last week, according to monthly data from a Citigroup Inc. index

- As a growth scare fuels turbulence in global markets, investors are cutting wagers on how high the Fed will raise policy rate this year

- The Swiss National Bank considered replacing a cap on the franc against the euro with a link to a basket of currencies, an option policy makers already entertained when they introduced the ceiling in 2011

- Donald Trump has not just survived six GOP debates but started to shine; last night he added substance to his trademark charisma to defend his own attacks on China, embrace criticism that he’s appealing to voters’ anger, and fend off incoming fire from rivals across the debate stage

- There’s a reason Hillary Clinton and Bernie Sanders continually bash the financial industry: “Anti-Wall Street” and “socialist” are each chosen by more than 40% of those planning to attend their party’s Iowa caucuses as words or phrases that describe them well

- Sovereign bond yields lower. Asian stocks and European stocks plunge again; equity-index futures lower with SPX down by nearly 2%. Crude oil falls, Brent and WTI both below $30/bbl; copper lower, gold higher

US Event Calendar

- 8:30am: Retail Sales Advance, Dec., est. -0.1% (prior 0.2%)

- Retail Sales Ex Auto, Dec., est. 0.2% (prior 0.4%)

- Retail Sales Ex Auto and Gas, Dec., est. 0.4% (prior 0.5%)

- Retail Sales Control Group, Dec., est. 0.3% (prior 0.6%)

- 8:30am: PPI Final Demand m/m, Dec., est. -0.2% (prior 0.3%)

- PPI Ex Food and Energy m/m, Dec., est. 0.1% (prior 0.3%)

- PPI Ex Food, Energy, Trade m/m, Dec., est. 0.1% (prior 0.1%)

- PPI Final Demand y/y, Dec., est. -1% (prior -1.1%)

- PPI Ex Food and Energy y/y, Dec., est. 0.3% (prior 0.5%)

- PPI Ex Food, Energy, Trade y/y, Dec., est. 0.2% (prior 0.3%)

- 8:30am: Empire Manufacturing, Jan., est. -4 (prior -4.59)

- 9:15am: Industrial Production m/m, Dec., est. -0.2% (prior -0.6%)

- Capacity Utilization, Dec., est. 76.8% (prior 77%)

- Manufacturing (SIC) Production, Dec., est. 0% (prior 0%)

- 10:00am: Business Inventories, Nov., est. -0.1% (prior 0%)

- 10:00am: U. of Mich. Sentiment, Jan. P, est. 92.9 (prior 92.6)

- Current Conditions, Jan P (prior 108.1)

- Expectations, Jan P (prior 82.7)

- 1 Yr Inflation, Jan P (prior 2.6%)

- 5-10 Yr Inflation, Jan P (prior 2.6%)

Central Banks

- 9:00am: Fed’s Dudley speaks in Somerset, N.J.

- 11:10am: Fed’s Williams speaks in San Francisco

- 1:00pm: Fed’s Kaplan speaks in Dallas

DB's Jim Reid completes the overnight wrap

At long last markets yesterday saw a little thawing from their 2016 mini ice age as a much sought after relief rally swept though the bulk of the US session. As we'll see below Asia hasn't been able to sustain the momentum but at least the US managed to hold its gains last night. A wobbly start aside, Oil rising back above $31/bbl helped the S&P 500 (+1.67%) gather some momentum and move back to unchanged on the week which will be a welcome sight given the start to the year. With volatility rife, it’s amazing to see that the index has had a 159pt trading range already this year which is 60% of the range we had for the whole of 2015. Prior to this it had looked like we might be in for another rough day after heavy falls across Europe. The Stoxx 600 at one stage was -3% down intraday before paring a decent chunk of the losses into the close, eventually finishing the session -1.51%.

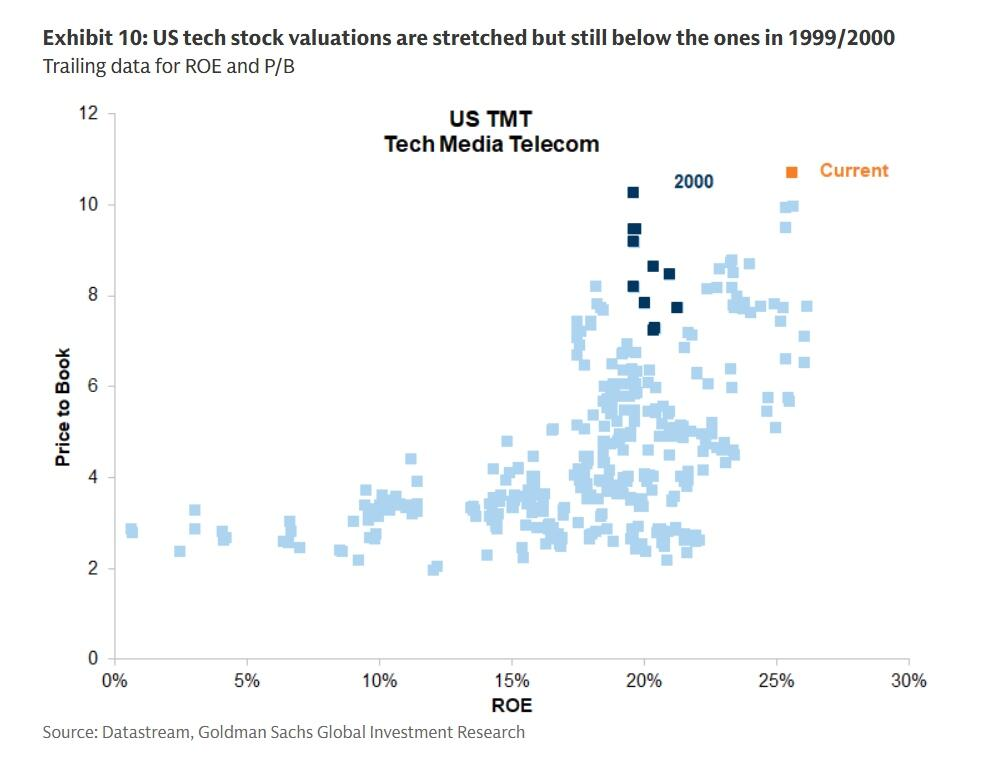

While the moves in Oil (WTI +2.36%) helped energy stocks (+4.47%) lead the gains, all sectors closed in positive territory yesterday. Fedspeak also played its part though particularly with a usually hawkish St Louis Fed President Bullard changing tune and sounding a lot more dovish after firing warning signs about inflation expectations – more on that shortly. Meanwhile JP Morgan set an early tone for bank results after reporting a beat in both earnings and revenues. However there were some less than encouraging signs in the details of Intel’s post-close quarterly results along with some downbeat comments from the CFO which got analysts worried about a cloudier outlook ahead for the tech giant.

Despite a reasonable start, some of the momentum seems to have been lost in Asia this morning with bourses generally trading lower as the session has wore on. The Nikkei (-0.68%), Hang Seng (-1.15%), Kospi (-1.11%), ASX (-0.34 %) are all down having started off positively although the sharper moves lower have been centered on Chinese equities where the Shanghai Comp has tumbled -2.96% as we type to finish the week on a down note. Some of that will reflect a pullback in Oil markets with WTI and Brent both back below $31/bbl this morning. Credit indices are generally a couple of basis points wider in Asia now.

Meanwhile there’ve been no surprises from the PBoC in the last day of the week after the CNY fix was once again left unchanged. There has been some Chinese data for us to digest however with the most significant being a material uplift in aggregate financing last month (CNY 1.82tn vs. 1.15tn,

expected) suggesting a big rise in new credit. New Yuan loans were lower than expected (CNY 598bn vs. CNY 700bn expected) while M1 and M2 money supply grew 15.2% (vs. 15.5% expected) and 13.3% (vs. 13.6% expected) respectively.

Back to the newsflow yesterday and those comments from the Fed’s Bullard. Seen as a more hawkish member of the Fed, the official added to other dovish commentary in recent days, saying that ‘with renewed declines in crude oil prices in recent weeks, the associated decline in market-based inflation expectations measures is becoming worrisome’. Bullard noted that while Central Bankers tend to ‘look through’ the changes in the price of oil, ‘one circumstance where one may be concerned is when inflation expectations themselves begin to change due to the changes in crude oil prices’. He went on to more or less rule out a January rate move before saying that no decision on March can be made until we ‘get more information and see how things play out’. The probability of a March hike has fallen from as much 52% at the start of the year to just 33% now. Next week’s US CPI report will be a big focus for markets given the slide in Oil and recent commentary.

From one Central Bank to another. Given the high market expectations leading into their December meeting, it didn’t come as too much of a surprise to us to hear that some ECB officials had ‘expressed a preference for a 20bp cut in the deposit facility rate’ in yesterdays minutes. The text highlighted that policy action was widely seen as warranted and a ‘reassessment could made in the future’ about increasing the size of monthly purchases. Interestingly and potentially highlighting a bit of a split on the board, it was noted in the text that ‘going beyond the ultimately agreed 10bp cut would, in the view of some members, raise issues about increase side effects over time’. The minutes went on to say that these issues concern the profitability of banks and other financial institutions whereby banks could try to recoup possible losses by increasing lending margins and so leading to a tightening instead of a further easing in financing conditions. Food for thought.

It was another quiet day for data on the whole again yesterday. In Germany we saw 2015 GDP growth come in at +1.7% yoy which was as expected and slightly better than 2014 (+1.6%). In the UK we saw the BoE keep rates unchanged once again after an 8-1 majority vote. The minutes highlighted that the falls in energy prices will ‘mean that the increase in inflation is now expected to be slightly more gradual in the near term than forecast in the committee’s November Inflation Report’, although the comments were somewhat balanced out with the reference to potentially being positive for consumer spending. It’ll be interesting to see if some of the commentary from the minutes are setting up for lower forecasts in next month’s report out of the BoE which may well get Economists revising their rate hike expectations again. Meanwhile, yesterday afternoon in the US saw the initial jobless claim print come in a touch higher than expected at 284k (vs. 275k expected), a rise of 7k versus the prior week. Claims have been on a bit of an upward trend now since the lows in October last year. Wrapping up, yesterday’s import price index reading of -1.2% mom came in more or less in line with the consensus.

Full story here Are you the author? Previous post See more for Next postTags: Bank of England,Bear Market,Bernie Sanders,Bond yield,Canadian Dollar,Carry Trade,China,Citigroup,Consumer Sentiment,Copper,Crude Oil,Equity Markets,Federal Reserve,Glencore,Goldman Sachs,Hong Kong,Iran,Japanese yen,Jim Reid,M1,M2,Michigan,Nikkei,Norway,Price Action,Swiss National Bank,Switzerland Money Supply,U.S. Consumer Confidence,U.S. Consumer Price Index,U.S. Retail Sales,University Of Michigan,Volatility,yuan