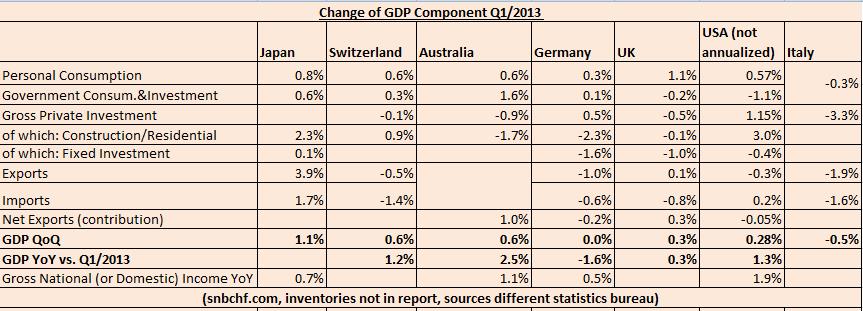

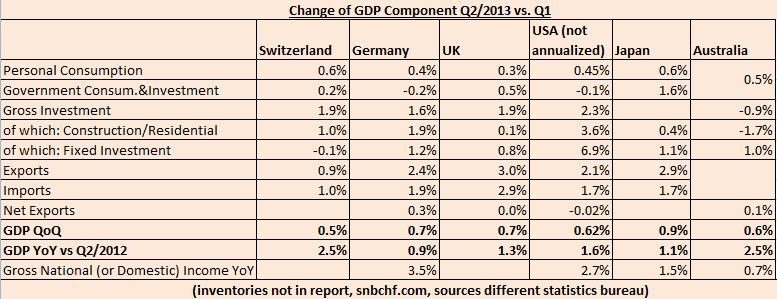

The Swiss GDP for Q2/2013 was in line with its peers in developed countries. The quarterly (not annualized) change was +0.5% compared to 0.6% for Japan and the United States, +0.7% for Germany and +0.5% for Australia.

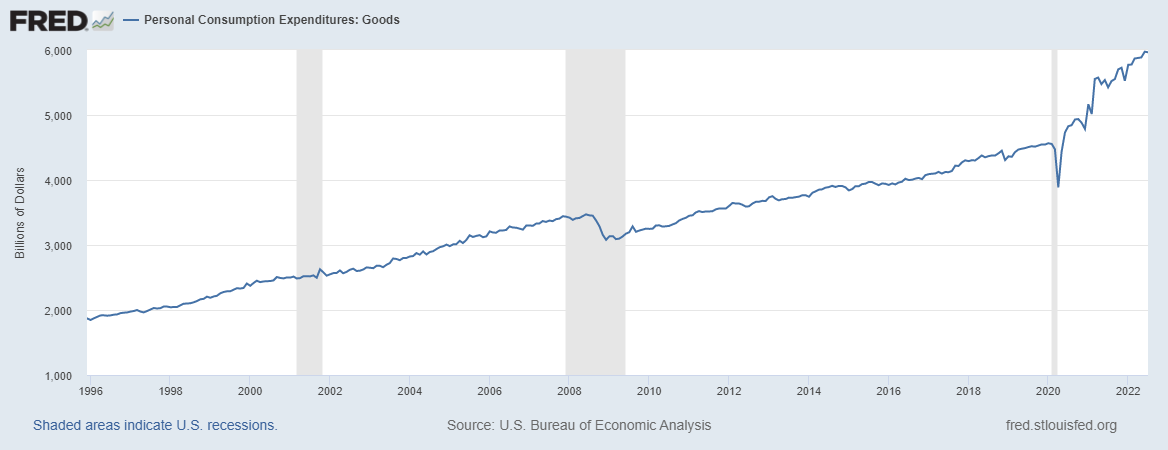

Swiss and Japanese growth was driven more by consumption, while the U.S. advances were based more on increases in investments. Given that the U.S. usually lead a global recovery, risk-averse German and Japanese companies often start investing later – the euro crisis accentuated the low level of investments in Germany.

Swiss and Japanese growth was driven more by consumption, while the U.S. advances were based more on increases in investments. Given that the U.S. usually lead a global recovery, risk-averse German and Japanese companies often start investing later – the euro crisis accentuated the low level of investments in Germany.

In the first quarter the Swiss managed to outpace U.S. growth – this despite austerity in the European neighbors. The Swiss had a 0.6% performance compared to 0.28% (or annualized 1.1%) for the U.S.

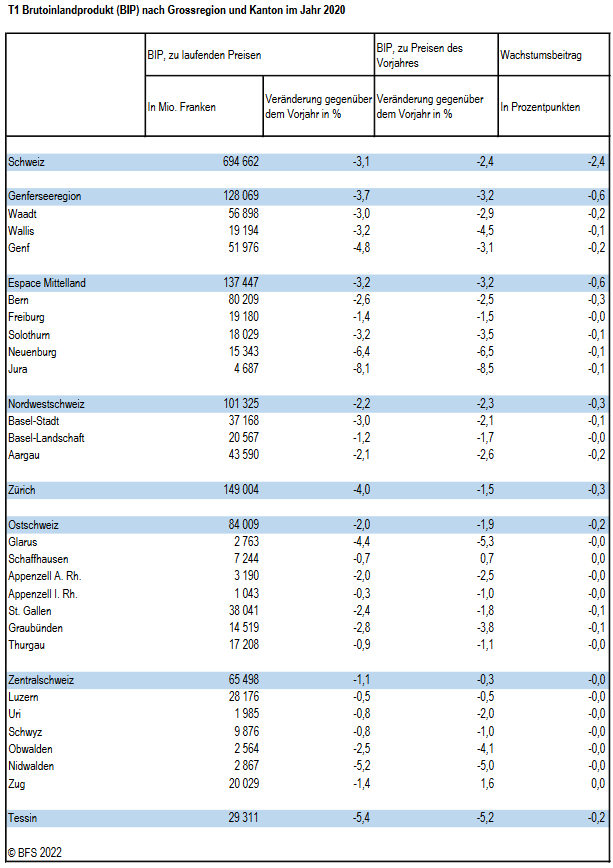

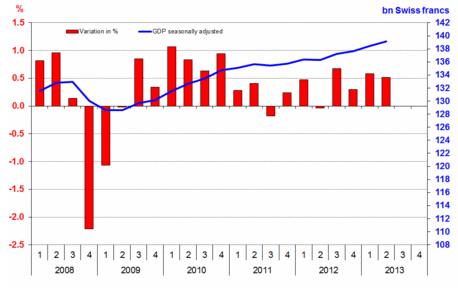

The following graph shows the Swiss 0.5% q/q and 2.5% increase over one year, full release at the SECO.

source SECO

SNB not impressed by strong GDP growth

The Swiss National Bank does not react to the strong GDP figures. It does not remove the CHF cap despite a normalization of the economy – this against influential voices from the Petersen Institute and potentially against promises given to the IMF.

Thomas Jordan said in a newspaper interview yesterday that there was no reason to give up the ceiling on the Swiss currency. The central bank imposed the cap of 1.20 per euro on the franc in September 2011, citing the need to ward off deflation and a recession. (source Bloomberg)

We do not think that EUR/CHF will fall under 1.20 for a prolonged period, even if the SNB removes the cap. We explained several times that an inflation figure of 1% would imply a removal of the cap, 2% a rate hike. Currently Swiss inflation is 0%.

Are you the author? Previous post See more for

Tags: exports,GDP,imports,Switzerland Gross Domestic Product,U.S. Consumer Spending