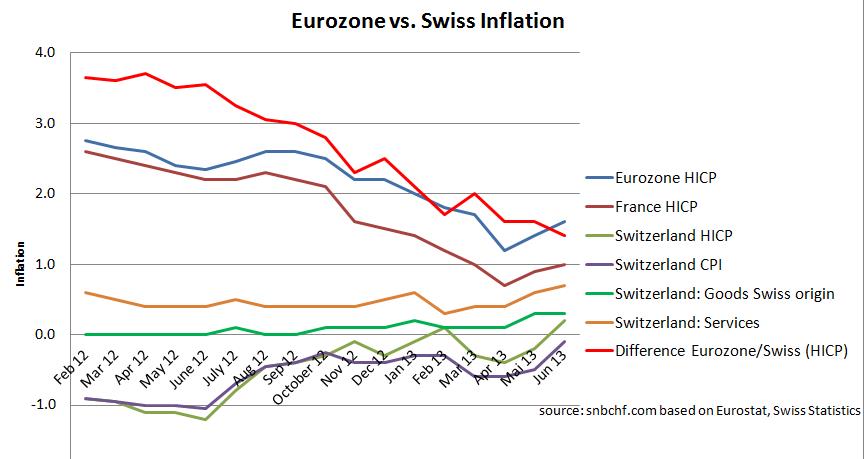

According to Swiss statistics, the yearly change in the Swiss consumer price index has risen from -0.5% to -0.1%; the end of deflation is near and has already happened in HICP terms. Swiss inflation measured with the European standard HICP has even improved to +0.2% y/y.

The difference between the HICP for the euro zone and Switzerland has fallen to its lowest level since 2010. The difference is only 1.4%. Inflation for Swiss services is 0.7%, close to the French total inflation value.

Still, in February 2012, Eurozone inflation was 2.9%, but the Swiss was -0.9%, a gap of 3.8%.

The influence on the EUR/CHF rate

In the July 2013 monetary assessment the ECB promised easy money and “an extended period of rates of 0.5% or below”.

Therefore we see three possibilities for EUR/CHF, cases 1a, 1b and 2:

Case 1: Lending and growth in the European periphery and France recovers: In this case, outflows from Switzerland will happen and the EUR/CHF will rise. Thanks to the European recovery, bank lending in Switzerland will increase even more than 4.7% per year (lending in the eurozone is minus 1%). Higher money supply and lending will inevitably lead to stronger Swiss inflation. There are two possible SNB policy responses:

- Case 1a: Carry trade scenario: The Swiss National Bank (SNB) keeps rates significantly lower than the ECB despite Swiss inflation: Swiss investors have become very “home-biased” in the use of their persistent current account surpluses and structural advantages. It will further fuel lending and the Swiss housing boom and could lead to a hard landing, i.e. some Swiss banks could go bankrupt.In the latest monetary assessment the SNB explicitly warned against this scenario. Moreover, the SNB’s legal mandate and also the promises made to the IMF, will prevent the CHF cap from being maintained, after Swiss inflation rises to levels of 1%.

Therefore, the period of using the Swiss franc as a funder is limited (here Morgan Stanley’s FX Pulse, suggests using the CHF as funder). Downwards currency risks will come back.

- Case 1b: The SNB hikes rates earlier or together with the ECB: This is the spring 2011 scenario when both central banks were expected to hike. Similar to in 2011, the EUR/CHF could fall, because Switzerland will attract funds that want both Swiss safety and higher returns.

Case 2: Low or negative euro zone growth will continue for some years, just like Draghi described. In this case the European and Swiss inflation will get closer and closer. The logical result of this scenario is that after 2 to 5 years, inflation rates in Switzerland will be identical to the euro zone. Again the SNB could hike rates as early as the ECB.

In summary, the upwards potential for EUR/CHF is not much higher than 1.25 to 1.28 and limited in time. If the franc weakens, then inflation pressures will force the SNB to exit the cap earlier.

After the exit, the Swiss real estate boom and higher Swiss inflation and – if a global recovery happens – higher CHF rates, should drive the franc higher again.

Read also:

Switzerland’s Slow Way to Inflation

Tags: Eurozone Consumer Price Index,inflation,Swiss real estate,Switzerland,Switzerland Consumer Price Index