Nicosia will impose a 9.9 percent one-off levy on deposits above 100,000 euros in Cypriot banks. This constitutes maybe the final stage of the euro crisis, with the very last country to be rescued. Or will it be a new escalation and may be the most dangerous one, a bank-run? How many Cyprus clients managed to successfully transfer the funds to Switzerland? The upcoming levy was no real secret.

We spoke about one reason why investors pile in currencies like the Swiss franc, namely that governments in the euro zone will try to get money from the rich: “The new cycle: The fear of debt, the rich will suffer.”

Apart from taxing the local rich in France or elsewhere, a new stage arrived in Cyprus with the taxation of foreigners, an implicit hair cut:

BRUSSELS (Reuters) – Euro zone ministers struck a deal on Saturday to hand Cyprus a bailout worth 10 billion euros ($13 billion) to stave off bankruptcy. Under the program, the island’s debt should fall to 100 percent of economic output by 2020.

Here are the outlines of the financial package:

– Nicosia will impose a 9.9 percent one-off levy on deposits above 100,000 euros in Cypriot banks and a tax of 6.75 percent on smaller deposits from March 19. The levy will generate 5.8 billion euros.

Depositors will be compensated by equity in the banks.

There will also be a tax on interest that the deposits generate.

– Cyprus has agreed to increase its nominal corporate tax rate by 2.5 percentage points to 12.5 percent, which could bring in up to 200 million euros a year.

– The International Monetary Fund is expected to contribute to the rescue package, but the amount is still to be determined.

– Russia will likely help finance the program by extending a 2.5 billion euro loan already made to Cyprus by five years to 2021 and reducing the interest rate, which is now at 4.5 percent.

– Cyprus may be required to privatize the Cypriot telecoms company, the electricity company and the ports authority.

– Cyprus will have to downsize its banking sector, reducing it to the EU average by 2018. The size of the banking sector in Cyprus is more than eight times the size of the economy, compared to around 3.5 times in the EU.

All funds in Cyprus are frozen until Tuesday. During the bank holiday on Monday, the levy will be deducted.

The levy seems to be deducted even retroactively. So it will not be sufficient to have moved some funds out of Cyprus, but it was necessary to move ALL of them.

It was rumoured that KYC departments of Swiss banks had a lot of work recently. The move to this levy was clear to most clients and might have helped a bit to maintain inflows into the Swiss franc despite improvements in the US economy. Effectively SNB liabilities (bank deposits and bank notes) are at record highs.

Bank customers flee Cyprus

08.03.13 @ 08:54

- By EUOBSERVER

Foreign investors have turned their backs on Cypriot banks reducing deposits by €1.7 billion in January, with the trend continuing in February, reports Die Welt. ECB president Draghi commented the situation Thursday, saying that the Cypriot “economy is a small economy, but the systemic risks may not be small.”

New Escalation or Final Stage in Euro Crisis?

It also shows that Germany and finance minister Schäuble have taken the clear lead in the euro crisis. They will make the rich pay so that the German tax payer has a smaller bill. Visible already with “Germany’s inquisitor”, Mario Monti, taking a grip on Italian tax evasion. The upcoming ECB study that Italians are actually (at least for median wealth) richer than Germans, will not be really helpful.

At the same time, European leaders risk stability with a potential bank run. We wonder how the European establishment could take this risk now: but we already stipulated that a sustained US recovery might even allow for a euro zone break-up. How markets shrugged off the Italian elections was impressive.

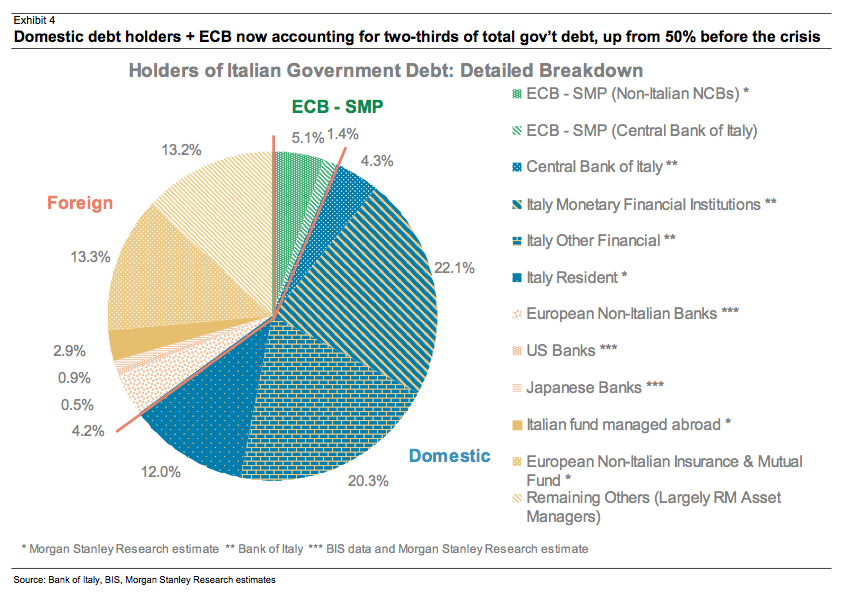

Many foreign bond holders had already left the peninsula. While this helps to reduce yields, the Italian government is constrained to generate tax returns to pay the interest to bondholders and the ECB (at a 7% yield in 2011).

For one decade, the common currency and current account deficits helped to transfer wealth from the Italian middle class to Germany and some Italian entrepreneurs and bankers. At the time, this transfer happened in the private sector, sustained by German banks lending, while real income continued to fall.

While the German private banks sold their Italian debt, the official sector is now continuing the wealth transfer from Italy, more or less indirectly to Germany. This time, however, the upper class and entrepreneurs must participate in the transfer. Therefore the Italian government will look for sources of income:

- Through higher income taxes, especially for the rich.

- Harder and harder tax evasion controls (you can get luxury cars for really cheap in Italy now).

- With a similar levy on deposits as in Cyprus.

The last elections show the risks: Italians did not like the “German inquisitor” and voted for Beppe Grillo, who would say: “Just the leave the euro and let the ECB and Germany pay the bill!”

Cyprus was maybe just the first step in a more or less ordered breakup. Or was it the last escalation in the euro crisis before the US recovers?

Are you the author? Previous post See more for Next post

Tags: bank run,Cyprus,Euro crisis,Tax evasion

2 comments

david

2013-03-16 at 15:25 (UTC 2) Link to this comment

Would this move not have the effect of scary the population into removing their money from the banks, let be honest the amounts they have taken with not solve the problem they will very probably need to take more very soon.

DorganG

2013-03-17 at 13:39 (UTC 2) Link to this comment

I do not see a huge bank run in Cyprus coming,definitely not in Spain or Italy. Do not underestimate the economic advisers of European leaders this time. They cannot risk a second haircut for Cypriot savers. It must all be well-calculated. If they need more money, next time it won’t be Cypriots.