Tag Archive: bank run

“Bank walk”: The first domino to fall?

In early May, Reuters published a report that truly captured my attention. “European savers are pulling more of their money from banks, looking for a better deal as lenders resist paying up to hold on to deposits some feel they can currently live without,” the article reported. Over in the US, we see a very similar picture. As the FT also recently reported, “big US financial groups Charles Schwab, State Street and M&T suffered almost $60bn in...

Read More »

Read More »

Banking crisis: The new bailout strategy

Part I of II

The recent turmoil that has roiled the global banking sector has placed central bankers in an impossible position: Cut rates and avert a domino-style disaster in the industry and a possible deep and prolonged recession in the wider economy or stay the hiking course to combat the still untamed inflationary pressures? Arguably the great losers in both cases will be the taxpayers and the average working household.

The recent...

Read More »

Read More »

Negativzinsen für Kunden bei Raiffeisen vorerst vom Tisch

Auf die Frage, ob auch die Raiffeisen-Gruppe künftig Strafzinsen verrechnen will, erklärte der 58-jährige Lachappelle: "Ich kann mir das nicht vorstellen." Wenn bei Sparkonti Negativzinsen eingeführt würden, sei die Gefahr gross, dass es zu einem "Bank Run" komme - also dass die Sparer ihr Geld von den Banken abziehen.

Read More »

Read More »

Cashless Society – Is The War On Cash Set To Benefit Gold?

Cash is the new “barbarous relic” according to many central banks, regulators, and some economists and there is a strong, concerted push for the ‘cashless society’. Developments in recent days and weeks have highlighted the risks posed by the war on cash and the cashless society.

Read More »

Read More »

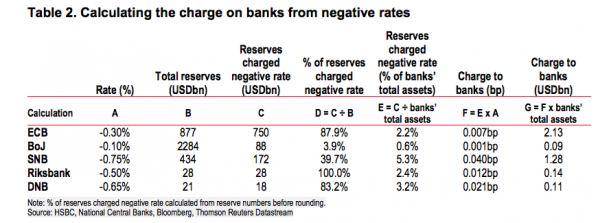

HSBC Looks At “Life Below Zero,” Says “Helicopter Money” May Be The Only Savior

In many ways, 2016 has been the year that the world woke up to how far down Krugman’s rabbit hole (trademark) DM central bankers have plunged in a largely futile effort to resuscitate global growth.

For whatever reason, Haruhiko Kuroda’s move into NI...

Read More »

Read More »

Cyprus, the Final Compromise: The Winners and the Losers

UPDATE March 25 The final compromise: via Reuters TOP NEWS Detail of EU/IMF bailout agreement with Cyprus Sun, Mar 24 22:19 PM EDT BRUSSELS (Reuters) – Cyprus clinched a last-ditch deal with international lenders on Monday for a 10 billion euro ($13 billion) bailout that will shut down its second largest bank and inflict heavy …

Read More »

Read More »

Cyprus Levy on Deposits: New Escalation or Final Stage of Euro Crisis?

Nicosia will impose a 9.9 percent one-off levy on deposits above 100,000 euros in Cypriot banks. This constitutes maybe the final stage of the euro crisis, with the very last country to be rescued. Or will it be a new escalation and may be the most dangerous one, a bank-run? How many Cyprus clients managed …

Read More »

Read More »