Monthly Archive: November 2012

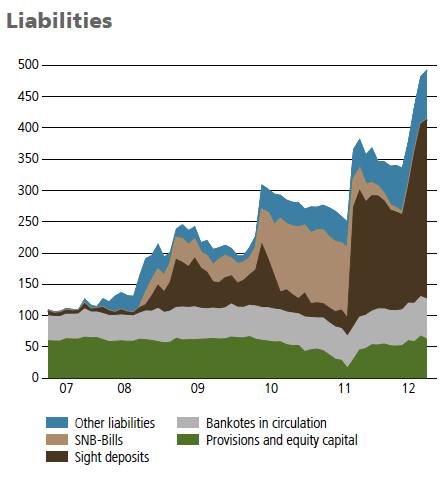

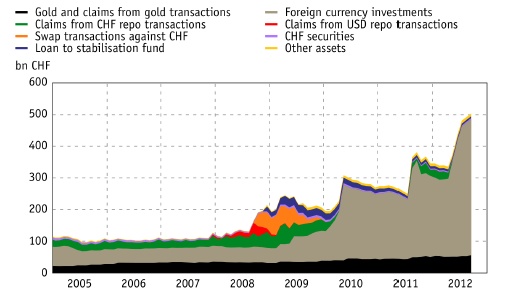

SNB Sight Deposits Week November 23

Total sight deposits at the SNB rose by nearly 1 billion to 374 bn francs in the week ending on November 23th. “Other sight deposits”, the ones of foreign banks and Swiss companies, fell by one billion francs, but the ones of local institutes increased by nearly 2 billion francs.

See full detail on our explanation, historical and our expected development of

Read More »

Read More »

Details zum neuen Piratenpartei Wirtschaftsprogramm #BPT122

Der Bundesparteitag der Piratenpartei Deutschland, ist für jeden, der auf Basisdemokratie setzt, ein sehr aufregender Anlass für jeden, auch wenn die Ziele der Partei sich nicht unbedingt mit den eigenen politischen Zielen decken.

Die Piratenpartei Deutschland ist eine basisdemokratische Denkfabrik, ganz im Gegensatz zu vielen anderen Parteien, die von einer parteipolitischen Oligarchie, Lobbyisten der Wirtschaft und der Medienlandschaft...

Read More »

Read More »

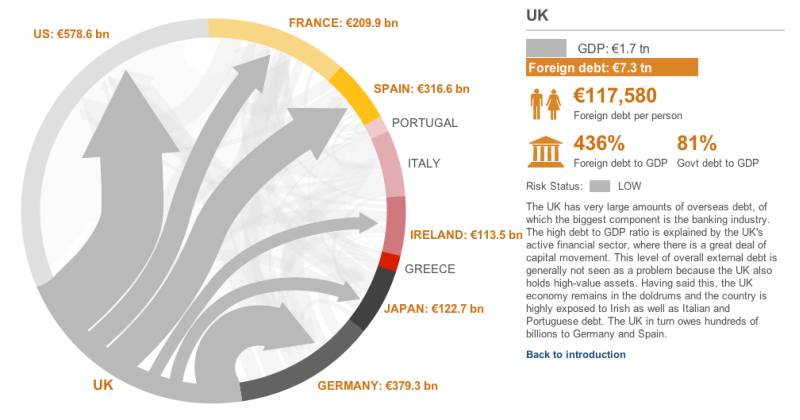

Who’s the Next Downgrade Domino to Fall?…The UK?

Who Downgrades France MUST downgrade the UK, too After Moody’s downgraded France, we are waiting the next major sovereign to suffer the same fate. According to the must-read interactive graph on the BBC, France now has a medium risk of default, but the UK is still in risk status “low”. According to the BBC, each citizen …

Read More »

Read More »

Net Speculative Positions, Week November 19

Submitted by Mark Chandler, from marctomarkets.com The US Dollar Index bottomed on September 14, the day after QE3+ was announced. It reached a 2-month high before the weekend. It has now retraced half of the ground lost from ECB President Draghi’s pledge to “to do whatever it takes” through hints, and then delivery, of …

Read More »

Read More »

SNB Sight Deposits Week November 16

Total sight deposits at the SNB rose by 0.5 billion to a total of 373 bn. francs in the week ending on November 16th. "Other sight deposits", the ones of foreign banks and Swiss companies, fell by 600 million francs, but the ones of local institutes increased by more than 1 billion francs.

See full detail on our explanation, historical and our expected development of

Read More »

Read More »

Ron Paul’s Very Best Moments

The Texas Congressman — and three-time presidential candidate — said goodbye in farewell remarks on the House floor Wednesday. Must watch these videos. On Washington Post

Read More »

Read More »

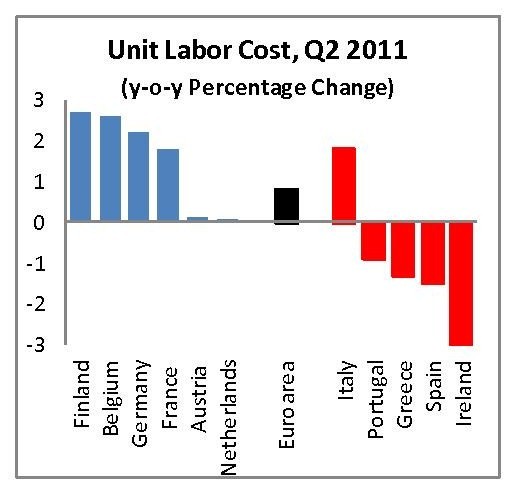

Falling Unit Labour Costs, but Rising Production Prices in the Periphery. Is this Competitiveness?

Currently European HICP inflation is at 2.5%, far above the 2.0% official ECB mandate, but the euro is becoming weaker and weaker. German salaries are rising with 2.6% per year. At the same time, the ECB cannot hike interest rates, because it wants to provide cheap money to the periphery. The periphery continues to buy German products, even …

Read More »

Read More »

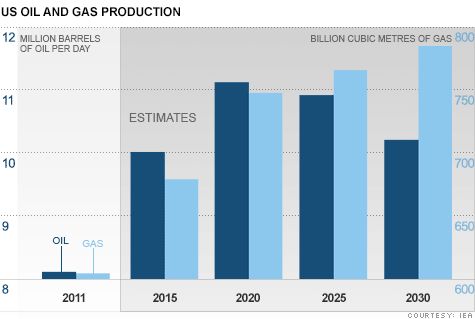

Before getting too excited about the IEA’s forecast of US oil production leadership…

Saxo Bank, recently called for quitting long Gold and "being scared" trades.

For them shale gas & oil is the game changer for the United States. It should make the US the leader for global growth in the next years. The International Energy Association (IEA) declared that the US would be energy-independent by 2030.

Today a nice article...

Read More »

Read More »

Warum uns das demokratische Prinzip in eine Sackgasse führt

Der „In-einer-Demokratie-herrscht-das-Volk“-Mythos wäre durch nichts nachhaltiger zu entzaubern gewesen als durch den seit Jahren aufgeführten Eiertanz um Griechenland- und Eurorettung, durchgeführt durch eine Bankenoligarchie, die dem unwissenden Bürger immer wieder mit Endzeitdrohungen kommt, sollte das kleine Griechenland die Eurozone verlassen. Die Endzeit erreichen wir nun, weil sich die Deutschen vor lauter Angst vor ESM und Target2 weigern...

Read More »

Read More »

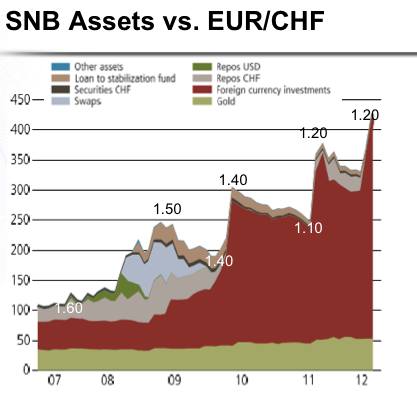

UBS Wealthy Clients and Hedge Funds Move into Shorts EUR/CHF

UBS wealthy clients and hedge funds are moving into shorts of EUR/CHF. The pressure on the SNB might become challenging. See more on Euromoney.

Read More »

Read More »

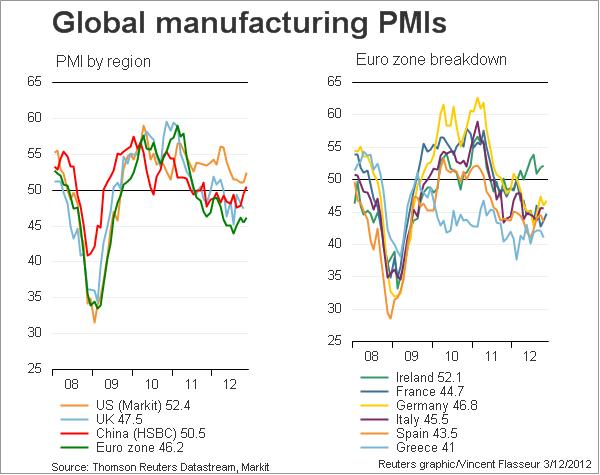

Global Purchasing Manager Indices, Update December 10

Manufacturing PMIs are considered to be the most leading and important economic indicators. Jim O’Neill, Chairman of Goldman Sachs Asset Management, believes the PMI numbers are among the most reliable economic indicators in the world. BlackRock’s Russ Koesterich thinks it’s one of the most underrated indicators. Global Purchasing Manager Indices for the manufacturing industry December 3, 2012 …

Read More »

Read More »

Ausschuss der deutschen Piratenpartei Fordert Schuldenschnitt für alle Peripherieländer

Der Ausschuss fordert: Die kurzfristige Durchführung frühzeitiger einmaliger Schuldenschnitte von Staatsschulden in der Europäischen Union. Eine effektive Restrukturierung und wenn nötig, Rekapitalisierung maroder Banken. Mehr direkt bei der Piratenpartei

Read More »

Read More »

Steen Jakobsen, Chief Economist Saxo Bank, Followed Our Shorts on Gold and Bullishness on USD

Steen Jakobsen, chief economist of Saxo Bank followed our bullishness on US dollar and our shorts on golds and silver of the beginning of October when gold was trading around 1780. At the time, Steen was writing his column, we have already realized some gains on silver and gold shorts. Steen seems to be content with …

Read More »

Read More »

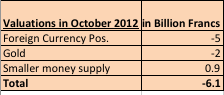

SNB Valuation Losses in October: Around 6 Billion Francs

The Swiss National Bank (SNB) had valuation losses of around 6 billion francs in October due to the weaker EUR/CHF exchange rate and a weaker gold price.

Read More »

Read More »

Die Wiederwahl Obamas bedeutet nichts Gutes für die Schweiz

Barack Obama war und ist der präferierte Kandidat vieler Schweizer. Obama scheint der Mann von Welt zu sein, während vom konservativen Mitt Romney eher feindselige Politik gegen Russland, China und Iran zu erwarten ist. Daher sind die Neutralität- und Frieden-liebenden Schweizer eher auf Obamas Seite. Aber auch wirtschaftspolitisch scheinen viele Eidgenossen Obama zu mögen. …

Read More »

Read More »

The Secret Return to the Global Gold Standard

Central banks are buying masses of gold reserves. If this game continues we will end up again in the global gold standard. MktGeist Blog

Read More »

Read More »

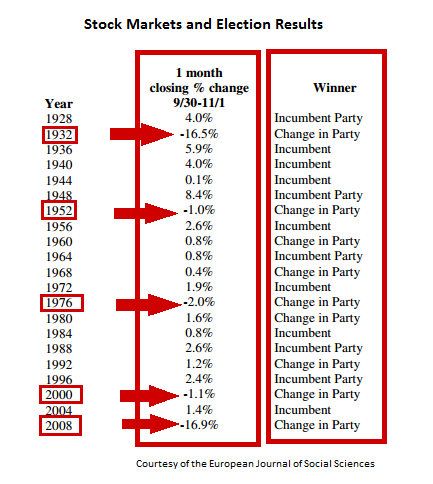

The Stock Market Performance Predicts that Romney Wins

An interesting correlation of stock markets performance in the month before the US presidential elections suggest that there will a change in party, hence Romney wins. alessiorastani.com

Read More »

Read More »