Central bankers assemble

The annual economic symposium for central bankers staged by the Federal Reserve Bank of Kansas City begins in Jackson Hole, Colorado (until September 1). Ben Bernanke, US Federal Reserve chairman, is due to speak on Friday.

Philipp Hildebrand, the former SNB president, regularly used Jackson Hole to extend his global network and to give guest speeches. The Swiss financial paper Cash reports that anybody of the SNB board is attending Jackson Hole this year. Cash reminds that on September 5, 2011, one day before the floor introduction, Thomas Jordan cancelled a banking conference in Frankfurt.

The official SNB reason for the non-attendance at Jackson Hole is a SNB bank council meeting on August 31st. However, these bank council meetings are scheduled from month to month. But the Jackson Hole scheduling is already known for nearly one year.

What are the reasons that the SNB timed a bank council meeting exactly in the middle of Jackson Hole?

Markets are speculating that deciders will opt for QE3 in their discussions at Jackson Hole. In this case the dollar would strongly fall; gold and the Swiss franc would rise. If Jackson Hole delivers more clarity on a potential QE3, then the SNB bank council could take this into account and may deliver an important decision.

It seems to be sure that if QE3 comes, then the SNB will need print francs at amounts even higher than in May and June 2012 or she might even give up the peg.

What happened one year ago ?

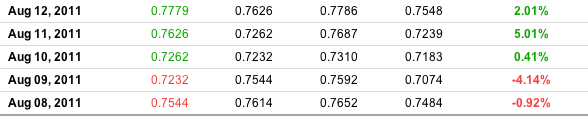

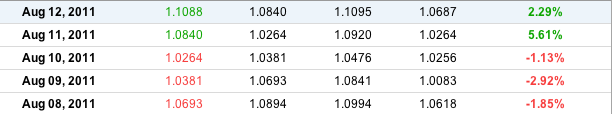

Let’s take a look what happened one year ago, more or less at the same time. A Federal Open Market Committee Meeting (FOMC) was held on August 9, 2011, at which the Fed decided to introduce Operation Twist.

When (one day before the FOMC) the meeting results became obvious, the Swiss franc rose strongly against the dollar, the EUR/CHF fell to 1.02. The SNB countered this movement two days later with heavy interventions.

Recent developments

Both April and May 2012 saw an increase of the SNB FX reserves by 59 bln. CHF. The reserves rose by 41 bln. CHF in July. In the first two weeks of August the sight deposits (the equivalent of FX reserves on the liability side of the balance sheet) increase was relatively low with 4 bln. francs.

Reasons for us were the recent stronger US data and continued deflationary pressure seen in the Swiss CPI. In July Swiss retailers gave some of their profits back to the consumers and lowered their prices in the end summer auctions. Swiss retailers were often accused that they do not give their cheaper imports back to their clients.

Last week the Swiss trade balance came in stronger than expected. The values show that the Swiss economy can cope very well with the current exchange rate.

July ’12 June ’12 July ’11

————————————————

Imports 14,493 14,664 13,814

Exports 17,409 16,853 16,516

Balance 2,916 2,189 2,702

The last week saw QE3 hopes (or fears respectively) intensifying. It let investors move out of the dollar into gold and the Swiss franc. Gold appreciated from 1615 to 1670 in one week. Consequently the bank deposits at the SNB rose by 5.8 bln. francs in the same week.

A professor at a finance school in Geneva stated that the SNB has lost control over the money supply in Switzerland. She will not be able to prevent an asset price bubble. Fortunately for the SNB many foreign holders of francs have not injected the money into the Swiss economy yet. When this happens then inflationary pressures could show up.

See more on Quantitative Easing, Jackson Hole and the relevance for the SNB here.

Are you the author? Previous post See more for Next post

Tags: Asset Price Bubble,Ben Bernanke,Federal Reserve,FOMC,franc,Gold,Jackson Hole,Jordan,QE3,Quantitative Easing,Swiss National Bank,Switzerland,Switzerland Consumer Price Index,Switzerland Money Supply,Trade Balance