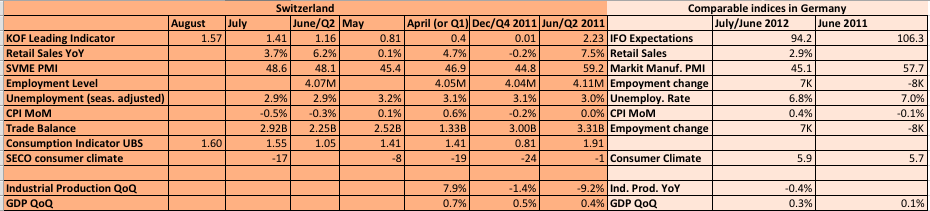

Swiss vs. German Economic Indicators, August 2012

Manufacturing indicators are lower than last year after the Chinese and Southern European demand for cars, machines and equipment has calmed down. The Swiss SVME PMI is with 48.6 only a bit in contraction, whereas the German one shows 45.1, both over 10 points down compared to last year June.

Similarly as one year ago, Switzerland has outpaced Germany in terms of GDP growth this year.

Some divergences between private and state-based ones: The KOF leading indicator and the UBS consumption indicator are expanding, but the official SECO consumer climate is contracting. German consumer confidence is bigger than last year June. Apart from the PMIs and the IFO business expectations, for these two countries the euro crisis seems to be far.

Some people consider the Manufacturing PMI as the one most leading indicator, we do not. See our discussion with Chris Williamson from Markit and why we went long the euro on August 15 against USD and GBP.

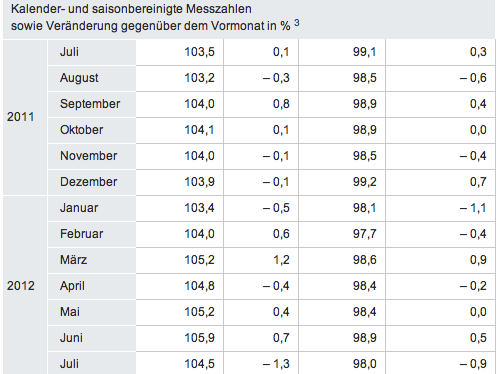

September update for Germany

German retail sales fell by 0.9% YoY in July. However the seasonally adjusted number (98.0) is still higher than the figures in February 2011 (97.7).

The German economy improves rather based on a higher trade surplus and a higher savings rates, after incomes moved higher.

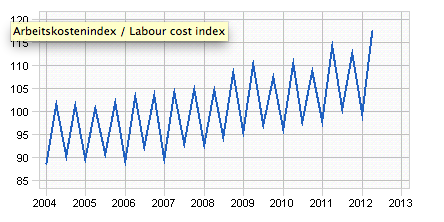

Labor costs Germany (source Destatis ) - Click to enlarge

Sources: all data on Daily FX, individual data on KOF, Swiss Statistics, SECO, UBS.

Germany: Daily FX, Industrial production: Eurostat, Retail sales: Destatis, Labor costs: Destatis

Are you the author? See more for Next postTags: Construction,Consumption indicator,Euro crisis,GDP,Germany GfK Consumer Climate,Germany IFO Business Climate Index,Germany Retail Sales,IFO,industrial production,PMI,PPI,Producer Price,Purchasing Manager,real wages,Retail sales,SECO,SVME,Switzerland,Switzerland KOF Economic Barometer,Switzerland Labor Costs,Switzerland SECO Consumer Climate,Switzerland UBS Consumption Indicator,Trade Balance,Unemployment