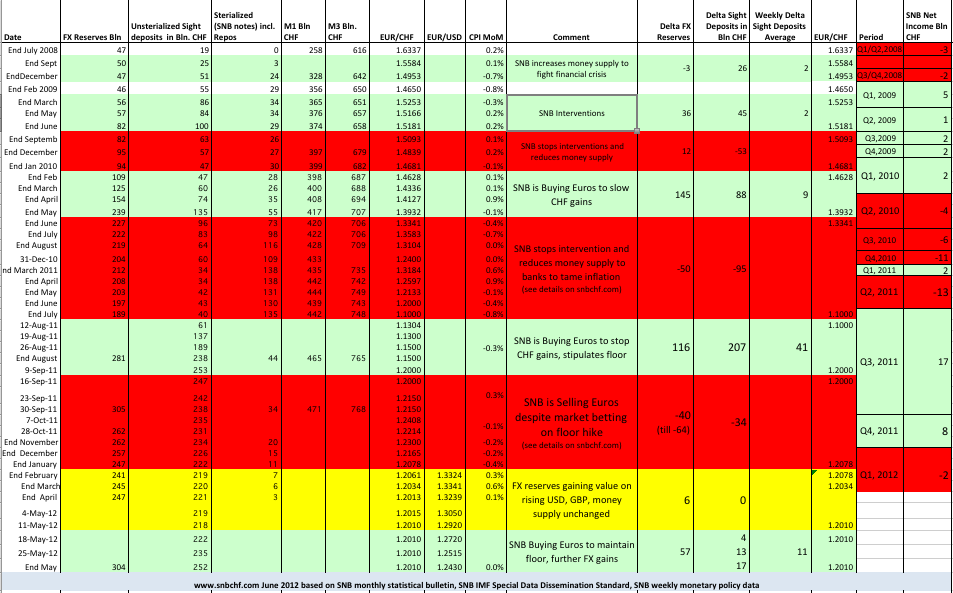

SNB Balsheet Week June 1st[/caption]

Currently we are leading our bet of 30 plus bln. CHF printed per month against ZKB's Marmet, who thought that the inflows into Switzerland will slow.

In a recent post we gave a wrap-up of the intense Swiss discussions about the floor. We argue in this post that it was Jordan himself (and the IMF policies and Swiss GDP), but not Grübel who triggered the big safe-haven flows into Switzerland.

Remark: The Tagesanzeiger (and Marmet ?) spoke of a flattening dynamics of inflows, however they got mistaken in their arguments. They use monthly averages as argument that flows are flattening, which is flawed.

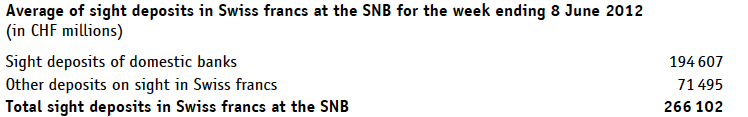

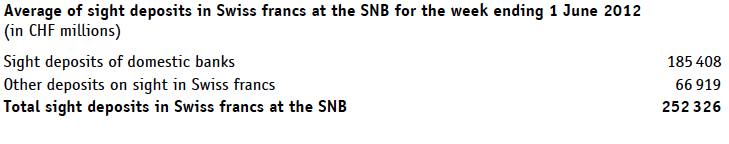

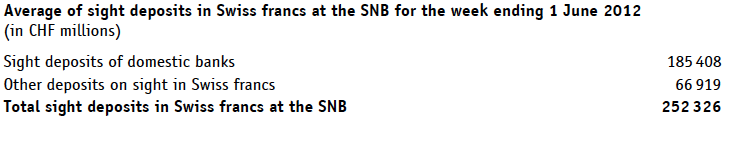

Weekly averages:

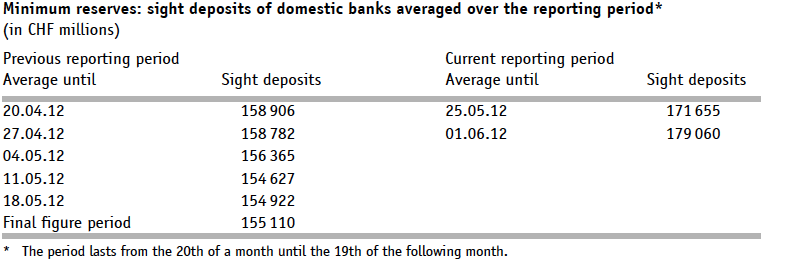

Monthly averages:

Disclosure: We are short EUR/CHF

Full story here

Are you the author?

See more for

Next post

SNB Balsheet Week June 1st[/caption]

Currently we are leading our bet of 30 plus bln. CHF printed per month against ZKB's Marmet, who thought that the inflows into Switzerland will slow.

In a recent post we gave a wrap-up of the intense Swiss discussions about the floor. We argue in this post that it was Jordan himself (and the IMF policies and Swiss GDP), but not Grübel who triggered the big safe-haven flows into Switzerland.

Remark: The Tagesanzeiger (and Marmet ?) spoke of a flattening dynamics of inflows, however they got mistaken in their arguments. They use monthly averages as argument that flows are flattening, which is flawed.

Weekly averages:

Monthly averages:

Disclosure: We are short EUR/CHF

Full story here

Are you the author?

See more for

Next post

Tags: Deposits,floor,franc,IMF,Jordan,monetary data,SNB sight deposits,Swiss National Bank,Switzerland,Switzerland Money Supply