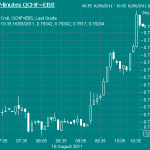

EUR/CHF Kicked Lower Again

Hitting a new low this week of 1.1545 and is down over 300 pips on the day. The moved largely initiated by a major swiss name earlier apparently in conjunction with a hedge fund.

Comments from the Swiss Econ Min over the last hour hardly helping matters, after the govt aid package came up short of original estimates..

The market was looking for a package of around CHF2 billion and got CHF870 mio; the govt also poured salt on the wounds stating that there was no specific target for the currency.

Low on the USD/CHF has been 0.7993, before a bounce back to 0.8040

Franc Rallies As SNB Refrains From Measures To Curb Advance – Bloomberg

EUR/CHF Drilled Lower By A Swiss Name

Whacked down from 1.1720 to a new low on the week of 1.1631 by a large Swiss bank, amid some talk that SNB’s ability to sustain the recent levels of liquidity additions may be short lived.

USD/CHF also hit hard to a week’s low of 0.8057

The Perils Of Forex Forecasting

I think he meant to say we could see 1.2000 by the end of the month, not 2012.

But hey, good for him. Got the right direction…….

Certainly tipped me the wink.

EUR/CHF Takes The Baton From USD/CHF

USD/CHF is holding the bulk of its gains but now it is the turn of EUR/CHF to rally. That pair has rallied from 1.1420 to almost 1.1700 before stalling.

Expect bids in the 0.8050/70 area on pullbacks in USD/CHF.

Swiss KOF Leading Growth Indicator 1.61 In August

Lower than median forecast of 1.82.

July revised down to 1.98 from initial 2.04.

Swissy weaker post release, EUR/CHF up at session high 1.1471.

Just Read Some Interesting EUR/CHF Comments

Well I thought they were interesting……

Dow Jones reporting UBS views on EUR/CHF.

They reckon cross may rise to 1.2000 by end 2012 (initally I thought it said 2011 and got quite excited)

Anyways economist Reto Huenerwadel opines “We aren’t looking for a material appreciation of the CHF from current levels, and expect SNB to succeed in their attempt to prevent it from reaching new highs” adding “We see the reduced attractiveness of the franc pushing EUR/CHF closer towards what we consider fair value based on purchasing power consideration, currently at 1.34.”

Cross presenty sits at 1.1430.

Swiss Whack The EUR/CHF Again

We’re back under 1.1400 with swiss names behind the bash lower to 1.1376 from around 1.1445.

Next support around 1.1340

USD/CHF taken with it down to day’s lows around 0.7878

Levels To Watch In All This Excitement….

EUR/USD- Resistance 1.4470 ( 76.4% of 1.4500-1.4375) , stops up through 1.4475, ahead of better resistance 1.4490/00. Bids 1.4440/50 and 1.4420/25

USD/JPY- bids 76.40/50, stops below , more bids 75.95 , stops through 75.90. offers 76.90/00, 77.30, 77.75

EUR/JPY- Resistance 110.90/111.05 and 111.84 (61.8% of 114.18-108.05). Support 110.15, 109.75 and 109.40

EUR/CHF- Support 1.1400, 1.1340 and 1.1250.Res 1.1460, 1.1515 and 1.1550

GBP/USD- Support 1.6475, 1.6450, Res 1.6550, 1.6610

EUR/GBP- Support 0.8725, 0.8695, 0.8675 (200 dma), Res 0.8770, 0.8800

AUD/USD: Bids 1.0445/55 (Asian sov, prop a/c’s), Offers 1.0500/05 (option related), 1.0535 (Tues high)

EUR/USD Holding Firm But Why?

Appalling ZEW should have sent the euro skidding, but seems other factors are coming to the fore today.

Earlier comments from China’s CB advisor Xia Bin, who apparently is highly respected in CB circles has put a bid tone on the euro and there’s also talk of some ongoing diversification coming away from the dollar from Asian sovereigns.

Another factor could be a double no touch option expiry today range 1.40-1.47.

As i mentioned before there’s trendline resistance and a possible barrier at 1.4500 with a break through 1.4535 looking pivotal. A close above here can extend up to 1.4695 seen in June, but it’s a long way off at the moment.

EUR/CHF also looks to be helping the euro cause, having taken out stops earlier up through 1.1390/00 which has held the last 2 sessions, and pushed up to 1.1420/25. Real money sellers are apparently attempting to now push the cross back down.

Euro’s around 1.4485

Germany’s DIHK Insitute Foreign Trade Chief Says Doe Not Expect Euro To Become Noticeably Weaker On Average This Year

Well it’s doing OK so far this morning, EUR/USD presently at 1.4435.

Hedge fund been seen notable buyer EUR/USD and EUR/CHF in recent trade. EUR/CHF up at 1.1385 from around 1.1320 when I parked my bum.

EUR/CHF, USD/CHF Struggling Into Offers

Following on from recent reports of SNB adding liquidity in the swap market, the move higher hasn’t been dramatic with a recent high of 1.1353.

Offers 0.7880/00 in USD/CHF, and 1.1345/55 EUR/CHF currently capping the moves higher

SNB not immediately avaialble to comment on talk it has been active in CHf 1 month forwards

Work in progress i guess…

Heard it was was Middle eastern offers in the dollar swiss earlier which may still be ongoing.

SNB Not Immediately Available To Comment On Talk Been Active In One Month Forward Market

Well they have been, and it’s going to be pretty much ongoing one would suspect. At least for the foreseeable future.

EUR/CHF sits at 1.1350.

Swiss National Bank In Forward Market

Very aggressive apparently. Guess it’s gonna be kinda ongoing.

EUR/CHF trading close to session highs, presently at 1.1340.

ForexLive Asian Market Open

The CHF was again the mover and instigator overnight but there were also notable moves in cable, which broke above previously solid resistance at 1.6475 and now looks set to retest 1.6745, and in AUD/USD, which broke back into the previous consolidation channel above 1.0500. EUR/USD stalled at Fibo resistance near 1.4515 and USD/JPY forgot to move, again.

Good luck today.

Swiss Govt: Government Supports Any SNB Measure On Franc

- Capital controls would have to be decided together

- Dollar and euro will remain weak until autumn

- Negative interest rates would need approval as well

A bit of a bounce in USD/CHF as the EcoMin and FinMin raise the notion of capital controls without dismissing them out of hand…

Governments use capital controls to limit inflows of capital when it becomes inconvenient (like China and Brazil) and outflows when things get bad…

Swiss Govt: Franc Level Not A Matter For Politicians

- Up to SNB to set franc target, if it decides to introduce one

- Franc is a matter for the SNB

- SNB’s job is to ensure price stability

- SNB is independent

Swiss Comments Without Teeth

Some marginalia from the Swiss government in support of industries impacted by CHF strength. The market ain’t impressed and is unwinding earlier buys of USD/CHF and EUR/CHF on the news of the press conference. Markets seems to have expected more…

Swiss Government To Hold Briefing On CHF At 15:00 GMT

Hopes for more measures to be announced seem to be pushing USD/CHF and EUR/CHF higher. Seems unlikely to me that they would add to what was announced earlier.

Top of the hour…Sorry for error…5 pm Bern time…Which according to the web is in 10 minutes from now…

SNB Turns Japanese

They’ve gone all QE on us, but with a bit more impact than their friends in Japan. They nearly doubled the amount sight deposits to CHF 200 bln and bought borrowed francs in the forward market while lending euros (of which they are massively long…) to increase liquidity further.

Results have been mixed, as the market was hoping for a peg at levels above the market, but has been slightly disappointed. The additional liquidity is not nothing, however, so keep your chin-straps buckled. 0.8000 will be a key level to break in USD/CHF…

Swiss National Bank In EUR/CHF Forwards

Apparently.

EUR/CHF pretty steady around 1.1300 (everything’s relative, I guess)

UPDATE: Now 1.1335 bid as news spreads.

This helping underpin EUR/USD. Been as high as 1.4437 after stops tripped through 1.4430.

Middle East names seen buying EUR/USD in recent trade.

EUR/USD Trades Lower In Line With EUR/CHF

EUR/USD has tripped aforementioned stops through 1.4385 presently at 1.4362. The move comes as EUR/CHF sells off sharply as the Swiss baulk at introducing a currency peg.

EUR/CHF down at 1.1245 in torrid trade.

Swiss National Bank Intensifies Measures Against Strong Swiss Franc

But no news on the peg front. EUR/CHF down at 1.1355.

- Aims to expand banks’ sight deposits at the SNB further, from 120 bln to 200 bln

- Will repurchase outstanding SNB bills, employ foreign exchange swaps

- Reiterates that will, if necessary, take further measures against strength of the franc

Swiss Govt Plans CHF 1.3 Bln Aid For Tourism, Export Sectors – Dow Jones

Todays’ TagesAnzeiger reports that the Swiss government plans to provide around 1.3 bln francs in relief aid to Swiss companies in the tourism and export sectors that have been hurt by the swiss francs’ burgeoning strength.

The Swiss Economy Minister and Finance Minister are proposing to offer some companies lower social security contributions for one year.

Package also envisages CHF 100 mln in aid for the tourism industry and a similar amount to promote technical innovation programs.

The proposals will be discussed at todays Swiss cabinet meeting in Bern.

Obviously there has been much recent speculation, that a move to peg the swiss franc to the euro, will also be up for discussion at todays meeting.

Levels of 1.15 and 1.20 have been oft mentioned in the past week or so.

The cross has risen in early European trading to the former level, presently at 1.1500 having been as high as 1.1550.

Whats Likely To Happen If Swiss Announce Peg Or Lower Limit For EUR/CHF

All possibilities are on the table so its best to dismiss nothing and be ready for all eventualities

- They do nothing- in this case the EUR/CHF will be smashed straight back below 1.10 with recent speculative longs leading the panic

- They set a lower limit at 1.10- in this case I’d expect the mareket to initially move lower towards the base but then dip buyers help stabilise it

- They set a lower limit anywhere above the market- some initial panic with heavy stops in USD/CHF above .8000 getting filled

No time has been set for an announcement but Swiss traders expect something today

Audience Participation: Where Is EUR/CHF Headed?

Sits at 1.0850 presently.

Which will we see first, 1.0550 or 1.1150?

I’ll go with 1.1150.

UPDATE: As we’re at 1.0900 make that 1.0600 or 1.1200.

ANOTHER UPDATE: US invesmtent house notable buyer of the cross in this latest spurt higher.

AEPs Take On The EUR/CHF ‘Peg’

It’s a very slow news day in the Asian FX market with risk trades, as usual for a Friday, drifting lower in quiet trade.

Why not have a read of AEPs take on the touted EUR/CHF peg.

Euro Easing Back With Equities Towards Mid Range On The Session.

Not hearing anything out there but EUR/CHF now 200 pips of the earlier stampede higher to 1.0922 possibly having some say in the matter.

EUR/USD down to 1.4210 after highs of 1.4295 and lows of 1.4103

Dow’s up 2.2% at 10957, S&P up 2.48% at 1149 and Nasdaq up 2.68% at 2445

EUR/CHF Heading For The 1.0992 Monday Highs

Not a million miles away now with that rally stalling around 1.0922

(Francesco …. you’re the man, well done)

looks like we could have some key day reversals now

EUR/CHF Steaming Ahead…

Next port of call looks like 1.0834/5 (Tuesday’s high) and 1.0993 seen on Monday

USD/CHF through Tuesday’s 0.7593 high on the way to 0.7650/55

May be a bad time to give up chocolate if this continues…

Swiss On The Move Again With Talk Of SNB Added Liquidity In The Forward Markets

EUR/CHF just rocketed 120 bips to 1.0648, EUR/USD up 60 bips to 1.4175

Who said this market wasn’t thin….. ?

Earlier model sellers no doubt falling on their swords

EUR/CHF Continues To Rally

Presently at 1.0480.

Move comes amid speculation the SNB could possibly move to peg the franc to the euro after comments from SNB’s Jordan.

Also talk that SNB will impose a 1% charge on bank deposits from as early as next week. The SNB has declined to comment on this rumuor.

SNB: No Comment On Talk Of Short-Term Movements In Fx

Guess there’s talk they’ve been in the market, EUR/CHF having popped up to 1.0450 from around 1.0385 when I sat down.

Personally haven’t heard jack, but then I haven’t spoken to anyone Bit early

I Was Just Reading……

Some UBS comments. And here they are:

“The remarkable quiet by SNB officials in light of the latest CHF strength should by no means be misinterpreted as an SNB that has given up on the CHF” adding “We can very well envisage a scenario whereby the SNB is coming up with a variety of different measures to counter the ongoing CHF strength before long.”

EUR/USD Head Higher Again

Just taken out some stops through 1.4300 and 1.4320, helped by a spike in EUR/CHF from 1.0143 to 1.0310, but slowing at the 100 day MA at 1.4345

Euro’s at 1.4333

Dollar Getting Crushed Against Safe Haven Pairs

USD/CHF, EUR/CHF and USD/JPY all smashed lower in trading that has no liquidity to 0.7067, 1.0075 and 76.76 respectively.

No rhetoric from the officials as yet but i’m sure it won’t be long

Dow tumbles to 10600 and S&P to 1100 in the melee, before staging recoveries

Total chaos…

Swiss Franc Hits New Highs Following The FOMC Statements

USD/CHF falls to 0.7176 and EUR/CHF to 1.0213 on safe haven demand as growth and economic outlook declines.

DJIA down towards 10720 before bouncing to 10870

Swiss Just Off Record Lows On The Run Into The FOMC

No bounce forthcoming ahead of the Fed with liquidity virtually non-existant according to traders.

EUR/CHF is at 1.0370 and USD/CHF at 0.7288

All time lows set today are 1.0355 and 0.7268

Its All Swissy Again..

Admittedly the market is very thin ahead of the FOMC, but there’s seems no stopping the Swiss Franc which has been strengthening rapidly since Europe opened for business.

EUR/CHF recently sank to 1.0376 with the USD/CHF to 0.7289 , both new life time lows.

GBP/CHF also crashed to 1.1833 a drop of around 6 cents on the day and took out a barrier apparently through 1.2000 in the process.

Swissy And Yen Gain As European Stocks Renew Slide

With European stocks having done a quick about face and renewed their slide, the swissy and to a lesser extent the yen are seeing accelerated gains.

EUR/CHF presently down at 1.0540.

Sounds Of Sudden Silence

Looks like we’ve seen all the volatility that we are going to see today. The FX market has hit the brakes and is now consolidating in relatively tight ranges.

Even if some risk aversion does emerge through lower equity markets, dealers do not expect any big sell-offs in the CHF crosses as the market is worried about more SNB action on the European open, perhaps this time ‘with friends’.

EUR/USD At The Mercy Of EUR/CHF

Pushed lower by persistent selling again in the EUR/CHF cross, taking out some stops through 1.4280 , but finding some bids under 1.4260.

Talk of some bids left towards 1.4240

EUR/CHF: Rumours Getting Louder

We need to be careful when listening to market rumours but the ones surrounding the Swiss Franc are getting much louder. One would think that after the non-event that was the Merkel-Sarkozy chat, the EUR would be significantly lower but it isn’t because of these EUR/CHF rumours. The market is now expecting a lower limit to be put on the EUR/CHF with some suggesting 1.20 and even others suggesting that it could be 1.25. Some of this chat is coming from well placed Swiss banks. Lots of bigger players are now furiously buying dips so the other side of this of course is that EUR/CHF will drop hard if the SNB doesn’t do as expected.

Looks Like Some GBP/CHF Going Through

Just glancing at my five-minute charts and noticing that GBP/USD and USD/CHF have both gotten a goosing in the last few minutes…Looks like a GBP/CHF order going through. Earlier we heard talk of large EUR/CHF buying from a clearer so it makes sense…

Fitch Gets The Blame For Latest CHF Slide

The reaffirmation of the US AAA rating is the catalyst for the renewed slide in the franc, traders say. A bit more of a reaction than I would have expected, but what do I know…

Traders note very solid buying by a UK clearing bank on the jump from 1.1200 to 1.1350. As ever, the Swiss market remains thinner than a cocaine-addled runway model.

Prices rallied earlier today on talk of the SNB calling around, checking prices in the forward market. I guess they want traders to think they will flood the market with more francs via swaps…

Next resistance is at 1.1380, followed by 1.1460 trend highs.

Swiss National Bank Checking Forward Rates

EUR/CHF has recovered from the session low 1.1176 seen post German GDP, presently back up at 1.1220.

If They Peg The Franc…

…wouldn’t you just buy the hell out of the CHF?

Investors were buying it last week with negative real rates. Wouldn’t they just by all the more if the Swiss adopted the ECB’s 1.5% interest rates? If you are given the choice of CHF or EUR, which would you choose? The SNB hopes you will just go look for greener speculative pastures and leave the franc alone…

I’m not 100% sold that the peg will work over the medium-term but it certainly has put a short-term floor under EUR/CHF and USD/CHF.

EUR/CHF, Back Down Again..

..from highs around 1.1459 in early Europe. Leveraged sellers were behind the shove lower apparently, as the pair slips to the 1.1240′s , but hearing precious little else in an otherwise very quiet market elsewhere.

EUR/CHF On A 1.1200 Handle!! Who Wud Have Thunk It?

I’m too good for this place 😉

Around The Markets

Regional stockmarkets are around 1.5% higher, Gold has rebounded from earlier loses to be unchanged near $1745/oz and oil is trading at $85.40, also unchanged.

The only FX action is in the CHF, which is nearly 2% lower against all other major currencies so far today.

EUR/CHF: Re-Testing Earlier Highs

EUR/CHF has been the main story of the day, after Swiss newspaper reports that the SNB is prepared to put a base in the pair and defend it vigorously.

EUR/CHF closed in NY at 1.1085 and is 200 pips higher on the session, currently retesting earlier highs at 1.1300.

EUR/USD Extends Rally Back

Presently back up at 1.4215.

Garnering support from strong buying of the EUR/CHF cross. That is up at session high 1.0955, US investment bank having been aggressive buyer of the cross this morning.

UPDATE: 4candles reports rumours SNB covertly getting involved selling swissy. EUR/CHF up at 1.1030.

EUR/CHF More Of The Same

Gets drilled lower again with talk that a US investment house was behind the earlier move ahead of the London fixing at 1500GMT, which apparently holds some selling interest in the pair.

It’s just off the recent lows of 1.0940

EUR/CHF Starting To Wobble Again

Seen a sharp drop of almost 100 pips in the last 25 minutes, but explanations are not exactly flooding in. Usual swiss secrecy i guess….., but stops went through on the break down through 1.1000 to a low of 1.0976 on the move

Rumour: Large LHS Fix Interest Lined Up In EUR/CHF

Ummmmm?

Sounds bit dodgy to me, but the talks out there. Personally I wouldn’t take much notice of it.

The market certainly isn’t taking much notice of it as EUR/CHF continues its’ sojourn higher, presently at session high 1.1060. SNB’s action has at least ensured swissy isn’t a one-way bet any longer.

Italy’s FTSE MIB Falls -1.8%

Hitting 27-month low.

Euro zone periphery concerns back with a vengeance today. Did they ever really go away? No.

EUR/USD sits at 1.4170 having been as low as 1.4158. Aforementioned buy orders at 50/60 so far soaking up the heavy selling pressure. One wonders for how long? Guess time will tell, as it always does…..

Swiss Retail Sales +7.4% Y/Y In June

Compared to -4.1% in May.

EUR/CHF reaches new session low of 1.1035 in wake of data.

The barrier interest at 1.1000 is looming large.

Italian/German 10 Year Govt Bond Yield Spread Widening Out

Presently stands at 370 bps, up from the 345 bps I jotted down on my arrival.

EUR/USD has slipped to 1.4205 at writing.

Elsewhere EUR/CHF has fallen through 1.1100, presently at 1.1075. Risk appetite still anemic.

Probably timely to remind readers of what Sean mentioned overnight; ie talk of substantial option structures down at 1.1000 in EUR/CHF. All things being equal, should expect some robust protection of said interest.

EUR/CHF: Large Option Structures At 1.1000

There are some large option structures at 1.1000 in EUR/CHF which are expected to attract the market over coming days. Probably not relevant today but worth keeping in mind.

Barrier Trashed In EUR/CHF

Through 1.1250 like a knife through butter which was also some trendline support. EUR/CHF down to a new record low of 1.12035 with USD/CHF in hot pursuit with a new low of 0. 7802.

Sellers Target EUR/CHF Barrier

Next one is at 1.1250 with the cross at a fresh recent all time low of 1.1258

Record Highs For The Swiss Franc Again…

USD/CHF falls to a record low of 0.7816 on the EBS trading system and the EUR/CHF falls to 1.1280. A notable US investment house seen behind the EUR/CHF sell off as the swissy continues to attract safe haven demand.

Tags: FOMC,Gold,Japanese yen,negative interest,negative interest rate,SNB sight deposits,Swiss National Bank,Switzerland,Switzerland KOF Economic Barometer,UBS