Tag Archive: wages

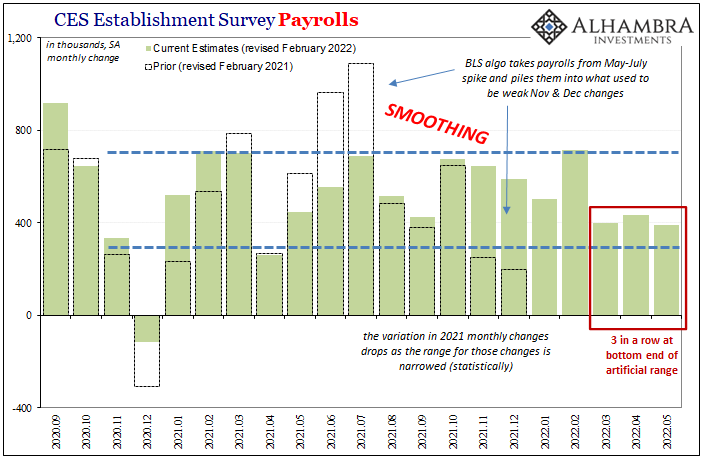

Payrolls Still Slowing Into A Third Year

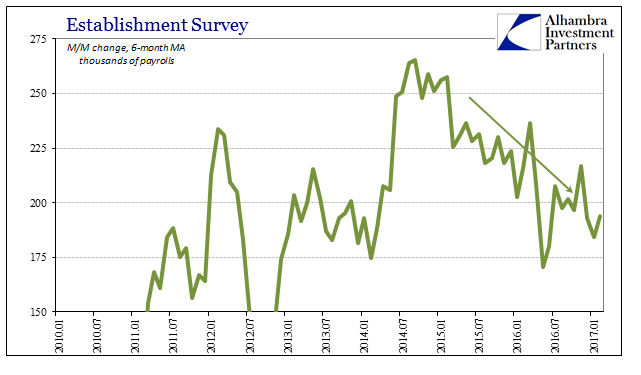

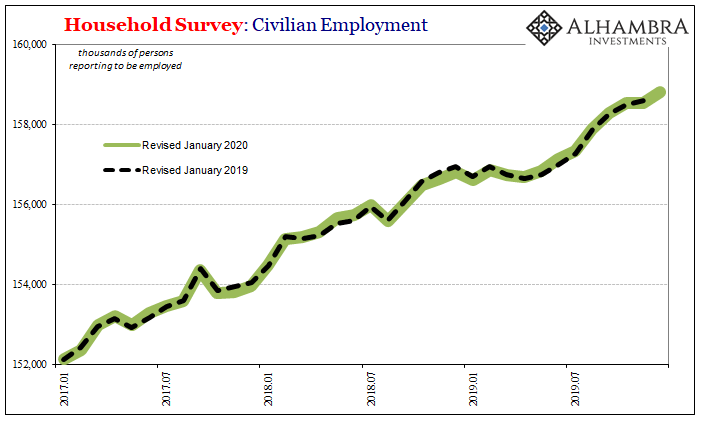

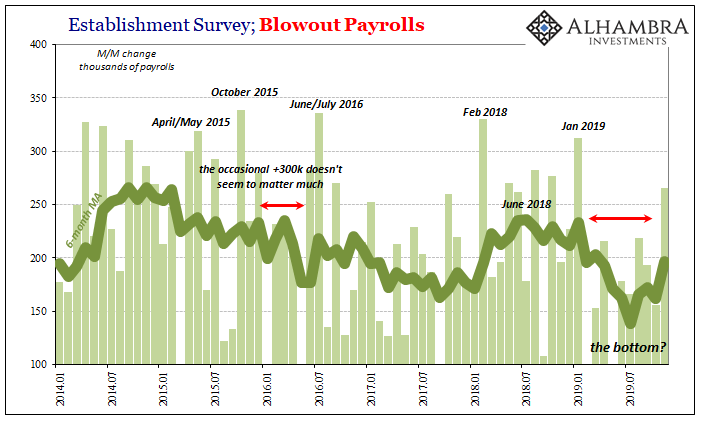

Today’s bland payroll report did little to suggest much of anything. All the various details were left pretty much where they were last month, and all the prior trends still standing. The headline Establishment Survey figure of 235k managed to bring the 6-month average up to 194k, almost exactly where it was in December but quite a bit less than November. In other words, despite what is mainly written as continued “strength” is still pointing down...

Read More »

Read More »

Real Disposable Income: Headwinds of the Negative

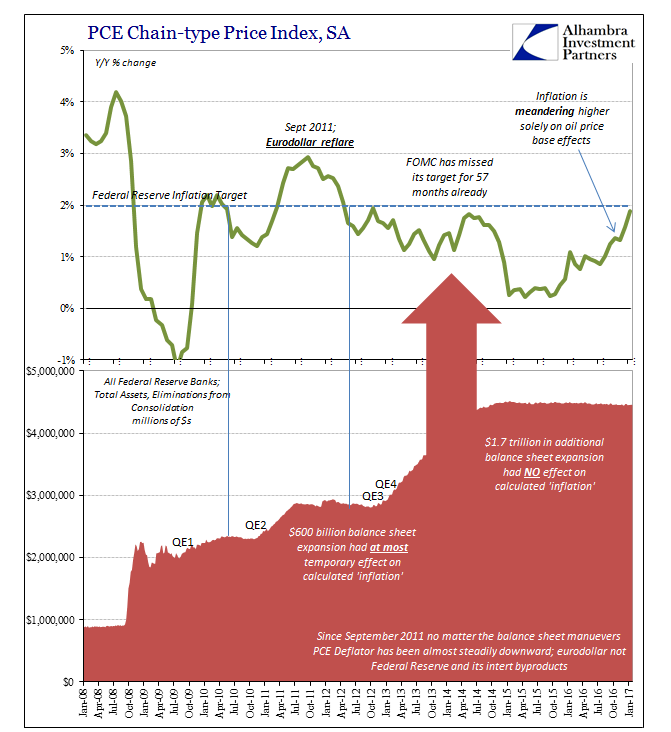

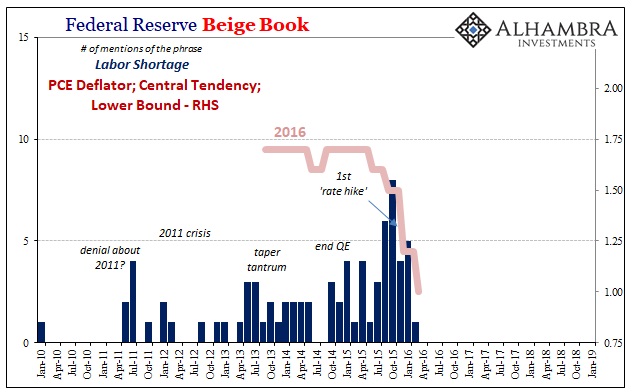

The PCE Deflator for January 2017 rose just 1.89% year-over-year. It was the 57th consecutive month less than the 2% mandate (given by the Fed itself when in early 2012 it made the 2% target for this metric its official definition of price stability).

Read More »

Read More »

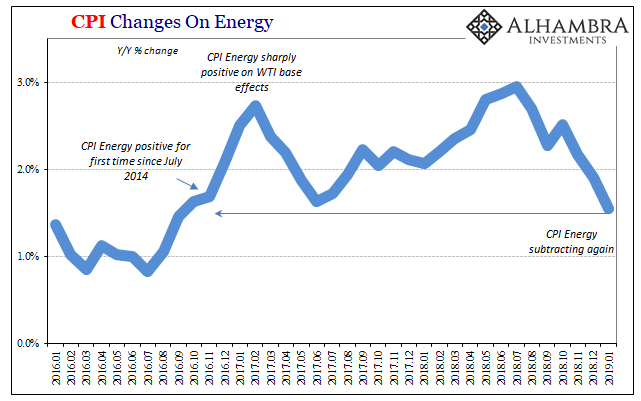

U.S. CPI after the energy push

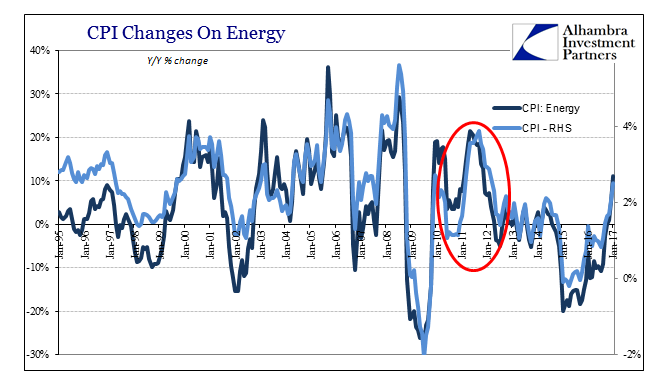

The Consumer Price Index for January 2017 rose 2.5%, pulled upward by its energy component which thanks to oil prices now being comparing to the absolutely lows last year saw that part of the index rise 11.1% year-over-year. Given that oil prices bottomed out on February 11, 2016, this is the last month where oil prices and thus energy inflation will be at its most extreme (except, of course, should WTI actually rise between now and the end of...

Read More »

Read More »

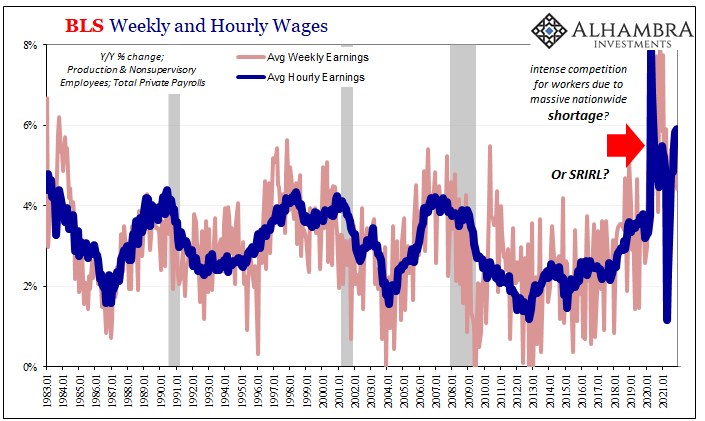

Real Wages Really Inconsistent

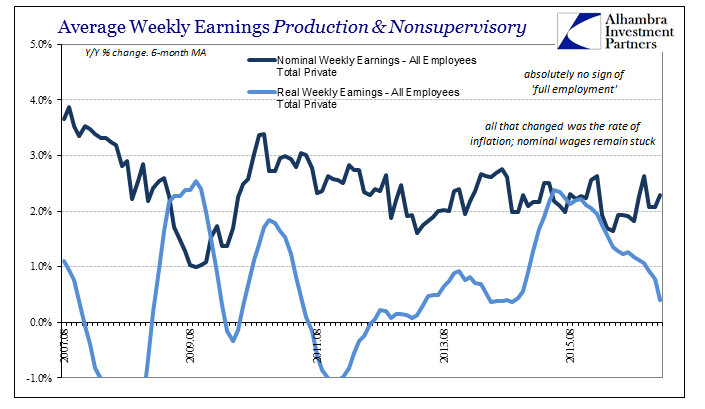

Real average weekly earnings for the private sector fell 0.6% year-over-year in January. It was the first contraction since December 2013 and the sharpest since October 2012. The reason for it is very simple; nominal wages remain stubbornly stagnant but now a rising CPI subtracts even more from them.

Read More »

Read More »

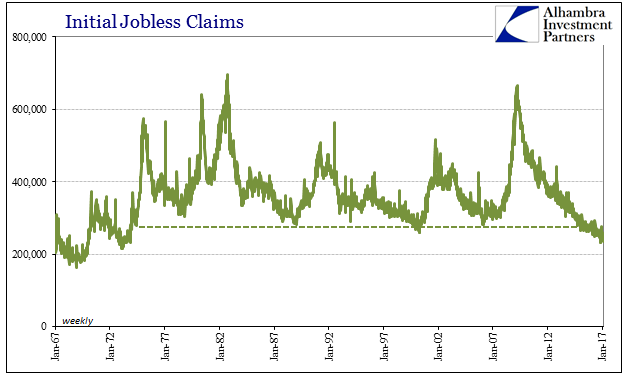

Jobless Claims Look Great, Until We Examine The Further Potential For What We Really, Really Don’t Want

Initial jobless claims fell to just 234k for the week of February 4, nearly matching the 233k multi-decade low in mid-November. That brought the 4-week moving average down to just 244k, which was a new low going all the way back to the early 1970’s. Jobless claims seemingly stand in sharp contrast to other labor market figures which have been suggesting an economic slowdown for nearly two years.

Read More »

Read More »

A Few Thoughts Ahead of the US Jobs Report

ADP and Non-Manufacturing ISM lend credence to our fear of a disappointing national jobs report. Economists estimate only a small part of the manufacturing jobs loss can be traced to trade policy. 19 states increased min wage at the start of the year, but the impact on the nation's average weekly earnings will likely be too small to detect.

Read More »

Read More »

Great Graphic: Real Wages

This Great Graphic caught my eye. It was tweeted by Ninja Economics. Her point was about immigration. German had much higher immigration than the UK, but also saw real wage increase of nearly 14% in the 2007-2015 period, while real wages in the UK fell nearly 10.5%.

Read More »

Read More »

Great Graphic: Low Wages in US Rising

The bottom of the US wage scale is rising. The added wage costs are being blunted by less staff turnover, hiring and training costs. It is consistent with our expectation of higher price pressures.

Read More »

Read More »

The Need for Higher Wages: Lots of Thunder, No Rain

Major central banks and many economists are calling for higher wages. However, they are reluctant to offer proposals to strengthen those institutions who's goal is to boost labor's share of national income. The advocates are more interested in boosting prices than in lifting aggregate demand or addressing the disparity of income and wealth.

Read More »

Read More »

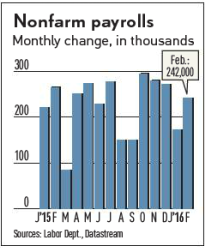

How you see the Stock Market determines your Profit or Loss!

The key economic note this week was that non-farm payrolls for February was 242,000 versus Wall Street’s expectation of only 190,000; 27% above the consensus target. Wages however fell back by 0.1% from February’s gain of 0.5%. The workforce participation rate moved up to 62.9%. The excellent news on Friday was however received mutely by the market. Interest rates may rise.

Read More »

Read More »

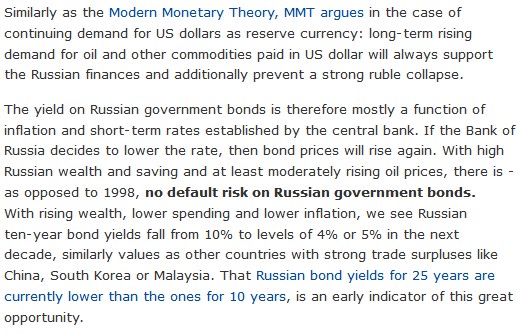

What Drives Government Bond Yields?

For us the five major drivers of government bond yields are:

Inflation expectations and inflation: The by far most important criterion. High inflation expectations must be compensated via higher bond yields. The main driver behind inflation expectations is the wage development, this is the form of inflation that typically persists. Price inflation follows inflation expectations with a certain lag.

Wealth: The higher the wealth of a country, the...

Read More »

Read More »

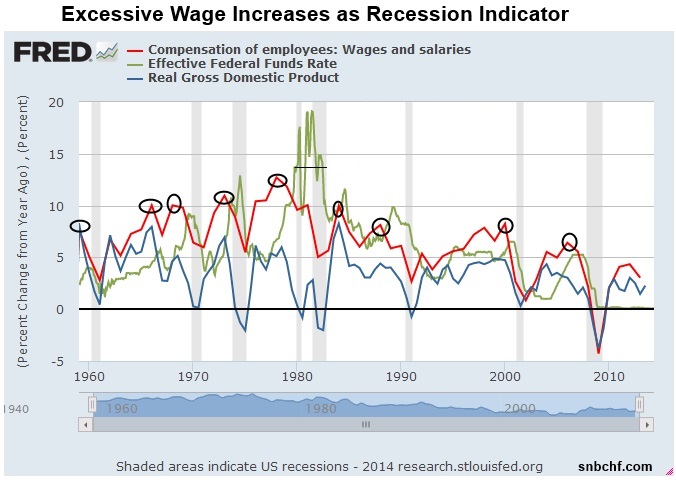

A Little History of Wages, Inflation, Treasuries and the Fed – And What We Learn from it

On this page we show that

Inflation expectations and wages drive the behaviour of the Fed and Treasury bond yields.

Excessive wage increases lead to recessions, more or less voluntarily caused by central bank tightening

Central banks pin down the short end of the yield curve, while financial-market participants price longer-dated yields

Some Emerging Markets seem to copy strong wage increases and inflation that we lived in the 1970s

Quickly...

Read More »

Read More »

Accumulated Capital of Centuries Going Up In Smoke

According to Keith Weiner, capital adds leverage to human effort. Capital makes employment and wages possible. Keith argues that Fed destroys savings with zero interest rates, and herds savers into bubbles. It causes wages to fall and creates chronic pressure to lay off workers. The Fed destroys capital.

Read More »

Read More »

The Best Contrarian Macro Investment: Russia?

We name thirteen macro-economic reasons why Russia is currently the best place for contrarian investments.

Read More »

Read More »

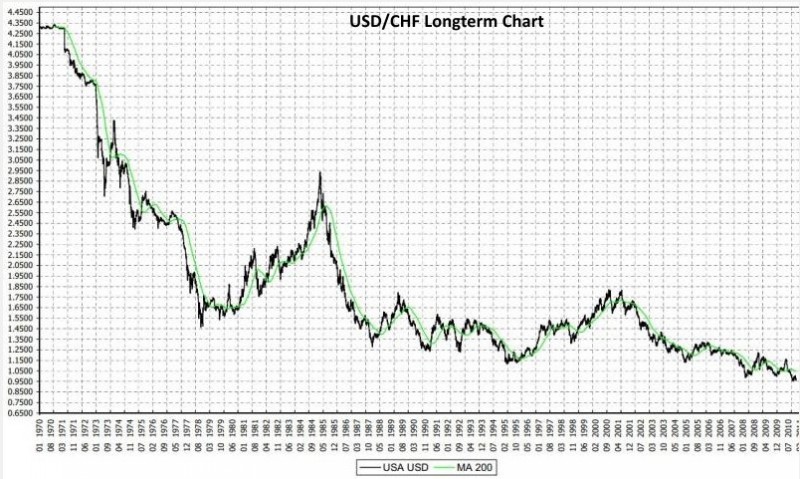

Swiss Franc History: The long-term view and the comparison with gold

We establish a long-term view and history of the Swiss franc. We compare the franc with gold.

Read More »

Read More »

Our March 2013 Analysis: “Volcker Moment Redux”: Upcoming Weakness of Emerging Markets

The 2010 QE2 is a reason why many emerging markets started to slow considerably in the course of 2012. We reckon that this weakness will continue. Bizarrely QE2 helped to reduce global imbalances.

Read More »

Read More »

The Fed Will Remain Gold’s Strongest Supporter For Years

In the early 1980s the Fed stopped the wage-price spiral and destroyed the gold price. Today main-stream economists have discovered that rising company profits compared to stagnating wages could an issue for the U.S. economy. For us this implies that the ultimate Fed goal will be to increase wages and inflation. Consequently the Fed has become the biggest supporter of gold and silver prices.

Read More »

Read More »

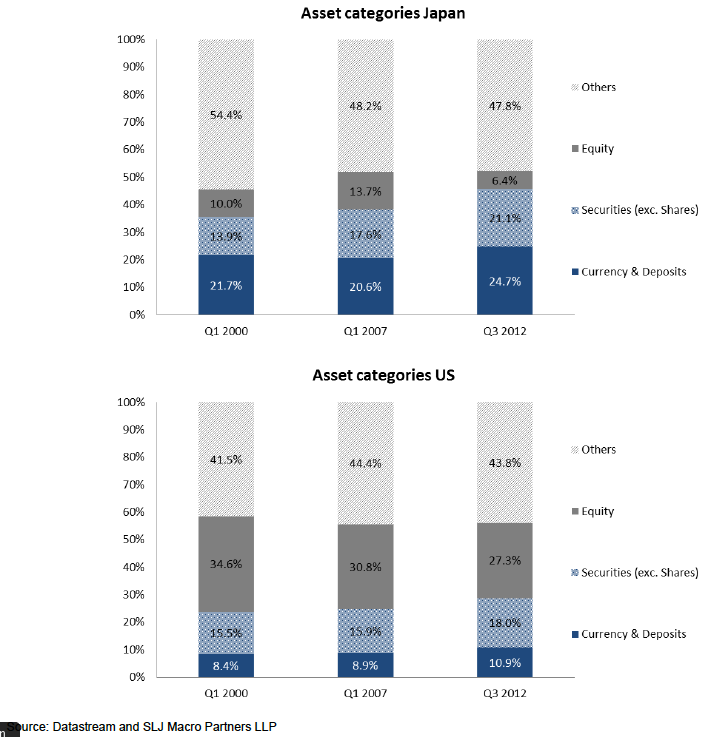

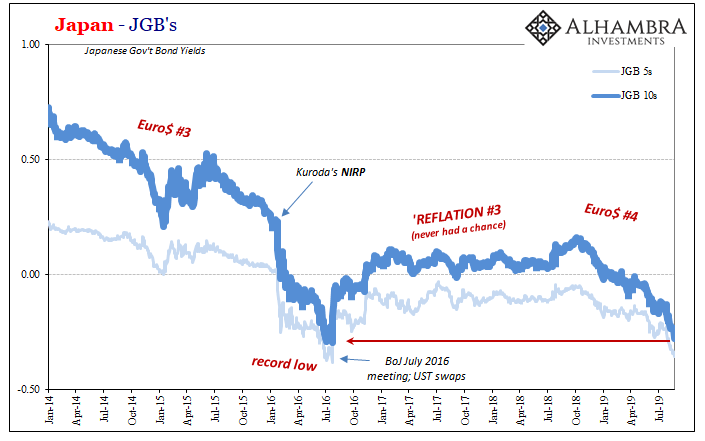

Japanese Investors Will Determine Fate of USD/JPY not U.S. Hedge Funds

By Stephen Jen (via Itau Global Connections). Bottom line Now that the Bank of Japan will be led by a team of super-doves, the mechanism through which a more aggressive BOJ could influence the yen is through capital flows. We have used the analogy of a two-stage rocket to describe how USDJPY could be propelled. … Continue reading »

Read More »

Read More »

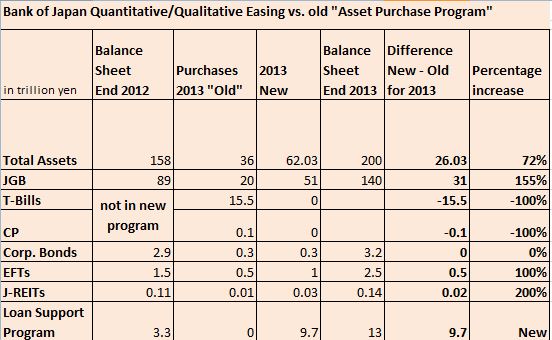

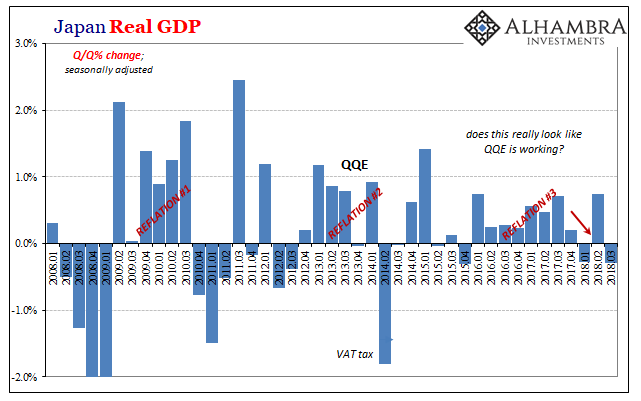

BoJ: Despite Quantitative and Qualitative Easing No Sign of FX Purchases

The Bank of Japan has introduced the expected “massive” quantitative and qualitative easing programme. “Quantitative” means increase of quantities of JGBs bought, “qualitative” the purchase of more ETFs, REIT and the loan support program.

Read More »

Read More »