Tag Archive: #USD

Is the Yen or Swiss Franc a Better Funding Currency?

Yen and Swiss franc are funding currencies. This goes a long way to explaining why they rally on heightened anxiety. The Swiss have lower rates than Japan and the franc is less volatile than the yen, but technicals argue for caution.

Read More »

Read More »

FX Daily, August 16: Swiss Franc and Yen Improve after Dovish Draghi Comments

Swiss Franc and Yen Improve after Dovish Draghi Comments, A return to the macroeconomic agenda is being deterred by new drama from Washington and reports suggesting that ECB's Draghi will not be discussing the central bank's monetary policy course at Jackson Hole confab, which will take place next week.

Read More »

Read More »

FX Daily, August 15: Greenback Firms, Encouraged by Dudley and Ebbing of Tensions

NY Fed President Dudley appears to have stolen any potential thunder in the July FOMC minutes that will be released tomorrow. While we put more emphasis on today's US retail sales data and the August Fed surveys, many others argued that the minutes were the key report this week.

Read More »

Read More »

FX Daily, August 14: Sigh of Relief Weighs on Yen and Gold, while Lifting Equities and the Dollar

The lack of new antagonisms over the weekend between the US and North Korea has prompted the markets to react accordingly. Already before the weekend, we detected some signs that at least some market participants had begun looking past the dramatic rhetoric.

Read More »

Read More »

FX Weekly Preview: Synthetic FX View — Macro and Prices

Economic data due out are unlikely to change macro views. Swiss franc's price action suggests some return to "normalcy" despite rhetoric remaining elevated. Sterling's 3.25 cent drop against the dollar looks over.

Read More »

Read More »

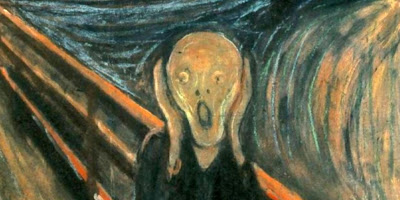

FX Daily, August 11: Geopolitical Tensions Remain Elevated into the Weekend

There has been no apparent attempt by either North Korea or the United States to ease the rhetorical flourishes that have made global investors nervous. Risk assets were liquidated, and the funding currencies, particularly the Japanese yen and Swiss franc were bought back. The yen gained nearly 1.6% this week, ahead of the US session, while the Swiss franc gained 1.3%.

Read More »

Read More »

FX Daily, August 10: Tensions Remain Elevated, Dollar Firms

It is difficult to walk back the saber-rattling rhetoric. US Secretary of State Tillerson tried to defuse the situation, which had appeared to ease nerves in North America yesterday. However, references to the modernization of US nuclear forces, a multi-year project begun last year, spurred a fresh threat by North Korea to fire four intermediate range missiles near Guam in week's time.

Read More »

Read More »

FX Daily, August 09: North Korea lets EUR/CHF Collapse

The bellicose rhetoric from the US and North Korean officials is the main driver today. We would qualify that assessment by noting that first, the market moves are rather modest, suggesting a low-level anxiety among investors. Second, pre-existing trends have mostly been extended. Turning to Asia first, the Korea's equity market fell 1.1%. The Kospi has fallen for the past two weeks (~2.2%).

Read More »

Read More »

FX Daily, August 08: Trade Featured as Dollar Drifts Lower

The US dollar has a slightly lower bias today, but the against most of the major currencies, it is consolidating within the range set at the end of last week. The main exceptions are sterling and the Canadian dollar. They had extended their pre-weekend losses yesterday, and are trading within yesterday's range today.

Read More »

Read More »

Great Graphic: Unemployment by Education Level

The US reports the monthly jobs data tomorrow. The unemployment rate stood at 4.4% in June, after finishing last year at 4.7%. At the end of 2015 was 5.0%. Some economists expect the unemployment rate to have slipped to 4.3% in July. Recall that this measure (U-3) of unemployment counts those who do not have a job but are looking for one.

Read More »

Read More »

FX Daily, August 07: Outlaw Mondays

The US dollar is narrowly mixed to start the new week. Two main developments stand out. First, the dollar-bloc currencies are trading heavily. The Australian dollar is pushing lower for the fifth consecutive session. The greenback is advancing against the Canadian dollar for the sixth consecutive session. The New Zealand dollar is weaker for the fifth time in six sessions.

Read More »

Read More »

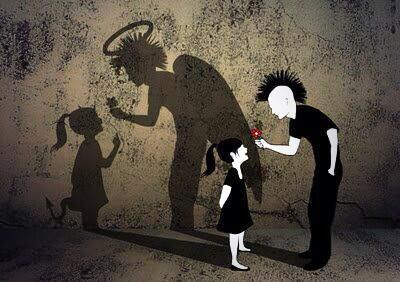

FX Weekly Preview: Moving Toward September

The technical and fundamental case for the euro has weakened. Rate differentials have begun moving back in the US favor. France's Macron and Japan's Abe have sunk in the polls lower than Trump.

Read More »

Read More »

Bank of England Crushes Sterling

Sterling reached a new 11-month high against the dollar earlier today, but the dovish take away from the Bank of England has seen sterling reverse lower. It has now fallen below the previous day's low, and a close below there (~$1.3190) would confirm the bearish key reversal pattern. Support near the week's low just below $1.3100 is holding, and if that goes, the $1.30 level can be tested. A break of $1.2930, the low from the second half of July...

Read More »

Read More »

FX Daily, August 04: Does the Employment Report Matter?

There are some chunky option strikes that could come into play today. There are 920 mln euros struck at $1.1850 that expire today. There are A$523 mln struck at $0.7950 expiring today. There are $680 mln struck at CAD1.2550 that will be cut.

Read More »

Read More »

FX Daily, August 03: Dollar-Bloc Currencies Turning, but Euro Downticks Limited

The high-flying dollar-bloc currencies may be a preliminary sign market change. The US dollar is gaining on the Canadian dollar for the fourth consecutive session. It is probing resistance we identified in the $1.2620 area. The US dollar has not traded above its 20-day moving average since the Fed hiked rates on June 14. It is found today near CAD1.2625.

Read More »

Read More »

Cool Video: Dollar Drivers on Bloomberg

There were three talking points. First was the observation that while the President took credit for the record stock market, the strength of the economy, the low unemployment rate, and business confidence, there was no mention of the dollar, which poised to close lower for its seventh consecutive month.

Read More »

Read More »

FX Daily, August 02: Euro Climbs Relentlessly, While Greenback is Mixed

The euro's strength is surely partly a reflection of US dollar weakness, but it is also a reflection of the improved sentiment among investors. The initial dollar losses at the start of the year was largely a correction that is common after a Fed hike. This is more or less what happened at the start of 2016 as well, following the Fed hike in December 2015.

Read More »

Read More »

FX Daily, August 01: The Most the Dollar Can Hope for on Turn Around Tuesday is Consolidation

After taking a step lower in the North American session yesterday, the dollar is consolidating today. The euro is holding above $1.18, and the dollar held JPY110.00. Global equities are mostly higher, while bonds are mixed. Asia-Pacific yields were mostly higher, while European rates are a little lower. The US 10-year yield is flat just below 2.30%.

Read More »

Read More »

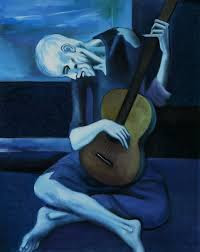

FX Daily, July 31: Monday Morning Blues

The euro is up by 0.15% to 1.1385 CHF. The US dollar is enjoying a respite from the recent selling, but its gains have been shallow, and will likely prove brief. The upticks have been concentrated in the recently high-flying dollar-bloc currencies, and sterling. The tone appears to be more consolidative than corrective, and month-end adjustment provides an additional wrinkle.

Read More »

Read More »

FX Weekly Preview: The Dollar may Need more than a Strong Employment Report

For the US jobs data to rally the dollar, it needs to increase the likelihood of a Fed hike in September, a high bar. The BOE will stand pat, a 6-2 vote would likely be accompanied by a hawkish inflation report. The RBA will also hold rates steady, and of course, it would prefer a weaker currency.

Read More »

Read More »