Tag Archive: #USD

Great Graphic: Possible Head and Shoulders Top in Euro

The euro appears to have carved out head and shoulder top. As this Great Graphic depicts, the euro was sold through the neckline at the end of last week and is 1% below it today. It is not unusual for the neckline to be retested. It is found near $1.15. It also dovetails with our near-term caution given that the euro is likely to close below its Bollinger Band for the second consecutive session (~$1.1440).

Read More »

Read More »

FX Daily, August 13: Turkey Drives Risk-Off, but Pressure Abating

The failure of Turkey to grab the bull by the horns, so to speak, and come to grips with the situation saw the dollar soar above TRY7.23(from TRY6.43 at the end of last week) and to ZAR15.55 (from ZAR14.09). The Mexican peso, the strongest currency this year, and which has been partially protected by prospects of a new NAFTA agreement has suffered as well.

Read More »

Read More »

The Yin and Yang of the US-China Relationship

Chimerica always seemed like an oversimplification of a complex and dialectic relationship between the US and China. However, it did express an underlying truth, that China's rise over the last 40 years has been predicated on Deng Xiaoping's political and economic reforms and, importantly, the world of free-trade (a reduction in tariff barriers to trade) promoted by the United States.

Read More »

Read More »

FX Daily, August 10: The Dollar Muscles Higher as Turkey Melts Down

The US dollar has surged. The main impetus comes from the dramatic slide in the Turkish lira. After moving above TRY5.0 yesterday, it reached TRY6.30 today before stabilizing a little below TRY6.0 as the European morning progressed. The trigger seemed to be the lack of credibility of the government's response as investors await officials to elaborate on the outline of the "new economic model" provided yesterday.

Read More »

Read More »

FX Daily, August 09: Sterling Remains Under Pressure, while the Greenback Firms Broadly

The global capital markets are mostly quiet. US sanctions on Turkey and Russia are pressuring their respective currencies, and the New Zealand dollar has slumped nearly 1.5% on the back of a dovish hold by the central bank. The Kiwi is at 2.5-year lows near $0.6650.

Read More »

Read More »

FX Daily, August 08: Sterling Can’t Get Out of Its Own Way, While Dollar and Yen Catch a Bid

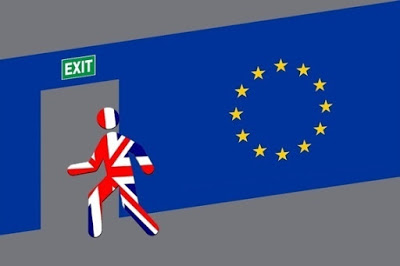

Fears that the UK could leave the EU in a little over six months without an agreement continues to drag sterling lower. Recall that over the weekend, the UK's International Trade Minister Fox suggested there was a 60% chance of a no-deal Brexit.

Read More »

Read More »

FX Daily, August 07: Turn Around Tuesday for the Greenback

The US dollar is pulling back today after yesterday's advance. All the major currencies are higher and even the Turkish lira, which plunged nearly 5% yesterday to cap a six-day slide, is trading firmer today ([email protected]). The dollar's losses are modest and appear corrective in nature.

Read More »

Read More »

FX Daily, August 06: Sterling’s Drop Paces Dollar Gains

The US dollar edged higher against most of the major currencies, and emerging market currencies are heavier. Sterling's quarter percent drop makes it the weakest of the majors in slow turnover and it was sufficient to record a new 11-month low.

Read More »

Read More »

FX Weekly Preview: Dog Days of August Begin

With most of the major central bank meetings and important economic data out of the way, the dog days of August are upon us. In terms of drivers, it means that players will have to look elsewhere for inspiration and it means that market liquidy is likely not at its best.

Read More »

Read More »

FX Daily, August 02: BOJ Surprises, BOE on Tap, Trade Worries Weigh on Stocks

The Bank of England meeting concludes a run of major central bank meetings over the past fortnight. The BOE is widely expected to join the Bank of Canada in raising rates. The Federal Reserve and the ECB were content to do and say nothing new.

Read More »

Read More »

FX Daily, August 01: Trade and Japan Drive Markets Ahead of Stand Pat Fed

Investors recognize the risks to growth posed by the tariffs and counter-tariffs being imposed, but the way the US is going about it is also disconcerting. Within a few hours of signals that the US and China were looking to re-engage in high-level talks, which have not taken place for two months according to reports, the US signaled that the 10% tariff on $200 bln of Chinese goods could now face a 25% tariff instead.

Read More »

Read More »

FX Daily, July 31: BOJ Prepares for QE Infinity

The Japanese yen has been sold following the adjustments to policy and outlook by the BOJ that will allow the unconventional policies continue for an "extended period of time." Cross rate pressure and month-end demand have lifted the euro and sterling through yesterday's highs.

Read More »

Read More »

FX Daily, July 30: Equities, Bonds, and the Dollar Start Week Softer

The week's big events lie ahead. It is seen as the last important week before the dog days of summer when many participants will take holidays. The BOJ's two-day meeting concludes tomorrow. Speculation that the BOJ is looking for ways to tweak its program continues to spur a small taper-lite tantrum in Tokyo.

Read More »

Read More »

FX Daily, July 27: Greenback Remains Firm Ahead of Q2 GDP

The US dollar is trading firmly in Europe after consolidating yesterday's gains during the Asian session and ahead of the first look at Q2 GDP. Yesterday's economic reports, including durable goods orders and inventory data, saw the Atlanta Fed's GDPNow tracker lower its forecast to 3.8% from 4.5%.

Read More »

Read More »

FX Daily, July 26: Equities like EU-US Trade Truce more than the Euro

The markets generated a collective sigh when Juncker and Trump announced that there would be no new tariffs while new trade negotiations took place. This was particularly important because Trump reportedly wanted to press ahead with a 25% tariff on car imports. It was also announced that the EU would buy more soy and liquid natural gas from the US.

Read More »

Read More »

FX Daily, July 25: Narrow Ranges Prevail

The US dollar is trapped in narrow trading ranges. That itself is news. At the end of last week ago, the US President seemed to have opened another front in his campaign to re-orient US relationships by appearing to talk the dollar down. Contrary to fears, and media headlines of a currency war, the dollar is fairly stable.

Read More »

Read More »

FX Daily, July 24: China Turns To Domestic Stimulus, Weighs on Yuan but Lifts Stocks

Following a record injection via the medium-term lending facility yesterday, China's officials unveiled a set of policies designed to support the weakening economy that soon could face a substantial drag from US tariffs. The effort focuses on boosting domestic demand. Measures include targetted tax cuts and accelerating new infrastructure.

Read More »

Read More »

Cool Video: Bloomberg Television–Dollar Outlook

The issue is the dollar's outlook. The greenback had looked to be on the verge of breaking out higher before the US President expressed disapproval with the Fed rate hikes and, then the following day, aggressively accused the EU and China of manipulating their currencies.

Read More »

Read More »

FX Daily, July 23: Dollar Consolidates Trump-Inspired Losses, BOJ Resolve Tested

US Treasury Secretary Mnuchin told G20 finance ministers and central bankers that President Trump was not trying to interfere in the foreign exchange market or encroach upon the Federal Reserve's independence. Trump's comments and tweets last Thursday and Friday effectively capped the dollar as it was looking to break out to the upside.

Read More »

Read More »

FX Weekly Preview: It was Supposed to be a Quiet Week

It was supposed to be a quiet week. The economic data and event calendar was light. There were three features, and none would likely disrupt the markets much. The first two are in Europe. The eurozone flash PMI for July, the first insight into how Q3 has begun. The PMI is expected to paint a mostly steady economic activity.

Read More »

Read More »