Tag Archive: #USD

FX Daily, April 30: Dollar Pares more Gains as EMU GDP Surprise

Overview: The S&P 500 set a new record high and close yesterday, but the lift to global markets was not strong enough to overcome the disappointing Chinese PMI. Although Chinese equities traded higher on ideas that the news will spur additional stimulative measures, other Asian markets were mixed.

Read More »

Read More »

Cool Video: Q1 US GDP Optics may Mark Near-Term Peak in Divergence Theme

I joined Tom Keene and Francine Lacqua to talk about US GDP with David Riley from BlueBay Asset Management. Here is a link to a 2.5-minute clip. The initial estimate of Q1 US growth was well more than nearly anyone expected. The details were underwhelming as the consumption was halved and the GDP deflator was halved. Final private domestic sales, which strips away inventories, trade, and government spending rose 1.3%, the least more than five years.

Read More »

Read More »

FX Daily, April 29: The Busy Week Begins Slowly

Overview: It promises to be an eventful week with the FOMC and BOE meeting, US jobs report and EMU April CPI and Q1 GDP on tap. However, the week is marked by the May Day holiday in the middle of the week. Japan's markets are closed all week, while China's markets are closed from mid-week on for an extended holiday. The week has begun on a decidedly consolidative tone.

Read More »

Read More »

FX Daily, April 26: Greenback Consolidates Ahead of Q1 GDP

Overview: The equities are finishing softly after the rally stalled in the middle of the week. The large markets in Asia fell, led by China, and the MSCI Asia Pacific Index fell for a third session, the longest losing streak in two months. Europe's Dow Jones Stoxx 600 ended an eight-day advance with a two-day loss coming into today where it is a little softer.

Read More »

Read More »

FX Daily, April 25: Equities Waiver, the Dollar Does Not

Overview: After closing at record highs on Tuesday, the S&P 500 slipped yesterday, and the Dow Jones Stoxx 600 snapped an eight-session advance. Asia followed suit, with the Shanghai Composite posting its biggest loss (~2.4%) in over a month. It is off about 4.6% this week, which if sustained tomorrow, would be the largest loss in six months.

Read More »

Read More »

FX Daily, April 24: Dollar Bloc in Focus, while Germany’s IFO Disappoints

The record high close for the S&P 500 failed to lift global equities. Far East trading was mixed. The Nikkei opened strong and closed weaker, while the Shanghai Composite began softer and closed firmly. Australian shares and bonds rallied on the back of mild inflation, while the Australian dollar tumbled.

Read More »

Read More »

FX Daily, April 23: Oil Extends Gains While Markets Await Fresh Incentives

Overview: Financial centers that have been closed for the extended holiday have re-opened, but the news stream is light and market participants are digesting developments and positioning for this week's central bank meetings and the first look at Q1 US GDP. The US decision to end exemptions to the embargo against Iran led to a surge in oil prices, which are extending gains to new six-highs today.

Read More »

Read More »

FX Daily, April 22: Surge in Oil Punctures Holiday Markets

Overview: With many centers closed for the extended holiday, the calm in the global capital markets has been punctuated by reports that the US is considering ending its exemption for eight countries to have bought Iranian oil over the past six months. The waivers were to end on May 2, but previously it was thought that a couple of waivers, like for China and India, would be extended.

Read More »

Read More »

FX Daily, April 19: Holiday Note

Many financial centers are closed today. These include Australia, India, most European markets, and the US. In Asia, equity markets that were open moved higher. The Nikkei, which gapped higher on Monday, rose 0.5% today for a 1.5% gain on the week. China's Shanghai Composite rose 0.6%, lifting the weekly increase to 2.6%.

Read More »

Read More »

FX Daily, April 18: EMU Disappointment Lifts the Dollar

Overview: A bout of profit-taking in equities began in the US yesterday and has carried through Asia and Europe today. The MSCI Asia Pacific Index fell for the first time in five days, while the Dow Jones Stoxx 600 is snapping a six-day advance. The Nikkei gapped higher to start the week and a gap low tomorrow would undermine the technical outlook.

Read More »

Read More »

FX Daily, April 17: Veracity of Chinese Data Questioned, but Lifts Sentiment Nevertheless

The veracity of Chinese data will be questioned by economists, but today's upbeat reports round out a picture that began with stronger exports and a surge in lending. Chinese officials, we argue, had a "Draghi moment" and decided to do "whatever it takes" to strengthen the economy in the face of US tariffs and during the 70th anniversary of the Revolution.

Read More »

Read More »

FX Daily, April 16: The Dollar and Stocks Catch a Bid

Amid light news, global equities are moving higher In Asia, the Nikkei rose to a new high since early December, while the Shanghai Composite rose 2.3% and posted its highest close since March 2018. European equities are solid, with the Dow Jones Stoxx 600 moving higher for the fifth consecutive session.

Read More »

Read More »

FX Daily, April 15: Redemption Monday

The holiday-shortened week is off to a slow, tentative start. The surge of the S&P 500 before the weekend failed to inspire today. Asia markets were mostly firmer, led by Japan, while China, Hong Kong, and Singapore moved lower.

Read More »

Read More »

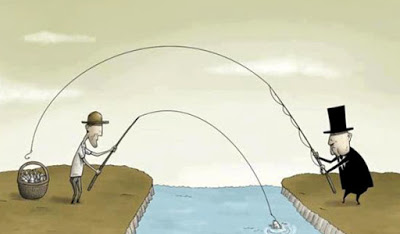

FX Weekly Preview: Dollar Super Cycle Revisited

In the big picture, we argue that the dollar’s appreciation is part of the third significant dollar rally since the end of Bretton Woods. The first was the Reagan-Volcker dollar rally, spurred by a policy mix of tight monetary and loose fiscal policies.

Read More »

Read More »

FX Daily, April 12: Euro Bid Above $1.13 for the First Time this Month

Overview: The consolidative week in the capital markets is drawing to a close. Equity markets are narrowly mixed. In Asia, most indices outside of the greater China (China, Taiwan, and Hong Kong) edged higher, leaving the MSCI Asia Pacific Index slightly lower on the week. The MSCI Emerging Markets Index snapped a ten-day rally yesterday and is little changed so far today.

Read More »

Read More »

FX Daily, April 11: Market Yawns at Latest Brexit Extension

The S&P 500 closed higher yesterday for the ninth session in the past ten, but the coattails are short and global equities are trading with a heavier bias today. A firm CPI reading in China took a toll local shares with the Shanghai Composite, shedding 1.6%, the most in more than two weeks. European bourses are mostly in the red.

Read More »

Read More »

FX Daily, April 05: Trade Talk and German Industrial Output Lifts Sentiment

Overview: Comments by Chinese President Xi, recognizing substantial progress in trade, helped boost sentiment after the US-China negotiators failed to set a date for the meeting between the two presidents. Although we have argued that the German economy may be past the worst, the sharp drop in factory orders spooked investors.

Read More »

Read More »

FX Daily, April 04: Limited Price Action Does not Do Justice to Macro Developments

Overview: The global capital markets are subdued despite several macro developments. The US and China may announce as early as today when the two presidents will meet to ostensibly sign a trade deal, while House of Commons effort to block a no-deal exit goes to the House of Lords today. India cut interest rates by 25 bp, the second consecutive cut.

Read More »

Read More »

FX Daily, April 03: Optimism Sweeps Through the Capital Markets

Overview: Japan announced the name of the new era that begins May 1 and a new emperor. The connotation is of beautiful harmony. And investors have taken the bit and run with it. Optimism that the US and China near reaching an agreement on trade. China and Europe have reported better than expected PMIs today.

Read More »

Read More »

FX Daily, April 02: Herding Cats

After surging yesterday, equities are struggling to maintain the momentum that carried that S&P 500 to its best level since last October. Most Asia Pacific equity markets advanced. Japan's small losses were a notable exception. The Dow Jones Stoxx 600 has advanced in four of the last five sessions and is little changed, while US shares are trading with a heavier bias.

Read More »

Read More »