Tag Archive: USD/CHF

FX Daily, November 13: Sterling Trounced by Growing Political Challenges

The US dollar has begun the new week on firm footing, without the help of either higher interest rates or increased confidence that Congress will agree on a tax plan. Indeed, over the weekend the Chair of the House Ways and Means Committee was explicit that the Senate plan to repeal the federal tax break for state and local taxes will not find support in the House of Representative.

Read More »

Read More »

FX Daily, November 03: Dollar Firms Ahead of What is Expected to Be Strong US Jobs Data

The US dollar is firm but is not going anywhere quickly. The lack of fresh interest rate support and uncertainty over the US tax proposals, which the Brady, the Chair of the House Ways and Means Committee hopes to have a revised version out after the weekend so the committee work can begin on Monday.

Read More »

Read More »

FX Daily, November 02: Dollar Pulls Back in Asia

We suggested the market was at crossroads. It is still not clear if the dollar's breakout, supported by higher yields is real or simply the fraying of ranges. Asia has pushed the dollar broadly lower. While the greenback finished the North American session above JPY114.00 for the first time since July, the fact that the US 10-year yield could not push back above the 2.40% level, does not help confidence.

Read More »

Read More »

FX Daily, November 01: Super 48 Hours

This is it: The next 48 hours will be among the busiest of the year. The Bank of England meets tomorrow, and it not only gives a verdict on interest rates but also provides an update of its economic projections (Quarterly Inflation Report). And, among the innovations, the MPC minutes will be released. Ahead of the Federal Reserve meeting, the market will have the ADP private-sector job estimate.

Read More »

Read More »

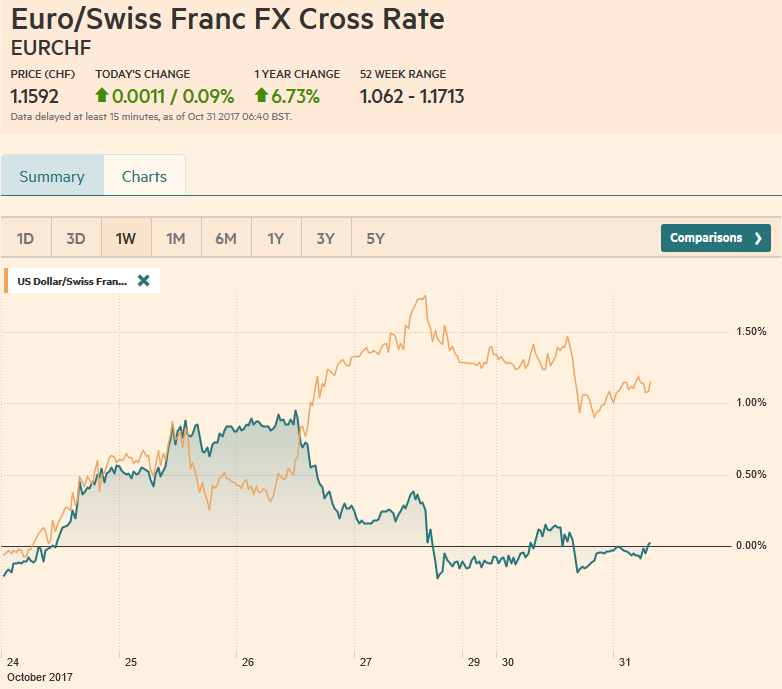

FX Daily, October 31: Month-End Leaves Market at Crossroads

Global equity markets are closing another strong month. The MSCI Asia Pacific Index was little changed on the day, but up 4.3% in October, the 10th consecutive monthly advance. Europe's Dow Jones Stoxx 600 is also flattish today, but up 1.6% on the month. It is the second monthly advance after a June-August swoon. The benchmark is closing in on the high for the year set in May.

Read More »

Read More »

FX Daily, October 30: Dollar Slips in Consolidative Activity

The markets are mixed, mostly responding to idiosyncratic developments, as the week's large events loom ahead. These BOJ, BOE, and FOMC meetings, eurozone flash CPI and US jobs reports. In addition, US President Trump is expected to announce his nomination of the next Fed chair, and the initial House tax bill will be unveiled.

Read More »

Read More »

FX Daily, October 27: Greenback Finishing Week on Firm Note

This has been a good week for the US dollar. The Dollar Index's 1.25% gain this week is the largest of the year. The driver is two-fold: positive developments in the US and negative developments abroad. The positive developments in the US include growing acceptance that the Fed will raise rates in December and that there will be more rate hikes next year. The Fed says three.

Read More »

Read More »

FX Daily, October 26: Draghi’s Day

It is all about the ECB meeting today. The market was hoping for more details last month, but Draghi pointed to today. The broad issue is well known. While growth has been strong, price pressures are still not, according to the ECB, on a durable path toward its "close but lower than 2%" target. The ECB judges that substantial additional stimulus is needed.

Read More »

Read More »

FX Daily, October 25: Sterling and Aussie Interrupt the Waiting Game

Most participants seemed comfortable marking time ahead of tomorrow's ECB meeting, and an announcement President Trump's nominations to the Federal Reserve. However, softer than expected Australian Q3 CPI and a stronger than expected UK Q3 GDP injected fresh incentives. Australia reported headline CPI rose 0.6% in Q3.

Read More »

Read More »

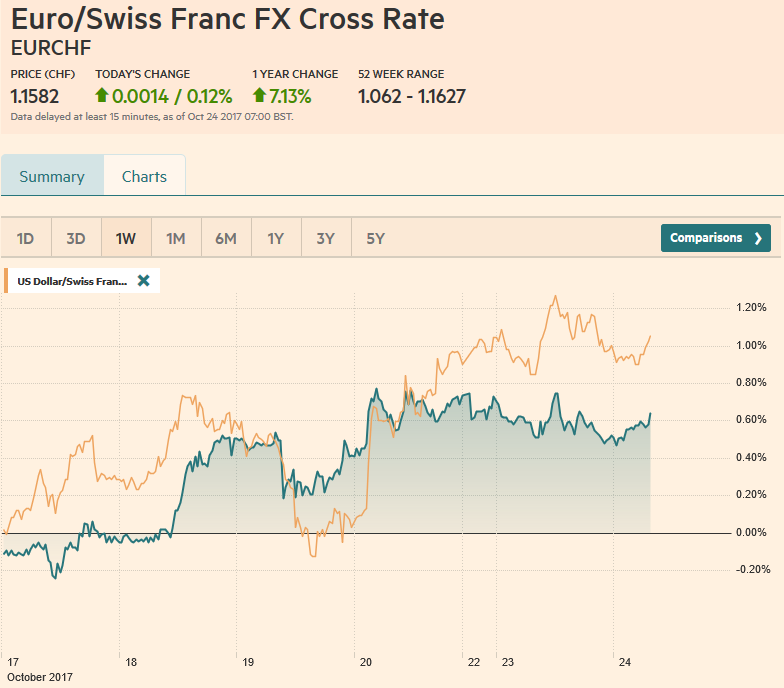

FX Daily, October 24: Dollar Treads Water as 10-year Yield Knocks on 2.40percent

The US dollar is narrowly mixed in mostly uneventful turnover in the foreign exchange market. There is a palpable sense of anticipation. Anticipation for the ECB meeting on Thursday, which is expected to see a six or nine-month extension of asset purchases at a pace half of the current 60 bln a month. Anticipation of the new Fed Chair, which President Trump says will be announced: "very, very soon."

Read More »

Read More »

FX Daily, October 23: US Dollar Starts New Week on Firm Note

The US dollar is enjoying modest gains against most currencies as prospects of both tax reform and additional monetary tightening by the Fed carry over from last week. The strong showing of the Liberal Democrats in Japan, where the governing coalition has maintained its super-majority is seen as confirmation of continuity. This helped lift Japanese shares and weighed on the yen. The Nikkei advanced 1.1%, the most in a month, and extends the...

Read More »

Read More »

FX Daily, October 20:Tax Prospects Lift Rates and Dollar Ahead of Weekend

The US Senate approved a budget resolution that is a necessary step toward using a parliamentary maneuver that prevents the Democrats to block tax reform by filibuster. This has helped spur dollar gains against all the major currencies and nearly all the emerging market currencies.

Read More »

Read More »

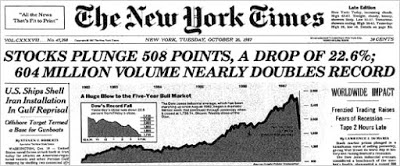

FX Daily, October 19: Kiwi Drop and Sterling Losses Punctuate Subdued FX Market

The 30th anniversary of the 1987 equity market crash the major US benchmarks at record highs. The drop in the market was at least partly a function of the lack of capacity, sufficient instruments, and regulatory regime. Each of these factors has been addressed to some extent. Circuit breakers have been introduced, and have evolved. The financial capacity has grown immensely.

Read More »

Read More »

FX Daily, October 13: Sterling Extends Yesterday’s Recovery; US Data Awaited

The EU's leading negotiator whipsawed sterling yesterday. The net effect was to ease fears that the UK would leave the EU without the agreement Initial concerns that the negotiations had stalled sent sterling to nearly $1.3120. The willingness to discuss a two-year transition period spurred sterling's recovery. After trading on both sides of Wednesdays, it closed on its highs was a bullish technical signal and there has been follow-through buying...

Read More »

Read More »

FX Daily, October 12: Discipline Argues Against Consensus Narrative

Following the release of the FOMC minutes from last month's meeting, the consensus narrative that has emerged says that it was dovish because there is a growing worry the reason inflation fell is not simply due to transitory factors. This explains, according to the narrative the dollar's losses and the stock market rally.

Read More »

Read More »

FX Daily, October 11: Markets Looking for a New Focus

The US dollar is consolidating after retreating since reversing lower following the US jobs data at the end of last week. While the greenback has largely been confined to yesterday's ranges against the major currencies, the euro has made a marginal new high, briefly trading through the $1.1830 area noted yesterday.

Read More »

Read More »

FX Daily, October 10: Dollar Pullback Extended

The US dollar's advance faltered before the weekend after rise average hourly earnings and a new cyclical low in unemployment and underemployment initially fueled greenback buying. There is no doubt the data was skewed by the storms, though the upward revision to the August hourly early cannot be attributed to the weather distortions. The reversal in the dollar before the weekend has carried over into the early trading this week. Even the Turkish...

Read More »

Read More »