Tag Archive: USD/CHF

FX Daily, May 25: US Dollar Loses Momentum Ahead of the Weekend

The euro and sterling were sold through yesterday's lows in Asia, but rebounded in Europe, with the help of mildly constructive data in the form of the German IFO and details of UK Q1 GDP. The IFO climate measure matched the April reading and thereby snapped a five-month slide. The expectations component slipped, but the current assessment improved.

Read More »

Read More »

FX Daily, May 24: Greenback Pushes Lower

The US dollar is pulling back after recording new highs for the year against the euro and sterling. The greenback is lower against nearly all the major currencies, but the Canadian dollar. It is also softer against most of the emerging market currencies. The chief exception is the Turkish lira. Yesterday's 300 bp rate hike could only stem the rot momentarily and the lira's 2.3% decline today, wipes out 2/3 of the annual rate increase.

Read More »

Read More »

FX Daily, May 23: Dollar and Yen Surge, European Data Disappoints

The US dollar has extended its gains against most of the major currencies. Momentum, positioning, and divergence continue to drive it. The euro briefly traded a little below $1.17, an important technical area and has enjoyed a bounce in late morning turnover in Europe.

Read More »

Read More »

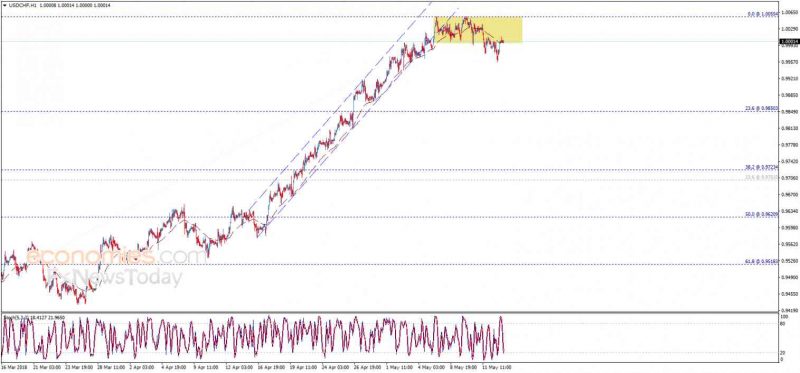

Weekly Technical Analysis: 21/05/2018 – USD/JPY, EUR/USD, GBP/JPY, USD/CAD, USD/CHF

The USDCHF pair reaches the key support 0.9955 now, and as we mentioned in our last report, breaking this level will confirm completing the double top pattern that appears on the chart, to rally towards our negative targets that begin at 0.9900 and extend to 0.9850. Therefore, we will continue to suggest the bearish trend supported by the negative pressure formed by the EMA50, unless the price managed to rally upwards to breach 1.0055 level and...

Read More »

Read More »

FX Daily, May 18: EUR/CHF Continues the Collapse

The US dollar is mostly firmer. US yields have stabilized. Asian equities were mostly higher, while European bourses are struggling. Oil prices are steady. There have been a number of sustained trends in the markets that we have been monitoring. The euro, for example, has fallen each day this week. It recorded its low for the year on Wednesday near $1.1765.

Read More »

Read More »

FX Daily, May 17: US Rates Edge Higher, while Dollar Turns Mixed

The Britsh pound was a cent from yesterday's lows on a press report that claimed the UK cabinet had agreed on seeking to stay in the customs union with the EU beyond the two-year transition period. The report suggested that the UK wanted to still negotiate other trade deals, which would seem to be a Trojan Horse.

Read More »

Read More »

FX Daily, May 16: US Yields Soften After Yesterday’s Surge

The US dollar is mixed today after the Dollar Index rose to new 2018 highs yesterday. It is being driven by rising US rates, which also punishes short dollar positions. The US 10-year yield rose seven basis points yesterday to nearly 3.10%. It is consolidating near 3.06% now. Many see the yield rising toward 3.20%, which would match the mid-2011 high.

Read More »

Read More »

FX Daily, May 15: Firm US Rates Underpin Greenback

US 10-year rates are again probing the air above 3%, and this is encouraging a push back toward JPY110, with the euro slipping toward $1.19. Asian equities fell, with the MSCI Asia Pacific shedding 0.8%, the most in nearly a month, snapping a three-day advance. China and India were able to buck the regional move. China's economic data was mostly softer than expected and is consistent with a gradual turn in the cycle as the Lunar New effect fades.

Read More »

Read More »

Weekly Technical Analysis: 14/05/2018 – USD/JPY, EUR/USD, EUR/JPY, GBP/USD, USD/CHF

The USDCHF pair provided positive trading yesterday to test 1.0000 level and settles around it, and as long as the price is below this level, our bearish overview will remain valid, noting that our next target is located at 0.9900, while breaching 1.0000 followed by 1.0055 levels represent the key to regain the main bullish trend again. Expected trading range for today is between 0.9920 support and 1.0055 resistance.

Read More »

Read More »

FX Daily, May 14: US Dollar Slips in Quiet Turnover

The US dollar is sporting a softer profile against most of the major and emerging market currencies to start the new week. It already seemed to be tiring in the second half of last week. With today's mild losses, Dollar Index is off for a fourth consecutive session, the longest losing streak in over a month. The US and China appear to have taken measure to diffuse the trade tensions between the world's two largest economies.

Read More »

Read More »

FX Daily, May 11: Dollar Momentum Sapped, Near-Term Pullback Likely

The US dollar pulled back following yesterday's slightly softer than expected CPI report and this likely marks the beginning of a new phase, with the dollar moving lower. Investors have learned over the past two weeks that neither wages nor consumer prices are accelerating. There is little reason in the recent string of data or official comments to suggest a more hawkish path for monetary policy (e.g., four rate hikes this year).

Read More »

Read More »

FX Daily, May 10: Kiwi Tumbles on Dovish RBNZ, While Sterling Goes Nowhere Ahead of BOE

The US dollar is consolidating in narrow trading against most of the major currencies as participants digest several developments ahead of what was expected to be the highlight today, the BOE meeting and US April CPI. The greenback's consolidation is giving it a heavier bias against most of the major currencies. The recently strong upside momentum has stalled, but the losses are modest and the euro and sterling are inside yesterday's ranges.

Read More »

Read More »

FX Daily, May 09: Oil Prices Surge and Dollar Gains Extended Post Withdrawal Announcement

The US dollar is broadly higher as the 10-year yield probes above 3.0%. Disappointing French industrial production and manufacturing data for March provided additional incentive, as if it were needed, to extend the euro's losses. The euro dipped below $1.1825. The single currency is off a cent this week after falling nearly two last week. A 38.2% retracement of the euro's gains since the beginning of last year is found a little above $1.1700 and...

Read More »

Read More »

Weekly Technical Analysis: 07/05/2018 – USD/JPY, EUR/USD, GBP/USD, Gold

The USDCHF pair’s recent trades are confined within mew minor bearish channel that we believe it forms bullish flag pattern, thus, the price needs to breach 1.0035 to activate the positive effect of this pattern followed by rallying towards our waited target at 1.0100. Therefore, we will continue to suggest the bullish trend supported by the EMA50, unless we witnessed clear break and hold below 1.0000. Expected trading range for today is between...

Read More »

Read More »

FX Daily, May 08: Dollar Races Ahead

The US dollar's surge continues. The Dollar Index is testing the space above 93.00. A month ago it was below 90. It does not appear to require fresh developments. The market continues to trade as if there are short dollar positions that are trapped at higher levels and the briefest and shallow pullbacks are new opportunities to adjust positions.

Read More »

Read More »

FX Daily, May 07: Greenback Starts Week on Firm Note

The US dollar recovered from a softer tone in early Asia and is higher against nearly all the major and emerging market currencies as North American market prepare to start the new week. The news stream is light and investors remain on edge geopolitical concerns remain elevated. Oil prices are extending gains, and WTI is above $70 a barrel for the first time since November 2014. Alongside an inverse yield curve, a jump in oil prices typically...

Read More »

Read More »

FX Daily, May 04: US Jobs-Not the Driver it Once Was

The US dollar fell last month in response to the disappointing non-farm payroll report. However, in general, the jobs report is not the market mover that it was in the past. With unemployment is at cyclical lows of 4.1% and poised to fall further. Weekly jobless claims and continuing claims at or near lows in a generation, though over qualification is more difficult than previously.

Read More »

Read More »

FX Daily, May 03: Respite to Dollar Short Squeeze

The Australian dollar is higher for a second session. It has been helped today by stronger than expected data in the form of a larger than expected March trade surplus (A$1.57 bln vs. expectations for A$865 mln) and building permits up more than twice as expected (2.6% vs. 1.0%). Today is the first session since April 19 that the Australian dollar has risen above the previous day's high. Initial resistance is seen near $0.7550 and then $0.7580.

Read More »

Read More »

FX Daily, May 02: Confident Fed Key to New Found Respect for the Dollar

There is a brief respite in the powerful short squeeze that has fueled the dollar's dramatic recovery. The greenback which was nearly friendless a month ago now has many suitors. It is higher on the year against all the major currencies but the yen (~2.6%), the Norwegian krone (~1.6%) and sterling ~0.9%). It is virtually flat against the euro.

Read More »

Read More »

FX Daily, May 01: Little Help on May Day

Most of the world's financial centers are closed for the May Day holiday, but the lack of participation has not prevented the extension of the US dollar's recovery. The Dollar Index has traded above its 200-day moving average for the first time in a year.

Read More »

Read More »