Tag Archive: USD/CHF

FX Daily, April 30: Dollar Pares more Gains as EMU GDP Surprise

Overview: The S&P 500 set a new record high and close yesterday, but the lift to global markets was not strong enough to overcome the disappointing Chinese PMI. Although Chinese equities traded higher on ideas that the news will spur additional stimulative measures, other Asian markets were mixed.

Read More »

Read More »

FX Daily, April 29: The Busy Week Begins Slowly

Overview: It promises to be an eventful week with the FOMC and BOE meeting, US jobs report and EMU April CPI and Q1 GDP on tap. However, the week is marked by the May Day holiday in the middle of the week. Japan's markets are closed all week, while China's markets are closed from mid-week on for an extended holiday. The week has begun on a decidedly consolidative tone.

Read More »

Read More »

FX Daily, April 26: Greenback Consolidates Ahead of Q1 GDP

Overview: The equities are finishing softly after the rally stalled in the middle of the week. The large markets in Asia fell, led by China, and the MSCI Asia Pacific Index fell for a third session, the longest losing streak in two months. Europe's Dow Jones Stoxx 600 ended an eight-day advance with a two-day loss coming into today where it is a little softer.

Read More »

Read More »

FX Daily, April 23: Oil Extends Gains While Markets Await Fresh Incentives

Overview: Financial centers that have been closed for the extended holiday have re-opened, but the news stream is light and market participants are digesting developments and positioning for this week's central bank meetings and the first look at Q1 US GDP. The US decision to end exemptions to the embargo against Iran led to a surge in oil prices, which are extending gains to new six-highs today.

Read More »

Read More »

FX Daily, April 22: Surge in Oil Punctures Holiday Markets

Overview: With many centers closed for the extended holiday, the calm in the global capital markets has been punctuated by reports that the US is considering ending its exemption for eight countries to have bought Iranian oil over the past six months. The waivers were to end on May 2, but previously it was thought that a couple of waivers, like for China and India, would be extended.

Read More »

Read More »

FX Daily, April 18: EMU Disappointment Lifts the Dollar

Overview: A bout of profit-taking in equities began in the US yesterday and has carried through Asia and Europe today. The MSCI Asia Pacific Index fell for the first time in five days, while the Dow Jones Stoxx 600 is snapping a six-day advance. The Nikkei gapped higher to start the week and a gap low tomorrow would undermine the technical outlook.

Read More »

Read More »

FX Daily, April 12: Euro Bid Above $1.13 for the First Time this Month

Overview: The consolidative week in the capital markets is drawing to a close. Equity markets are narrowly mixed. In Asia, most indices outside of the greater China (China, Taiwan, and Hong Kong) edged higher, leaving the MSCI Asia Pacific Index slightly lower on the week. The MSCI Emerging Markets Index snapped a ten-day rally yesterday and is little changed so far today.

Read More »

Read More »

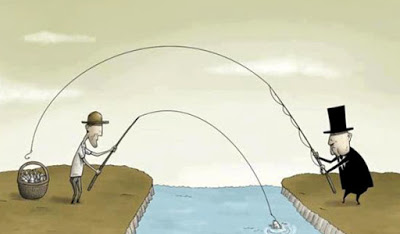

FX Daily, April 10: Be Careful What You Wish For

There were only a few formal disputes under NAFTA 1.0. It says more about the adjudication process than the underlying issues. It was not binding. The Democrats want stronger enforcement provisions in what the NAFTA 2.0. It is understandable. Still, without opening up the agreement, which had been already agreed to by three heads of state, it is difficult to see how this will happen.

Read More »

Read More »

FX Daily, April 09: Is the USMCA Dead?

The heads of state may have agreed on the modernization of NAFTA, but the necessary legislative approval may not be forthcoming this year. The US legislative process has been complicated by the fact that the Democrats secured a majority in the House of Representatives last year.

Read More »

Read More »

FX Daily, April 8: Brexit, the EU-China, and the Abandonment of the Open Door

(I am in Mexico at the World Trade Center General Assembly, participating on a panel about USMCA--NAFTA2.0--for which approval remains elusive. It is possible that the US threatens to pull out of NAFTA 1.0 to force action by the US Congress. Mexico is due to pass legislation this week that may meet demands by the some in the US and Canada for stronger labor protections.

Read More »

Read More »

FX Daily, April 05: Trade Talk and German Industrial Output Lifts Sentiment

Overview: Comments by Chinese President Xi, recognizing substantial progress in trade, helped boost sentiment after the US-China negotiators failed to set a date for the meeting between the two presidents. Although we have argued that the German economy may be past the worst, the sharp drop in factory orders spooked investors.

Read More »

Read More »

FX Daily, April 04: Limited Price Action Does not Do Justice to Macro Developments

Overview: The global capital markets are subdued despite several macro developments. The US and China may announce as early as today when the two presidents will meet to ostensibly sign a trade deal, while House of Commons effort to block a no-deal exit goes to the House of Lords today. India cut interest rates by 25 bp, the second consecutive cut.

Read More »

Read More »

FX Daily, April 03: Optimism Sweeps Through the Capital Markets

Overview: Japan announced the name of the new era that begins May 1 and a new emperor. The connotation is of beautiful harmony. And investors have taken the bit and run with it. Optimism that the US and China near reaching an agreement on trade. China and Europe have reported better than expected PMIs today.

Read More »

Read More »

FX Daily, March 29: Equities Bounce While Bonds Pullback to End Q1

The global growth scare may be subsiding. It had been fanned by the ECB and Fed statements and projections. Poor US jobs growth reported in early March and the poor flash EMU PMI late in the month contributed. The slowdown in China and the flurry of measures to combat it also had a role.

Read More »

Read More »

FX Daily, March 28: Brexit Uncertainty Deepens as Parliament is Divided, while Turkey’s Short Squeeze Falters

The lurch lower in global interest rates continue. The US 10-year yield is at new 15-month lows, five basis points through the average effective Fed funds rate. Late yesterday, it appeared that 10-year German Bund yields slipped below similar Japanese government bond yields for the first time since Q4 16, but when the JGB market opened, it the 10-year JGB yield fell a couple more basis points to minus 10, the most negative since August 2016.

Read More »

Read More »

FX Daily, March 27: Global Bond Rally Continues, Greenback Remains Firm

Overview: The US 10-year yield is trading below the Fed funds target. The two-year yield is trading below the lower end of the Fed funds target range. A warning by New Zealand that the next rate move could be a cut sent New Zealand and Australian yields to new record lows. In Japan, the 10-year yield slipped below the overnight unsecured call rate.

Read More »

Read More »

FX Daily, March 26: Semblance of Stability Re-Emerging

Overview: The sell-off in equities seemed to peak yesterday, and US indices were narrowly mixed. Traders found comfort in that performance, even though the S&P 500 finished a little below 2800, and took the markets in the Asia-Pacific region higher, except in China, where the Shanghai Composite fell 1.5%.

Read More »

Read More »

FX Daily, March 25: Monday Blues: Equities Pare Quarterly Gains

Overview: Global equities have soured after the US shares dropped the most since very early in the year before the weekend. Asia's sell-off was led by the 3% decline in Nikkei, while Malaysia fared among the best, surrendering 1%. Europe's Dow Jones Stoxx 600 is off for a fourth session. It lost 1.2% at the end of last week and gapped lower today but stabilizing after the better than expected German IFO survey.

Read More »

Read More »

FX Daily, March 22: Dreadful EMU PMI and US Machinations Rival Brexit for Attention

Overview: The S&P 500 recovered from the post-FOMC reversal to close a new 5-month high yesterday, led by technology. Financials were the only main sector to retreat. The large equity markets in Asia, Japan, China, Australia, South Korea, and Taiwan all advanced. Europe's Dow Jones Stoxx 600 reversed its initial gains and is nursing a small loss on the week.

Read More »

Read More »

FX Daily, March 21: Dovish Fed Sends Global Yields Lower, but Little Succor for Stocks

The dovishness of the Federal Reserve sent ripples through the capital markets. US equities reversed initial gains, but Asia Pacific equities edged higher, though Japanese markets were closed for a national holiday. European shares are struggling, as financials and consumer discretionary lead the 0.3% push lower. US shares are also trading with a heavier bias.

Read More »

Read More »