Tag Archive: USD/CHF

FX Daily, November 20: Dollar Snaps Back

Overview: The idea that a US-China trade deal is proving more elusive than the agreement in principle on October 11 implied is being seized upon to spur what we suspect is an overdue round of profit-taking in global equities. The MSCI Asia Pacific Index snapped a three-advance, with over 1% declines in South Korea and Australia.

Read More »

Read More »

FX Daily, November 19: Hong Kong Stocks Rally as Stand-Off Continues

Overview: The run-up in equities continues to be the dominant development in the capital markets. Although the Japanese and South Korean bourses fell, the rise in Australia, China, Hong Kong, and Taiwan underpin the MSCI Asia Pacific Index. The Hang Seng's gains (1.5% on top of yesterday's 1.3% rise) is notable as the situation on the ground remains intense and unresolved.

Read More »

Read More »

FX Daily, November 18: Sterling Shines in Subdued Start to the New Week

Overview: Equities in Europe and the US look to extend their six-week rally, while the MSCI Asia Pacific Index gets back on the winning way after stumbling last week. Despite the escalation of the conflict in Hong Kong, the Hang Seng rose 1.35% to lead the region and recoup a chunk of last week's 4.8% slump. The Dow Jones Stoxx 600 puts the European benchmark within spitting distance of the four-year high set recently.

Read More »

Read More »

USD/CHF technical analysis: Bulls struggle to extend the recovery beyond 0.9900 handle

Renewed US-China trade optimism helped regain some traction. The uptick lacked bullish conviction and warrants some caution. The USD/CHF pair stalled its recent pullback from levels beyond 200-day SMA and regained some traction on the last trading day of the week. Renewed trade optimism weighed on the Swiss franc's safe-haven status and led to a modest recovery, though bulls struggled to extend the momentum beyond the 0.9900 handle.

Read More »

Read More »

FX Daily, November 15: Market Runs with US Line that US-China Deal is Close

Comments by US presidential adviser Kudlow playing up the prospects of a trade agreement between the US and China, with other reports suggesting a key call be held today, is helping to underpin sentiment into the weekend. The MSCI Asia Pacific Index pared this week's loss today, with China the only main market not participating, despite the PBOC's unexpected injection of CNY200 bln of the Medium-Term Lending Facility.

Read More »

Read More »

FX Daily, November 14: Unexpected German Growth Fails to Buoy the Euro

Overview: Rising trade anxiety and disappointing economic reports from the Asia Pacific region helped unpin the profit-taking mood in equities, while bond yields continued to pullback. The MSCI Asia Pacific Index and the Dow Jones Stoxx 600 are in the red for the fourth time in the last five sessions. Germany reported a surprise 0.1% expansion in Q3, but it has done little for the DAX or the euro.

Read More »

Read More »

FX Daily, November 13: Investors Temper Euphoria

Overview: The recent rise in equity markets and backing up in yields spurred many observers to upgrade their macroeconomic outlooks rather than the other way around. Yet we continue to see may worrisome signs. It is not just trade, though, of course, that is part of it. Sentiment itself is fragile and will likely follow prices.

Read More »

Read More »

USD/CHF technical analysis: Greenback loses steam against Swissy, trades near 0.9930 level

USD/CHF erased its intraday gains, settling near the 0.9930 level. Support is seen at the 0.9920 level. On the daily chart, USD/CHF is trading in a range below its 200-day simple moving average (DMA). The spot is holding just above the 50 SMA today at the 0.9921 level.

Read More »

Read More »

FX Daily, November 12: Farage Declares Truce with Tories after being Offered a Peerage, Underpins Sterling

Global capital markets are calm as investors look for a new catalyst. The MSCI Asia Pacific Index snapped back after posting its first back-to-back decline in a month. All the equity markets were higher, but Australia. The Nikkei, Kospi, and Taiex led the advance with about a 0.8% gain. European shares closed firmly near session highs yesterday, even if still lower on the day, and there has been some follow-through buying today.

Read More »

Read More »

FX Daily, November 11: Dollar Consolidates and Equities Follow Asia Lower

Overview: Escalating violence in Hong Kong and the continued fall in Chinese producer prices weighed on equities in Asia Pacific trading. The MSCI Asia Pacific Index has risen nearly 7% during the five-week rally and is off to a weak start this week. Hong Kong's Hang Seng fell around 2.6%, its biggest loss in three months, and China's CSI 300 was off 1.75%. Nearly all the local markets fell but Australia.

Read More »

Read More »

FX Daily, November 8: Risk Appetites Satiated Ahead of the Weekend

The capital markets are consolidating the recent moves ahead of the weekend. Equities are paring this week's gains, though the Nikkei, which was closed on Monday, extended its advance for the fourth consecutive session. Despite the profit-taking today, the MSCI Asia Pacific Index rose for the fifth week. Europe's Dow Jones Stoxx 600 is snapping a five-day rally, but it is closing in on the fifth consecutive weekly advance.

Read More »

Read More »

USD/CHF extends rally to 0.9975, highest since mid-October

Swiss Franc amid the worst performers on Thursday amid positive trade headlines. US dollar rises supported by higher US yields; Wall Street hits a new record. The USD/CHF pair broke to the upside after trading sideways around 0.9925 for hours. It climbed to 0.9975, reaching a three-week high. Near the end of the session, it is consolidating gains, holding above relevant short-term technical levels.

Read More »

Read More »

FX Daily, November 7: Trade Optimism Boosts Sentiment but Weighs on the Dollar

Indications that a phase one agreement between the US and China would include rolling back some existing tariffs is boosting risking appetites, sending stocks higher, and pushing up yields. However, this appears to be simply a restating of China's views rather than a new breakthrough. The dollar is paring its recent gains. The MSCI Asia Pacific Index rose for the fifth time in six sessions to reach its best level since August 2018.

Read More »

Read More »

USD/CHF technical analysis: Greenback hanging near the November highs against CHF

USD/CHF is trading flat on the day, consolidating the gains of the last two days. The level to beat for bulls is the 0.9940/0.9956 resistance zone. On the daily chart, USD/CHF is trading in a range below its 200-day simple moving average (DMA). The market is holding just above the 50 SMA today at the 0.9916 level.

Read More »

Read More »

FX Daily, November 6: Markets Catch Collective Breath as Dollar Consolidates Yesterday’s Advance

Overview: Investors seem to be catching their collective breath today, and the global capital markets are consolidating recent moves. A notable exception is the Chinese yuan, which has continued to strengthen, and the dollar has slipped back below CNY7.0. Asia Pacific equities were mixed, and the four-day advance in the regional benchmark stalled today.

Read More »

Read More »

FX Daily, November 5: Animal Spirits Remain Animated

The prospects that the US-China deal could include some rolling back of existing US tariffs helped underpin risk appetites. After new record highs in the US S&P 500 and NASDAQ, Asia Pacific markets marched higher, and the MSCI Asia Pacific reached its highest level since August 2018. A small rate cut by China and catch-up by Tokyo, which was on holiday on Monday, helped extended the regional rally for the 14th session in the past 17.

Read More »

Read More »

FX Daily, November 4: Investor Optimism Carries into the New Week

Overview: Investor optimism is reflected by the risk-taking appetite that is lifting equity markets and bond yields. With Japanese markets closed for a national holiday, the MSCI Asia Pacific Index was led higher by more than 1% gains in Hong Kong, Taiwan, South Korea, and Thailand. The regional benchmark advanced for the seventh session in the past eight and is approaching the year's high.

Read More »

Read More »

FX Daily, November 1: Dollar Remains on the Defensive Ahead of Jobs Report

Overview: An unexpected increase in China's Caixin manufacturing PMI helped lift Asia Pacific equities after the S&P 500 stumbled yesterday amid concerns that there will not be a phase 2 in US-China trade negotiations. The MSCI Asia Pacific Index rose 4.3% in October, and with the help of gains in China, Hong Kong, Korea, and Taiwan began November with a gain.

Read More »

Read More »

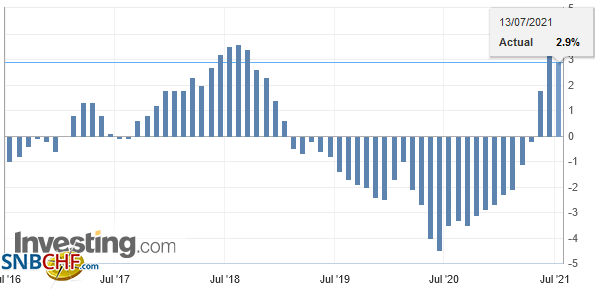

SNB’s Jordan: Without negative rates, CHF would be more attractive and rise in value

In his prepared remarks delivered to pension managers on Thursday, Swiss National Bank Chairman Thomas Jordan said negative interest rates and readiness to intervene in the forex market was still essential to ease the pressure on the Swiss Franc.

Read More »

Read More »

USD/CHF technical analysis: Greenback nearing the October lows, consolidating near 0.9870 level

USD/CHF is consolidating its losses this Thursday. The level to beat for bears is the 0.9855 support. On the daily chart, USD/CHF is trading in a range below its main daily simple moving averages (DSMAs). The market is approaching the October low, currently at the 0.9837 price level.

Read More »

Read More »

-637094243479377368-800x391.png)