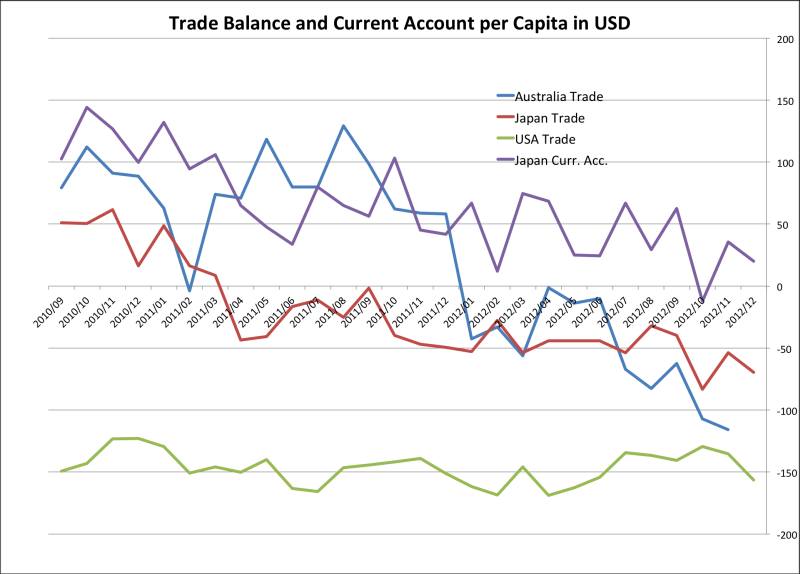

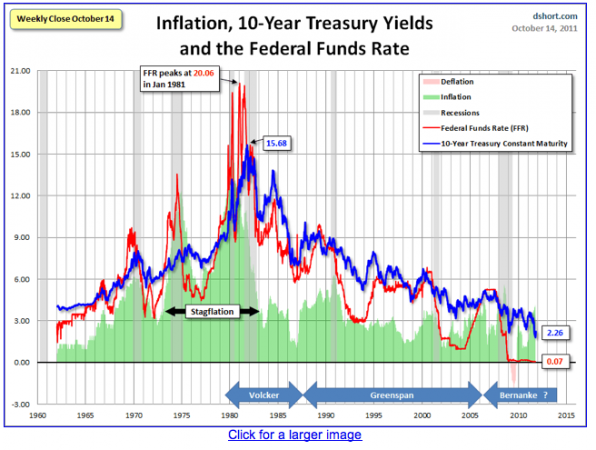

In our first part on Japans currency debasement, we look on three aspects, government bond yields, current account balances and potential hyper-inflation which causes yields to rise strongly.

Read More »

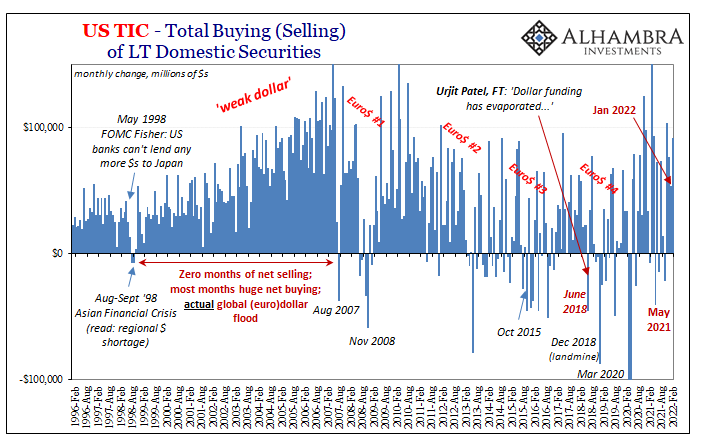

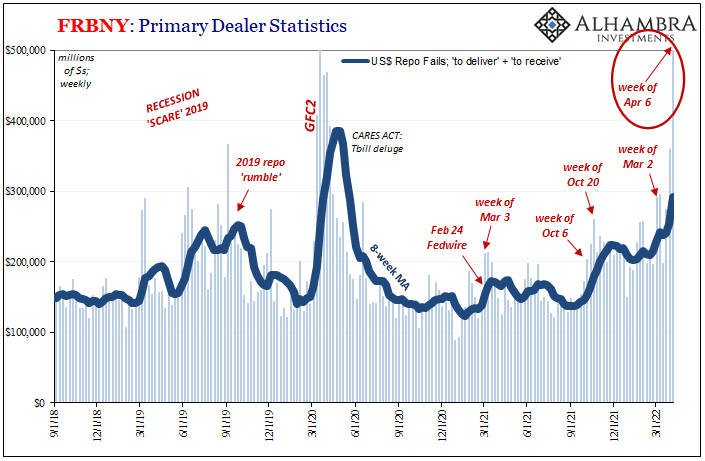

Tag Archive: U.S. Treasuries

Helicopter Money against Animal Spirits and our Critique

The newest paper by McCulley and Poszar "Helicopter Money: or how I stopped worrying and love fiscal-monetary cooperation" presents fiscal policy and monetary policy along these two criteria

Read More »

Read More »

The Biggest Bubble of the Century is Ending: Government Bond Yields

Government bond yields under 10 years for safe-havens are close to zero. In April 2013, even 20 year bond yields are less than 3%, What can explain this bubble of the century? Update August 16, 2013: So, 10-year Treasury yields have ended the day closer to 3 per cent. But not as close as they … Continue reading »

Read More »

Read More »

Who Has Got the Problem? Europe or Japan?

A couple of months ago the euro traded close to EUR/USD 1.20 and the whole world was betting on its breakdown. Once the euro downtrend ended thanks to QE3, OMT and euro zone current account surpluses, the common currency did not stop to appreciate against the yen and reached levels of EUR/JPY 104 and above. … Continue reading...

Read More »

Read More »