Tag Archive: U.S. Savings Rate

A savings rate is the amount of money, expressed as a percentage or ratio, that a person deducts from his disposable personal income to set aside as a nest egg or for retirement. The cash accumulated is typically put into very low-risk investments (depending on various factors such as expected time until retirement), like a money market fund or a personal individual retirement account (IRA) composed of non-aggressive mutual funds, stocks and bonds.

Retail Sales, Consumer Sentiment, And The Aftermath Of Hurricanes

Consumer confidence has been sky-high for some time now, with the major indices tracking various definitions of it at or just near highs not seen since the dot-com era. Economists place a lot of emphasis on confidence in all its forms, including that of consumers, and there is good reason for them to do so; or there was in the past.

Read More »

Read More »

The Savings Rate Conundrum

The economy is booming. Employment is at decade lows. Unemployment claims are at the lowest levels in 40-years. The stock market is at record highs and climbing. Consumers are more confident than they have been in a decade. Wages are finally showing signs of growth.

Read More »

Read More »

The (Economic) Difference Between Stocks and Bonds

Real Personal Consumption Expenditures (PCE) rose 0.6% in September 2017 above August. That was the largest monthly increase (SAAR) in almost three years. Given that Real PCE declined month-over-month in August, it is reasonable to assume hurricane effects for both. Across the two months, Real PCE rose by a far more modest 0.5% total, or an annual rate of just 3.4%, only slightly greater the prevailing average.

Read More »

Read More »

US Retail Sales: Retail Storms

Retail sales were added in September 2017 due to the hurricanes in Texas and Florida (and the other states less directly impacted). On a monthly, seasonally-adjusted basis, retail sales were up a sharp 1.7% from August. The vast majority of the gain, however, was in the shock jump in gasoline prices. Retail sales at gasoline stations rose nearly 6% month-over-month, so excluding those sales retail sales elsewhere gained a far more modest 0.6%.

Read More »

Read More »

The Damage Started Months Before Harvey And Irma

Ahead of tomorrow’s payroll report the narrative is being set that it will be weak because of Harvey and Irma. Historically, major storms have had a negative effect on the labor market. Just as auto sales were up sharply in September very likely because of the hurricane(s) and could remain that way for several months, payrolls could be weak for the same reasons and the same timeframe.

Read More »

Read More »

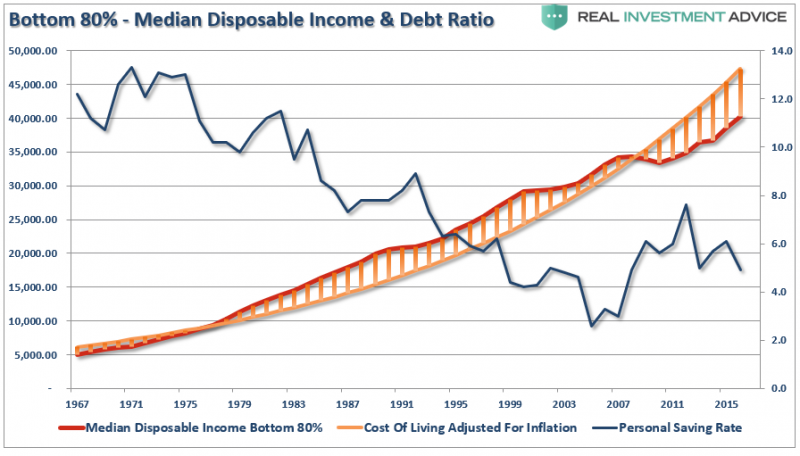

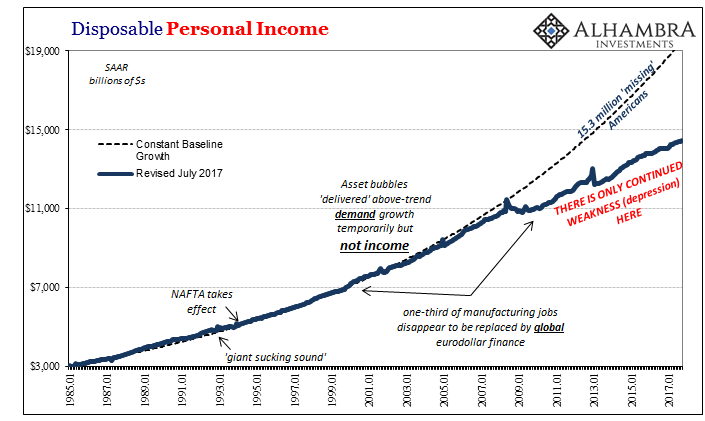

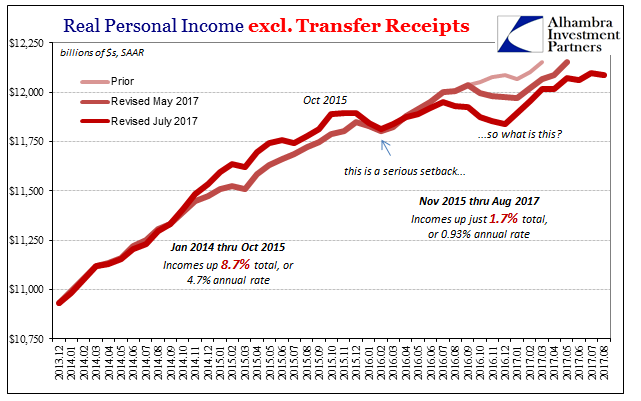

Incomes Are What Matters, So Bad Month, Bad Year, Bad Decade

Sometimes economics can be complicated, such as why the labor market has slowed in such lingering fashion since early 2015. Sometimes economics can be easy, such as why there is so much less to the economy this year than thought. The easy part relates to the hard part. The labor market slowed and so did national income. Though so much of official focus is on debt supplementation, it’s always, always about income.

Read More »

Read More »

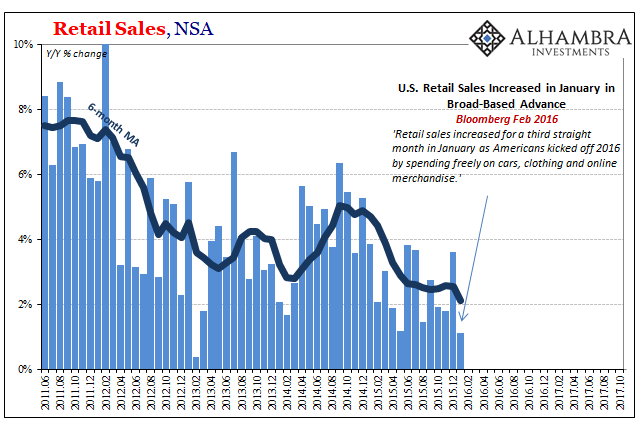

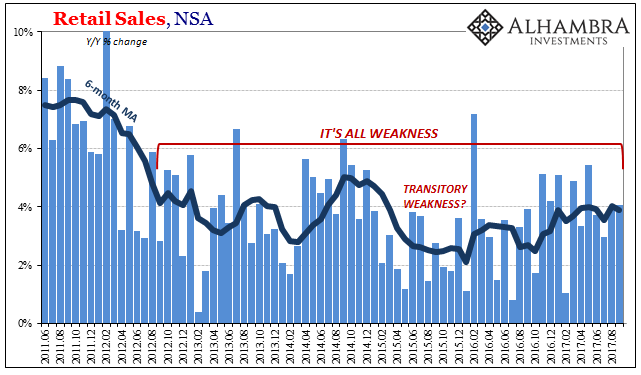

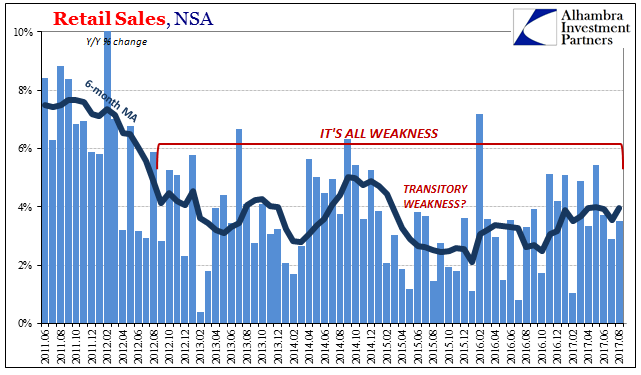

Retail Sales and the End of ‘Reflation’

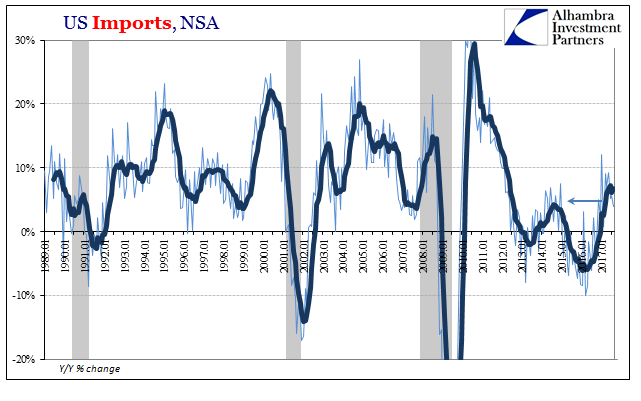

There will be an irresistible urge to the make this about the weather, but more and more data shows it’s not any singular instance. Nor is it transitory. What does prove to be temporary time and again is the upside. The economy gets hit (by “dollar” events), bounces back a little, and then goes right back into the dumps. This, it seems, is the limited extent of cyclicality in these times.

Read More »

Read More »

Net National Savings Rate, the Best Alternative Indicator to GDP Growth

For us the Net National Savings Rate is the best alternative indictator to GDP growth. It is positively correlated with the change in wealth, with the establishment of future productive capacity, the price of government bonds and currency valuations. But today GDP growth is often negatively correlated to the Net Savings Rate. Hence GDP is often a less useful measure.

Read More »

Read More »

FX Daily, August 02: Greenback Slides Despite RBA Rate Cut and 7-year Low in UK Construction PMI

The US dollar is offered against the major currencies, but appreciating against many emerging market currencies, include the South African rand and Turkish lira. Oil prices are trying to stabilize with Brent near $42 and WTI near $40, but the recent losses continue to weigh on the Malaysian ringgit and the Mexican peso.

Read More »

Read More »

Stockman Rages: Ben Bernanke Is “The Most Dangerous Man Walking This Planet”

Ben Bernanke is one of the most dangerous men walking the planet. In this age of central bank domination of economic life he is surely the pied piper of monetary ruin. At least since 2002 he has been talking about “helicopter money” as if a notion which is pure economic quackery actually had some legitimate basis.

Read More »

Read More »

Weak CHF during the Fat Years of the Joseph Cycle

In December 2015, the seven year Joseph cycle ended with a Fed rate hike. These lean years of the Joseph cycle started in December 2008 when the Fed lowered rates to the current level. We think that in the next seven year cycle, even the risk-averse Swiss investors will buy more foreign assets, not only the central bank and speculators. Different crises have passed in the three parts of the world, the U.S. subprime, the euro crisis and the Emerging...

Read More »

Read More »

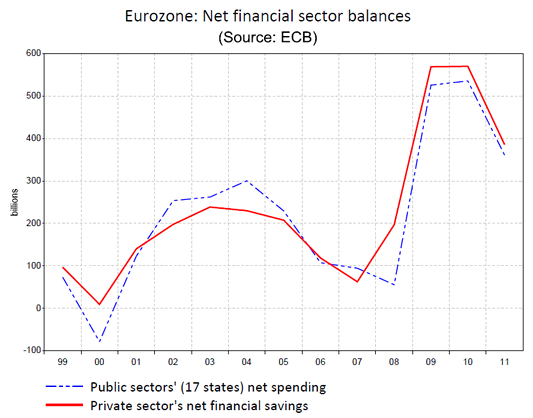

(5.4) The Relationship between Current Accounts and Savings

Private savings finance public deficit and current account surpluses. Important for understanding the euro crisis and the drivers of government bond yields.

Read More »

Read More »

(6.1) FX Theory: The relationship between Current Accounts Surpluses and the Carry Trade

The EUR/USD is going on its longest winning streak for a long time. Since May 27, it has improved from 1.2850 to 1.3396 and is approaching 1.34. What are the reasons?

Read More »

Read More »

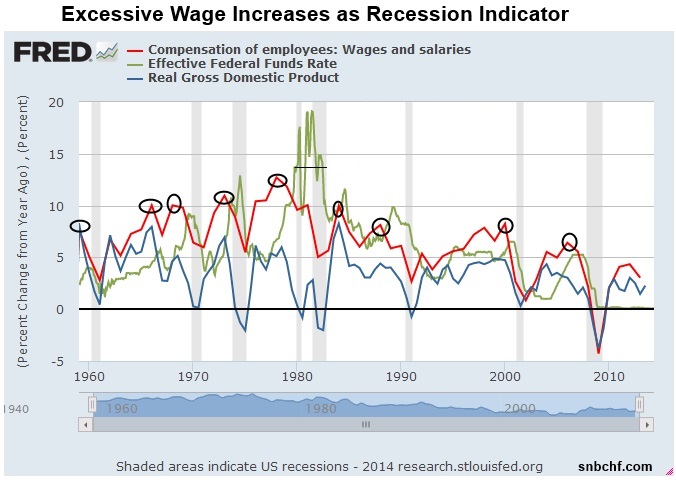

A Little History of Wages, Inflation, Treasuries and the Fed – And What We Learn from it

On this page we show that

Inflation expectations and wages drive the behaviour of the Fed and Treasury bond yields.

Excessive wage increases lead to recessions, more or less voluntarily caused by central bank tightening

Central banks pin down the short end of the yield curve, while financial-market participants price longer-dated yields

Some Emerging Markets seem to copy strong wage increases and inflation that we lived in the 1970s

Quickly...

Read More »

Read More »

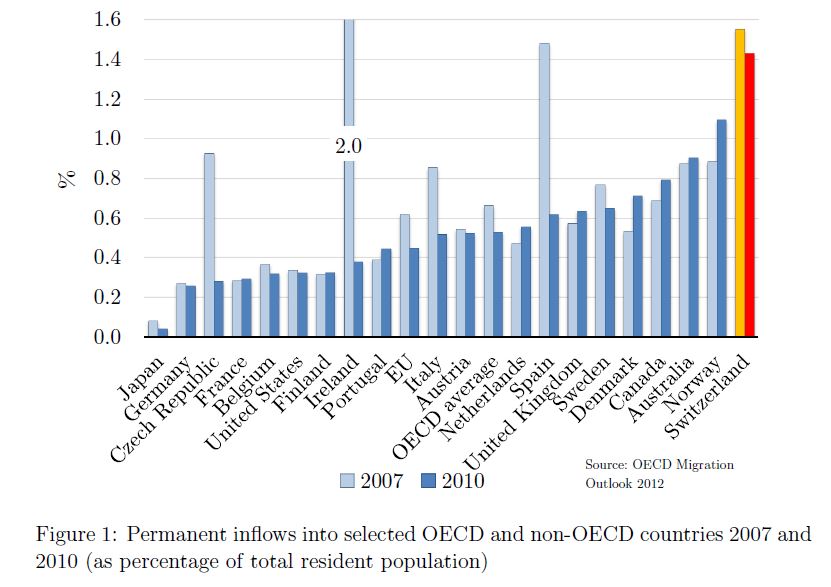

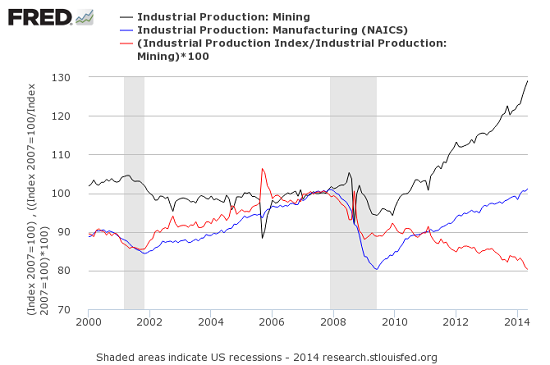

Will the Dollar Appreciate on higher U.S. Savings and a Smaller Trade Deficit?

In summer 2013, even the sceptical and "gold-friendly" economist John Mauldin followed the mainstream thinking that fracking and other technology could reduce OPEC's and the Chinese advantage in global trade and reduce the U.S. trade deficit. Recently both claims got refuted: the first with WTI crude oil prices rising to nearly 108$ despite enhanced supply. Detailed data showed that rising U.S. industrial production was not caused by more...

Read More »

Read More »

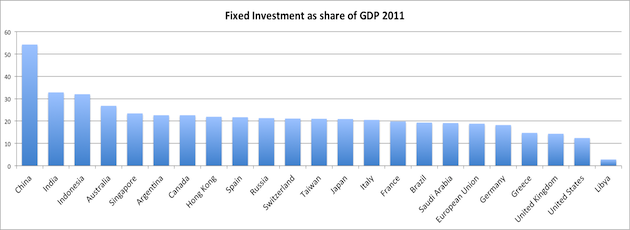

Is China’s Growth Rate Healthy Now? Golden Rule of Capital

After a slowing in Chinese growth this year, economists recently stated that a hard landing has been avoided and that the economy might have bottomed out. Marc Faber has changed his mind and considers buying Chinese stocks. Also Sprach Analyst provides the following data: Sequential growth rates since Q1 through Q3 were 1.5%, 2.0% and 2.2% respectively, or in annualised annual rate, 6.16%, 8.24%, and 9.09% respectively. Compared that with the...

Read More »

Read More »