Tag Archive: U.S. Participation Rate

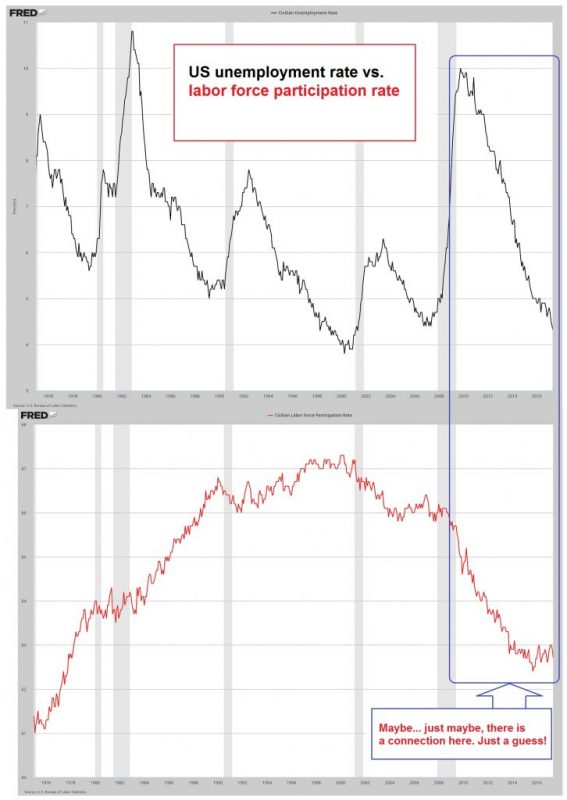

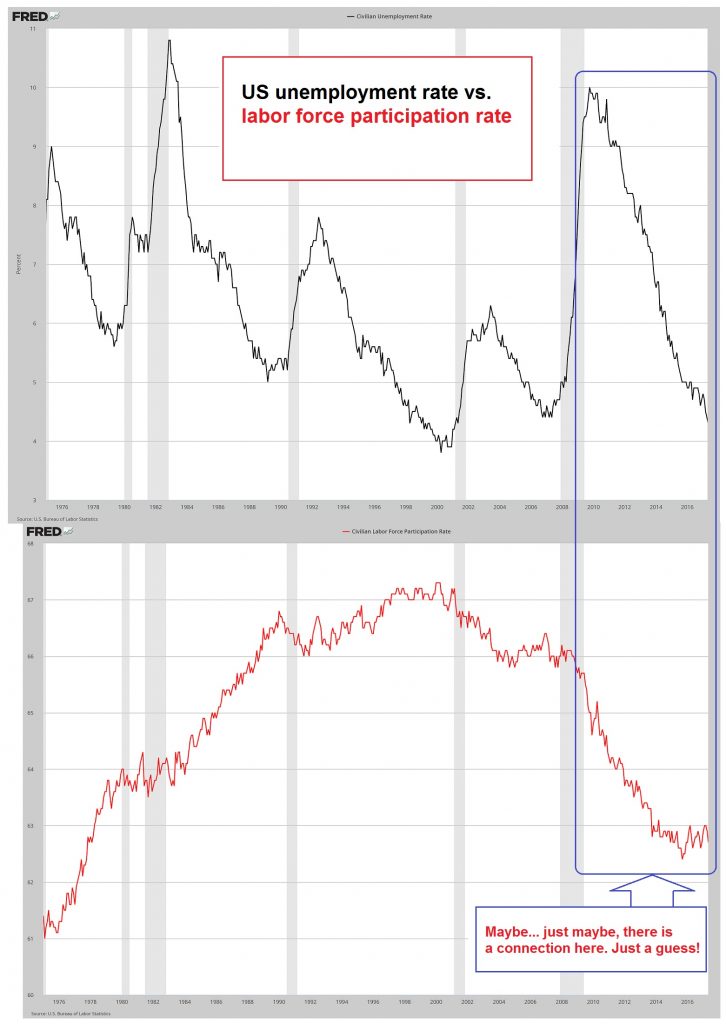

The participation rate is an important indicator of the supply of labor. It measures the share of the working-age population either working or looking for work. The number of people who are no longer actively searching for work would not be included in the participation rate.

FX Daily, June 5: Greenback Remains Soft Ahead of Employment Report, but Reversal Possible

The modest loss in the S&P 500 and NASDAQ yesterday did not signal the end of the bull run. All the markets in the Asia Pacific region rallied, with the Hang Seng among the strongest with a 1.6% advance that brought the week's gain to around 7.8%. South Korea's Kospi was not far behind with a weekly gain of 7.5%. In the past two weeks, the MSCI Asia Pacific Index is up nearly 10%.

Read More »

Read More »

FX Daily, May 8: Jobs and Negative Fed Funds Futures

Overview: The S&P 500 closed near its session lows for the third day running yesterday but failed to deter the bulls in Asia-Pacific, where most markets rose by more than 1%. Taiwan, Korea, and Australia lagged a bit though closed higher. Europe's Dow Jones Stoxx 600 is firm, and the modest gains (~0.5%) would be enough to ensure a higher weekly close if it can be maintained.

Read More »

Read More »

FX Daily, February 7: Dollar Rides High as Eurozone Disappoints, and Caution Sets In

Overview: A more cautious tone is evident today in the markets, which seem to have run well ahead of macro developments and evidence that the new coronavirus is not yet contained. After a roughly 3.5% advance in the past three sessions, the MSCI Asia Pacific index pulled back with nearly the markets in the region slipping.

Read More »

Read More »

FX Daily, January 10: Jobs Friday: Asymmetrical Risks?

Overview: The first full week of 2020 is ending on a quiet note, pending the often volatile US jobs report. New record highs US equities on the back of easing geopolitical anxiety is a reflection of greater risk appetite that is evident across the capital markets. Asia Pacific equities mostly rose today, though Chinese shares and a few of the smaller markets saw small losses.

Read More »

Read More »

FX Daily, October 4: The US Jobs Data to Close a Sobering Week

Overview: The recovery of US shares yesterday signaled today's fragile stability. Gains in Japan, Australia, and Taiwan blunted the losses elsewhere in the region, including a 1% slide in Hong Kong. The MSCI Asia Pacific Index fell for the third week. China's markets have been closed since Monday and will re-open Monday and may play some catch-up.

Read More »

Read More »

FX Daily, July 05: Dollar is Bid Ahead of Jobs Report

Overview: The dovish response to news that Lagarde was nominated to replace Draghi was extended by the dismal German factory order report that has pushed the euro to new two-week lows and kept bond yields near record lows. The focus ahead of the weekend is squarely on the US employment data, where a second consecutive poor report will fan expectations for a large Fed cut to initiate an easing cycle.

Read More »

Read More »

FX Daily, May 03: Ahead of US Jobs Report, the Greenback Remains Firm

Overview: The US April jobs data stand before the weekend, and the greenback is holding on to most of yesterday's gains as participants wait for the report. Equities in the Asia Pacific region were mixed without leadership from China and Japan, where the markets remain closed for the extended holiday. On the week, Australia's ASX was the worst performing.

Read More »

Read More »

Jump in Hourly Earnings is Key to US Jobs, while Canada adds 40k Full-Time Positions

The 201k rise in US non-farm payrolls edged above the median forecasts, but the 50k downward revision to the past two-months removes the gloss. It is the first August report in seven years that the initial estimate was above the Bloomberg median. The most important part of the report was the 0.4% jump in hourly earnings, lifting the year-over-year rate to a new cyclical high of 2.9%.

Read More »

Read More »

US Jobs Data Optics Disappoint, but Signal Unchanged

The US jobs growth slowed in March more than expected, but the details of the report suggest investors and policymakers will look through it. The poor weather seemed to have played a role. Construction jobs fell (15k) for the first time since last July, and the hours worked by production employees and non-supervisory worker slipped.

Read More »

Read More »

FX Daily, March 09: Today is about Jobs, but Not Really

The US Administration has softened its initial hardline position of no exemptions for the new steel and aluminum tariffs. There is little doubt that the actions will be challenged at the World Trade Organization and the idea that national security includes the protection of jobs for trade purposes will be tested. At the same time, US President Trump has agreed to meet North Korea's Kim Jong Un.

Read More »

Read More »

FX Daily, February 02: A Note Ahead of US Jobs Report

The US dollar is sporting a firmer profile against all the major currencies after weakening yesterday. Frequently, it seems the Australian dollar leads the other currencies, and we note that it is making a new low for the week today. Briefly, in Europe, it slipped below its 20-day moving (~$0.7985) average for the first time since December 13.

Read More »

Read More »

FX Daily, January 05: Dollar Given Reprieve Ahead of Employment Report

As the US dollar finished last year, so too did it begin the New Year, and after extending its losses, the bears have paused. Technical factors had been stretched, but it appears to have been old-fashioned macroeconomic considerations to have helped the dollar to move off the mat. Quickly summarized, these considerations are a larger than expected Australian trade deficit, slippage in Japan's service sector PMI, a larger than expected drop in the...

Read More »

Read More »

Headline US Jobs Disappoint, but Earnings as Expected

The headline US non-farm payrolls disappointed, rising by 148k instead of the consensus of 180k-200k. However, the other details were largely as expected and are unlikely to change views about the trajectory of Fed policy or the general direction of markets. It is a very much steady as she goes story.

Read More »

Read More »

FX Daily, November 03: Dollar Firms Ahead of What is Expected to Be Strong US Jobs Data

The US dollar is firm but is not going anywhere quickly. The lack of fresh interest rate support and uncertainty over the US tax proposals, which the Brady, the Chair of the House Ways and Means Committee hopes to have a revised version out after the weekend so the committee work can begin on Monday.

Read More »

Read More »

US Storm-Skewed Report Means Nothing about Anything

US interest rates and the dollar rose in response to the data. It was firm before the report. The US Dollar Index is up for a fourth consecutive week. It is the longest streak since Q1. US 10-year yields are near 2.40%, an area that has blocked stronger gains for nearly six months.

Read More »

Read More »

FX Daily, October 6: Look Through the US Jobs Report

Traders are putting the final touches on another strong weekly performance for the US dollar. Strong economic data, including the PMIs, auto sales, and factory orders have surprised to the market. The ADP report warns that the storms that flattered some high frequency data will likely skew today's employment report (both headline and details) to the downside. Of course, investors will quickly look for the number of people who could get to work due...

Read More »

Read More »

Constructive US Jobs, but Where Do the Euro Bulls make a Stand?

The US created 209k jobs in July and jobs growth in June was revised higher (+9k) to 231k. The underemployment rate was unchanged at 8.6%. The unemployment rate ticked down to 4.3%, matching the cyclical low set in May. This is all the more impressive because the participation rate also ticked up (62.9% from 62.8%).

Read More »

Read More »

FX Daily, July 07: Taper Tantrum 2.0 Dominates

Taper Tantrum 2.0, emanating from Europe rather than the United States continues to overshadow other developments. Yesterday, the yield on the 10-year German Bund pushed through the 50 bp mark that has capped the occasional rise in yields in recent months. The record of the ECB meeting was understood as indicating that the official assessment had surpassed the actual communication in order try to minimize the impact.

Read More »

Read More »

Dudley in a Good Place

Dear Mr. Dudley, Your recent remarks in the wake of last week’s FOMC statement were notably unhelpful. In particular, your explanation that further rate hikes are needed to prevent crashing unemployment and rising inflation stunk of rotten eggs.

Read More »

Read More »

Drop in the US Unemployment Rate Not Sufficient to Mask Disappointing Report

Poor jobs growth won't challenge June hike expectations but September and balance sheet. Little positive in today's report. Drop in unemployment explained by drop in participation rate. Trade deficit was larger than expected, which may point to slower Q2 growth.

Read More »

Read More »