Tag Archive: U.S. Industrial Production (ZH)

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

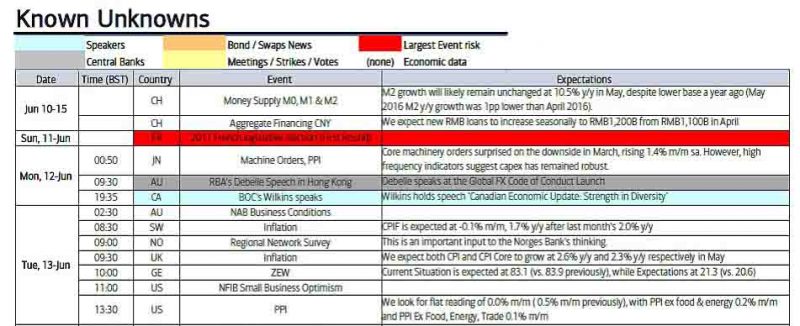

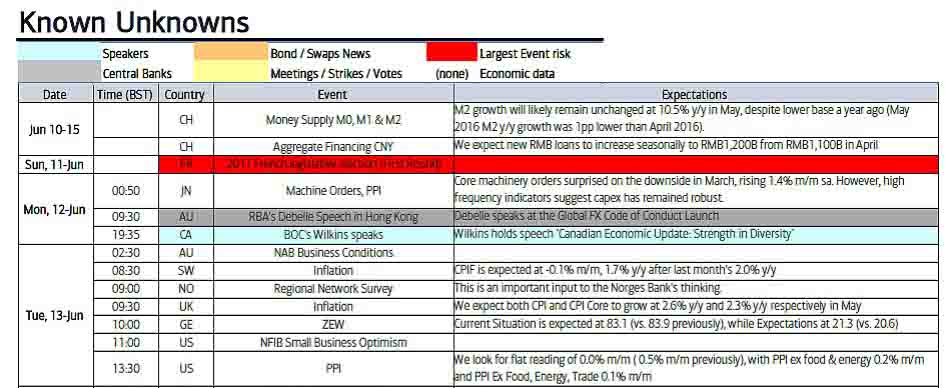

Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece.

Read More »

Read More »

FX Daily, May 16: Greenback and Dollar Bloc Lose Ground to Europe and Yen

Dollar selling pressure emerged at the end of last week, partly in response to disappointing US economic data. This selling pressure carried over into yesterday's activity. It appeared to have been trying to stabilize yesterday in the North American session.

Read More »

Read More »

FX Daily, December 14: Markets Quietly Edge into FOMC Meeting

The Pound is entering mid-December in the same fashion it begun the month after having a very strong November as well. After being buoyed by Donald Trump’s victory and the High Courts ruling that parliamentary approval is needed before invoking Article 50, the Pound has been boosted further after economic data has also impressed, with yesterday being a good example of this.

Read More »

Read More »

FX Daily Rates, October 17: Dollar Starts Week Narrowly Mixed, while Bonds and Stocks Retreat

The US dollar is consolidating in relatively narrow trading ranges. Participants appear to be waiting for fresh incentives, while the recent rise yields continue and equities have begun the new week on a soft note. Yellen spoke before the weekend, and her explicit willingness to tolerate higher inflation pushed yields higher, while not deterring expectations for a hike in December.

Read More »

Read More »

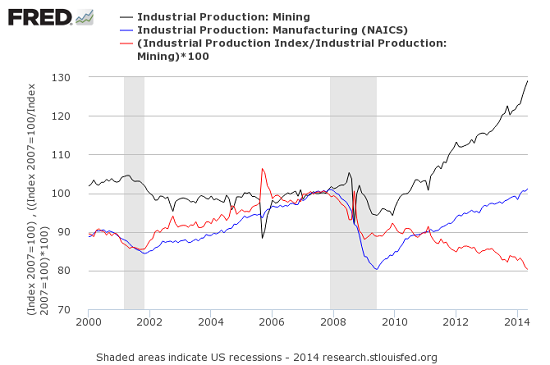

US Economy – Curious Pattern in ISM Readings

Head Fake Theory Confirmed? This is a brief update on our last overview of economic data. Although we briefly discussed employment as well, the overview was as usual mainly focused on manufacturing, which is the largest sector of the economy by gross output.

Read More »

Read More »

FX Daily, August 16: Dollar Slumps, but Driver may Not be so Obvious

The US dollar is being sold across the board today. The US Dollar Index is off 0.65% late in the European morning, which, if sustained, would make it the largest drop in two weeks. The proximate cause being cited by participants and the media is weak US data that is prompting a Fed re-think.

Read More »

Read More »

FX Daily, June 15: Key Data and FOMC

The Swiss Franc was today on the back-foot against the euro, while the FOMC helped him to rise against the dollar.

Yesterday Swiss producer prices were published. Negative changes in producer prices in 2015 reduce the Swiss franc overvaluation in terms of the Real Effective Exchange strongly. Now, however, changes producer prices are approaching zero again.

Read More »

Read More »

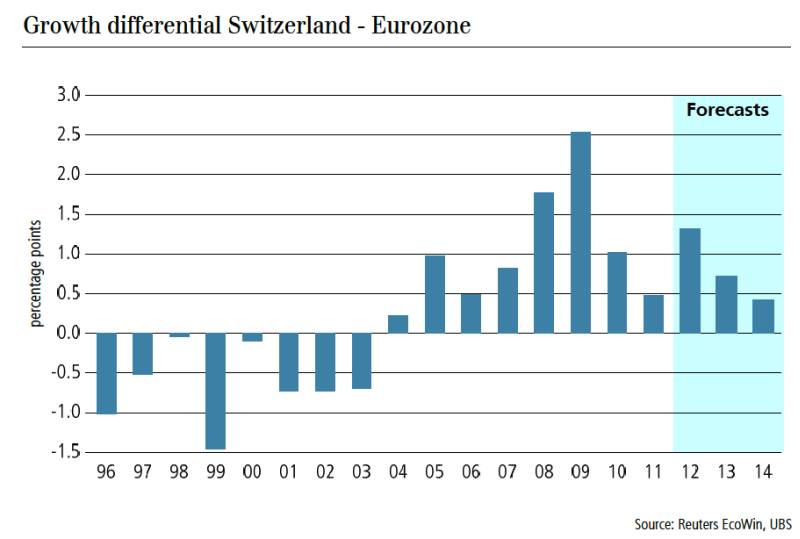

Will the Dollar Appreciate on higher U.S. Savings and a Smaller Trade Deficit?

In summer 2013, even the sceptical and "gold-friendly" economist John Mauldin followed the mainstream thinking that fracking and other technology could reduce OPEC's and the Chinese advantage in global trade and reduce the U.S. trade deficit. Recently both claims got refuted: the first with WTI crude oil prices rising to nearly 108$ despite enhanced supply. Detailed data showed that rising U.S. industrial production was not caused by more...

Read More »

Read More »

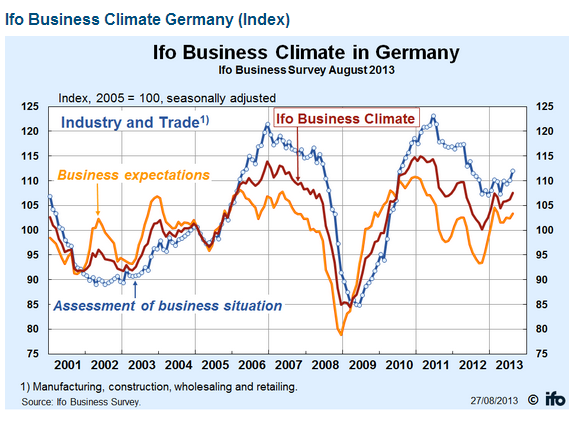

Fundamentals and FX Movements, Week September 16 to September 20

Weekly summary of fundamental news with a focus on CHF and gold price movements. Friday, September 20:The St. Louis Fed president James Bullard explained that the Fed was close to tapering 10 bln. $ and that markets overreacted after the FOMC with their strong performance. As a consequence the S&P500 inched down by 0.6% while …

Read More »

Read More »

Jim O’Neill’s Bullish BRICS Outlook until 2020 and our Critics

Perfect charts by Goldman's Jim O'Neill that help to understand the former and future growth of different emerging, "growth markets", the BRICS. We criticise his partially over-optimistic views.

Read More »

Read More »

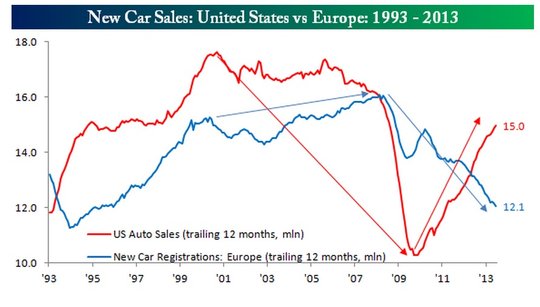

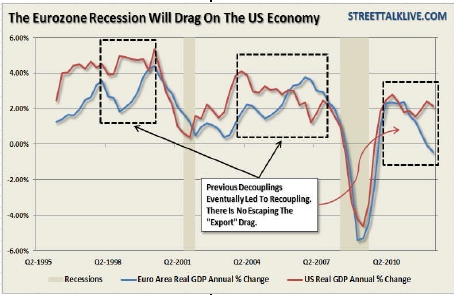

Same Procedure as Every Year: Analysts Shouting “The Great Recession is Over!” But It Is Not!

Or why we do not believe in the American economy. Like every year in Q4, analysts proudly present the end of the great recession: 2009: The big picture: The Great Recession is Over! Long Live the Ordinary Recession …. 2010: Mish Global Trend Analysis: The Great Recession is Over; Bad News: It Doesn’t Feel Like … Continue...

Read More »

Read More »