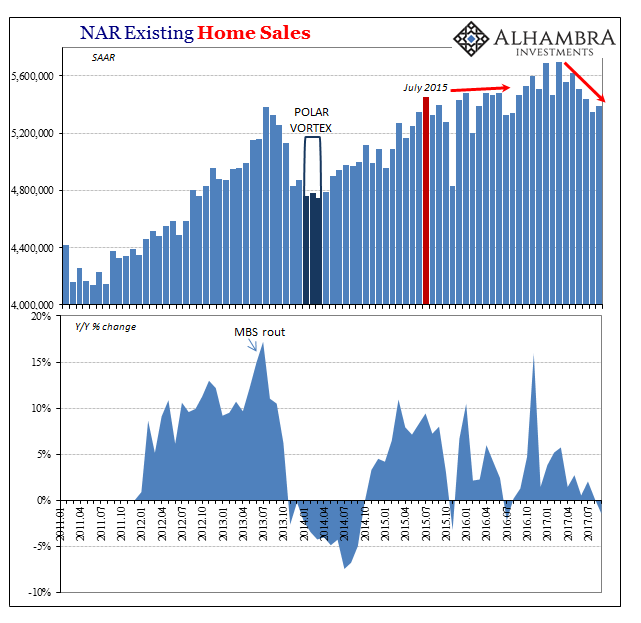

Tag Archive: U.S. Existing Home Sales

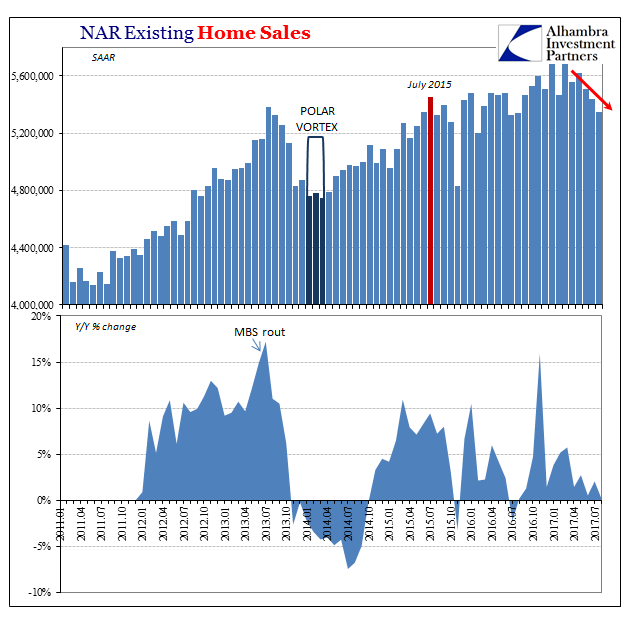

Existing Home Sales measures the change in the annualized number of existing residential buildings that were sold during the previous month. This report helps to gauge the strength of the U.S. housing market and is a key indicator of overall economic strength.

FX Daily, April 18: Doha Failure Sets Tone

Oil producers failed to reach an agreement yesterday at the meeting in Doha. That is the main spur to today’s activity. It is not that the outcome was a surprise. One newswire poll found around half of the respondents thought an agreement was elusive. Although not oil experts by any stretch, we too thought political … Continue reading...

Read More »

Read More »

Beware of Particularly Challenging Week Ahead

It is never easy, but the week ahead may be particularly difficult for market participants. It will first have to respond to weekend developments. First, the front page of the NY Times on Saturday was a report that the Saudi Arabia warned the US if a bill making its way through Congress that would allow it (Saudi … Continue reading...

Read More »

Read More »

Collective Sigh of Relief Ahead of the Weekend

Like a car ignition that finally catches after several attempts, the global markets are building on the recovery seen in North America yesterday. Asian stocks rallied, with the Nikkei leading the way with a 5.9% rally. More modest 1.25% gain...

Read More »

Read More »

Week Ahead: What Will It Take to Stabilize the Capital Markets?

Two weeks into the year and most investors are nursing sizable drawdowns. The recovery in the US equities on January 14 looked like a potential turning point. However, the coattails proved non-existent, and the bull trap was sprung with new downside momentum established before the weekend. The obvious takeaway is that the current driver is not …

Read More »

Read More »

Quiet but Choppy Markets as Activity Winds Down

The foreign exchange market is becalmed, leaving the US dollar narrowly mixed in uneventful and light turnover. The euro has been confined to less than a third of a cent range. Yesterday it briefly dipped below its 20-day moving average for the first time since the ECB met earlier this month. It remains in the … Continue reading »

Read More »

Read More »

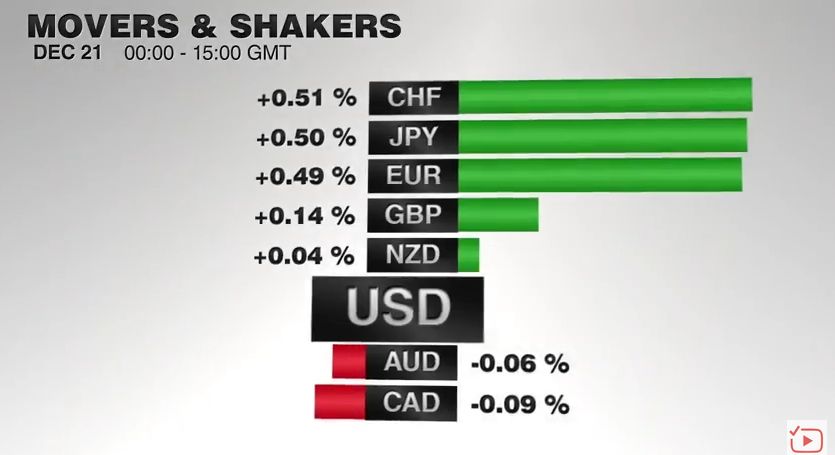

Three Rate Differentials to Note

During this holiday period, participation is light and order-driven activity can push prices more than usual. Investors should not let the noise and gyrations obscure the bigger picture. We continue to place the divergence of monetary policy at the center of our narrative. Barring a significant negative surprise from the labor market, we expect the …

Read More »

Read More »

Tuesday’s Highlights

1. China's Central Economic Work Conference is responsible for setting the annual GDP target. Although it was not formally announced, President Xi previously indicated that the goal for the economy to expand by around 6.5% a year through 2020. More telling than the GDP target is the intentions expressed in the new slogan: flexible monetary policy, …

Read More »

Read More »

A Few Takeaways

1. The election in Spain did not lift the uncertainty but re-redoubled it. Given the outcome, it is difficult envision a majority government. Purely looking at the numbers, a coalition between the Popular Party and the Socialists is simplest...

Read More »

Read More »

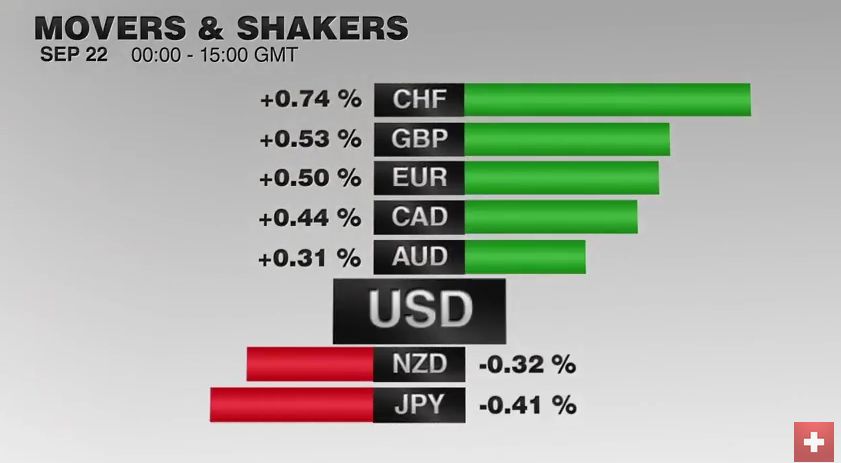

Net Speculative Positions, FX Outlook, Global Stock Markets, Week September 17

Submitted by Mark Chandler, from marctomarkets.com Nearly every development in recent days has been embraced by the foreign exchange market as a reason to continue to do what it has been doing since late July, and that is to sell the dollar. The German Constitutional Court ruling, allowing the European Stability Mechanism to …

Read More »

Read More »