Tag Archive: U.K. Retail Sales

Retail sales are an aggregated measure of the sales of retail goods over a stated time period, typically based on a data sampling that is extrapolated to model an entire country. Measuring consumer demand for finished goods, retail sales help gauge the pulse of an economy and its projected path toward expansion or contraction. As a leading macroeconomic indicator, healthy retail sales figures typically elicit positive movements in equity markets.

FX Daily, July 20: ECB Game Day

The US dollar is enjoying a firmer tone against the major currencies today. It does not appear to be simply position adjustments ahead of the ECB meeting. Consider that Australia reported strong employment data, and after making new highs, reaching almost $0.8000, it has reversed to toy with yesterday's low. A convincing break of that area (~$0.7910), especially on a closing basis, could be the kind of technical reversal that momentum traders take...

Read More »

Read More »

FX Daily, June 15: Dollar Trades Higher in Wake of the FOMC

The US dollar gains scored yesterday in response to what appeared to be a more hawkish FOMC than expected have been extended today. The euro and the Swiss franc have recorded new lows for the month.

Read More »

Read More »

FX Daily, May 18: Some Respite from US Politics as Sterling Surges Through $1.30

Yesterday's dramatic response to the political maelstrom in Washington is over. The appointment of a special counsel to head up the FBI's investigation into Russia's attempt to influence the US election appears to have acted a circuit breaker of sorts. It is not sufficient to boost confidence that the Trump Administrations economic program is back the front burners, but it is sufficient to stem the time for the moment.

Read More »

Read More »

FX Daily, April 21: Markets Enter Consolidative Mode Ahead of Weekend

Neither the terrorist attack in Paris nor the strong eurozone flash PMI has managed to shake investors. Judging from the social media, many suspect that the terrorist attack plays into Le Pen's hands, but investors do not seem particularly concerned. The French interest rate premium over Germany has narrowed, and gold is flat. UK retail sales fell sharply, yet sterling is holding on to the bulk of this week's gains, which are the most here in 2017.

Read More »

Read More »

FX Daily, March 23: Some Thoughts about the Recent Price Action

The gains the US dollar scored last month have been largely unwound against the major currencies. The dollar's losses against the yen are a bit greater, and it returned to levels not seen late last November. The down draft in the dollar appears part of a larger development in the capital markets that has also seen the US 10-year yield slide 25 bp in less than two weeks. The two-year yield is off 17 bp.

Read More »

Read More »

FX Daily, February 17: Greenback Stabilizes Ahead of the Weekend

The US dollar is finishing the week on a steady to firmer note against the major currencies but the Japanese yen. The softer yields and weaker equity markets often are associated with a stronger yen. For the week as a whole, the dollar is mostly lower, though net-net it has held its own against sterling, the euro and Canadian dollar.

Read More »

Read More »

FX Daily, January 20: Trump Day

The dollar peaked against the yuan two days after the Federal Reserve hiked interest rates in the middle of last month. We argue that that is when the market correction began, not at the turn of the calendar. Despite claims that China's currency is dropping like a rock, it has actually risen for the fifth consecutive week. That is the longest rising streak for the yuan since early 2016.

Read More »

Read More »

FX Daily, November 17: Consolidation Gives Dollar Heavier Tone

The US dollar is trading with a heavier bias today as its recent run is consolidated. The euro is trying to snap the eight-day slide that brought it to nearly $1.0665 yesterday, the lows for the year. It is almost as if participant saw the proximity of last year's lows ($1.0460-$1.0525) and decided to pause, perhaps to wait for additional developments, such a Fed Chief's Yellen's testimony before the Joint Economic Committee of Congress.

Read More »

Read More »

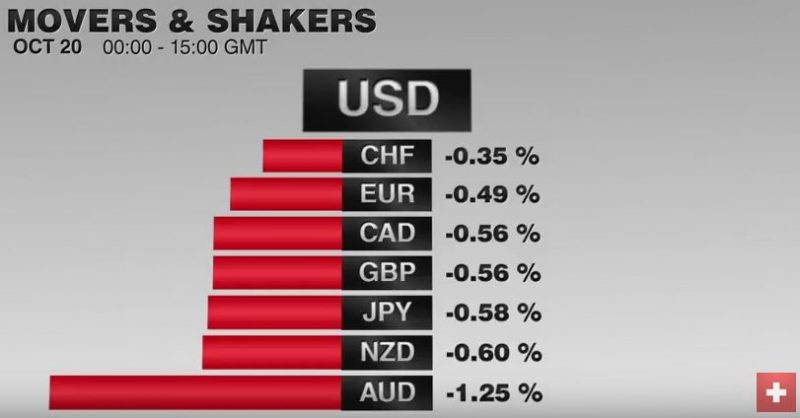

FX Daily, October 20: ECB Unlikely to Shake Dollar’s Slumber

GBP/CHF rates have fallen dramatically over the past month, as Sterling continues to find itself under pressure against the major currencies. However, despite these losses it is not all doom and gloom for those clients holding GBP, as Tuesday’s positive spike for the Pound proved. Currency does not move in a straight line and therefore we will see opportunities for those clients holding GBP to take advantage of, even if a sustainable Sterling...

Read More »

Read More »

FX Daily, September 6: Dollar Heavy in Quiet Markets

The US dollar is trading heavily against most of the major and emerging market currencies. However, the losses are modest, and the greenback remains within recent ranges. The Antipodean and Scandi bloc currencies are performing best.

Read More »

Read More »

FX Daily, August 18: US Dollar Pushed Lower, but Do FOMC Minutes Really Trump Dudley?

A bad day for the dollar means a good day for CHF, that appreciates against both euro and dollar. It is not a good day for the US dollar. It is being sold across the board. The seemingly dovish FOMC minutes released late yesterday appears to have gotten the ball rolling. The takeaway for many was that any officials wanted more time to assess the data at the July meeting.

Read More »

Read More »

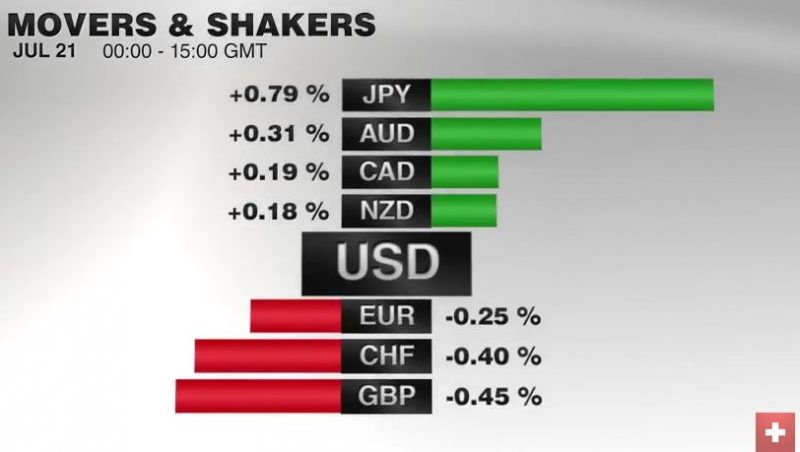

FX Daily, July 21: Monetary Policy Expectations are Driving Foreign Exchange

Monetary policy is said to have lost its impact on the foreign exchange market, as investors scratch their heads at the resilience of currencies with negative interest rates. Yet the price action in the action cannot be understood without recognizing the ongoing importance of monetary policy expectations.

Read More »

Read More »

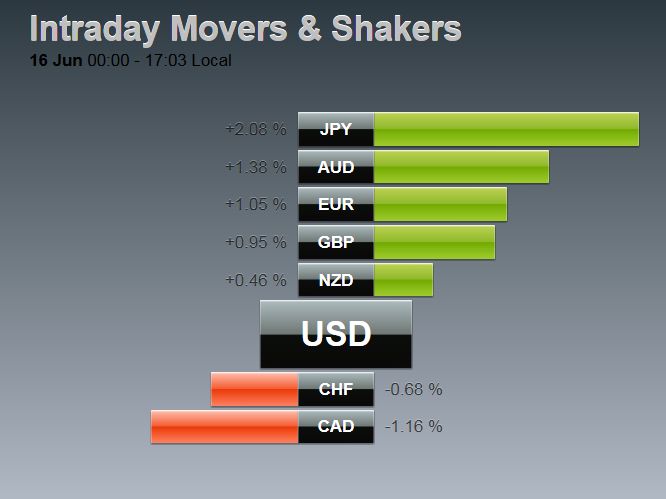

FX Daily, June 16: Markets are Anxious, Yen Soars

The US dollar is higher against the major currencies but the Japanese yen and the New Zealand dollar. The dollar fell to new two-year lows against the yen to JPY103.55 before bouncing in the European morning back to JPY104.40. The...

Read More »

Read More »

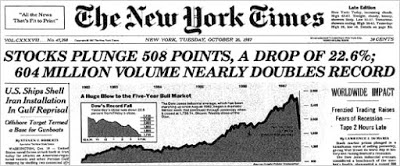

The World is not Ending (Yet), Panic To Subside

Investors have become unhinged. The increased volatility and dramatic market moves challenge even the most robust investment strategies. This sets off a chain reaction of money and risk management that further amplifies the price action, like an...

Read More »

Read More »

Collective Sigh of Relief Ahead of the Weekend

Like a car ignition that finally catches after several attempts, the global markets are building on the recovery seen in North America yesterday. Asian stocks rallied, with the Nikkei leading the way with a 5.9% rally. More modest 1.25% gain...

Read More »

Read More »

The World Survives Fed Hike

Asia extended the US dollar's post-Fed gains while Europe has seemed content to consolidate the move, perhaps waiting for US leadership.

Much of the commentary about the Fed's action have noted that the FOMC statement used the word "gradual" no...

Read More »

Read More »

After ECB’s Hawkish Cut, Is the Fed about to Deliver a Dovish Hike?

After much hemming and hawing since mid-year, the Federal Reserve is finally poised to raise rates for the first time in nearly a decade. Indeed, given the speeches by the leadership and the economic data, especially the labor market readings, the failure to raise rates would likely be more destabilizing at this juncture than lifting them. …

Read More »

Read More »

Dollar Corrects Lower

The US dollar is trading heavily today. The losses are not particularly steep against either the majors or the emerging market currencies. A common narrative is attributing the dollar's pullback to "dovish minutes," but this is not a fair asse...

Read More »

Read More »