Tag Archive: U.K. Industrial Production

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

FX Daily, March 11: US Over-Promises and Under-Delivers, while BOE Steps Up with 50 bp Rate Cut

Overview: The S&P 500 and Dow Jones Industrials sold off after the higher open and briefly traded below yesterday's lows. Investors seemed disappointed that the Trump Administration was not ready with specific policies after Monday's tease that had initially helped lift Asia Pacific and European markets earlier on Tuesday. This sparked a sharp decline in Europe into the close.

Read More »

Read More »

FX Daily, February 11: New Calm in the Capital Markets Continues, Powell Moves to Center Stage

Overview: Investors are taking solace from reports indicating that the increase in the new coronavirus at ground zero (Hubei) is slowing. After the S&P 500 reversed early losses yesterday to close at new record highs helped keep the bullish sentiment intact. Benchmarks in Hong Kong, South Korea, Australia, and China rose for the sixth session.

Read More »

Read More »

FX Daily, July 10: North American Focus: Poloz and Powell

Overview: The US Treasury market is retreating for the fourth consecutive session ahead of Fed Chairman Powell's testimony before Congress. It is the longest losing streak in six months, and the 10-year yield has risen 15 bp over the run. This is helping drag up global yields, and today Asia Pacific yields mostly rose 2-3 basis points while core European bond yields are 5-7 bp higher and peripheral yields up a little less.

Read More »

Read More »

FX Daily, June 10: Collective Sigh of Relief Lifts Equities, Yields, and the Dollar

Overview: A global sigh of relief that the US will not tariff all its imports from Mexico. Equities are all higher, and the weekend demonstrations in Hong Kong over a bill allowing extraditions to the mainland for the first time did not deter investors from bidding up the Hang Seng over 2.3%, the most this year. European equities are following suit.

Read More »

Read More »

FX Daily, May 10: Waiting for the Other Shoe to Drop

Overview: Contrary to hopes and expectations, the US made good on the presidential tweet and raised the tariff on around $200 bln of Chinese goods from 10% to 25%. Trump indicated that the process that will levy a 25% tariff on the remaining Chinese imports has begun. Also contrary to expectations, Chinese officials did not detail their response, though it is expected to be forthcoming.

Read More »

Read More »

FX Daily, July 10: May Survives to Fight Another Day, but Sterling’s Recovery Falters

The political obituary of UK's May, who many see as an "accidental" Prime Minister, has been written many times in the past year and a half only to be withdrawn. Again, it looked like the resignation of two ministers, and a couple of junior ministers was going to spur a leadership challenge. While this still may come to pass, the hard Brexit camp, which has huffed and puffed, simply does not appear to represent a majority of the Tory Party, and...

Read More »

Read More »

FX Daily, May 10: Kiwi Tumbles on Dovish RBNZ, While Sterling Goes Nowhere Ahead of BOE

The US dollar is consolidating in narrow trading against most of the major currencies as participants digest several developments ahead of what was expected to be the highlight today, the BOE meeting and US April CPI. The greenback's consolidation is giving it a heavier bias against most of the major currencies. The recently strong upside momentum has stalled, but the losses are modest and the euro and sterling are inside yesterday's ranges.

Read More »

Read More »

FX Daily, April 11: Mr Market Waits for Other Shoe to Drop

Between Syria, trade tensions, and the US special investigator into Russia's attempt to influence the US election, market participants are cautious as they wait for another shoe to drop. The US equity market recovery yesterday has short coattails as markets in Asia and Europe struggle. Bond yields are mostly softer, and the US 10-year note yield is dipping back below 1.80%.

Read More »

Read More »

FX Daily, March 09: Today is about Jobs, but Not Really

The US Administration has softened its initial hardline position of no exemptions for the new steel and aluminum tariffs. There is little doubt that the actions will be challenged at the World Trade Organization and the idea that national security includes the protection of jobs for trade purposes will be tested. At the same time, US President Trump has agreed to meet North Korea's Kim Jong Un.

Read More »

Read More »

FX Daily, February 09: Equity Sell-Off Extends to Asia, but More Muted in Europe

The 100-point slide in the S&P 500 and the 1000-point drop in the Dow Jones Industrials yesterday spurred more bloodletting in Asia. The 1.8% drop in the MSCI Asia Pacific Index (for a 6.7% loss for the week) may conceal the magnitude of the regional losses. At one point the CSI 300 of the large Chinese mainland shares was off more than 6% before closing off 4.3% (and 10% for the week). The H-shares index was down 3.9% and 12% for the week.

Read More »

Read More »

FX Daily, January 10: Yen Short Squeeze Extended

Sparked by fears that the BOJ took a step toward the monetary exit by reducing the amount of long-term bonds it is buying, there is an apparent scramble to cover previously sold yen positions. The dollar finished last week near JPY113.00. It fell to about JPY112.35 yesterday, near the 50% retracement of the greenback's bounce from the late-November lows near JPY110.85.

Read More »

Read More »

FX Daily, December 08: Brexit Talks Move to Stage II, While Greenback Remains Firm

Sufficient progress will be judged to have been made, and negotiations of the separation between the UK and EU will be allowed to enter the second stage. The formal decision will be made at next week's EU summit. To be sure, "sufficient progress," which the diplomatic-speak that does not mean that any agreement has really been reached, but rather that the UK has made a few concessionary signals.

Read More »

Read More »

FX Daily, October 10: Dollar Pullback Extended

The US dollar's advance faltered before the weekend after rise average hourly earnings and a new cyclical low in unemployment and underemployment initially fueled greenback buying. There is no doubt the data was skewed by the storms, though the upward revision to the August hourly early cannot be attributed to the weather distortions. The reversal in the dollar before the weekend has carried over into the early trading this week. Even the Turkish...

Read More »

Read More »

FX Daily, September 08: US Dollar Tracks Yields Lower

The US dollar has been unable to find any traction as US yields continue to move lower. The US 10-year year is slipping below 2.03% in European turnover, the lowest level in ten months. The risk, as we have noted, is that without prospects of stronger growth and inflation impulses, the yield returns to where was before the US election (~1.85%). The two-year note yield, anchored more by Fed policy than the long-end, is also soft. It yielded 1.25%...

Read More »

Read More »

FX Daily, August 10: Tensions Remain Elevated, Dollar Firms

It is difficult to walk back the saber-rattling rhetoric. US Secretary of State Tillerson tried to defuse the situation, which had appeared to ease nerves in North America yesterday. However, references to the modernization of US nuclear forces, a multi-year project begun last year, spurred a fresh threat by North Korea to fire four intermediate range missiles near Guam in week's time.

Read More »

Read More »

FX Daily, July 07: Taper Tantrum 2.0 Dominates

Taper Tantrum 2.0, emanating from Europe rather than the United States continues to overshadow other developments. Yesterday, the yield on the 10-year German Bund pushed through the 50 bp mark that has capped the occasional rise in yields in recent months. The record of the ECB meeting was understood as indicating that the official assessment had surpassed the actual communication in order try to minimize the impact.

Read More »

Read More »

FX Daily, June 09: Sterling Shocked, Dollar Broadly Firmer

What looked like a savvy move in late April has turned into a nightmare. Collectively, voters have denied the governing Conservative party a parliamentary majority. The uncertainty today does not lie yesterday with the known unknown, but with the shape of the next government and what it means for Brexit.

Read More »

Read More »

FX Daily, May 11: Canadian and New Zealand Dollars Get Whacked, While Greenback Consolidates

The US dollar has been mostly confined to about a 30 pip range against the euro and yen in Asia and the European morning. Sterling is under a little pressure after a series of poor data, including larger than expected falls in manufacturing and construction output, and a sharp widening of the trade deficit.

Read More »

Read More »

FX Daily, March 10: US Jobs Data: Deja Vu All Over Again?

A week ago, after nine Fed officials had spoken, the market widely expected Yellen and Fischer to confirm that the table was set for a rate hike later this month. They did, and the dollar and US interest rates fell. Now, after a strong ADP jobs report (298k), everyone recognizes upside risk to today’s national report, and the dollar has lost its upside momentum against most major currencies, but the Japanese yen.

Read More »

Read More »

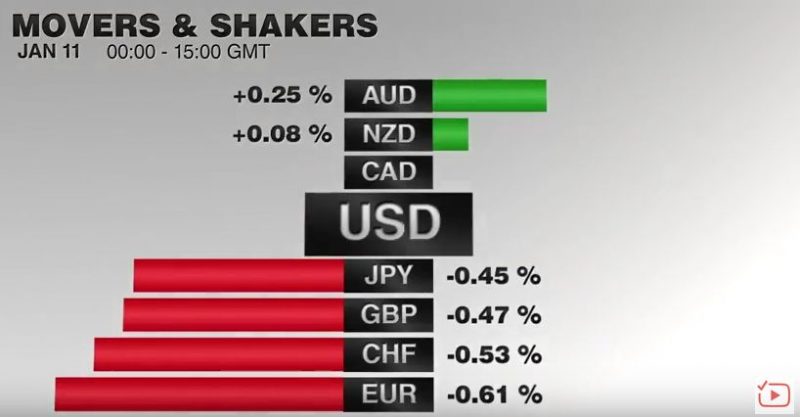

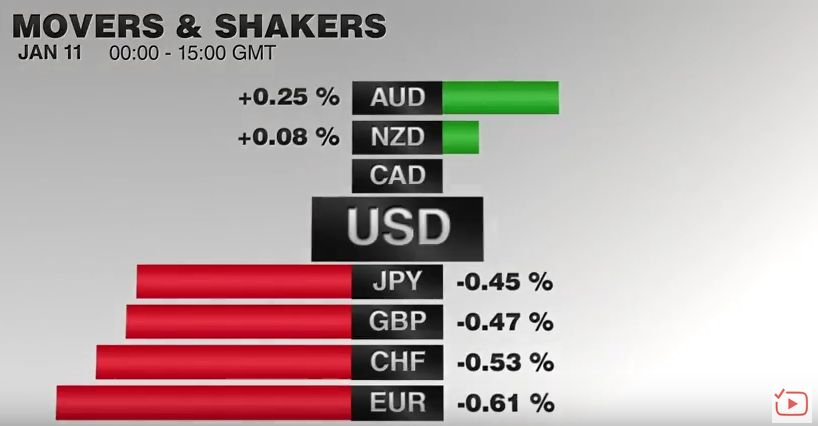

FX Daily, January 11: Dollar Comes Back Bid

The pound has seen a sharp fall following the interview that Theresa May gave with Sky news on Sunday although there has been a small rebound this afternoon. GBP CHF exchange rates are hovering around 1.2350 for this pair.

Read More »

Read More »