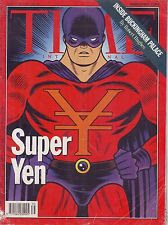

The US dollar and sterling have stabilized after being sold off yesterday. The yen, which had begun recovering from a four-month low, is the strongest of the major currencies today, gaining around 0.5% against the dollar (@~JPY113.40).

Read More »

Tag Archive: U.K. Average Earnings Index

FX Daily, June 14: FOMC and upcoming SNB

The Euro has risen by 0.37% to 1.0901 CHF. This is a typical movement ahead of the SNB meeting tomorrow.

This movement is probably unrelated to the Fed rate hike, given that the USD/JPY has fallen.

It makes sense to go long CHF against JPY, if you bet on an inactive SNB. Inactive SNB would mean that the central bank will not speak about stronger FX Interventions or about lower rates.

Read More »

Read More »

FX Daily, May 17: Drama In Washington Adds To Dollar Woes

The US dollar has drifted lower against most of the major currencies as the culmination of news from Washington, escalating already rising concerns about the economic agenda that was to bolster growth with dramatic tax reform, infrastructure initiative, and re-orienting trade.

Read More »

Read More »

FX Daily, April 12: Investors Catch Breath, Markets Stabilize

Markets are calmer today. The significant movers yesterday have stabilized. The dollar has been unable to resurface above JPY110, but after plumbing to new lows near JPY109.35 in Asia, the dollar has recovered back levels since in North America late yesterday. The decline in the US 10-year yield was also initially extended in Asia before stabilizing and returning to levels seen in the US afternoon.

Read More »

Read More »

FX Daily, March 15: Greenback Softens Ahead of FOMC

The US dollar is paring yesterday's gains as the market awaits the outcome of the well-telegraphed FOMC meeting. In recent weeks, the combination of data and official comments have swayed market, which had previously anticipated a hike in May or June.

Read More »

Read More »

FX Daily, February 15: Yellen Helps the Dollar Extend Streak

The Dollar Index's ten-day rally was at risk yesterday, but Yellen's reiteration of the commitment to continue to lift rates gradually helped extend the streak to eleven sessions.This surpassed the streak around the election (November 7-November 18). With today's gains, it may draw closer to what appears to be the long streak, 14 sessions between April 30, 2012 and May 17.

Read More »

Read More »