Tag Archive: Turkey

Seven Things I Learned while Looking for Other Things

Mainland demand for HK shares has dried up this month. EMU growth may accelerate in Q4, while the collective deficit continues to fall. German fertility rate increased last year.

Read More »

Read More »

No Big Thoughts, but Several Smaller Observations

Notable that as the CRB Index moves lower, MSCI emerging market equities have done well. European banks are retreating after the stress test results. Tokyo elected its first women governor as this seem to be in part a sign of protest against Abe.

Read More »

Read More »

Some Thoughts on Turkey

INTRODUCTION After last Friday’s failed coup attempt in Turkey, a measure of calm has returned to global markets. We did not think Turkish developments have wide-reaching implications for EM assets, but we do remain very negative on Turkish assets in the wake of the coup and ongoing political uncertainty.

Read More »

Read More »

FX Weekly Preview: EMU Returns to Center Stage in the Week Ahead

Key event in Europe is not on many calendars--it is a ruling by the European Court of Justice. UK government and Tory Party stabilizing, leaving the Labour Party in disarray. US economy appears to have accelerated into the end of Q2. BOJ's meeting at the end of the month.

Read More »

Read More »

The EU and Turkey: Unvarnished Truth and Stuffing

Turkey and the EU will begin negotiations over financial and budget reform.

It is one of 35 areas (chapters) of negotiations.

Turkey is no where close to joining the EU, for which it initially applied in 1987.

Read More »

Read More »

Political Crisis in Turkey is Not Good for Europe

It has been long recognized by the investment community that power in Turkey was concentrated in Erdogan’s hands. He enjoys incredible power in the ceremonial presidential post and brooks no rivals. Common among authoritarian leaders they habitually turn on hand-picked successors as they grow fearful of competitors. This is precisely what has played out …

Read More »

Read More »

Here Comes The Turkish Flood: EU Commission Backs Visa-Free Travel For 80 Million Turks

Earlier this week we observed that in what may be Europe's latest mistake, the European Union is about to grant visa-gree travel to 80 million Turks: a key concession that Erdogan obtained as a result of the ongoing negotiations over Europe's refugee...

Read More »

Read More »

Two Decisions from Europe

It might not be on investors' calendars, but European officials will take steps toward addressing two issues tomorrow. First, the EC will make a preliminary recommendation of visa-free travel in the Schengen area for Turkish passport holders. S...

Read More »

Read More »

Switzerland Readies Military In Preparation For A New Wave Of Migrants

According to The BBC, the most asylum claims in 2015 occurred in Germany, which saw >500,000...

With the main route (reportedly shut down) being from Turkey to Greece, and up through the Balkans...

With Syrians making up the bulk of migrants tryi...

Read More »

Read More »

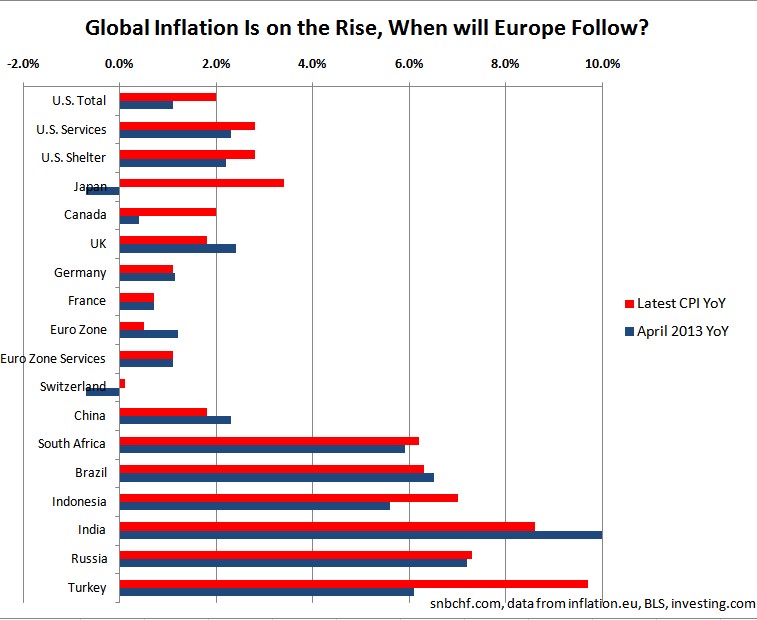

Global Inflation Spikes Up, Are You Sure About What You Are Doing Mr Draghi?

The European Central Bank (ECB) has the habit of reacting late. As seen in July 2008 and July 2011, the ECB is often the last major central bank to hike rates. They hike rates at the moment when others prepare for a recession or a significant slowing. Currently we are witnessing the opposite movement: The world is getting … Continue...

Read More »

Read More »

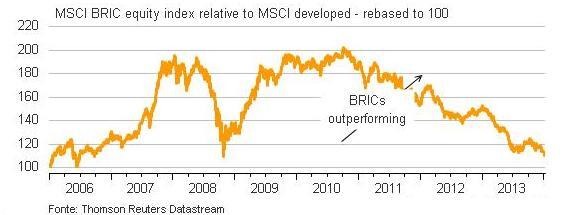

Last Week’s Sell-Off: More on the Discrepancy between Developed and Emerging Markets

Last week’s decline in stock markets was probably caused by the HSBC manufacturing PMI for China that contracted for the first time in months, and possibly also by the rapid fall of UK unemployment rates and Bank of England’s response to it. As the rising gold price showed, Fed “tapering fears” were not at the …

Read More »

Read More »

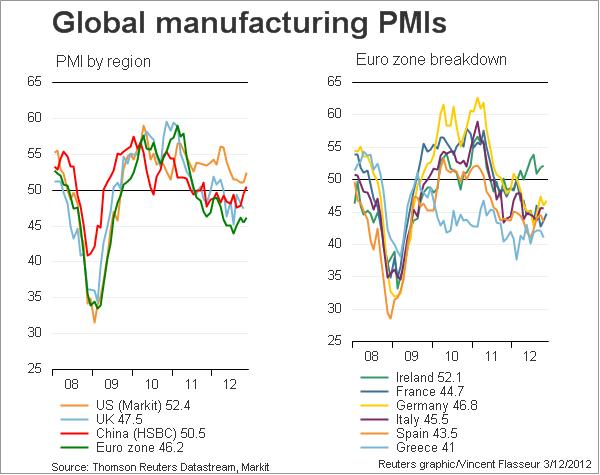

Global Purchasing Manager Indices

Manufacturing Purchasing Manager Indices (PMIs) are considered to be the leading and most important economic indicators. August 2013 Update Emerging markets: Years of strong increases in wages combined with tapering fears have taken its toll: Higher costs and lower investment capital available. EM Companies have issues in coping with developed economies. Some of them …

Read More »

Read More »

Global Purchasing Manager Indices, Update January 25

Manufacturing PMIs are considered to be the leading and most important economic indicators. After a strong slowing in summer 2012 and the Fed’s QE3, this is the fourth month of improvements in global PMIs January 25th Expansion-contraction ratio: There are 15 countries that show values above 50 and 14 with values under 50. Positive-negative-change ratio: …

Read More »

Read More »

Global Purchasing Manager Indices, Update December 17

Manufacturing PMIs are considered to be the leading and most important economic indicators. Since the Fed’s QE3, this is the third month of improvements in global PMIs after a strong slowing in summer 2012. January 25th Expansion-contraction ratio: There are as many countries that show values above 50 as under 50. Positive-negative-change ratio: 18 countries …

Read More »

Read More »

Global Purchasing Manager Indices, Update December 10

Manufacturing PMIs are considered to be the most leading and important economic indicators. Jim O’Neill, Chairman of Goldman Sachs Asset Management, believes the PMI numbers are among the most reliable economic indicators in the world. BlackRock’s Russ Koesterich thinks it’s one of the most underrated indicators. Global Purchasing Manager Indices for the manufacturing industry December 3, 2012 …

Read More »

Read More »